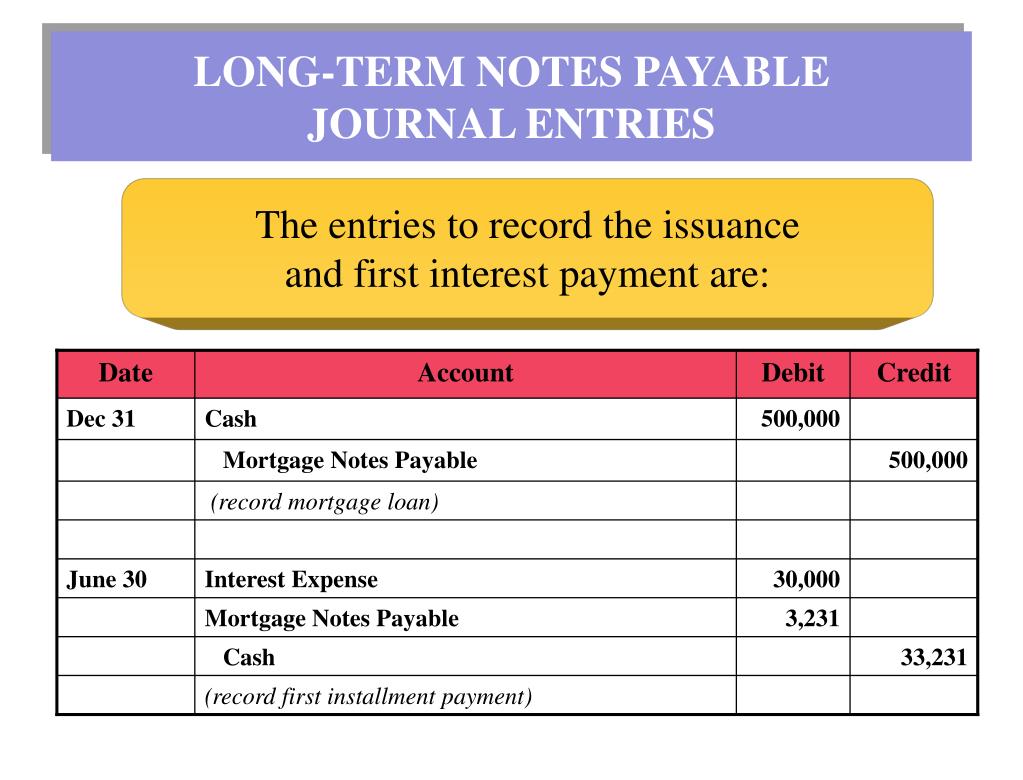

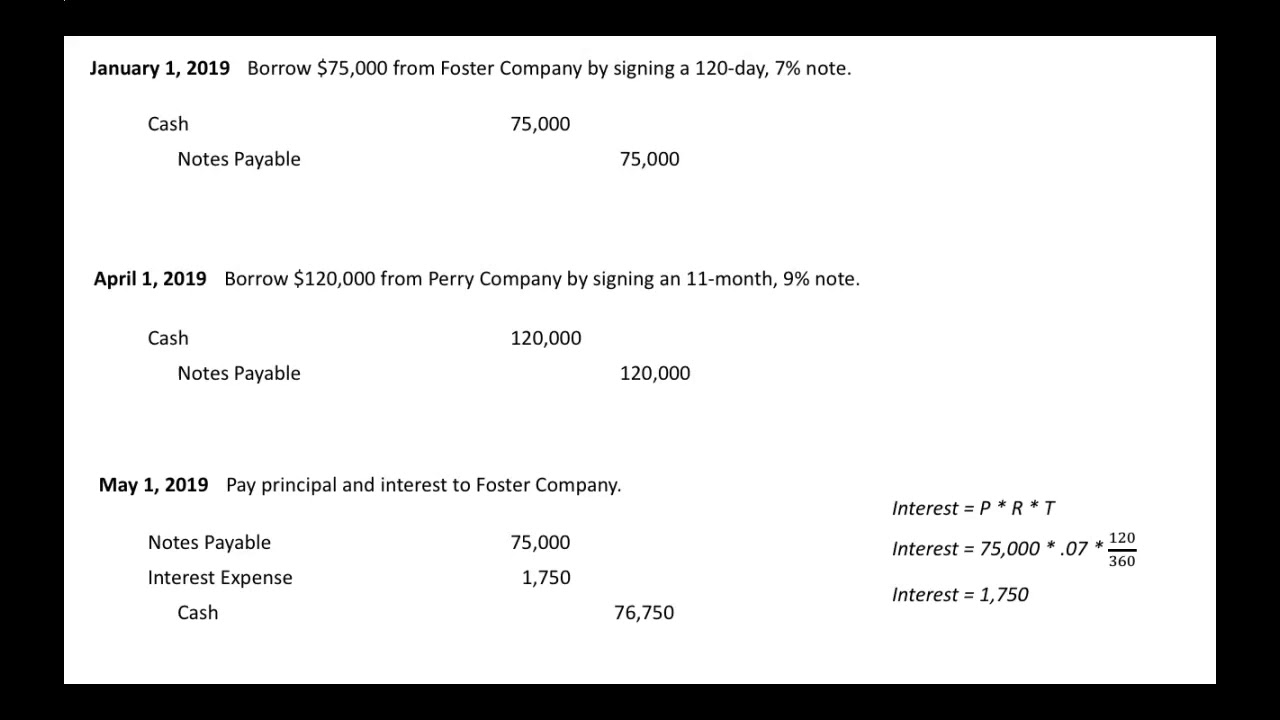

Journal Entry Notes Payable - In addition, the amount of interest charged is recorded as part of the initial journal entry as interest expense. Web the payment of the notes payable journal entry will decrease both total assets and total liabilities on the balance sheet. Observe that the $1,000 difference is initially recorded as a discount on note payable. Web a journal entry example of notes payable. And when that happens, notes payable come into play. Web the journal entry to log a purchase with a note payable impacts at least two of your small business’s accounts. The amount to be paid. If ram inc issues notes payable for $30,000 due in 3 months at 8% p.a. Accounts payable are recorded in the balance sheet under current liabilities. So goods or services acquired under credit will be transacted against current liabilities.

Accounting for a Note Payable YouTube

This liability is recorded based on the sellers’ invoice. Notes payable is a promissory note that represents the loan the company borrows from the creditor.

PPT CHAPTER 11 LIABILITIES PowerPoint Presentation, free download

Contained within the notes payable are also the terms stipulated between the two parties. In each case the accounts payable journal entries show the debit.

Accounting for a Long Term Note Payable YouTube

The following is an example of notes payable and the corresponding interest, and how each is recorded as a journal entry. At some point or.

Notes Payable Journal Entries YouTube

Likewise, the company needs to make the notes payable journal entry when it signs the promissory. Notes payable is a promissory note that represents the.

Notes Payable (Journal Entries) YouTube

Web a journal entry example of notes payable. In each case the accounts payable journal entries show the debit and credit account together with a.

