Journal Entry Supplies On Hand - Spokesman stephane dujarric said simply: Examples of supplies on hand are production supplies, maintenance supplies, and office supplies. Likewise, the office supplies used journal entry is usually made at the period end adjusting entry. When cost of supplies used is recorded as supplies expense. Etefa said the wfp was still passing out hot meals and. Asked about the ramifications of suspending aid, u.n. They take transactions and translate them into the information you, your bookkeeper, or accountant use to create financial reports and file taxes. This is posted to the supplies t. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. If this journal entry had been omitted, many errors on the financial statements would result.

A Beginner's Guide to Journal Entries A and M Education

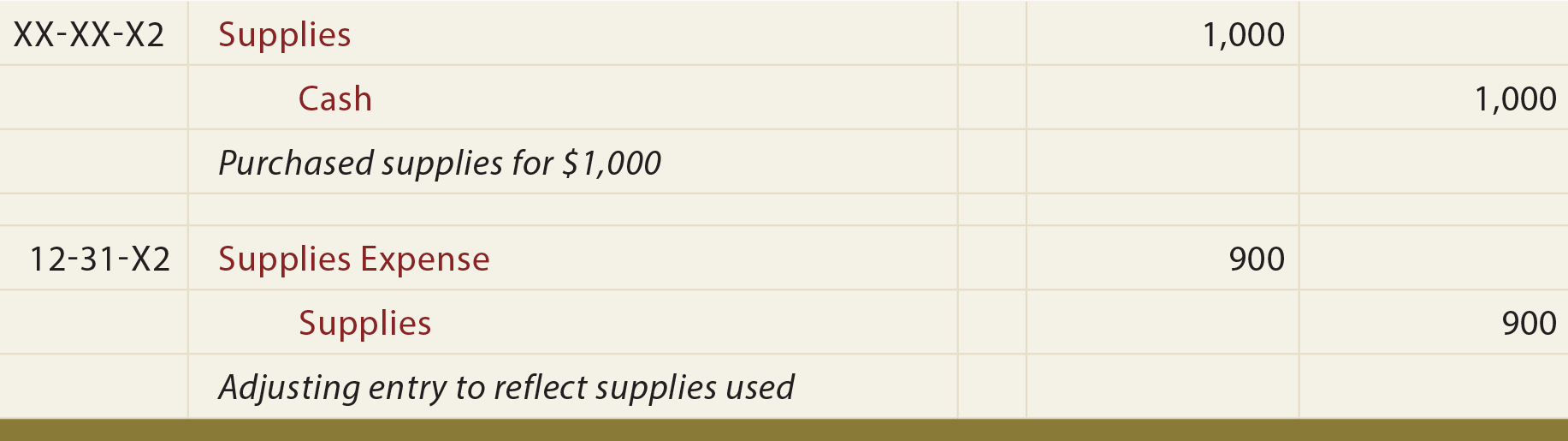

The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. 3 boxes of paper, 4.

office supplies on hand journal entry fashionartillustrationartworks

Web for example if a business purchases supplies of pens and stationery for 400, the journal entry to record this is as follows: 3 boxes.

office supplies on hand journal entry pandaartillustrationcharacterdesign

The supplies account will be increased or decreased, as needed, to bring it to the correct balance. Supplies has a credit balance of $100. Web.

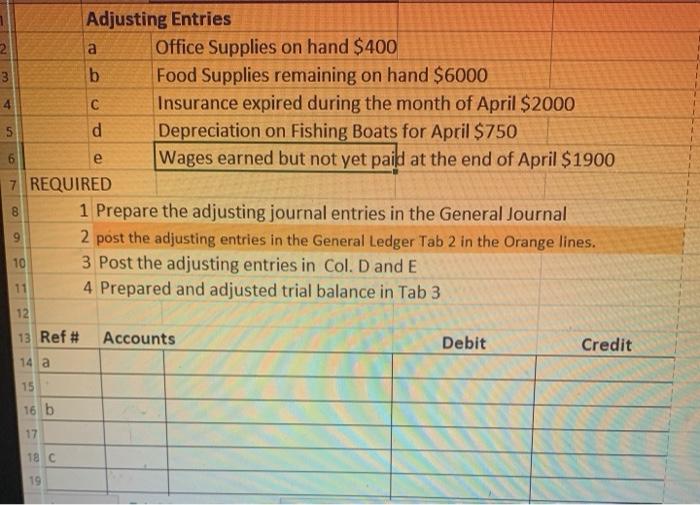

Solved 4 С Adjusting Entries 2 a Office Supplies on hand

Examples of supplies on hand are production supplies, maintenance supplies, and office supplies. At the end of the accounting period, the supplies on hand are.

What is the Adjusting Entry for Office Supplies? YouTube

At the end of the accounting period, the supplies on hand are counted and the movement recorded as an expense item in the income statement..

