Journal Entry Reversal - At the beginning of the new month,. Navigate to the enter journals window. Web reversing entries are the reversals of accrued journal entries in order to back out the accrual and make space for the actual. Web a reversing entry is an accounting journal entry made at the beginning of an accounting period to reverse or cancel out a prior entry. This is a record of the change you made. In this session, i explain reversing journal. Web reversing journals saves you time and helps prevent data entry errors. The accounting information system | intermediate accounting | cpa exam far. This technique is primarily used to avoid. Web the purpose of reversing entries is to cancel out certain adjusting entries that were recorded in the previous accounting period.

Reversal Journal Entry YouTube

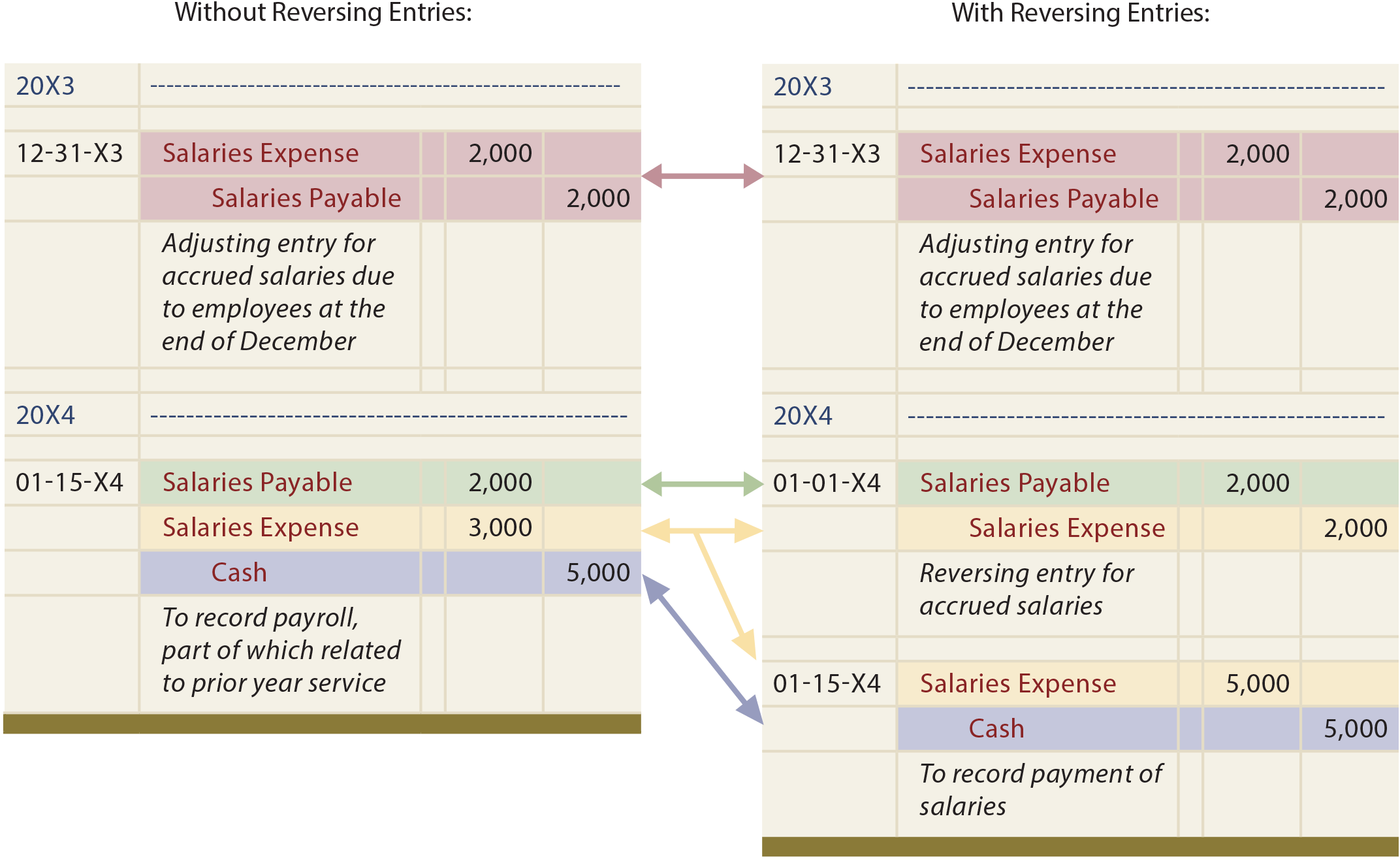

A reversing entry is a journal entry made in an accounting period, which reverses selected entries made in the immediately preceding period. Note that the.