Note Payable Calculating Maturity date and Journal Entries (MOM

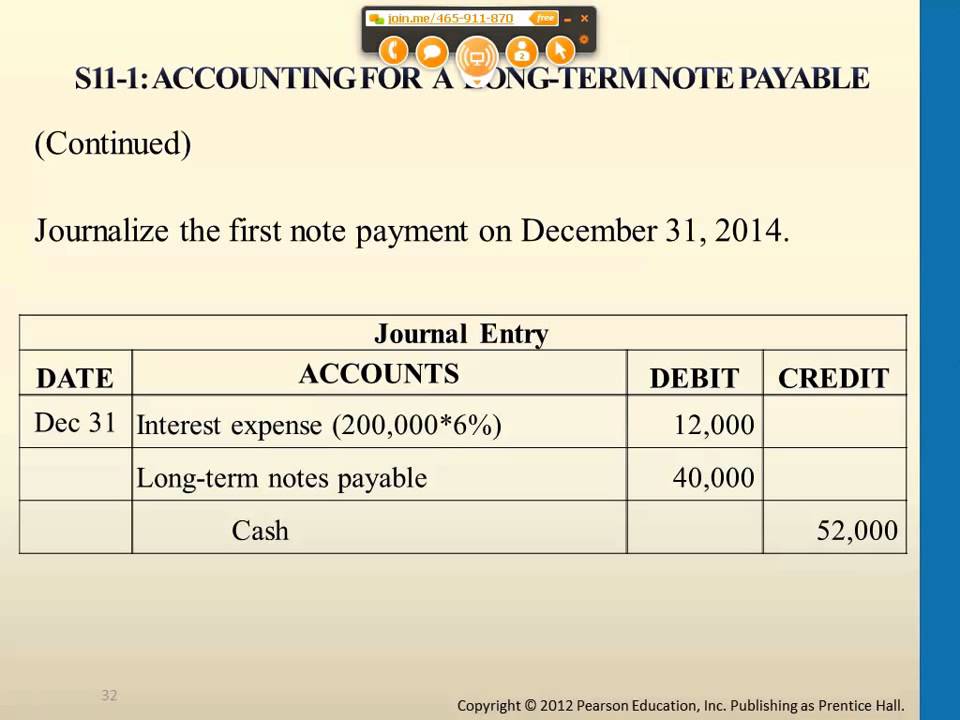

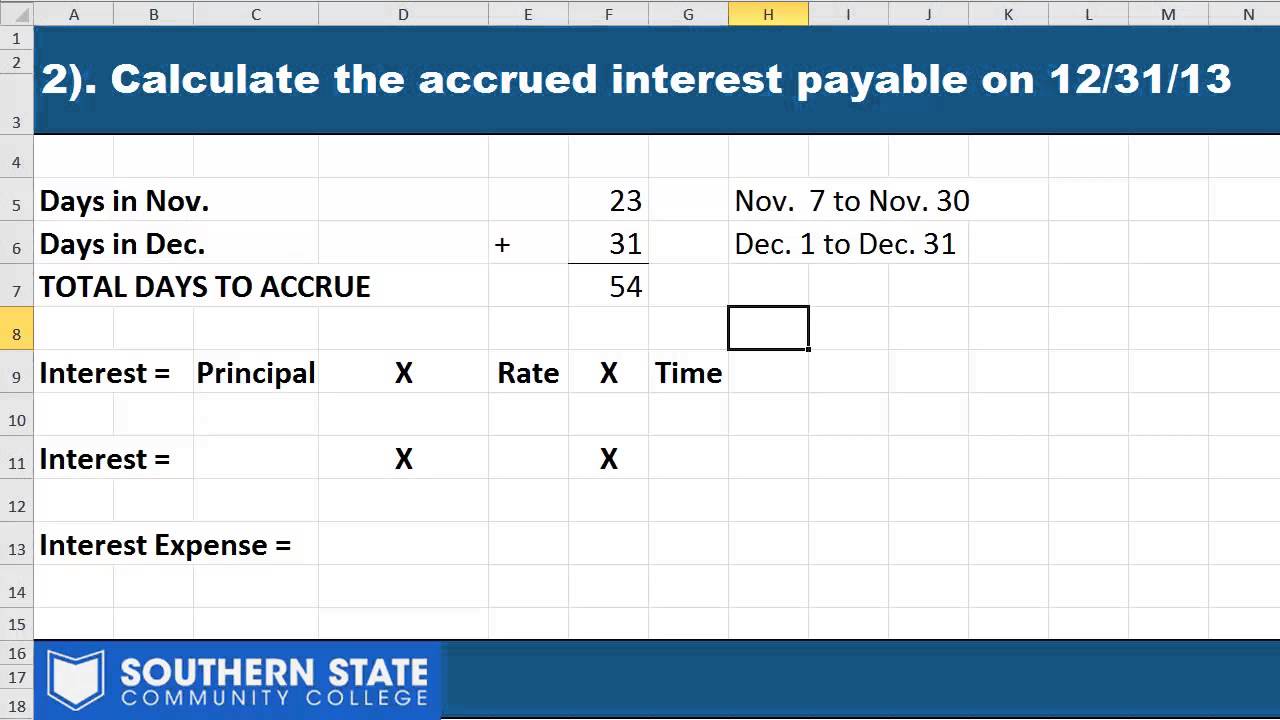

For example, we run a merchandising business that uses the perpetual inventory system and our accounting period ends on december 31. Web the journal entry.

Notes Payable

Web note payable is credited for the principal amount that must be repaid at the end of the term of the loan. Notes payable is.

PPT Accounting I BA 104 PowerPoint Presentation, free download ID

Web on february 1, 2019, the company must charge the remaining balance of discount on notes payable to expense by making the following journal entry..

Notes Payable Adjusting Entry Adjusting Journal Entry for Notes

The amount to be paid. Web a note payable is an unconditional written promise to pay a specific sum of money to the creditor, on.

The Interest Would Be $ 30,000 * 3/12 * 8% = $600.

Web the payment of the notes payable journal entry will decrease both total assets and total liabilities on the balance sheet. Some key characteristics of this written promise to pay (see figure 12.12) include an established date for repayment, a specific payable amount, interest terms, and the possibility of debt resale to another party. Web a note payable is an unconditional written promise to pay a specific sum of money to the creditor, on demand or on a defined future date. Any transaction related to purchasing goods or services on credit results in an accounts payable liability.

Web The Accounts Payable Journal Entries Below Act As A Quick Reference, And Set Out The Most Commonly Encountered Situations When Dealing With The Double Entry Posting Of Accounts Payable.

For example, we run a merchandising business that uses the perpetual inventory system and our accounting period ends on december 31. Web the journal entry to record a note with interest included in face value (also known as a note issued at discount), is as follows: Web what is the definition of notes payable? Learn all about notes payable in accounting and recording notes payable in your business’s books.

Issued Notes Payable For Cash.

If ram inc issues notes payable for $30,000 due in 3 months at 8% p.a. Web journal entries for notes payable. The first account affected by the journal entry is the specific asset account for the item you acquire with a note payable. The amount of interest reduces the amount of cash that the borrower receives up front.

The Following Is An Example Of Notes Payable And The Corresponding Interest, And How Each Is Recorded As A Journal Entry.

Web what is the journal entry for accounts payable? On a balance sheet, the discount would be reported as contra liability. Notes payable is a promissory note that represents the loan the company borrows from the creditor such as bank. This liability is recorded based on the sellers’ invoice.