Journal Entry Of Depreciation - Web here are four easy steps that’ll teach you how to record a depreciation journal entry. Debit to the income statement account depreciation expense; Web journal entry for the depreciation of fixed assets. In other words, the cost of the fixed asset equals its accumulated depreciation. Web the dow jones segment — which includes the wall street journal — of parent company news corp. In the books of accounts, depreciation can be recorded by any of the following two methods, 1. The depreciation expense is calculated at the end of an accounting period and is entered as a journal as follows:. Before you record depreciation, you must first select. Debit to depreciation expense, which flows through to the income statement. Recently ended its third quarter with an ebitda (earnings before interest,.

Depreciation Posting and Journal Entry Professor Victoria Chiu YouTube

Purchase price and all incidental. How to keep your journal entries and accounting under control. By debiting the depreciation expense and crediting accumulated depreciation, the.

Adjusting Entries Journalizing Depreciation Adjusting Entries

The journal entry to record this expense is straightforward. Web here are four easy steps that’ll teach you how to record a depreciation journal entry..

13.4 Journal entries for depreciation

The depreciation expense is calculated at the end of an accounting period and is entered as a journal as follows:. Before you record depreciation, you.

Describing the Depreciation Methods Used in the Financial Statements

Unlike journal entries for normal. Web a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed.

Journal Entry for Depreciation Example Quiz More..

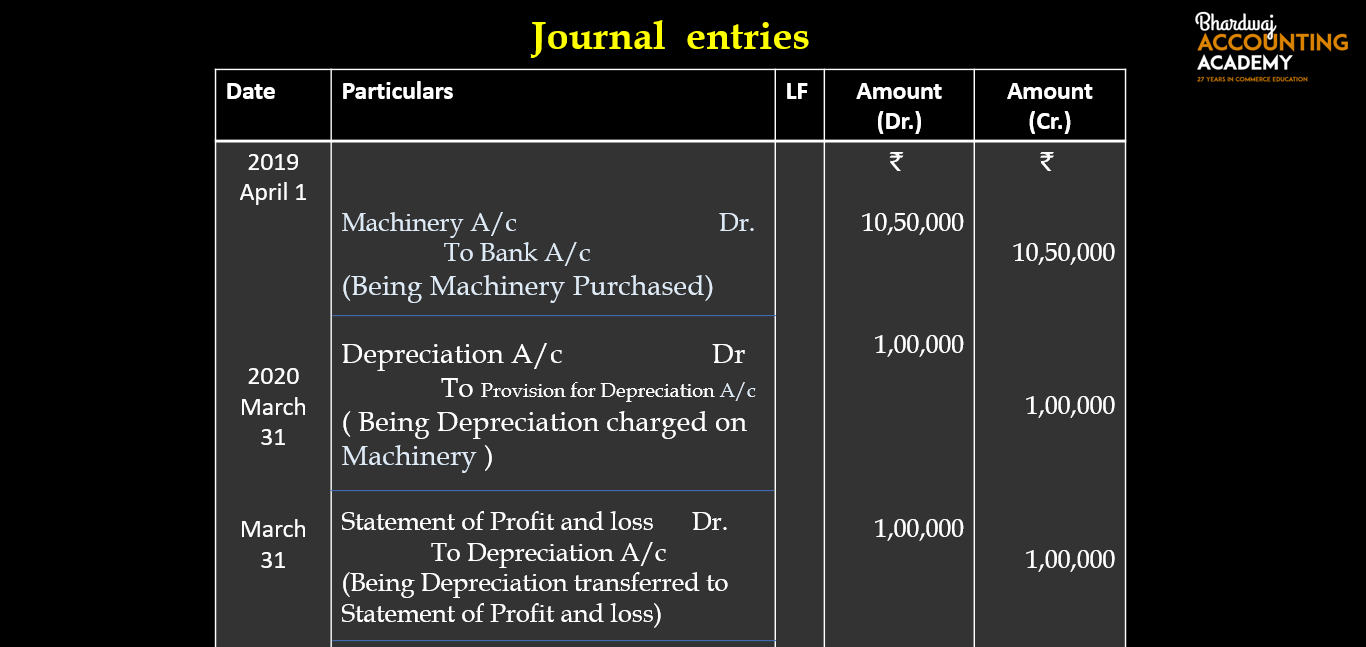

Web the journal entry consists of a: Purchase price and all incidental. We simply record the depreciation on debit and accumulated. The depreciation expense is.

