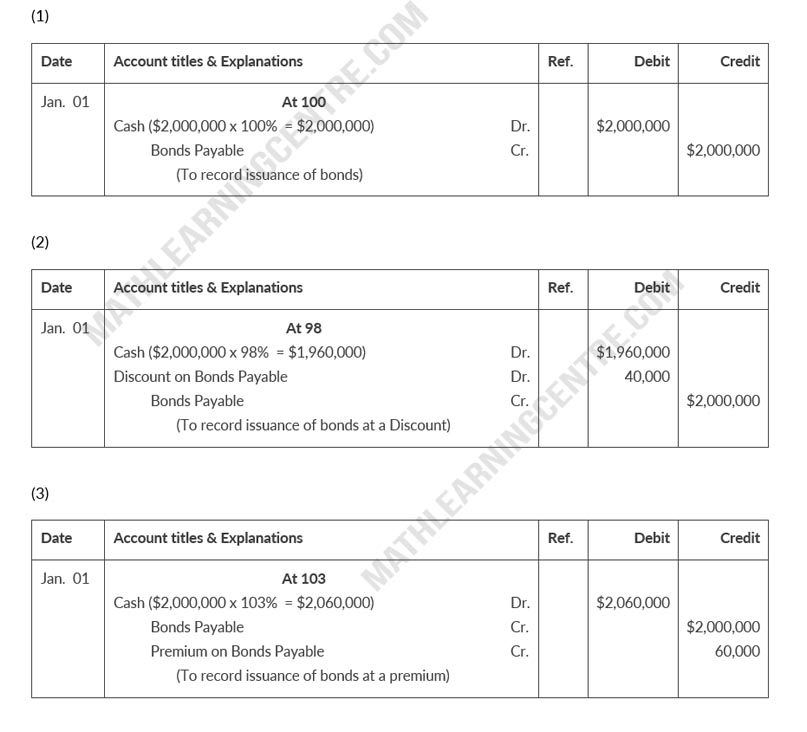

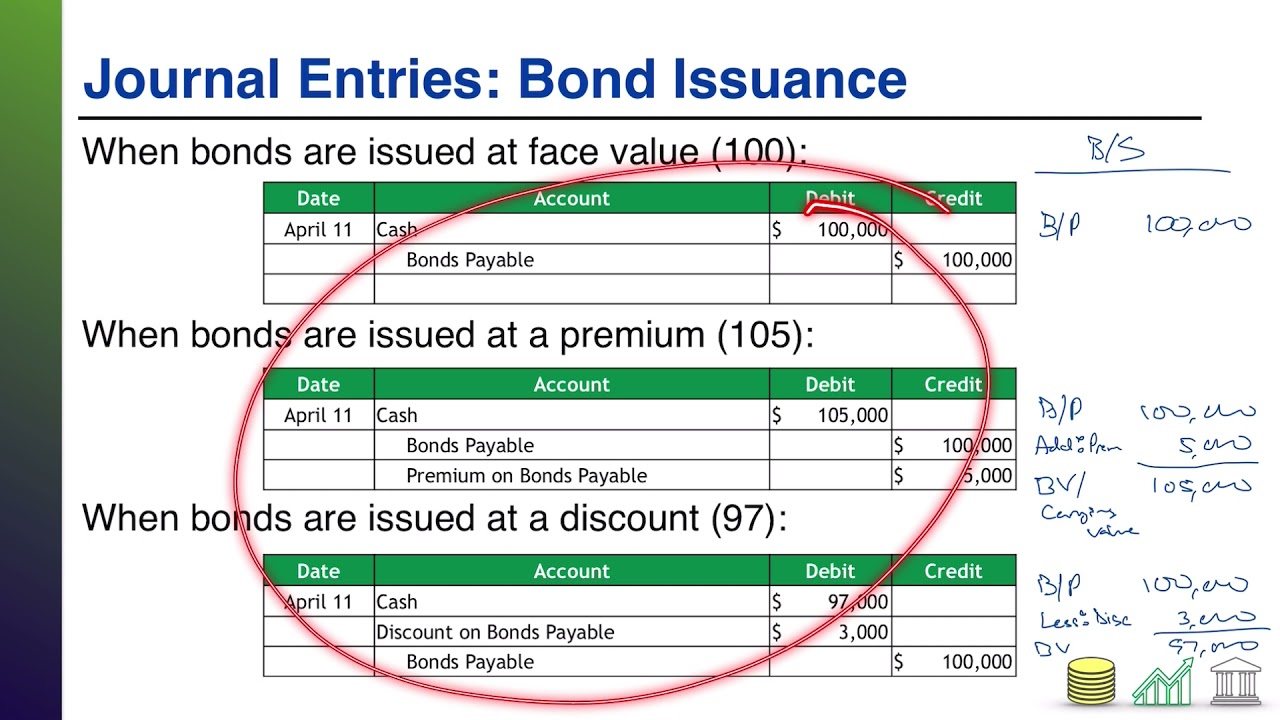

Journal Entry To Issue Bonds - The entry on 1 july 2020 is: Web when a bond is issued at its face amount, the issuer receives cash from the buyers of the bonds (investors) and records a liability for the bonds issued. A journal entry must be made for each of these transactions. 4.9k views 2 years ago notes payable, bonds payable. Web the journal entry for this transaction is: One entry to record cash received from investors and another entry to record liabilities incurred by issuing bonds. Debit bond discount for $0.5 million. Note that the total amount received is debited to the cash account and the bond’s face amount is credited to bonds payable. Issuing bonds at a discount. Amortize the discount or premium;

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

Explain the handling of notes and bonds that are sold between interest dates and make the journal entries for both the issuance and the first.

