Journal Entry To Record Bad Debt Expense - Web bad debt expense (bde) helps you record the impact uncollectible accounts have on your bottom line. Web how to record a bad debt expense. The percentage of credit sales approach focuses on the income. Web there are two ways to calculate bad debt expense: This accounting entry allows a company to write off. Another common term used for bad debts is doubtful accounts. Web how to record the bad debt expense journal entry. Web the bad debt expense journal entry is executed by debiting the bad debt expense account and crediting the allowance for doubtful debt accounts. Web the journal entry for the bad debt expense increases (debit) the expense’s balance, and the allowance for doubtful accounts increases (credit) the balance in the allowance. Web learn about a bad debt entry in an expense journal and why it's important, including steps on how to input bad debt expenses properly on your balance sheet.

Accounting Q and A EX 914 Entries for bad debt expense under the

Written by andrew in accounting tutorials. In this guide, you’ll learn what bad debt expense is, along with: It is known as the bad debt.

Journal Entries for Bad Debts and Bad Debts Recovered YouTube

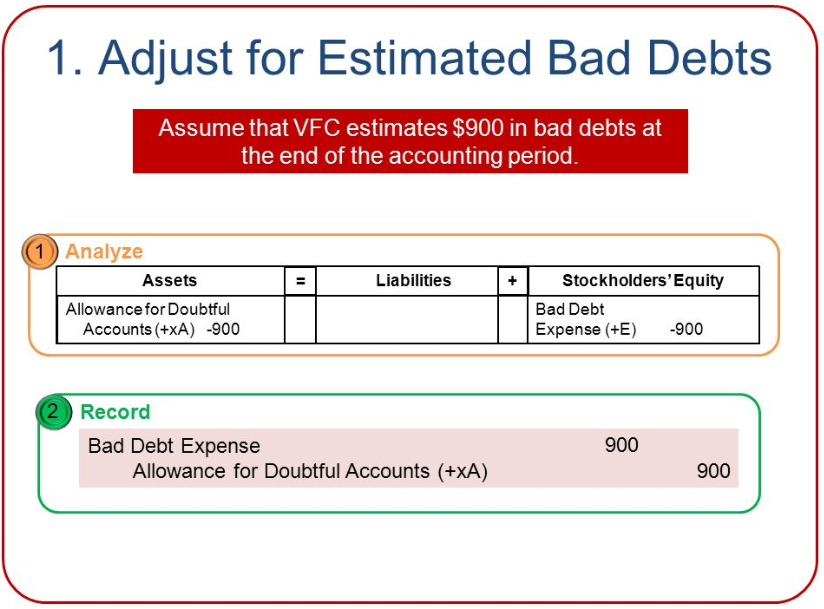

The allowance method estimates bad debt. Web the journal entry for the bad debt expense increases (debit) the expense’s balance, and the allowance for doubtful.

