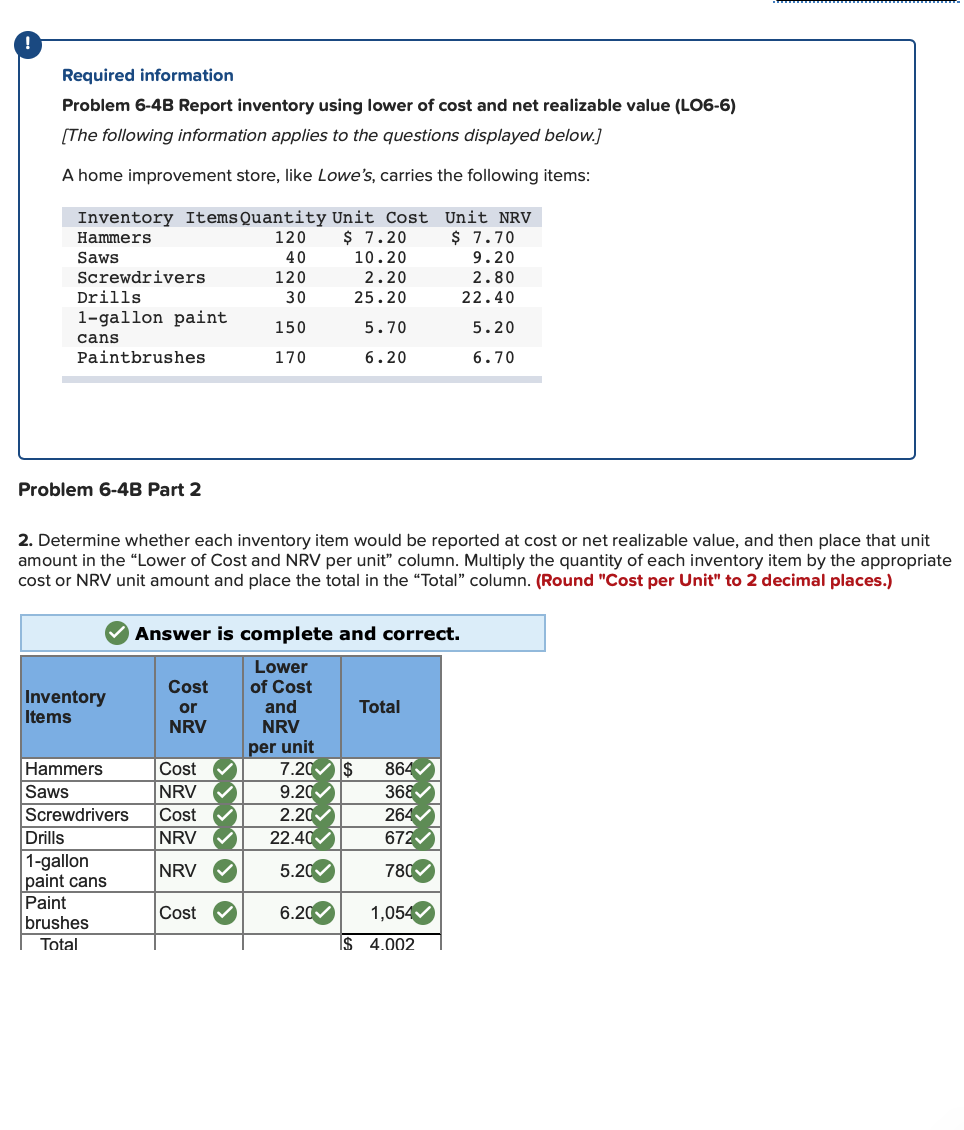

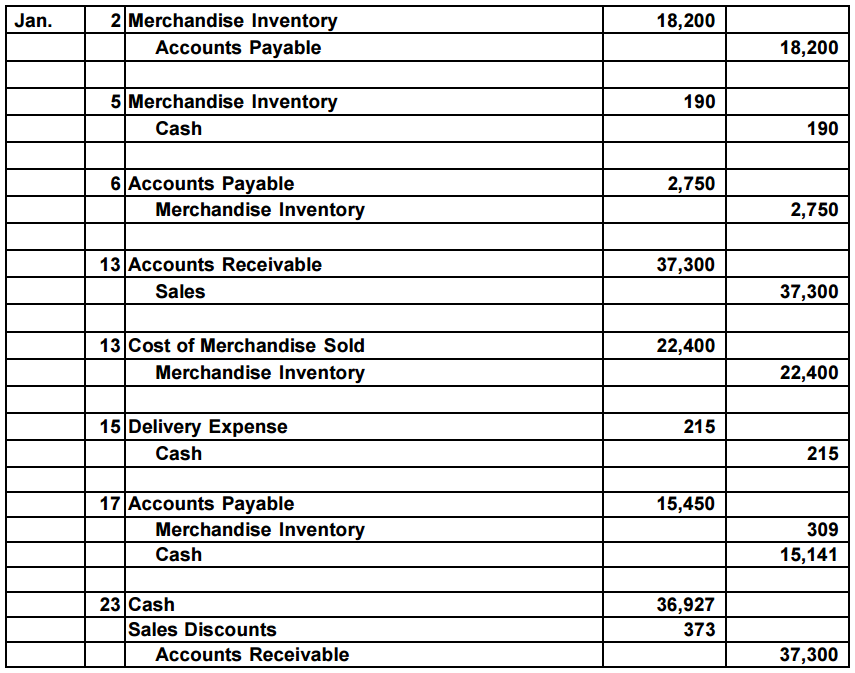

Journal Entry For Writing Down Inventory - Post the adjustment to inventory and a. Web an inventory write down is an accounting process used to record the reduction of an inventory’s value and is required when the inventory’s market value drops below its book. It is a common accounting practice used to adjust the. There are two aspects to writing down inventory, which are the journal entry. Web in this method, periodic inventory system journal entries are made to record the purchase, sale, and ending inventory balances. Inventory is written down when its net realizable value is less than its cost. The journal entries below act as a. Which results in the following: Web the write down of inventory involves charging a portion of the inventory asset to expense in the current period. In this case, as the inventory is initially.

Journal Entry Problems and Solutions Format Examples

Imagine an online store called case haven. It is a common accounting practice used to adjust the. Which results in the following: In this case,.

Inventory Writedown Journal Entry YouTube

Once there is a sale of goods from finished goods, charge the cost of the finished goods sold to the cost of goods sold. Web.

Write Down of Inventory Journal Entries Double Entry Bookkeeping

Web the write down of inventory involves charging a portion of the inventory asset to expense in the current period. Post the adjustment to inventory.

Solved 3. Prepare necessary entry to write down inventory

Inventory is written down when goods are lost. The value of the inventory has fallen by 1,000, and the reduction in value needs to be.

Inventory Write Down Double Entry Bookkeeping

Once there is a sale of goods from finished goods, charge the cost of the finished goods sold to the cost of goods sold. Imagine.

Perpetual Inventory System Journal Entry

Post the adjustment to inventory and cogs. The company may write off some items in the inventory when it deems that they are no longer.