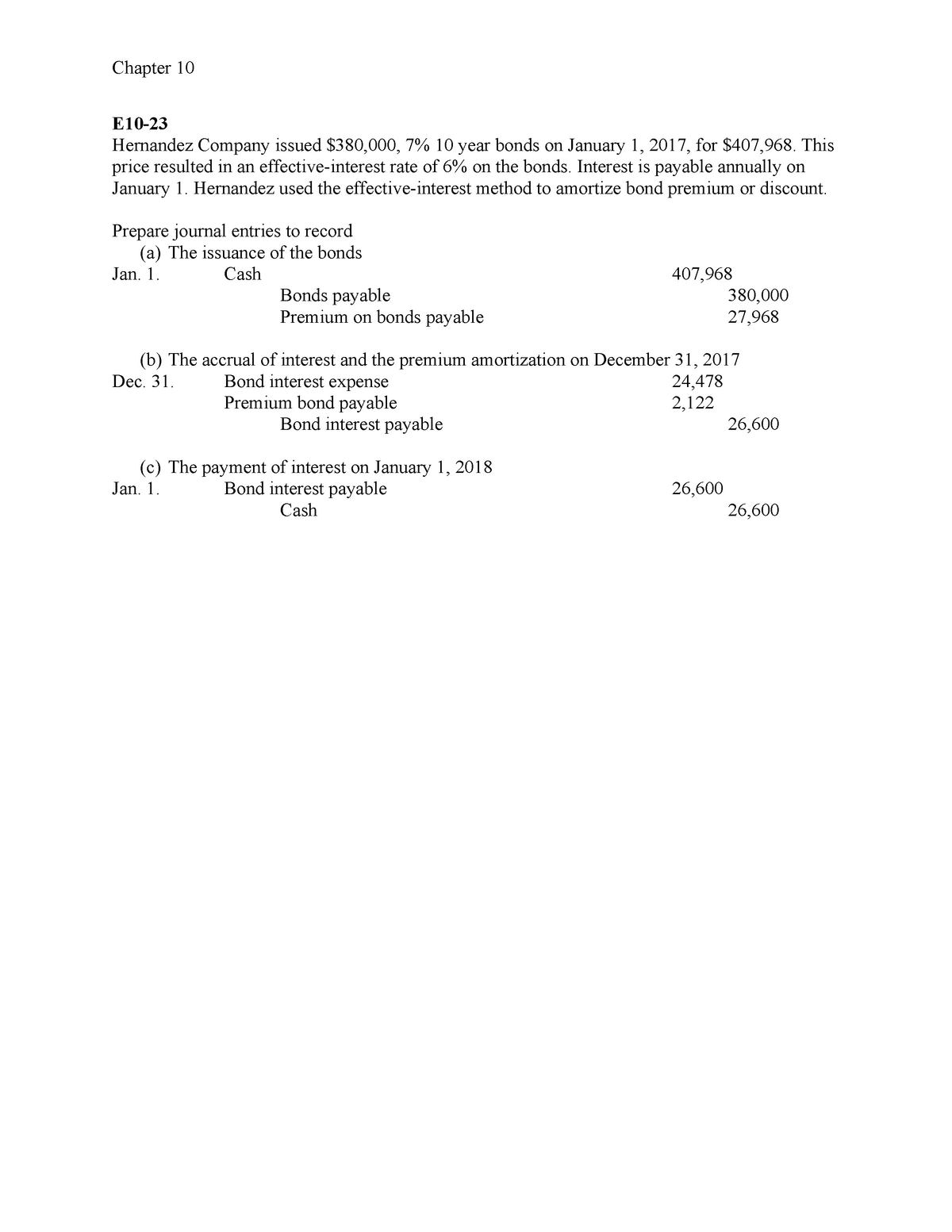

Swisher Company issued 2,000,000 of bonds on January 1, 2019

Explain the handling of notes and bonds that are sold between interest dates and make the journal entries for both the issuance and the first.

Bonds Payable Lecture 2 Journal Entries YouTube

Web the journal entry to record this bond issue is: Note that the total amount received is debited to the cash account and the bond’s.

Issuing Bonds (Journal Entries) YouTube

Mark the question as read. Repayment of the bond at maturity. Bonds issued at a premium. Web the journal entry to record this bond issue.

