Journal Entry For Vacation Accrual - Web check out how to calculate vacation accrual based on concrete examples + use our free vacation time calculator to simplify the process even more. Web the journal entry to accrue compensated absences would adjust the liability for vacation payable to the balance computed in the spreadsheet. Determine if you plan to record the vacation accrual each pay period, monthly, quarterly, or annually. In this journal entry, the expense. Web once companies calculate the vacation benefits payable, they can record the journal entries. Web the company can make accrued vacation journal entry by debiting vacation expense account and crediting vacation payable account. What is accrued vacation pay? An example of an accrued expense might include: In the first row, pick your bank and enter the amount in the debit box. This means that in the current.

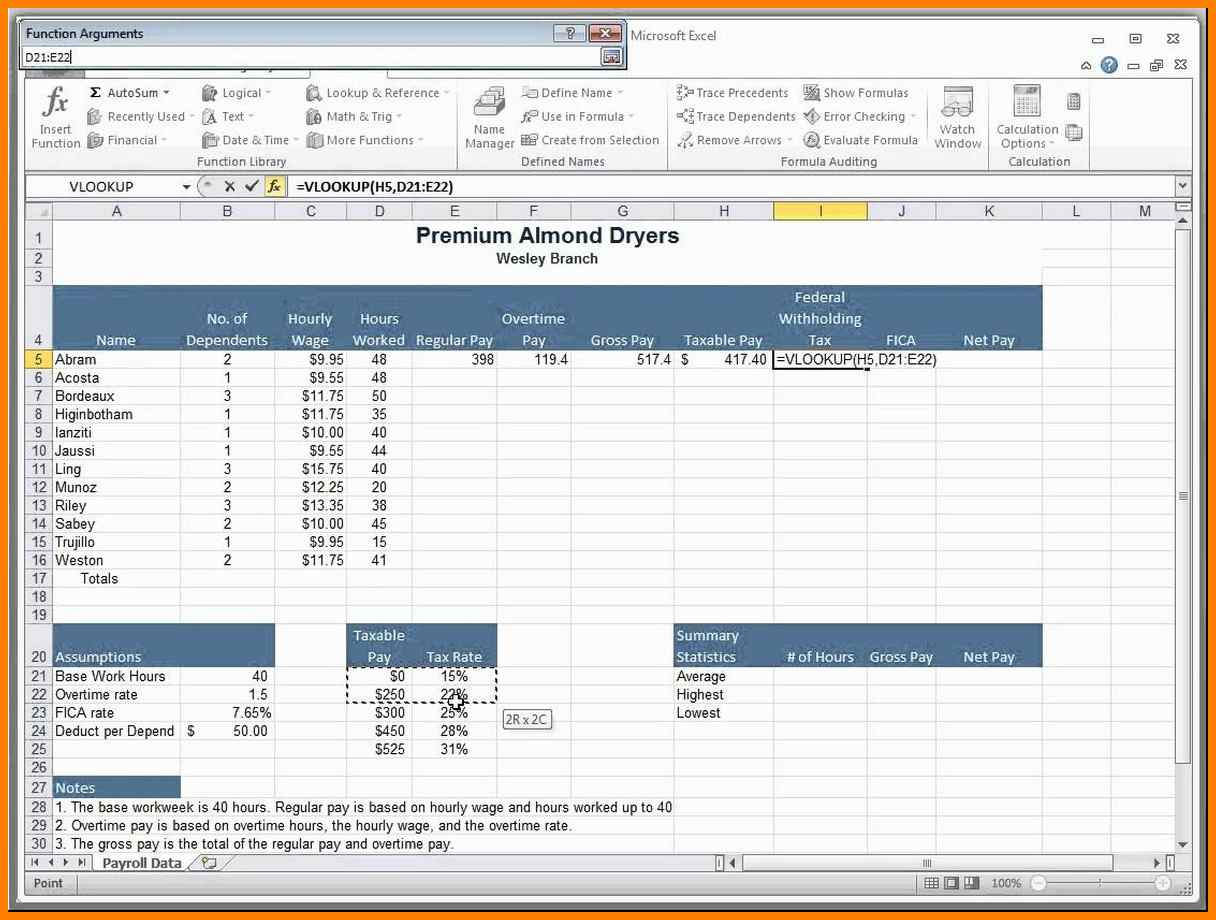

Employee Vacation Accrual Template Excel Master of Documents

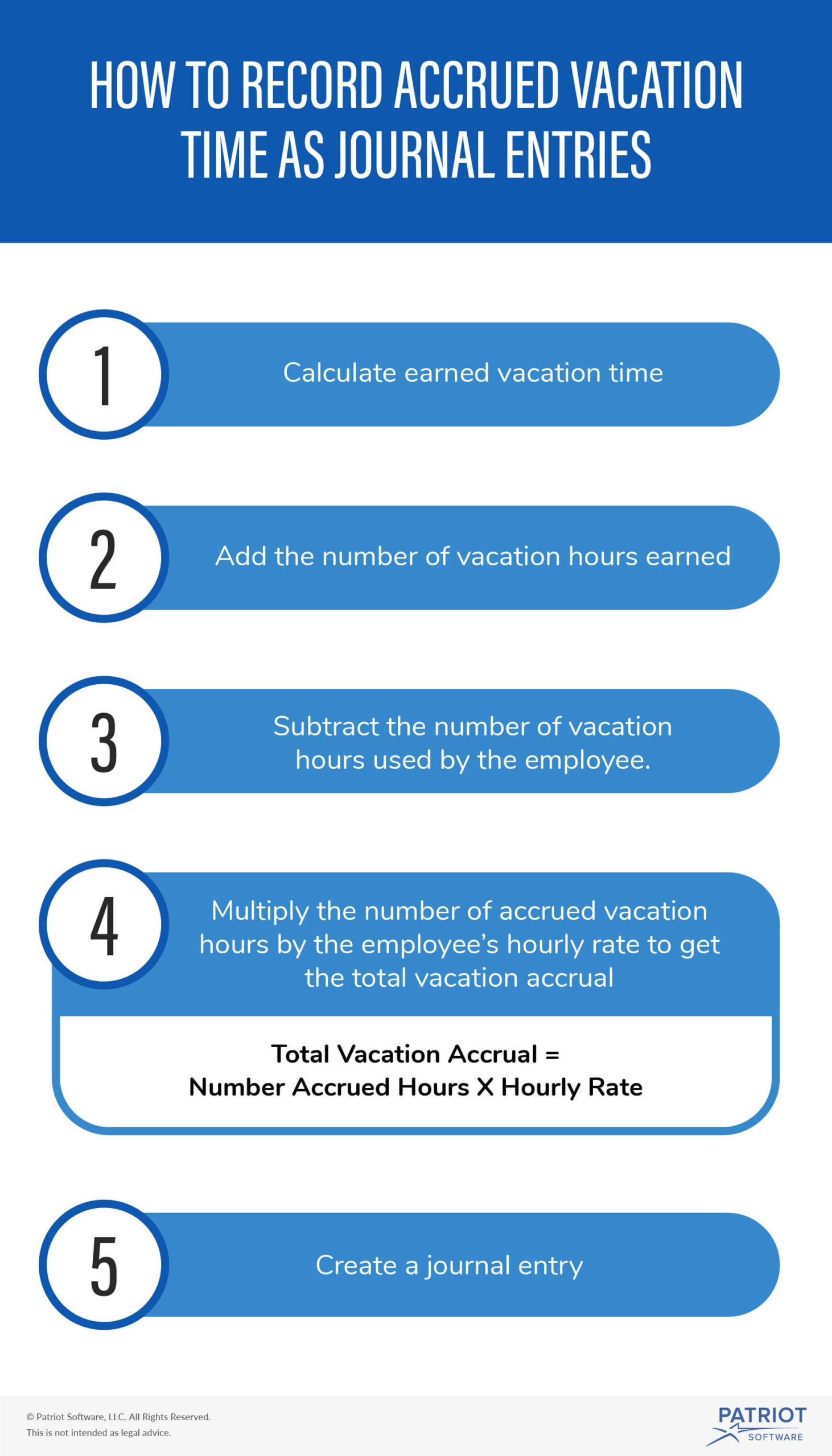

Determine if you plan to record the vacation accrual each pay period, monthly, quarterly, or annually. Here’s the formula to calculate accrued. The total vacation.

