Journal Entry Rent - Web accrued rent represents the sum of the amount owed in rent by a tenant to their landlord within a reporting period for which payment has not yet been made. Unlike small businesses, the large entities pay their rents by cheque to keep legal evidence for taxes and audit trail. Let’s assume you own a single rental property, as. Web the journal entry is debiting rental expenses and credit cash. Cash balance increases by $20,000. In accounting, the rent paid in advance is an asset, not an expense, as the amount paid represents the advance payment for the future use of the rental property. Web journal entry to record the payment of rent. Accounting for accrued rent under asc 840. Initial journal entry for prepaid rent: Web employers plan to hire 5.8% fewer new graduates than they did last year, according to a spring survey of 226 employers by the national association of colleges and employers.

Finance Lease Journal Entries businesser

Web paid rent journal entry. Web journal entries when prepaid rent is paid by cheque; Company abc is in the. Prepare a journal entry to.

Self Study Notes The Adjusting Process And Related Entries

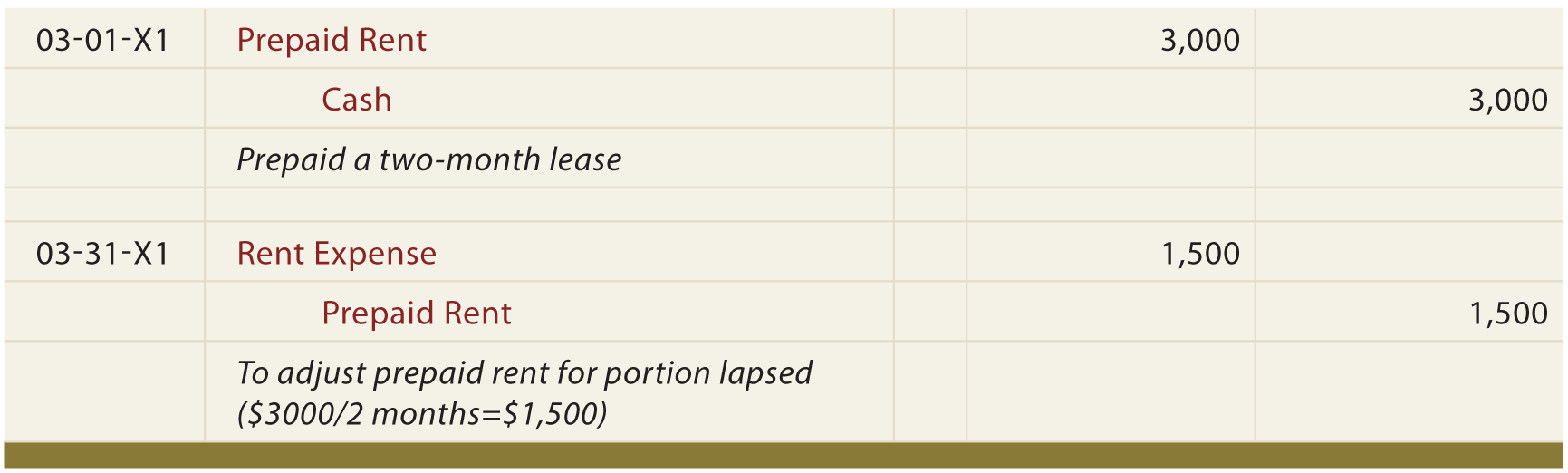

So let’s now work through a simple example to show the debits and credits involved. Web prepaid rent journal entry overview. Web the journal entries.

The Adjusting Process And Related Entries

Web this journal entry is made to eliminate the rent payable on the balance sheet that we have recorded in the prior period. Accounting for.

Journal entry of Rent received in advance and Accrued Rent

[q1] the entity paid $12,000 for monthly rent. Prepare a journal entry to record this transaction. Prepaid rent is the amount the company pays in.

Prepaid Salary Journal Entry

Web accounting for prepaid rent with journal entries. Web the journal entries for prepaid rent are as follows: Web this journal entry is made to.

Journal entries for lease accounting

How has accounting for rent payments changed under asc 842? Rent is an expense for business and thus has a debit balance. Written by andrew.

Journal entries for lease accounting

Accounting for accrued rent with journal entries. The transaction will impact the rental expense on the income statement. Web paid rent journal entry. Web journal.

Rent Receivable Journal Entry CArunway

Prepare the journal entry for the following transaction: Written by andrew in accounting tutorials, tutorials. Web journal entries when prepaid rent is paid by cheque;.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Other considerations in rent expense. This should provide you with a good overview of all the. Prepare a journal entry to record this transaction. Accounting.

In Accounting, The Rent Paid In Advance Is An Asset, Not An Expense, As The Amount Paid Represents The Advance Payment For The Future Use Of The Rental Property.

Web rent payable (or accrued rent) is simply the unpaid rent expense of a business entity at the end of its accounting period. Web the journal entries for prepaid rent are as follows: Web contents [ show] journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. Web in this article, we will be looking at the accrued rent journal entry from both the landlord’s and tenant’s perspectives.

Web Prepaid Rent Journal Entry Overview.

Prepare a journal entry to record this transaction. A common question you will see in accounting. If a business does not own an office premise it may decide to hire a property and make periodical payments as rent. Such a cost is treated as an indirect.

Adjusting Journal Entry As The Prepaid Rent Expires:

How is rent expense measured? Accounting for accrued rent with journal entries. Probably the easiest part of working out the journal entry is. Web employers plan to hire 5.8% fewer new graduates than they did last year, according to a spring survey of 226 employers by the national association of colleges and employers.

Initial Journal Entry For Prepaid Rent:

Cash balance increases by $20,000. Prepaid rent is the amount the company pays in advance to use the rental facility (e.g. Web journal entries when prepaid rent is paid by cheque; Company abc is in the.