Journal Entry For Vehicle Purchase With Tradein - Next, you can fill out an instant cash offer request. Financing new company vehicle purchased with trade in of old vehicle. It is not the discount but the net off of old car value for. March 07, 2023 08:03 am. New 2023 vehicle purchase $76,580.70 hst $11,485.13, trade in allowance. 14k views 1 year ago accounting. I am not an accountant so please be patient and detailed on your suggestions. Pay invoice for sale of asset via contra account. Specifically, we will discuss how to remove the old vehicle from our books, book any gains or losses, and. You'll have to make asset purchase.

Journal Entry for Vehicle TradeIn a Comprehensive Guide

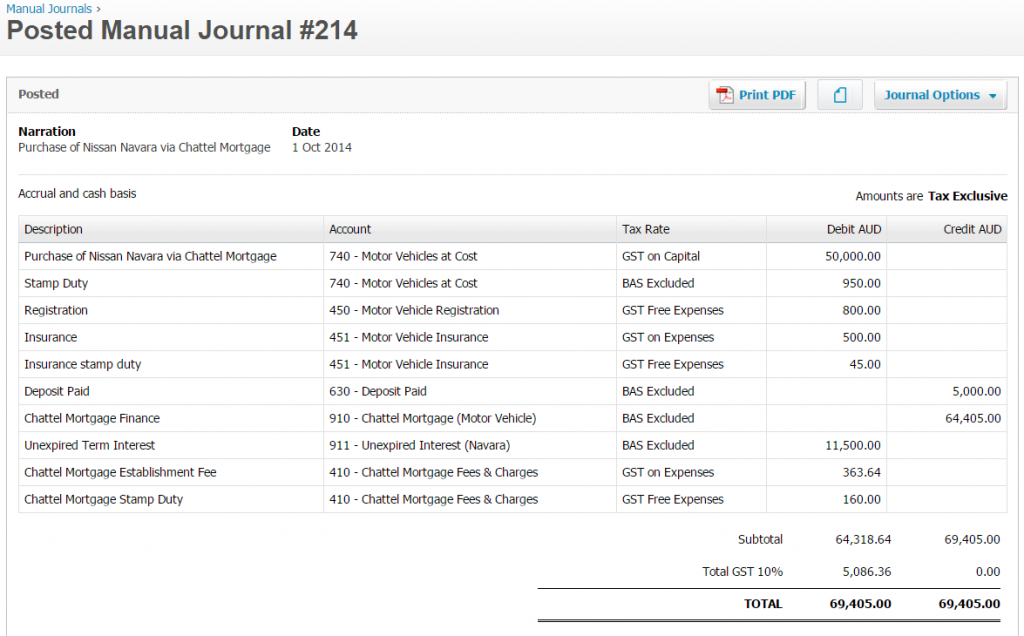

Financing new company vehicle purchased with trade in of old vehicle. Web how do i create a journal entry for the sale of a fixed.

how to record hire purchase motor vehicle Brian Coleman

Web the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). You'll have to make asset purchase. Last updated march.

journal entry format accounting accounting journal entry template

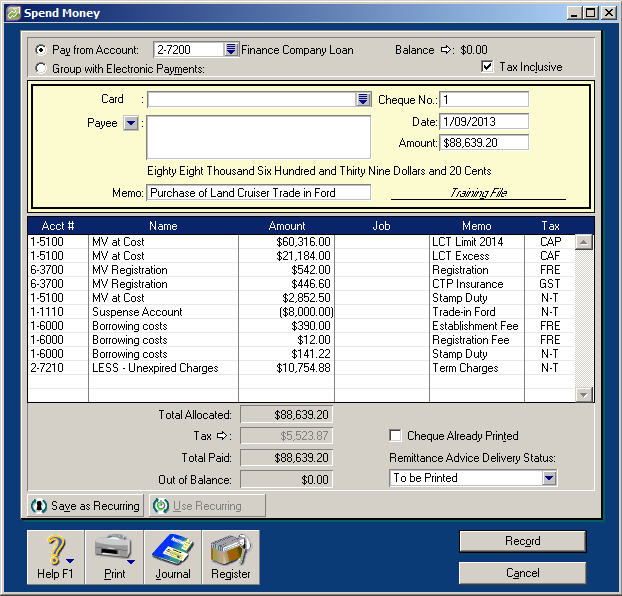

Journal entry for a car purchase (loan) with no downpayment but a trade in. March 07, 2023 08:03 am. Generate a tax invoice for sale.