Reversing Entries When, What, How and Why? YouTube

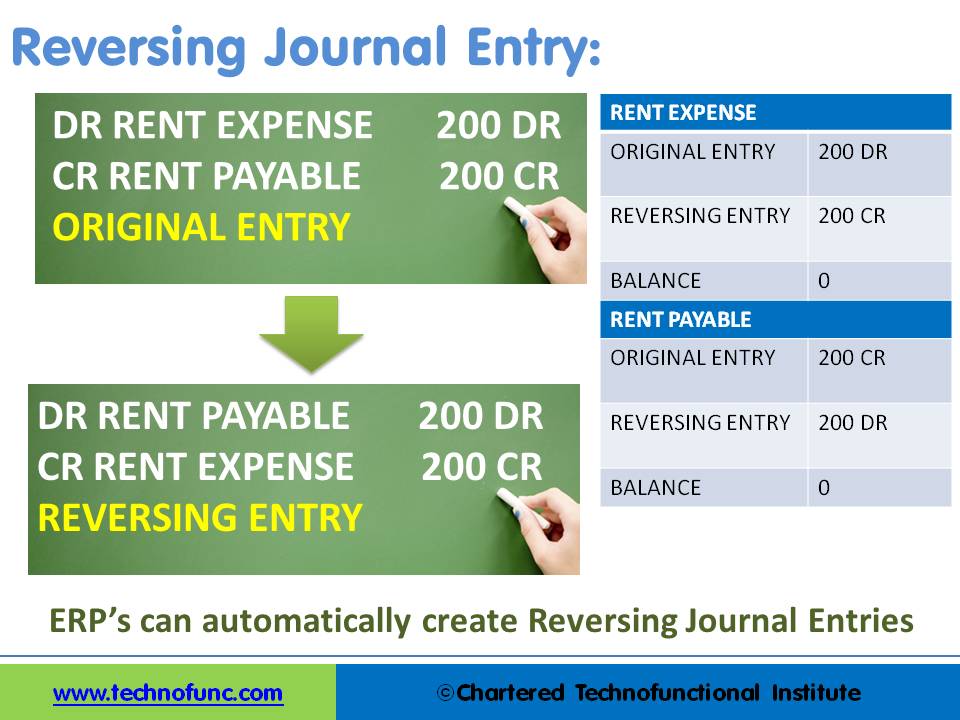

Web what is a reversing entry? Web reversing entries are a type of journal entry, which is how businesses record transactions. Web reversing entries are.

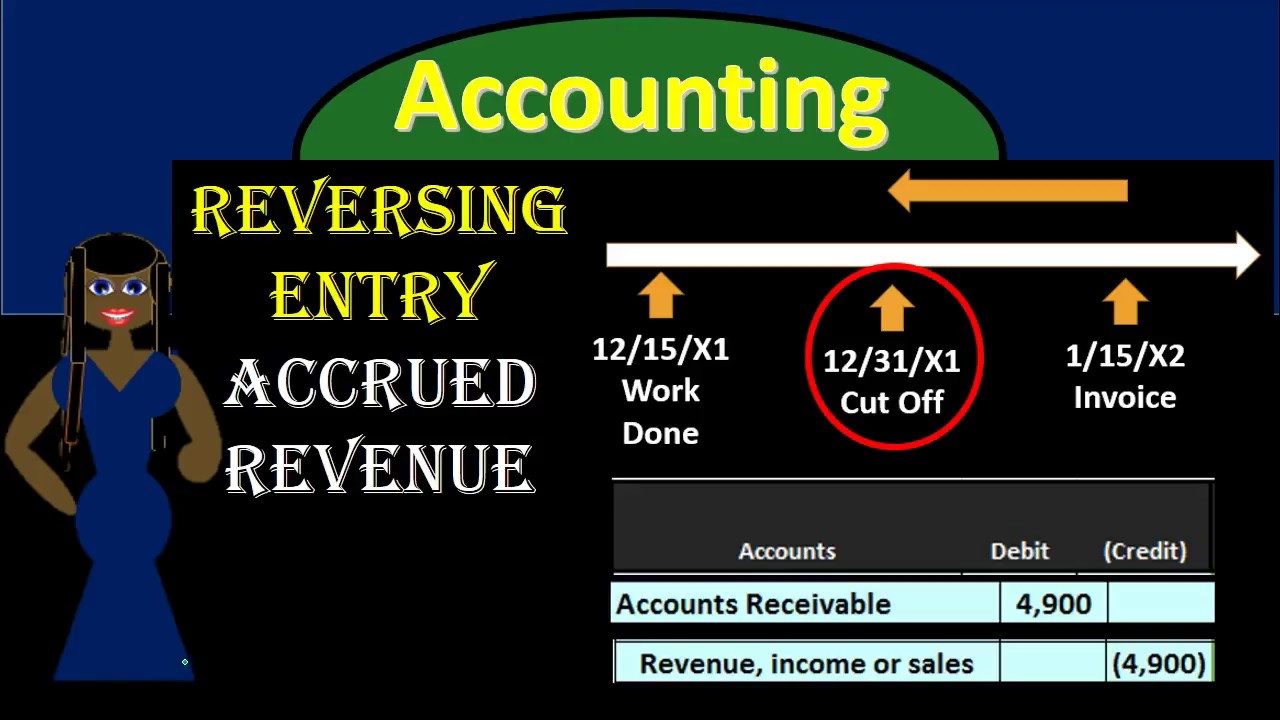

300 Reversing Journal Entries Accrued Revenue YouTube

Web a reversing journal entry is a type of adjusting entry that is made at the beginning of an accounting period to reverse the effects.

