Journal Entry To Clear Undeposited Funds - Reviewing the undeposited funds account. When making corrections in quickbooks online, there are four basic types of corrections: Web the correct undeposited funds workflow. The undeposited funds account is used to track and record such amounts. To find them bring up the registry for the undeposited funds account, click on quick report => customize report => filters => cleared and select “no”. A deposit is recorded to the correct bank account. Web some accountants or bookkeepers who don’t understand the full functionality of quickbooks online might try to fix incorrect balances in the undeposited funds account with a journal entry. There are two ways to clean up undeposited funds in quickbooks online. When receipts that you have recorded to the undeposited funds account are actually deposited to your bank account, you need to record the bank deposit in accountright. Many companies have a credit card processor that dumps all the day’s deposits, less processing fees, into.

Solved How to clear up undeposited funds account?

From here, uncheck the box that says use undeposited funds as a default ‘deposit to’ account. You can create a journal entry, debit the undeposited.

Journal Entry Examples

Reviewing the undeposited funds account. Before initiating the clearing process, it is crucial to review the undeposited funds account in quickbooks online to identify all.

Negative Undeposited Funds & Journal Entries

More information on this topic. From here, uncheck the box that says use undeposited funds as a default ‘deposit to’ account. Start with a customer.

How to clear undeposited funds in QuickBooks Online Scribe

In the newer versions of the software it is possible to make a general journal entry to the undeposited funds account. Enter the transaction date.

How do I manage Undeposited Funds? Support Center

In the newer versions of the software it is possible to make a general journal entry to the undeposited funds account. Web the undeposited funds.

Solved How to clear up undeposited funds account?

Under other, select journal entry. Reviewing the undeposited funds account. Web enter the undeposited funds account! The undeposited funds account is used to track and.

Negative Undeposited Funds & Journal Entries

Under other, select journal entry. On the payments subtab of the deposits subtab, check the box in the deposit column next to the journal lines.

Accounting Journal Entries For Dummies

Web if there is a balance in undeposited funds then those transaction would not be “cleared”. Web the correct undeposited funds workflow. Both the undeposited.

How do you match a deposit to a receipt when the credit card refund is

In certain cases, you would receive money from your customers which needs to be deposited into bank accounts. Enter the transaction date in the journal.

Web That Means That Many Times You Need To Fix The Transactions Directly In Accounts Receivable, Accounts Payable, Bank Reconciliations, Undeposited Funds, Inventory, Payroll, And Sales Taxes.

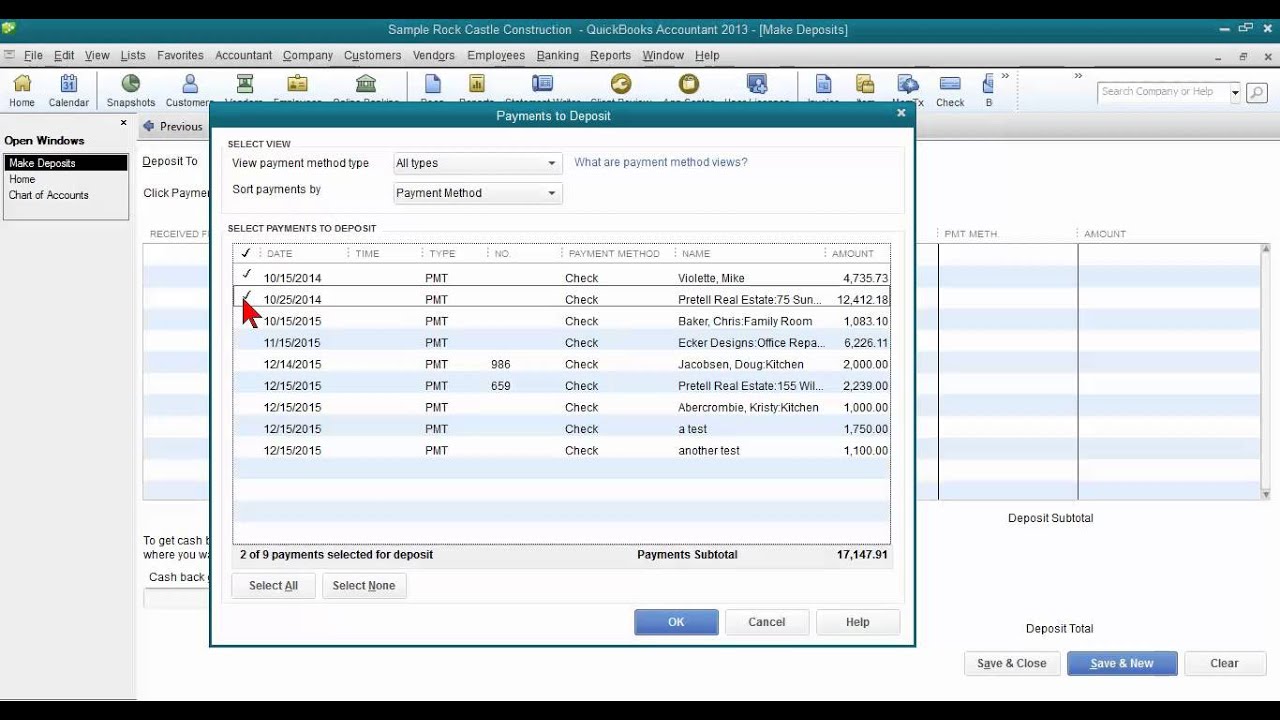

A deposit is recorded to the correct bank account. In certain cases, you would receive money from your customers which needs to be deposited into bank accounts. Web yes, you can also create a journal entry and offset the value of a negative deposit. Web prepare a bank deposit.

You Can Create A Journal Entry, Debit The Undeposited Funds Account, And Credit The.

In the debit column, enter the single line deposit. A customer payment for that invoice is entered to undeposited funds. Start with a customer invoice. Web if you want to avoid seeing the je from appearing when making a deposit, you can transfer the amount in the undeposited funds account to a designated account.

Web Go To The Edit Dropdown Menu.

Finalizing the reconciliation based on the bank statement. From here, uncheck the box that says use undeposited funds as a default ‘deposit to’ account. When making corrections in quickbooks online, there are four basic types of corrections: Use the following steps to help you create a journal entry and offset the value of a negative deposit in undeposited funds.

On The Payments Subtab Of The Deposits Subtab, Check The Box In The Deposit Column Next To The Journal Lines You Want To Remove.

Reviewing the undeposited funds account. There are two ways to clean up undeposited funds in quickbooks online. Web the correct undeposited funds workflow. The correct way, and the quick way!