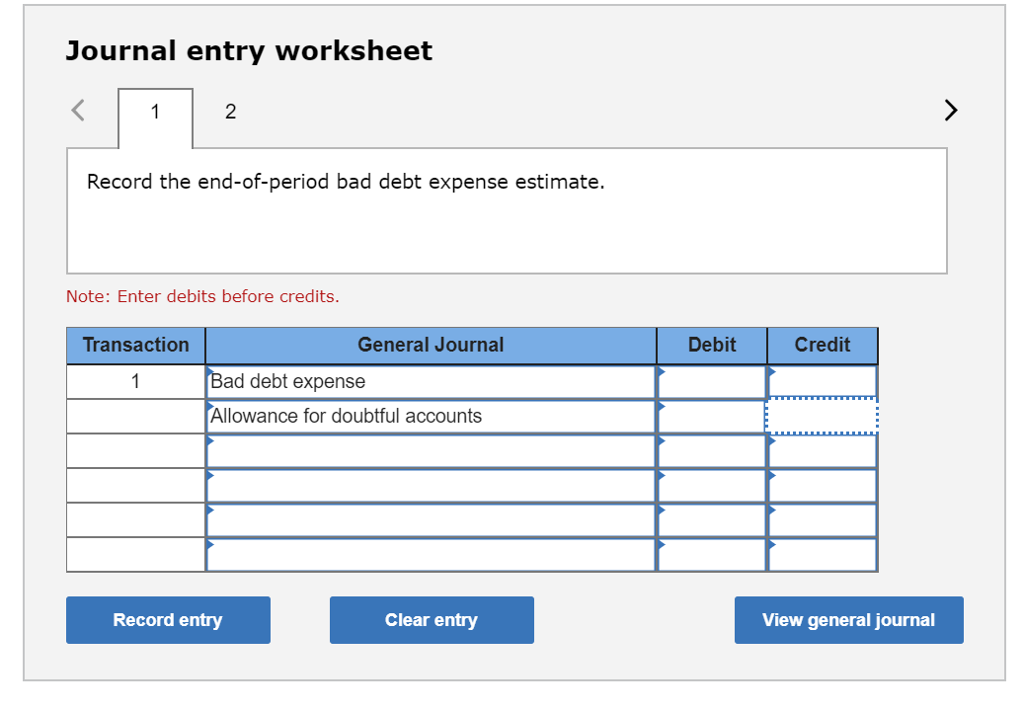

Solved Journal entry worksheet 2 Record the endofperiod

There are two situations in which you’d record a bad debt expense in your books: For example, in one accounting period, a company can experience.

How to calculate and record the bad debt expense QuickBooks

Web the journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. Dr bad debts expense.

How Do I Write Off Bad Debt Expense Journal Entry

Web the bad debt written off is an expense for the business and a charge is made to the income statement through the bad debt.

How to Calculate Bad Debt Expense? Get Business Strategy

Web the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. Web bad debt expense (bde) helps you.

[Solved] Prepare the adjusting journal entry to record bad debt expense

Web if the company identifies an unrecoverable or uncollectable balance, it must expense out the balance. In this guide, you’ll learn what bad debt expense.