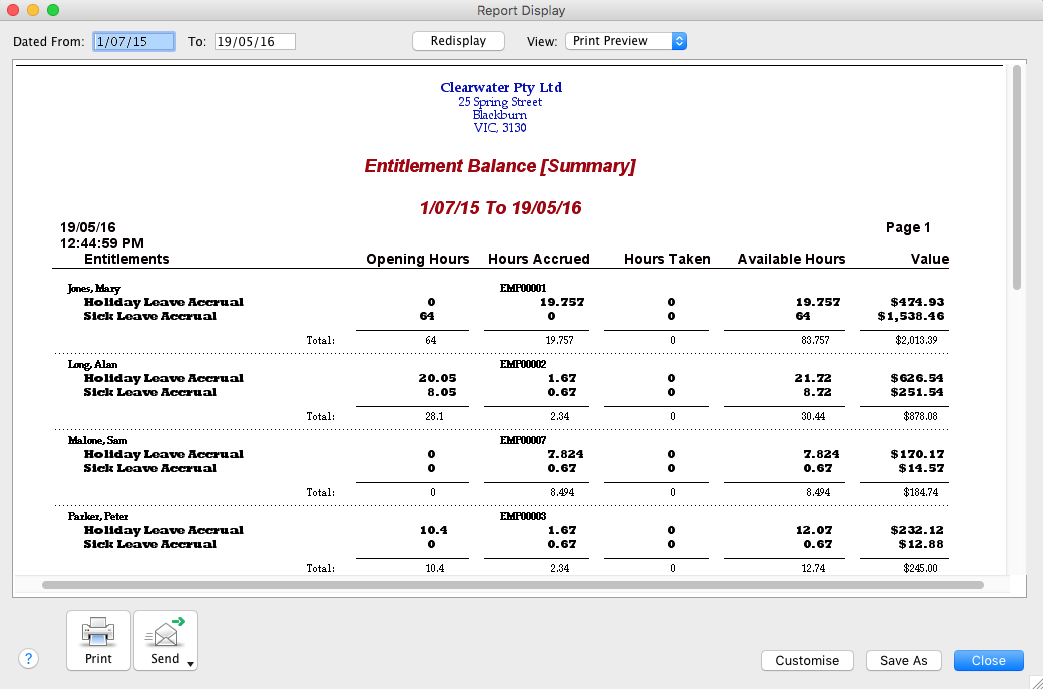

Tracking leave accruals as liabilities (Australia only) Support Notes

In the first row, pick your bank and enter the amount in the debit box. Accrued vacation pay is the amount of vacation time that.

Vacation Calculation Spreadsheet —

Web accrued vacation is a type of employee benefit that allows employees to build up and use multiple days off from work without requesting additional.

Vacation Accrual Journal Entry How to Record Accrued Time Off

Web the company can make accrued vacation journal entry by debiting vacation expense account and crediting vacation payable account. In year 2, the staff accrued.

Vacation Accrual Journal Entry Double Entry Bookkeeping

Web it also helps to prepare your recurring journal entries to expense vacation. An example of an accrued expense might include: Web accrue means “to.