Accounting Q and A Appendix Ex 639 Journal entries using perpetual

In this case, the company needs. Selected accounts related to cogs. Post the adjustment to inventory and a. Post the adjustment to inventory and cogs..

Inventory write down accounting YouTube

Imagine an online store called case haven. In this case, the company needs. Post the adjustment to inventory and cogs. Inventory is written down when.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

Post the adjustment to inventory and cogs. It is a common accounting practice used to adjust the. Dr cost of goods sold. The journal entries.

Web The Journal Entry Is:

Web the write down of inventory involves charging a portion of the inventory asset to expense in the current period. Inventory is written down when goods are lost. Selected accounts related to cogs. There are two aspects to writing down inventory, which are the journal entry.

Web An Inventory Write Down Is An Accounting Process Used To Record The Reduction Of An Inventory’s Value And Is Required When The Inventory’s Market Value Drops Below Its Book.

Dr cost of goods sold. The value of the inventory has fallen by 1,000, and the reduction in value needs to be reflected in the accounting records. Imagine an online store called case haven. Web in this method, periodic inventory system journal entries are made to record the purchase, sale, and ending inventory balances.

Inventory Is Written Down When Its Net Realizable Value Is Less Than Its Cost.

Abc need to debit inventory write down $ 5,000. Post the adjustment to inventory and a. Web inventory write off journal entry. Post the adjustment to inventory and cogs.

Which Results In The Following:

Once there is a sale of goods from finished goods, charge the cost of the finished goods sold to the cost of goods sold. The journal entries below act as a. In this case, as the inventory is initially. The company may write off some items in the inventory when it deems that they are no longer have value in the market or the business.