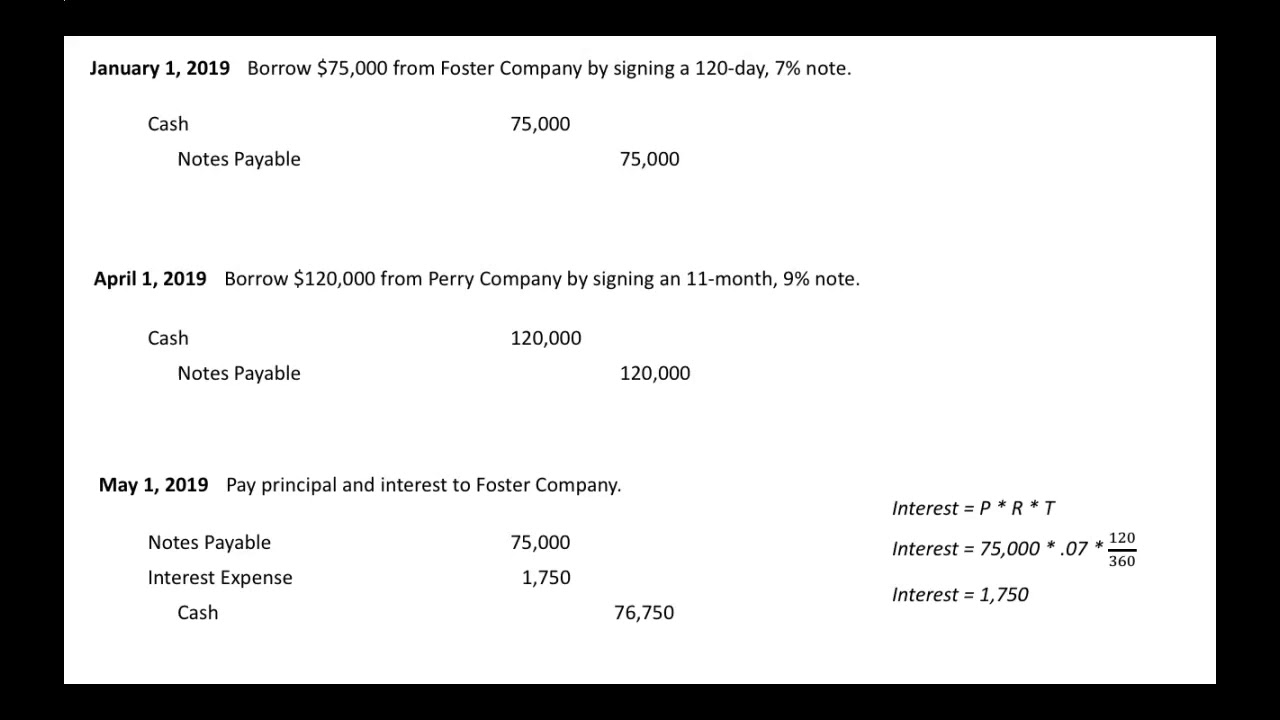

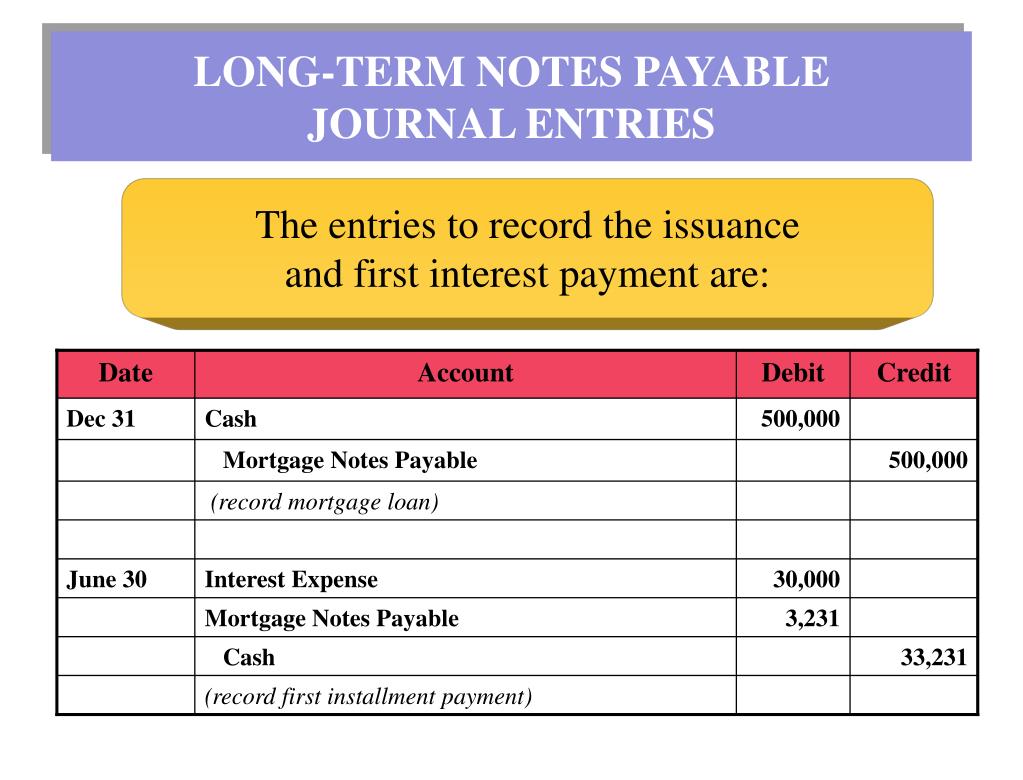

Journal Entry Note Payable - Web when borrowers make the contract’s journal entry as liability, it is termed as notes payable. Web this journal entry of accrued interest on note payable will increase total expenses on the income statement and total liabilities on the balance sheet by the same amount of $500. Web a note payable can be defined as a written promise to pay a sum of the amount on the future date for the services or product. The supplier might require a. Web a note payable is an unconditional written promise to pay a specific sum of money to the creditor, on demand or on a defined future date. We can suggest a note payable to be the. Let’s discuss the various instances of