Bond Issuance Journal Entries and Financial Statement Presentation

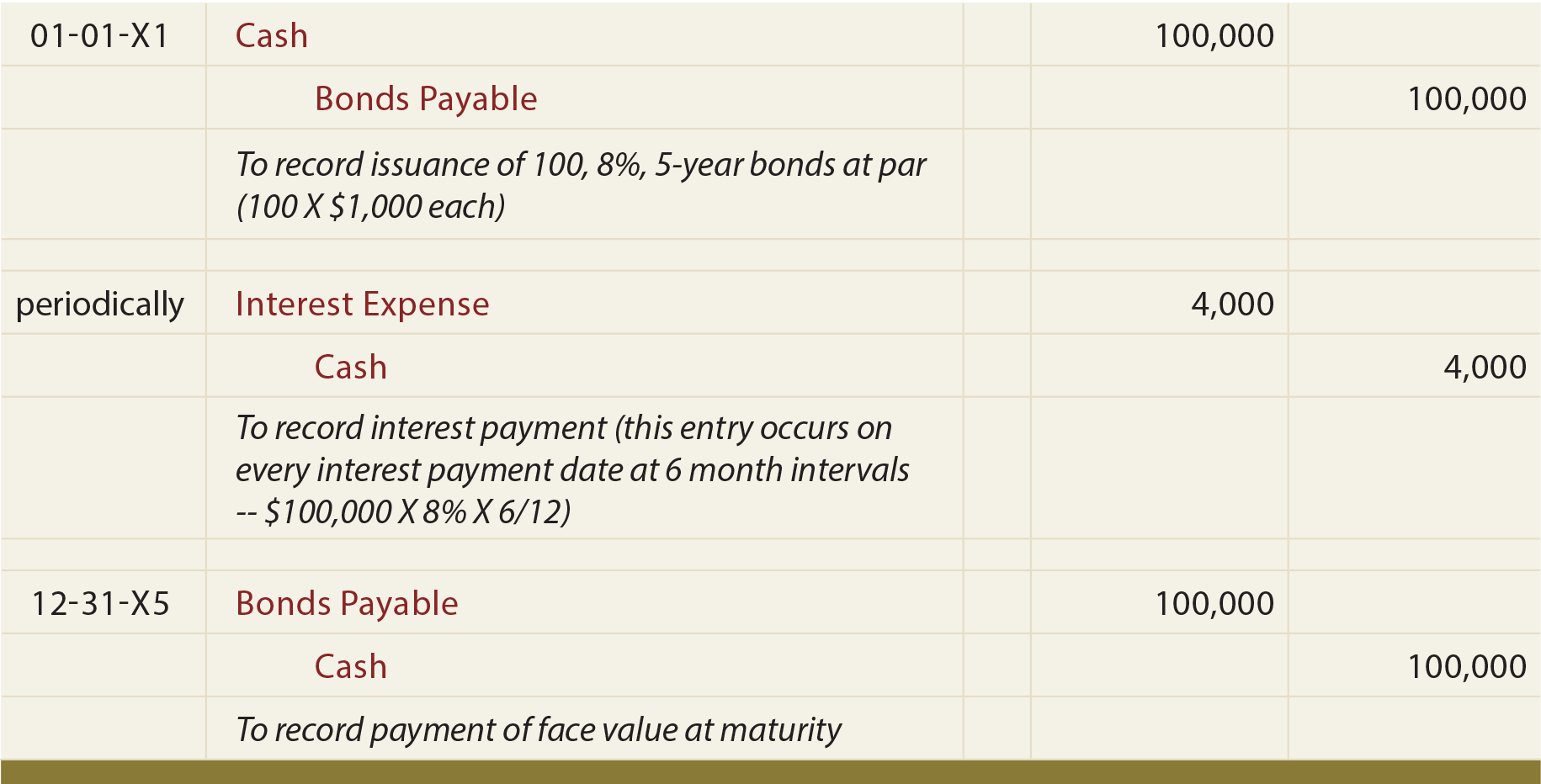

Web there are five possible journal entries related to investing in bonds, as follows: If interest was promised semiannually, entries are made twice a. If.

Bond Issued at Par Journal Entry to Record Issue Bonds at Par YouTube

Web when a company issues bonds, they make a promise to pay interest annually or sometimes more often. If the interest is paid annually, the.

Issuance of Bonds Journal Entries YouTube

Note that the total amount received is debited to the cash account and the bond’s face amount is credited to bonds payable. Mark the question.

Accounting For Bonds Payable

4.9k views 2 years ago notes payable, bonds payable. Web the journal entry for this transaction is: If the interest is paid annually, the journal.

Bonds Issued Between Interest Dates

Web when a company issues bonds, they make a promise to pay interest annually or sometimes more often. The liability is recorded because the issuer.

Web Accounting Record On The Initial Recognition:

The $750 received by the corporation for the accrued interest is credited to interest payable. Credit bonds payable for $100 million. Repayment of the bond at maturity. If interest was promised semiannually, entries are made twice a.

Company Abc Need To Make Journal Entry By Debiting Cash $ 2,00,000, Credit Financial Liabilities $ 1,845,300 And Other Equity $ 154,700.

Web the general journal entry to record the issuance of bonds will be: Web the journal entry for this transaction is: Advance your accounting and bookkeeping career. Earlier, we found that cash flows related to a bond include the following:

Web When Issuing Bonds, Two Primary Journal Entries Must Be Recorded:

If the interest is paid annually, the journal entry is made on the last day of the bond’s year. Record cash received from investors, debit cash, and credit bond proceeds for the total amount received from investors. The next interest payment is due on 2 january 2021. Mark the question as read.

Web May 28, 2024 5:30 Am Et.

Payment of interest each period. Hence, the carrying value of the bonds payable on the balance sheet equals the face value of issued bonds. A journal entry must be made for each of these transactions. Web when a company issues bonds, they make a promise to pay interest annually or sometimes more often.