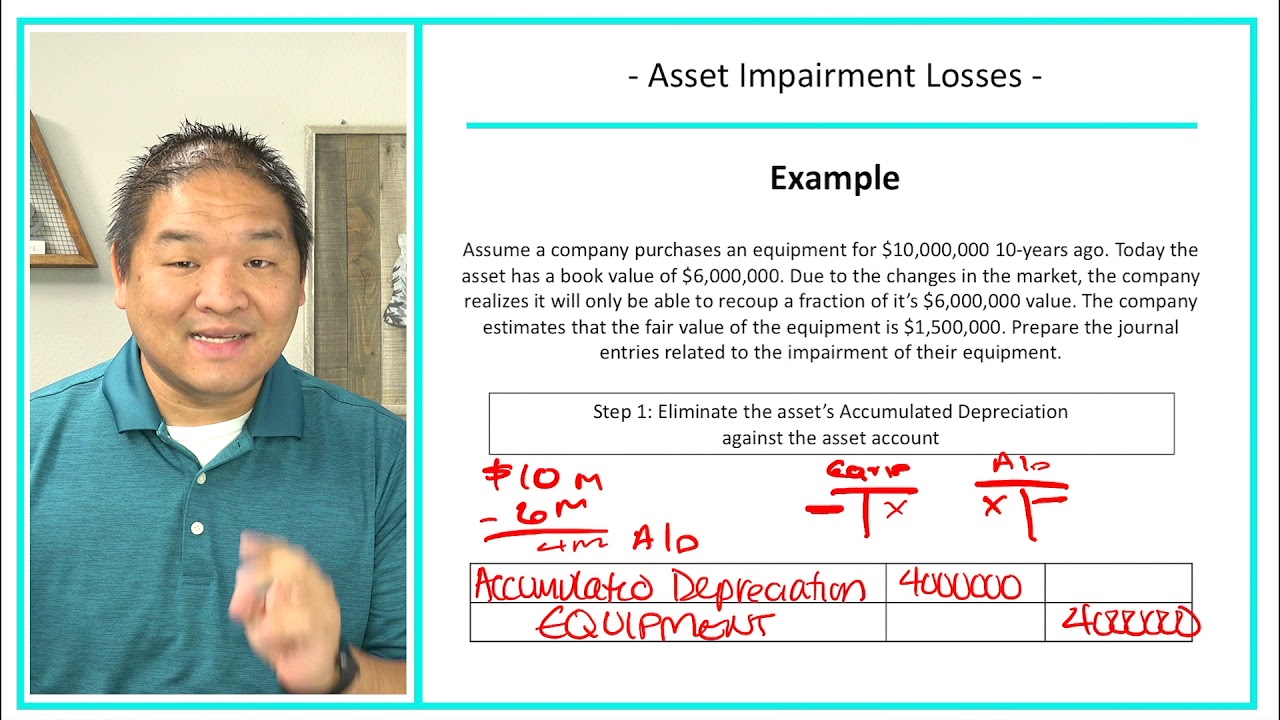

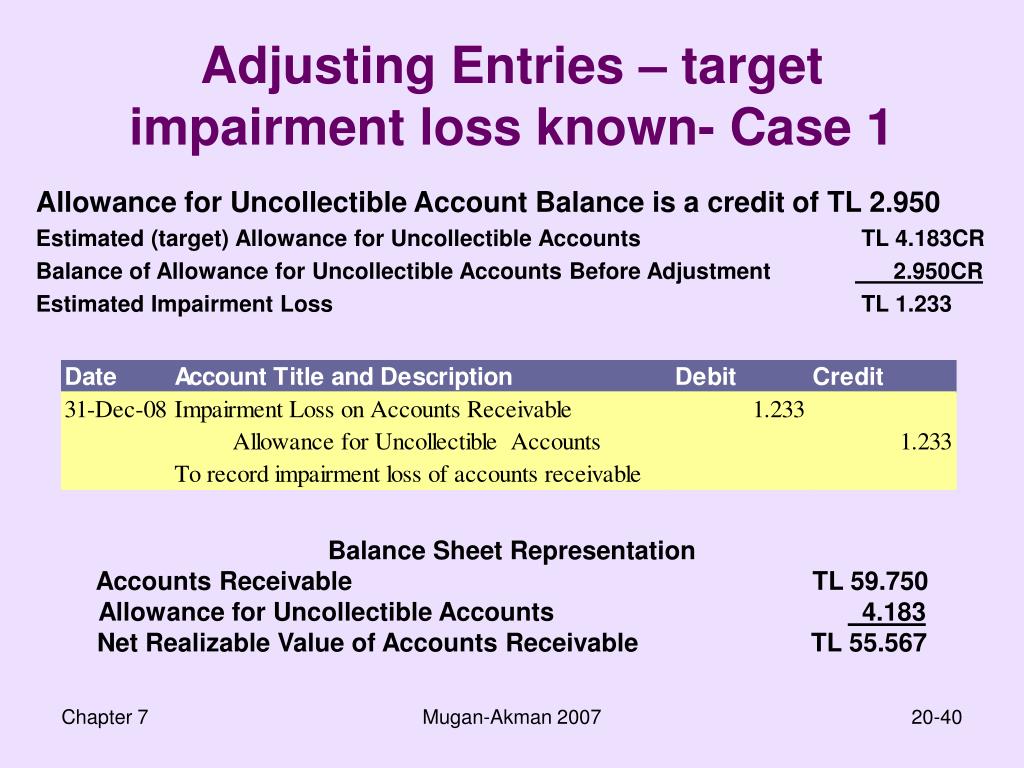

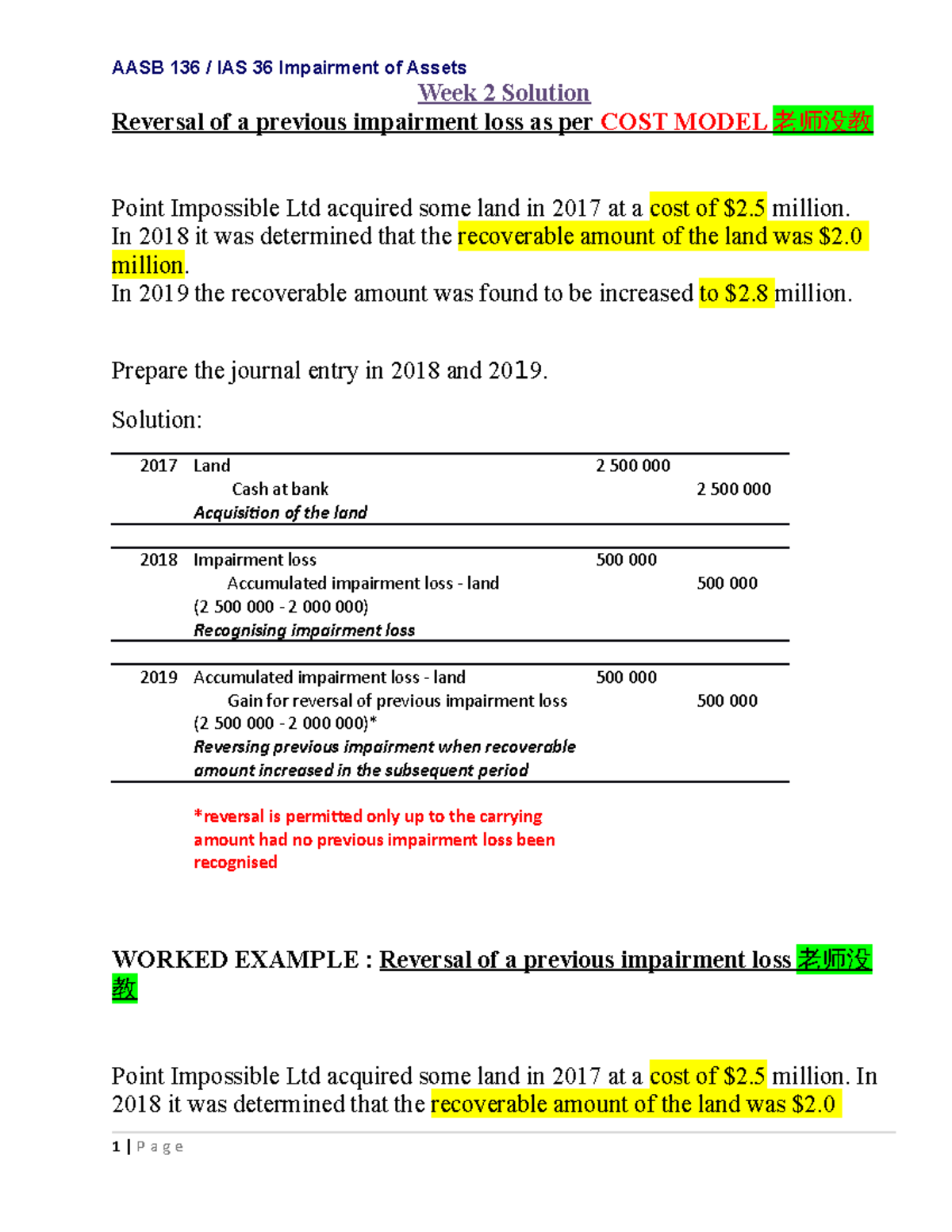

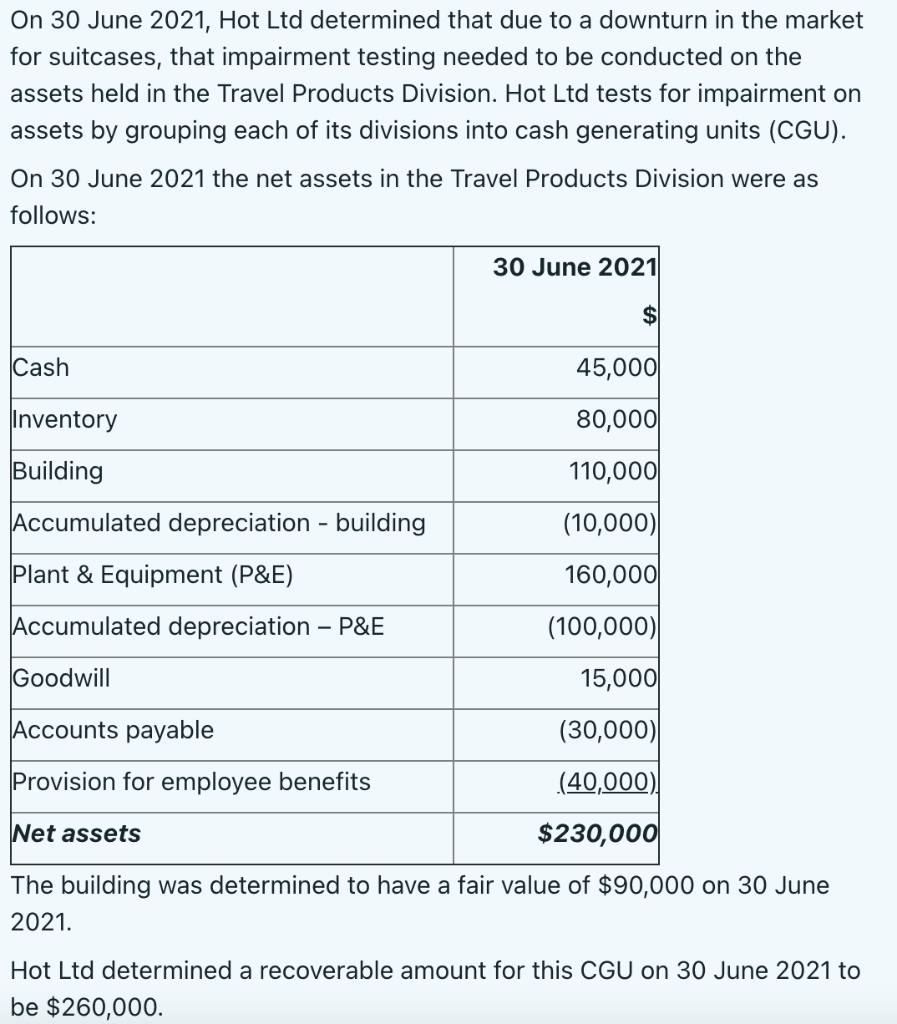

Journal Entry Of Impairment Loss - Web the company can make the fixed asset impairment journal entry by debiting the impairment losses account and crediting the accumulated impairment losses account. Web in accounting, impairment is a permanent reduction in the value of a company asset. In this journal entry, total expenses on the income statement increase while total assets on the balance sheet decrease. Web the impairment loss is when the book value is higher than the fair value. Web as the recoverable amount is less than the carrying value, the asset is impaired. “4.8 impairment of an equity method investment. You must record the new amount in your books by writing off the difference. These expansions trigger a cascade of cellular damage, including protein aggregation and abnormal rna binding. Can calculate the impairment loss. Their dissenting opinions are set out after the basis for conclusions.

6 Reversal of an impairment loss YouTube

Web trinucleotide repeat expansion disorders, a diverse group of neurodegenerative diseases, are caused by abnormal expansions within specific genes. When testing an asset for. Web.