Insurance Claim Journal Entry

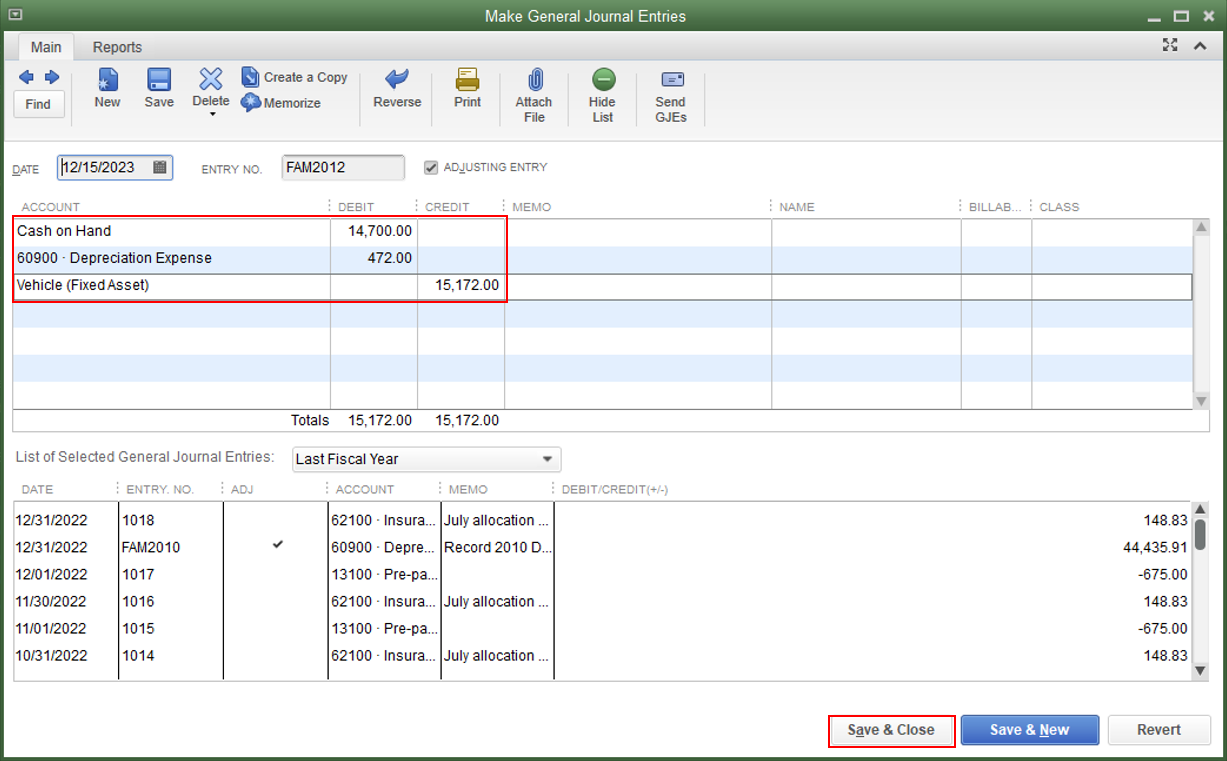

What about a purchase without a loan (cash) with a trade in. Web you can create a journal entry to record the purchased vehicle transaction.