Reversing Entries

Web the purpose of reversing entries is to cancel out certain adjusting entries that were recorded in the previous accounting period. Web a reversing journal.

TechnoFunc GL Reversing Journal Entry

Web reversing entries refer to those journal entries passed in the current accounting period to offset the entries for outstanding expenses and accrued income. When.

Reversal Journal Entry Support Center

Web reversing entries are passed at the beginning of an accounting period as an optional step of accounting cycle to cancel the effect of previous.

Journal Entry Reversal Module Deltek Vision Quickly create reversals

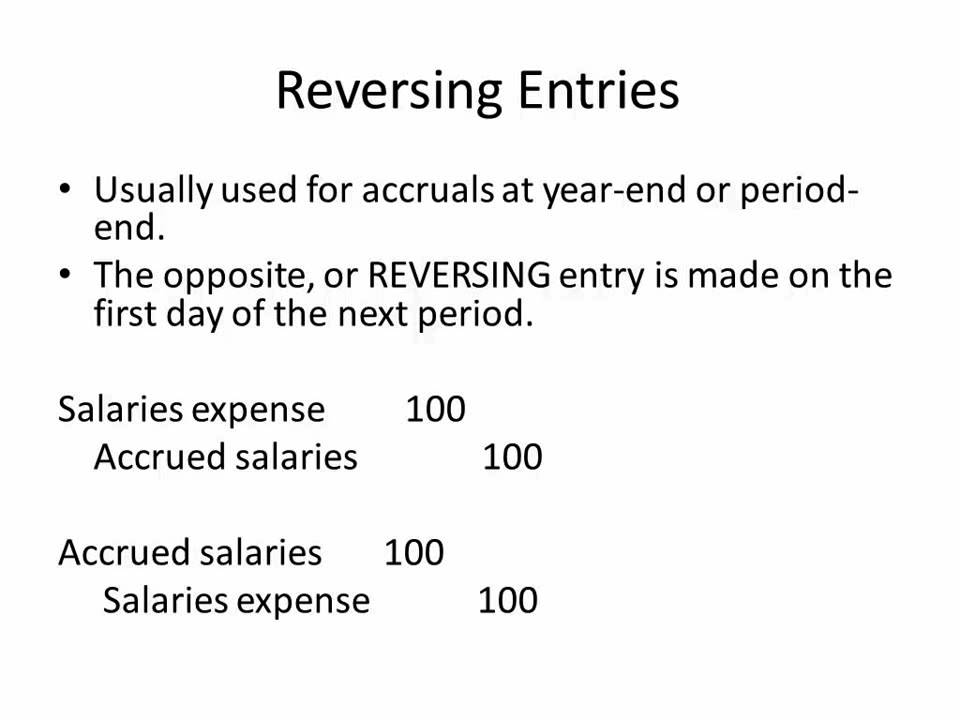

Reversing entries are made on the first day of an accounting period to remove accrual adjusting entries that were made at the end of the..

Reversing Entries YouTube

This is a record of the change you made. Query the batch and journal within the batch for which you want to assign a reversal.

Impairment Loss Journal Entry

Navigate to the enter journals window. In this session, i explain reversing journal. The accounting information system | intermediate accounting | cpa exam far. Web.

Navigate To The Enter Journals Window.

Web reversing entries refer to those journal entries passed in the current accounting period to offset the entries for outstanding expenses and accrued income. The reversing entry typically occurs at the beginning of an accounting period. In this session, i explain reversing journal. This is a record of the change you made.

3 Benefits Of Using Reversing Entries.

15k views 1 year ago chapter 3: Web accounting entries, reversing entries included, of course, are really important because they’re key in keeping your financial situation up to date. Accrued revenue journal entries refer to the figures derived and entered by adjusting entries at the end of an. Web reversing entries are passed at the beginning of an accounting period as an optional step of accounting cycle to cancel the effect of previous period adjusting.

A Reversing Entry Is A Journal Entry Made In An Accounting Period, Which Reverses Selected Entries Made In The Immediately Preceding Period.

Web reversing journals saves you time and helps prevent data entry errors. Web a reversing journal entry is a type of adjusting entry that is made at the beginning of an accounting period to reverse the effects of a previous adjusting entry. Reversing entries are made on the first day of an accounting period to remove accrual adjusting entries that were made at the end of the. Web what are accrued revenue journal entries?

This Technique Is Primarily Used To Avoid.

Web what is a reversing entry? The accounting information system | intermediate accounting | cpa exam far. Web the journal entry will increase the expense on income statement and the type of expense will depend on the nature of the transaction. They are usually made on the first.