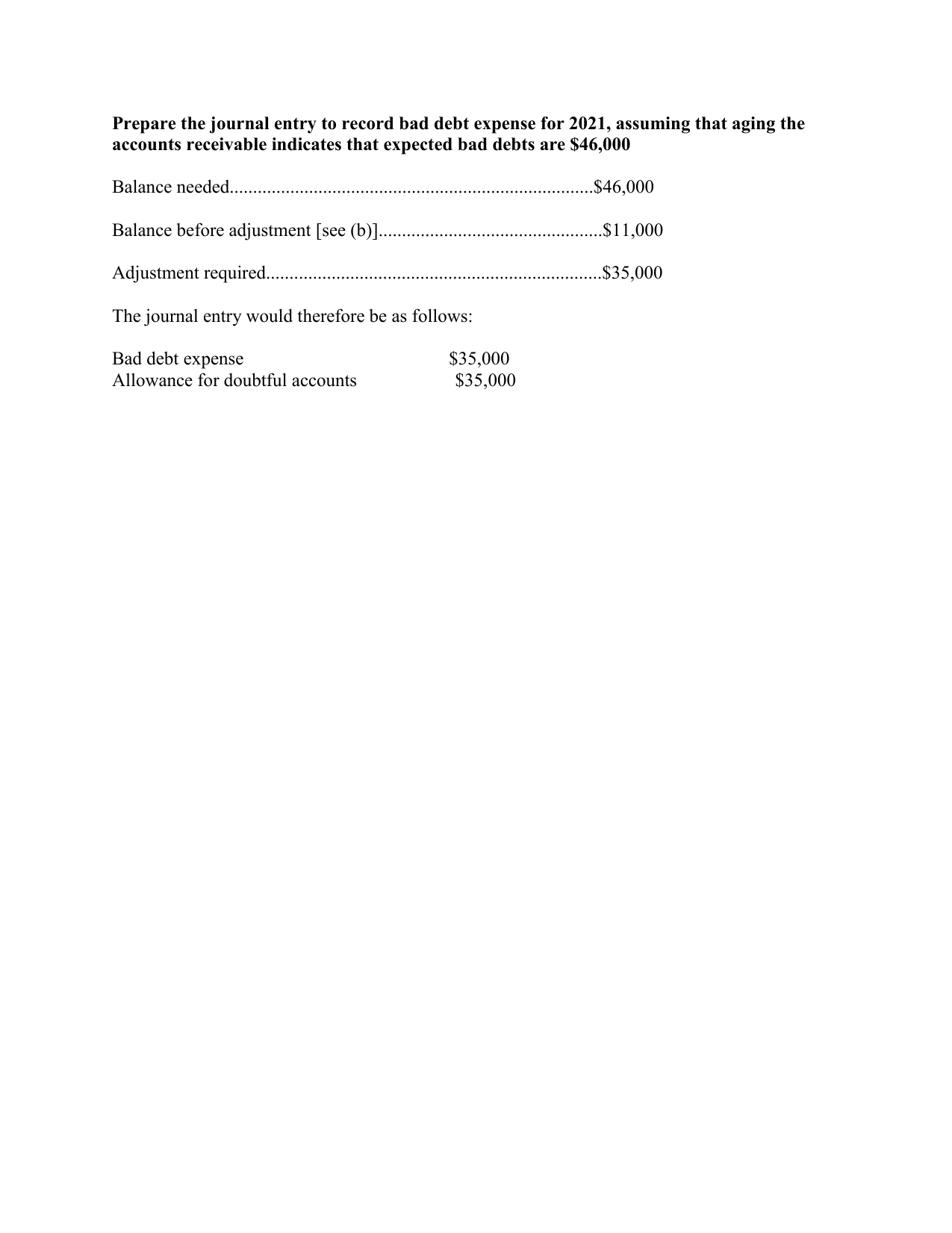

Prepare the journal entry to record bad debt expense for 2021

This accounting entry allows a company to write off. Web the journal entry for the bad debt expense increases (debit) the expense’s balance, and the.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Web the bad debt expense journal entry is executed by debiting the bad debt expense account and crediting the allowance for doubtful debt accounts. Establishing.

Web It Estimates Its Bad Debts Expense To Be $1,500 (0.003 X $500,000) And Records The Following Journal Entry:

Web the correct bad debt expense journal entry depends on which method you’re using. Written by andrew in accounting tutorials. When directly writing off an account receivable that you’ve. Web how to record the bad debt expense journal entry.

Web The Bad Debt Expense Journal Entry Is Executed By Debiting The Bad Debt Expense Account And Crediting The Allowance For Doubtful Debt Accounts.

Web the journal entry for the bad debt expense increases (debit) the expense’s balance, and the allowance for doubtful accounts increases (credit) the balance in the allowance. Another common term used for bad debts is doubtful accounts. It may also be necessary to reverse any related sales. Web once it determines the amount, the company records it as a bad debt expense while also recognizing an allowance for doubtful debt.

Web The Bad Debt Written Off Is An Expense For The Business And A Charge Is Made To The Income Statement Through The Bad Debt Expense Account.

This accounting entry allows a company to write off. Web learn about a bad debt entry in an expense journal and why it's important, including steps on how to input bad debt expenses properly on your balance sheet. Web the journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. There are two situations in which you’d record a bad debt expense in your books:

The Percentage Of Credit Sales Approach Focuses On The Income.

Journal entries (debit and credit) the allowance method estimates the “bad debt” expense near the end of a period and relies on. Web there are two ways to calculate bad debt expense: In this guide, you’ll learn what bad debt expense is, along with: What is the bad debt expense allowance method?