notes payable with examples in each of the following circumstances: Businesses use this account in their books to record their written promises to repay lenders. Web the journal entry to record a note with interest included in face value (also known as a note issued at discount), is as follows: It is supported by a formal written.

Notes Payable Journal Entries YouTube

Web notes payable is a liability account that reports the amount of principal owed as of the balance sheet date. Businesses use this account in.

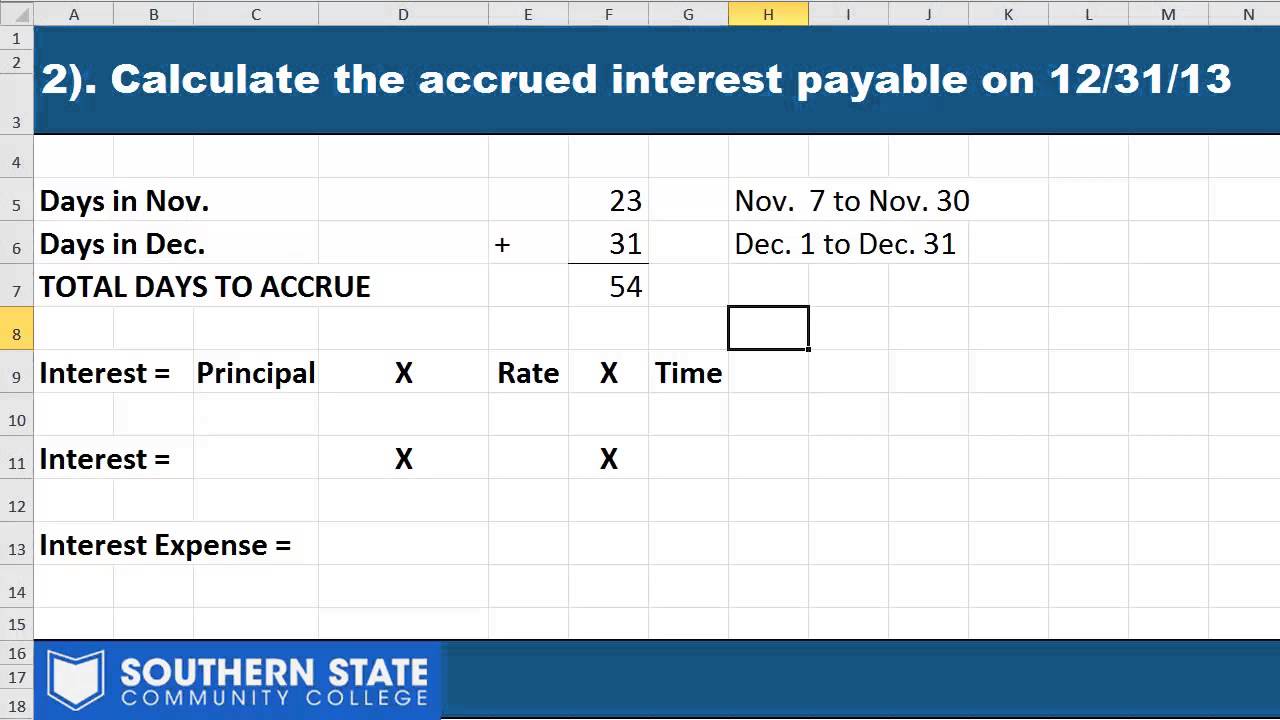

Notes Payable Adjusting Entry Adjusting Journal Entry for Notes

The first account affected by the journal entry is the. Web notes payable journal entry overview. Notes payable is a promissory note that represents the.

