Journal Entry For Write Off Of Accounts Receivable - Web create a journal entry to write off the appropriate amount of the asset. This will be a credit to the asset account. Assuming the allowance method is being used, you would have an allowance for doubtful account reserve already established. One method of recording the bad debts is referred to as the direct write off method which involves removing the. A customer has been invoiced 200 for goods and the business has decided the debt will not be paid and needs to post a bad. Web a quick reference for accounts receivable journal entries, setting out the most commonly encountered situations when dealing with accounts receivable. Web journal entries for accounting receivable. Web bad debt write off journal entry. Web the bad debt journal entry is a crucial accounting process that ensures accurate financial reporting and a strong financial position for a company. Web journal entry for writing off uncollectible account.

Journal Entries of Loan Accounting Education

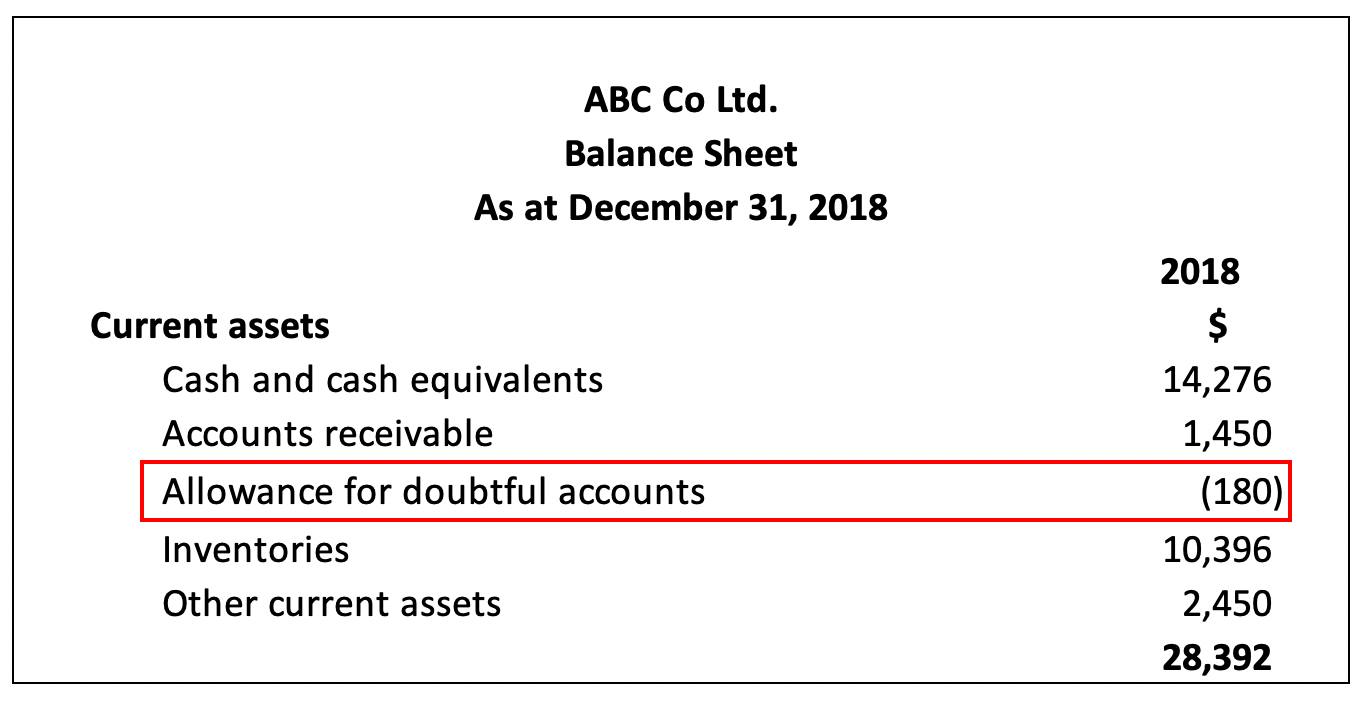

Assuming the allowance method is being used, you would have an allowance for doubtful account reserve already established. Web the journal entry is a debit.

300 utility bill with cash. On in 2021 Journal entries, Accounting

Web the first journal entry that is made to reverse the entry that the company made when writing off the receivable of the customer’s account.

Accounting Chapter 14 2 Writing Off and Collecting Uncollectable

Web the journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. Web the bad debt.

Uncollectible Accounts Written Off Accounting Methods

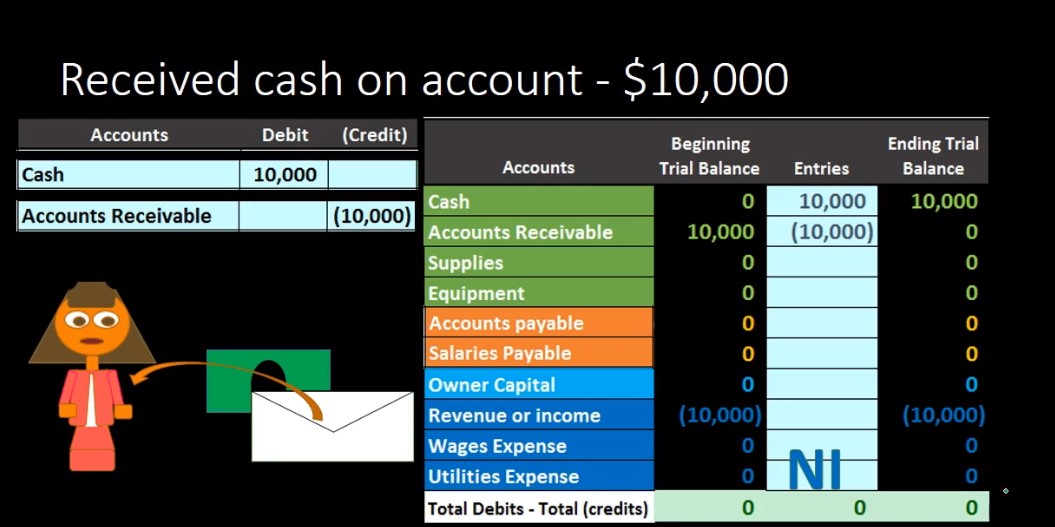

Web a quick reference for accounts receivable journal entries, setting out the most commonly encountered situations when dealing with accounts receivable. There are two choices.