Depreciation and Disposal of Fixed Assets Finance Strategists

Credit to the balance sheet account accumulated depreciation; Debit to depreciation expense, which flows through to the income statement. Depreciation is a term used in.

Journal Entry for Depreciation Example Quiz More..

Accelerated depreciation methods, on the other. In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as..

What is the journal entry for depreciation? Leia aqui What is

The journal entry to record this expense is straightforward. Purchase price and all incidental. Web the basic journal entry for depreciation is to debit the.

Depreciation journal Entry Important 2021

Web depreciation journal entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and.

Debit To Depreciation Expense, Which Flows Through To The Income Statement.

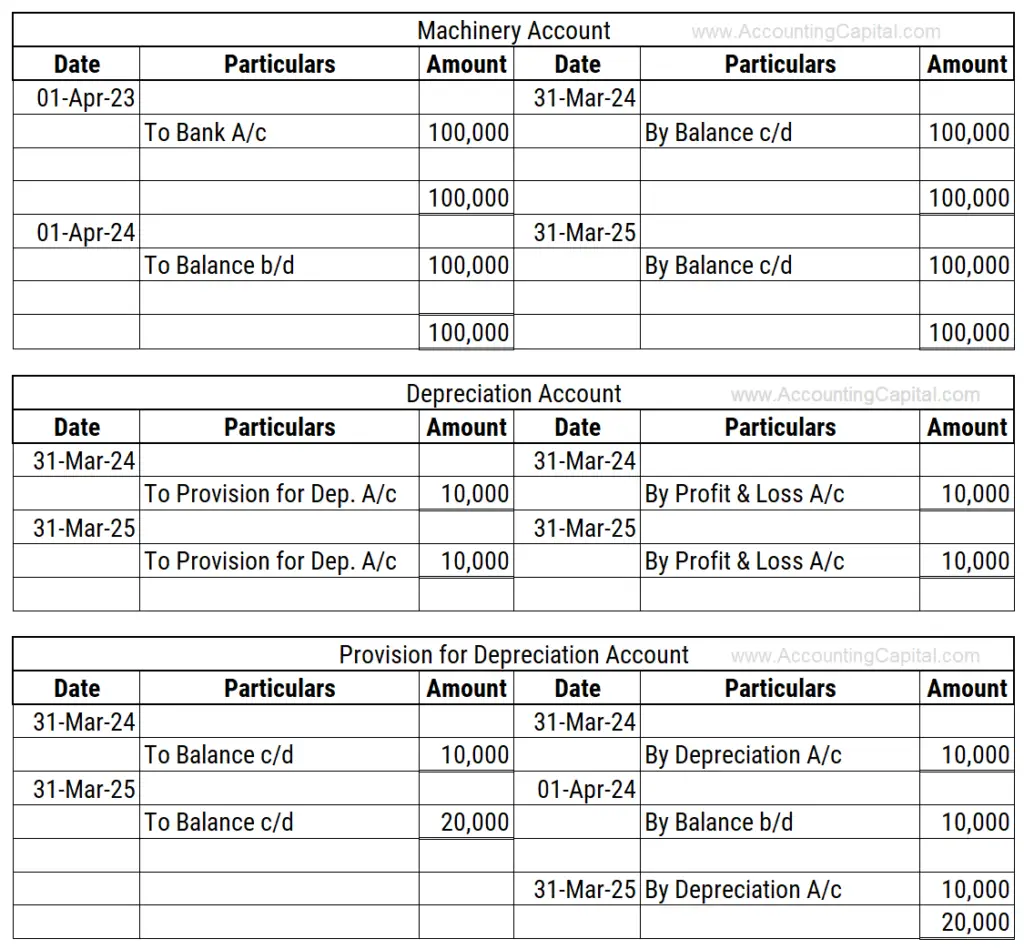

Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting software. How to keep your journal entries and accounting under control. Credit to accumulated depreciation, which is reported on the balance. In the books of accounts, depreciation can be recorded by any of the following two methods, 1.

The Journal Entry To Record This Expense Is Straightforward.

To calculate depreciation expense, you need to. Accelerated depreciation methods, on the other. Before you record depreciation, you must first select. In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as.

Web Depreciation Journal Entry Example:

Recently ended its third quarter with an ebitda (earnings before interest,. Credit to the balance sheet account accumulated depreciation; By debiting the depreciation expense and crediting accumulated depreciation, the book value of the asset decreases on the balance sheet. Depreciation is a term used in accounting to.

When Depreciation Is Charged To The ‘Asset’ Account.

Journal entry for accumulated depreciation. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system. Web the journal entry for depreciation is: Web the journal entry consists of a: