Journal Entry For Write Off Bad Debts - Bad debt provision bookkeeping entries explained. Web journal entry for the bad debt provision. Web rules applied in the journal entry are as per the golden rules of accounting, “cash/bank a/c” is a real account therefore debit what comes in and credit what goes out. For example, in one accounting period, a company can experience large increases in. Irrecoverable debts is the term that is used to describe this. Web write off accounts receivable journal entry. The journal entry is a debit to the bad debt expense account and a. Establishing a bad debt reserve. Web if any bad debt is recovered, then, two journal entries should pass as below. Web how to record the bad debt expense journal entry.

Journal Entries for Bad Debts and Bad Debts Recovered YouTube

Bad debts can happen due to several reasons. One method of recording the bad debts is referred to as the direct write off method which.

How to calculate and record the bad debt expense QuickBooks

As mentioned above, both processes result in different accounting treatments. Journal entry for the allowance method for bad debt. Hence, the journal entries will also.

How Do I Write Off Bad Debt Expense Journal Entry

A bad debt expense is a portion of accounts receivable that your business assumes you won’t ever collect. Web a journal entry is made to.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

“bad debts recovered a/c” is a nominal account therefore debit all expenses and losses, and credit all incomes and gains. Normally, you reach this decision.

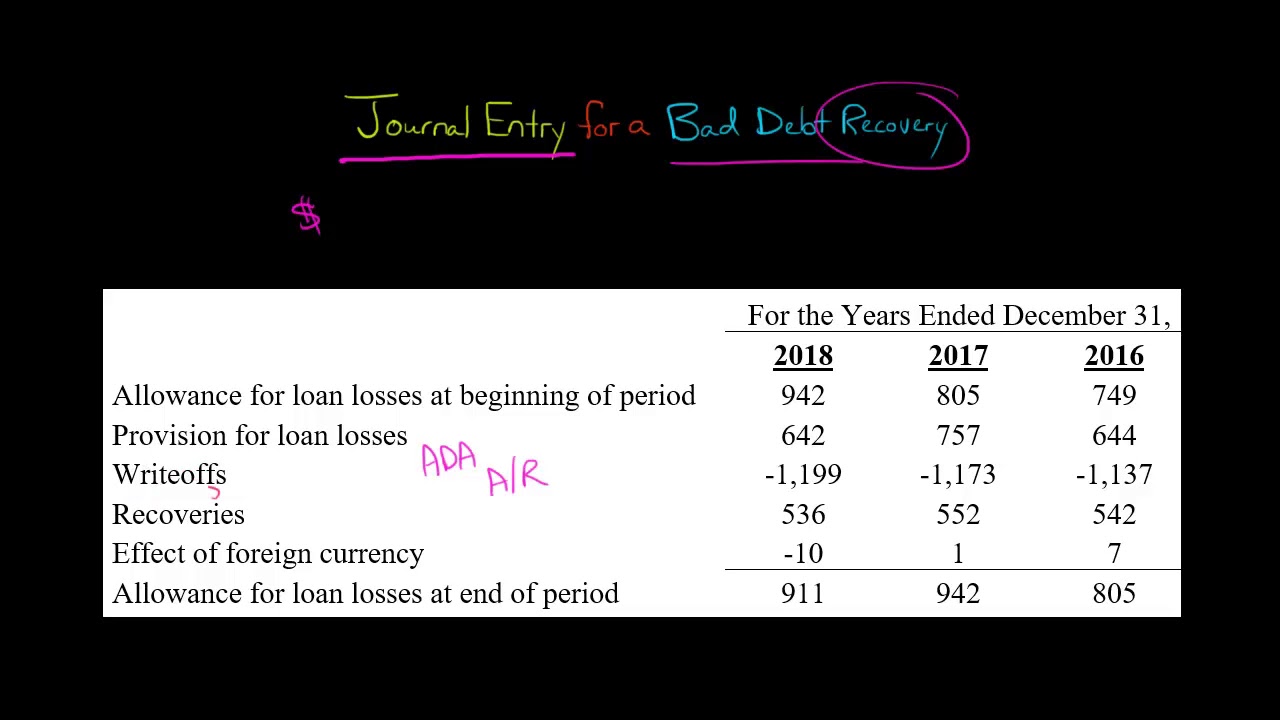

Journal Entry for a Bad Debt Recovery YouTube

Web pay the monthly minimums on all of your card debts (to avoid any late fees). Web journal entry for the bad debt provision. Web.

2024672 Bad Debt Provisions and Bad Debt WriteOffs Visma

Cash / bank a/c (asset) 3,000. Bad debt provision bookkeeping entries explained. Z as uncollectible with a balance of usd 350. To record the collection.

Bad Debt Journal Entry Bad Debt Recovered 28 Journal Entries

Hence, the journal entries will also vary due to that treatment. The provision for the bad debt is an expense for the business and a.

Accounting Q and A EX 914 Entries for bad debt expense under the

A bad debt expense is a portion of accounts receivable that your business assumes you won’t ever collect. To record the collection of cash: Z.

Journal Entry for Bad Debts Journal Entry for Provision for Bad

Decides to write off one of its customers, mr. Web rules applied in the journal entry are as per the golden rules of accounting, “cash/bank.

Web The Easiest Way To Handle The Journal Entries For A Bad Debt Is To Directly Charge A/R When You Decide To Write Off The Debt.

For example, in one accounting period, a company can experience large increases in. The journal entry is a debit to the bad debt expense account and a. When the company writes off accounts receivable under the allowance method, it can make journal entry by debiting allowance for doubtful accounts and crediting accounts receivable. Irrecoverable debts is the term that is used to describe this.

Web Journal Entry For The Bad Debt Provision.

Z as uncollectible with a balance of usd 350. Web if any bad debt is recovered, then, two journal entries should pass as below. Web write off accounts receivable journal entry. Bad debts can happen due to several reasons.

For Example, If A Customer Goes Bankrupt Or Liquidates, It May Not Be Able To Repay Its Liabilities.

The accounting records will show the following bookkeeping entries when using the allowance method for bad debt. The accounting records will show the following bookkeeping entries for the bad debt write off. For example, company xyz ltd. Bad debt is a concept closely related to accounts receivable.

Normally, You Reach This Decision Several Months After.

If a receivable appears on your statement of financial position that you no longer deem collectible, you must write it off. Web rules applied in the journal entry are as per the golden rules of accounting, “cash/bank a/c” is a real account therefore debit what comes in and credit what goes out. The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be paid. Hence, the journal entries will also vary due to that treatment.