Notes Payable Learn How to Book NP on a Balance Sheet

Web a note payable can be defined as a written promise to pay a sum of the amount on the future date for the services.

Accounting for a Note Payable YouTube

Accounts payable is the amount a business owes its vendors for goods or services purchased on credit. The supplier might require a. Web in notes.

Notes Payable

Web journal entries for notes payable. The first account affected by the journal entry is the. Web the balance in notes payable represents the amounts.

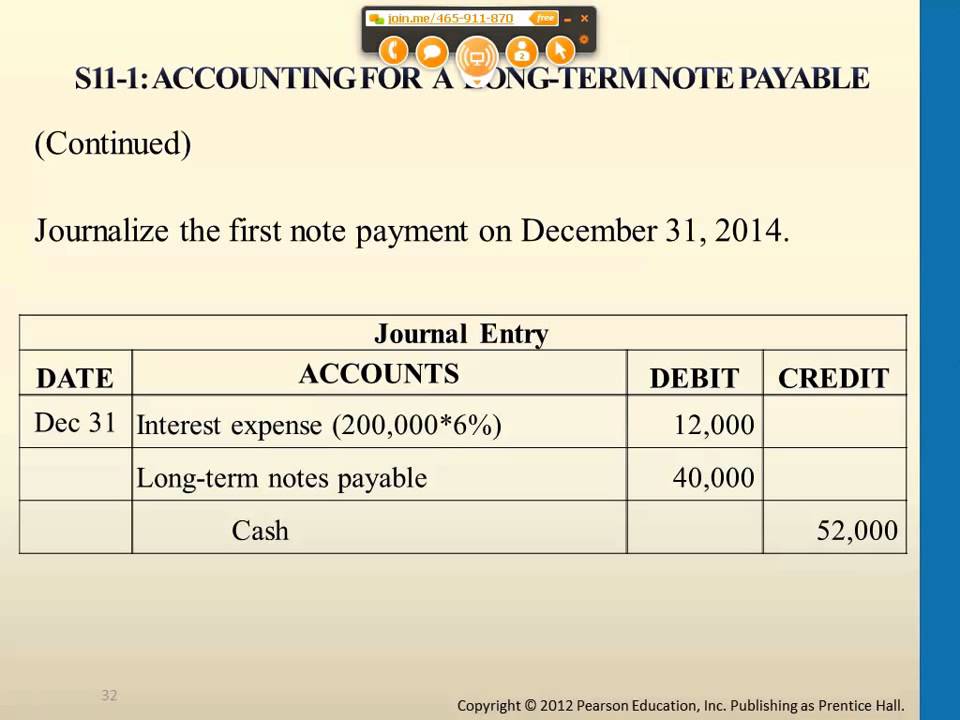

Accounting for a Long Term Note Payable YouTube

Web notes payable is a liability account that reports the amount of principal owed as of the balance sheet date. Interest expense will need to.

Note Payable Calculating Maturity date and Journal Entries (MOM

On the other hand, when the same is recorded as an asset by lenders, it is. Observe that the $1,000 difference is initially recorded. Web.

Notes Payable (Journal Entries) YouTube

Usually, any written instrument that includes interest is a. Likewise, the company needs to make the notes payable journal entry when it signs the promissory..

PPT CHAPTER 11 LIABILITIES PowerPoint Presentation, free download

Web notes payable is a liability account that’s part of the general ledger. In addition, the amount of interest charged is recorded as part of.

Likewise, The Company Needs To Make The Notes Payable Journal Entry When It Signs The Promissory.

Notes payable is a written promissory note stating a borrower’s payment obligation to a lender along with the associated borrowing terms (e.g. Some key characteristics of this written promise to pay (see figure. Web when borrowers make the contract’s journal entry as liability, it is termed as notes payable. Any transaction related to purchasing goods or services on credit results in an accounts payable liability.

Web A Note Payable Is An Unconditional Written Promise To Pay A Specific Sum Of Money To The Creditor, On Demand Or On A Defined Future Date.

Web a note payable can be defined as a written promise to pay a sum of the amount on the future date for the services or product. Businesses use this account in their books to record their written promises to repay lenders. Web this journal entry of accrued interest on note payable will increase total expenses on the income statement and total liabilities on the balance sheet by the same amount of $500. Accounts payable is the amount a business owes its vendors for goods or services purchased on credit.

We Can Suggest A Note Payable To Be The.

Web the balance in notes payable represents the amounts that remain to be paid. Web the journal entry to log a purchase with a note payable impacts at least two of your small business’s accounts. Issued notes payable for cash. The first account affected by the journal entry is the.

Usually, Any Written Instrument That Includes Interest Is A.

Web notes payable is a liability account that’s part of the general ledger. Web the journal entry to record a note with interest included in face value (also known as a note issued at discount), is as follows: In addition, the amount of interest charged is recorded as part of the initial. Alternatively put, a note payable is a loan.