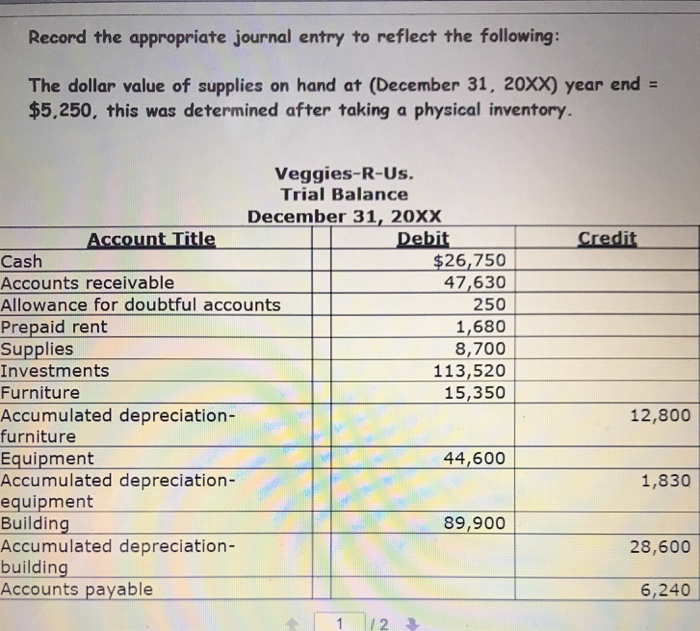

Solved Record the appropriate journal entry to reflect the

When cost of supplies used is recorded as supplies expense. Examples of supplies on hand are production supplies, maintenance supplies, and office supplies. In the.

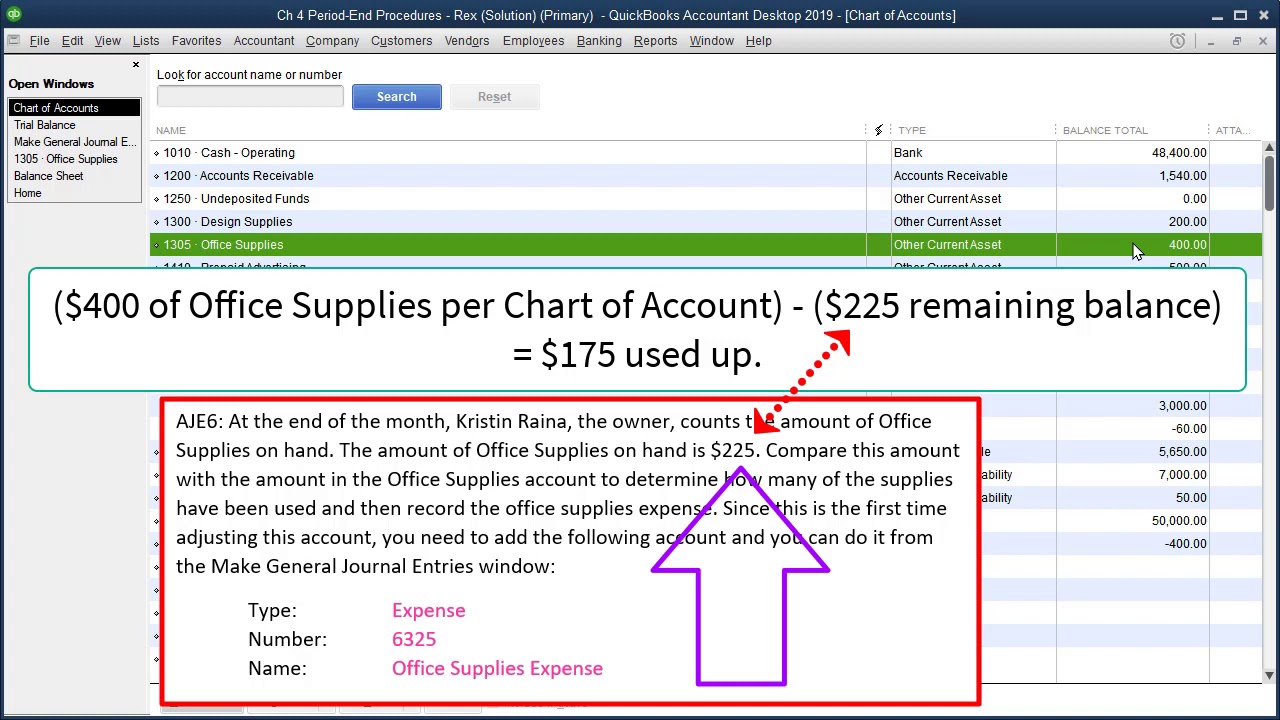

QuickBooks Adjusting Journal Entry 6 Office Supplies YouTube

Every transaction your business makes requires journal entries. And calculate a total value for supplies on hand, based on what we paid for the items.

Stationery on hand / Consumable Stores on hand YouTube

The supplies account will be increased or decreased, as needed, to bring it to the correct balance. Determined that the cost of supplies on hand.

Supplies on hand and Supplies Expense YouTube

Supplies are incidental items that are expected to be consumed in the near future. Determined that the cost of supplies on hand was 900; If.

Web Locate The General Journal.

Web the following journal entries are created when dealing with office supplies. Debit the supplies expense account for the cost of the supplies used. Web for months, the u.n. If this journal entry had been omitted, many errors on the financial statements would result.

Examples Of Supplies On Hand Are Production Supplies, Maintenance Supplies, And Office Supplies.

Indicate the effect of each transaction. In the journal entry, supplies expense has a debit of $100. Accounting for supplies on hand. Web this results in expense on the income statement being equal to the amount of supplies used, while the remaining balance of supplies on hand is reported as an asset.

This Is Posted To The Supplies T.

Only later, did the company record them as expenses when they are used. Balance the entry by crediting your supplies account. Asked about the ramifications of suspending aid, u.n. Over time, the supplies are used or discarded.

The Original Journal Entry Will Show A Debit In The Supplies Column And A Credit In The Cash Column.

Web make a journal entry on 1 january 2016, when the office supplies are purchase. Supplies has a credit balance of $100. Web the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as supplies or supplies on hand. View the original amount of supplies recorded in the general journal.