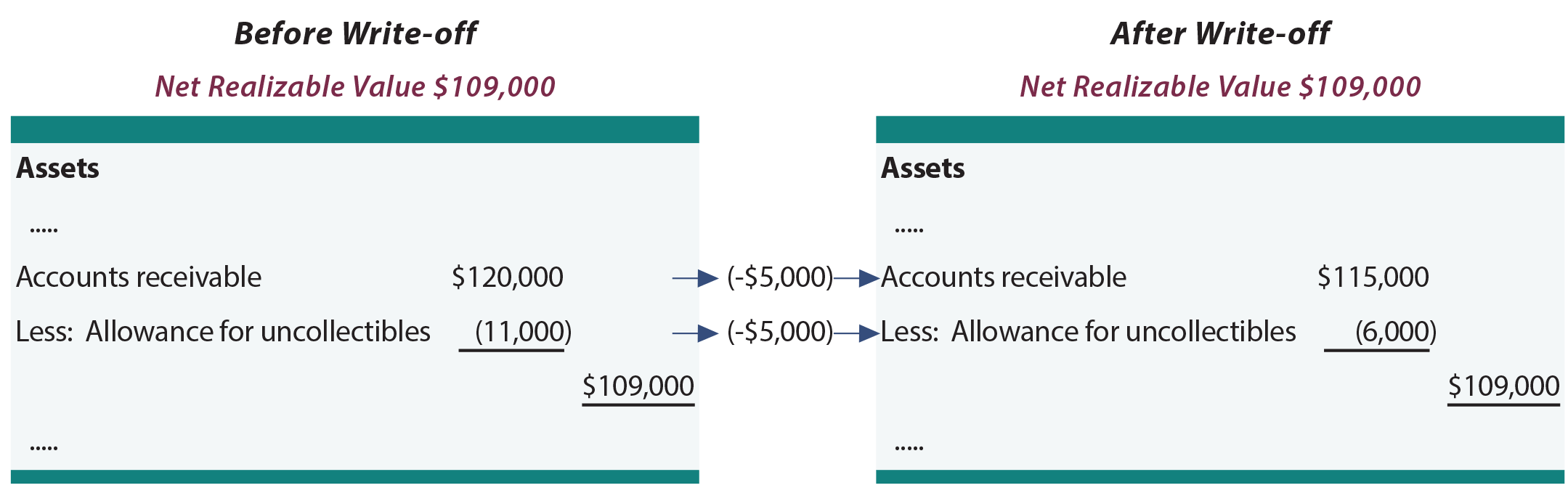

Allowance Method For Uncollectibles

Debit bad debts expense (to report the amount of the loss on the company’s income statement). As the name suggests, this method will directly remove.

Accounting Q and A EX 914 Entries for bad debt expense under the

Web the first journal entry that is made to reverse the entry that the company made when writing off the receivable of the customer’s account.

Recovering Writtenoff Accounts Wize University Introduction to

Debit bad debts expense (to report the amount of the loss on the company’s income statement). Web journal entry for writing off uncollectible account. Web.

Accounts Receivable Journal Entries 230 Accounting Instruction, Help

Web the following journal entry is passed: Web an accounts receivable journal entry describes and records the sale of goods or services that are made.

Accounting Journal Entries For Dummies

As the name suggests, this method will directly remove accounts receivable to bad debt expenses. Web the first journal entry that is made to reverse.

A Customer Has Been Invoiced 200 For Goods And The Business Has Decided The Debt Will Not Be Paid And Needs To Post A Bad.

For example, nate made sales of $9,000 to serena on credit in 2017. Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. It may also be necessary to reverse any related sales. Debit the bad debts expense.

Web A Quick Reference For Accounts Receivable Journal Entries, Setting Out The Most Commonly Encountered Situations When Dealing With Accounts Receivable.

Debit bad debts expense (to report the amount of the loss on the company’s income statement). Web an accounts receivable journal entry describes and records the sale of goods or services that are made on credit. Web the journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. This, in turn, results in a rise in the accounts.

There Are Two Choices For The Debit Part Of The Entry.

Web here are the 34 business records trump was found guilty of falsifying, as described in judge juan merchan 's jury instructions: Web the bad debt journal entry is a crucial accounting process that ensures accurate financial reporting and a strong financial position for a company. Web the first journal entry that is made to reverse the entry that the company made when writing off the receivable of the customer’s account shows that the company made an. Web journal entry for writing off uncollectible account.

Web Journal Entries For Accounting Receivable.

One method of recording the bad debts is referred to as the direct write off method which involves removing the. Web for proper recording of accounts that get written off, one has to make the following standard journal entries in their accounts book: Web the following journal entry is passed: Using the allowance method for writing off bad debts, journal entries are made using debit in.