Accruals and Prepayments Journal Entries

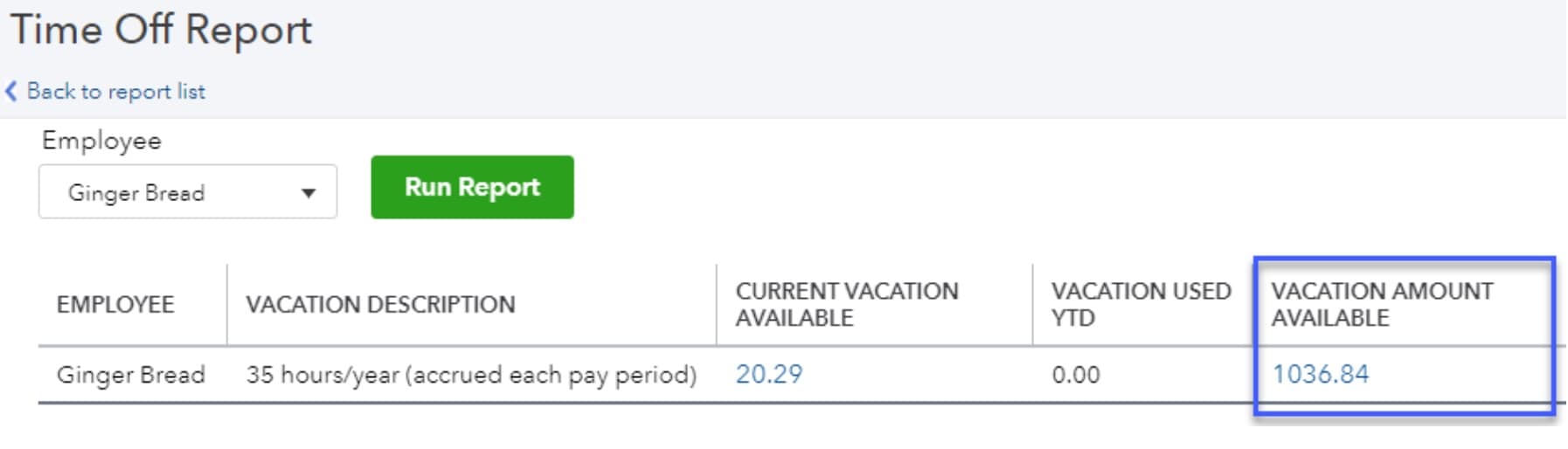

Here are answers to some frequently asked questions (faqs) about vacation accrual. Web solved • by quickbooks • 31 • updated january 25, 2024. You.

3959 Vacation Accrual and Usage Accounting

Here are answers to some frequently asked questions (faqs) about vacation accrual. Here’s the formula to calculate accrued. In the second row, select your vacation..

Vacation Accrual and Tracking Template with Sick Leave Accrual

Web check out how to calculate vacation accrual based on concrete examples + use our free vacation time calculator to simplify the process even more..

Vacation accrual In QuickBooks Online Payroll FAQ

An example of an accrued expense might include: You must record vacation accrual as a journal entry for your business. Web once companies calculate the.

Web Choose The Make General Journal Entries Button.

Web once companies calculate the vacation benefits payable, they can record the journal entries. To book the vacation accrual, debit vacation expense and credit the accrued vacation liability. Determine if you plan to record the vacation accrual each pay period, monthly, quarterly, or annually. Web vacation benefit is a type of paid absence that the company needs to accrue for.

An Example Of An Accrued Expense Might Include:

Dr expense account (p&l) cr accruals (balance sheet) the debit side of this journal increases the expense account. Web any expense you record now but plan to pay for at a later date creates an accrued expense account in your books. Web record the journal entries. Here are answers to some frequently asked questions (faqs) about vacation accrual.

In This Journal Entry, The Expense.

Evaluate your vacation accrual methods at least once per year to ensure accuracy, and account for any changes in pay rates or unused. Web it also helps to prepare your recurring journal entries to expense vacation. Web the journal entry for accruals is as follows: Web at the end of year 1, we show $500 payroll vacation expense and as liability.

60 Hours × $30 = $1800.

This means that in the current. For the records to be usable in financial statement. Here’s the formula to calculate accrued. See the journal entry in accrual.