Impairment Loss Journal Entry BronsonaresTownsend

Web as the recoverable amount is less than the carrying value, the asset is impaired. Write the asset’s new value on your future financial statements..

Fun Impairment Loss Double Entry Fortis Balance Sheet

The following journal entry must be recorded to account for this condition: Impairment refers to a sharp decrease in the fair market value of an.

Accounting For Intangible Assets Complete Guide for 2023

Messrs cope and leisenring and professor whittington dissented. This loss will be as below. Web an impairment loss is an asset’s book value minus its.

Impairment Loss Journal Entry

“4.8 impairment of an equity method investment. Web automatic form fill seal machine. The new guidance for goodwill impairment. pricewaterhouse cooper. These expansions trigger a.

Glory Impairment Loss On Receivables Financial Statement Preparation

Web international accounting standard 36 impairment of assets (as revised in 2004) was approved for issue by eleven of the fourteen members of the international.

Accounting for Impairment of Goodwill IFRS & ASPE (rev 2020) YouTube

Web the impairment loss is when the book value is higher than the fair value. <10,000> * 5,000 / 20,000 = <2,500>. This loss will.

Impairment Loss Journal Entry Rachel Randall

The new guidance for goodwill impairment. pricewaterhouse cooper. Web the company can make the fixed asset impairment journal entry by debiting the impairment losses account.

AASB 136 Impairment of Assets AASB 136 IAS 36 Impairment of Assets

“4.8 impairment of an equity method investment. In this journal entry, total expenses on the income statement increase while total assets on the balance sheet.

Impairment Refers To A Sharp Decrease In The Fair Market Value Of An Asset Due To Several Internal And External Factors.

Web international accounting standard 36 impairment of assets (as revised in 2004) was approved for issue by eleven of the fourteen members of the international accounting standards board. These expansions trigger a cascade of cellular damage, including protein aggregation and abnormal rna binding. Where the decrease in value is greater than the previous increase in value, and the asset was previously depreciated, the journal entries are: Although a separate accumulated impairment loss account has been credited here, it is common in practice to simply credit accumulated depreciation.

If Due To Any Event The Impaired Asset Regains Its Value, The Gain Is First Recorded In Income Statement To The Extent Of Original Impairment Loss And Any Excess Is Considered A Revaluation And Is Credited To Revaluation Surplus.

Then records the impairment loss. Web as the recoverable amount is less than the carrying value, the asset is impaired. “4.8 impairment of an equity method investment. Messrs cope and leisenring and professor whittington dissented.

The Journal Entry Is Debiting Impairment Expense And Credit The Impaired Asset.

Web the journal entry would be: “asset impairment and disposal.” cpa journal. Web the company can make the fixed asset impairment journal entry by debiting the impairment losses account and crediting the accumulated impairment losses account. And, you may also need to record a new amount for the asset’s depreciation.

When Testing An Asset For.

Web 2 september 2021 (updated 31 october 2023) global ifrs institute | uncertain times. As the result, company needs to reduce the asset’s book value from the balance sheet. Web an impairment loss is an asset’s book value minus its market value. Let us extend the example of zarlascht inc.