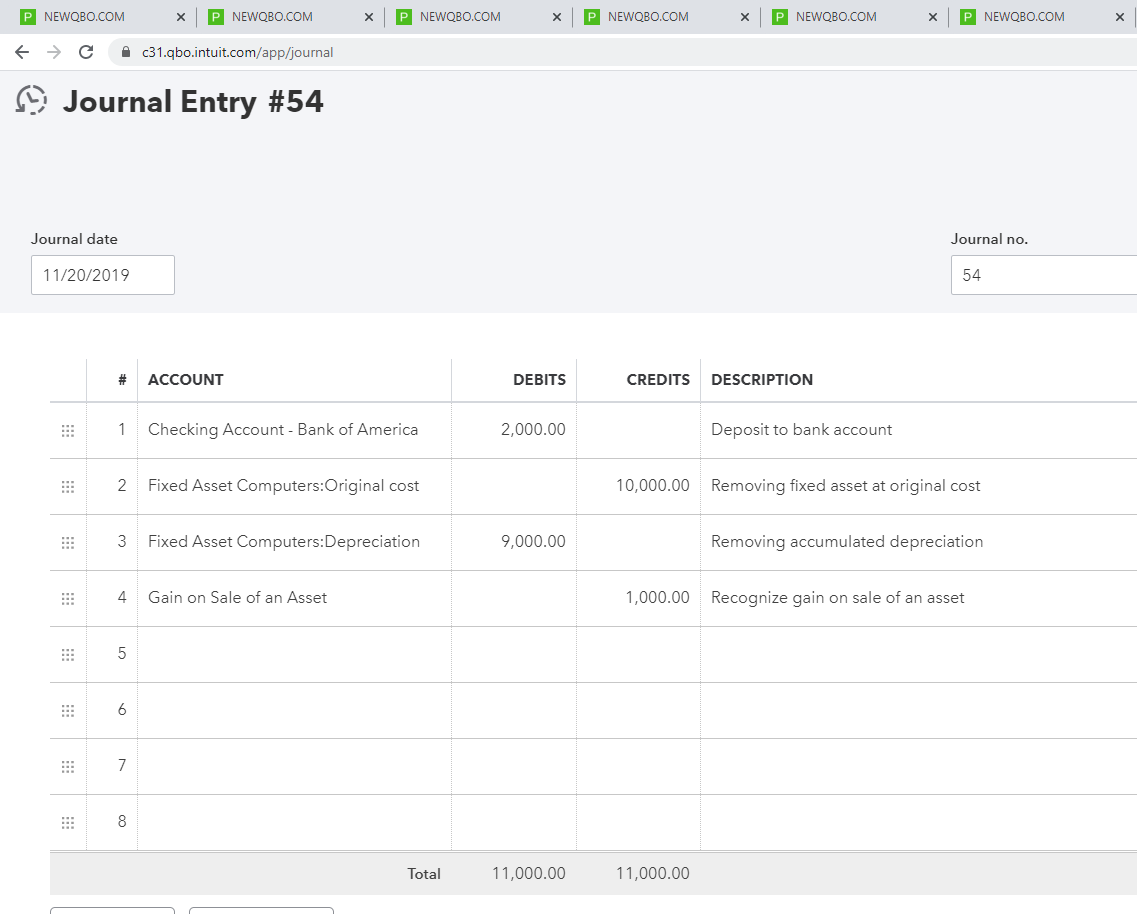

Journal Entries In Quickbooks Online Farmer Lextre

Posted by sr heavy equip repair over 4 years ago. I am not an accountant so please be patient and detailed on your suggestions. What.

Accounting Record A Vehicle Purchase With A Loan, TradeIn, And Down

What about a purchase without a loan (cash) with a trade in. Existing vehicle #1 cost of $50,000 with accumulated depreciation of $40,000 =. It.

Car Purchase Journal Entry Stephen Anderson

Go to the + new button; Web looking for the journal entry to record the following transaction in accordance with us gaap: Journal entry for.

How do I record a fullyowned company delivery vehicle that has been

Posted by sr heavy equip repair over 4 years ago. These actual offers from car dealers take the hassle out. Web to trade your old.

How to Enter, Setup Record a Vehicle Purchase in QuickBooks

Web how do i create a journal entry for the sale of a fixed asset (vehicle) with a loan liability paid off by dealership? Next,.

14K Views 1 Year Ago Accounting.

Generate a tax invoice for sale of asset. Last updated march 07, 2023 8:03 am. The entry should be made at the time of purchase and should include the details. Web you can create a journal entry to record the purchased vehicle transaction in quickbooks online.

Pay Invoice For Sale Of Asset Via Contra Account.

Journal entry for a car purchase (loan) with no downpayment but a trade in. What if you paid part cash and traded in an existing van that is included as an asset on your books? It is not the discount but the net off of old car value for. What about a purchase without a loan (cash) with a trade in.

Web Its Presence Only Slightly Modifies The Preceding Accounting By Adding One More Account (Typically Cash) To The Journal Entry.

I am not an accountant so please be patient and detailed on your suggestions. Existing vehicle #1 cost of $50,000 with accumulated depreciation of $40,000 =. Financing new company vehicle purchased with trade in of old vehicle. February 12, 2024 07:50 am.

Abc Has The Option To Trade In The Old Car For A Discount Of $ 20,000 On A New Car.

Specifically, we will discuss how to remove the old vehicle from our books, book any gains or losses, and. Web help for recording double entries for purchasing a vehicle with partly trade in and party cash. Go to the + new button; Web looking for the journal entry to record the following transaction in accordance with us gaap: