Journal Entry For Trade In Vehicle - See journal entries, tax implications, and user questions and answers. Web business use was 100%. Web what about a purchase without a loan (cash) with a trade in. Generate a purchase for the new motor vehicle. Web no matter how we use our company vehicles, when it comes to trading in old vehicles, it is important to make sure we properly book the journal entries as it impacts our balance. Generate a tax invoice for sale of asset. Web learn how to record the exchange of old and new vehicles in accounting. Obviously, if you don’t know a transaction. Tax basis of the old truck in 2018 is zero (cost $40,000 minus depreciation $40,000). There are generally three steps to making a journal entry.

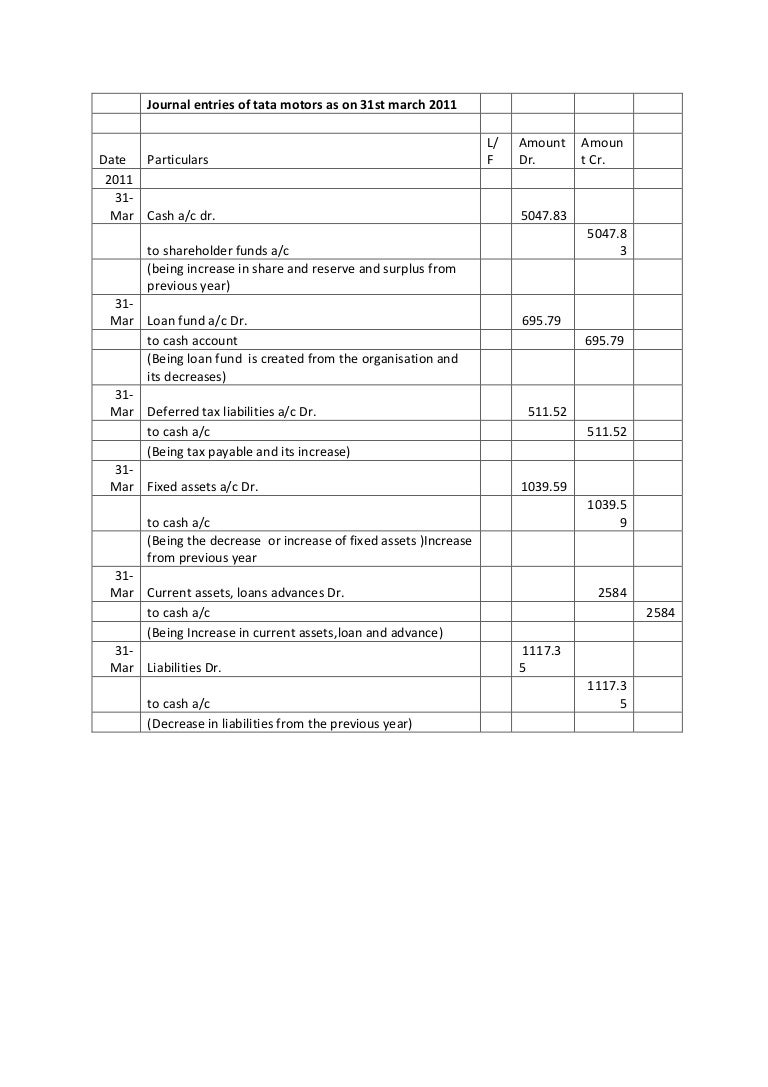

Journal entries of tata motors as on 31st march 2011

Obviously, if you don’t know a transaction. Web no matter how we use our company vehicles, when it comes to trading in old vehicles, it.

How do I record a fullyowned company delivery vehicle that has been

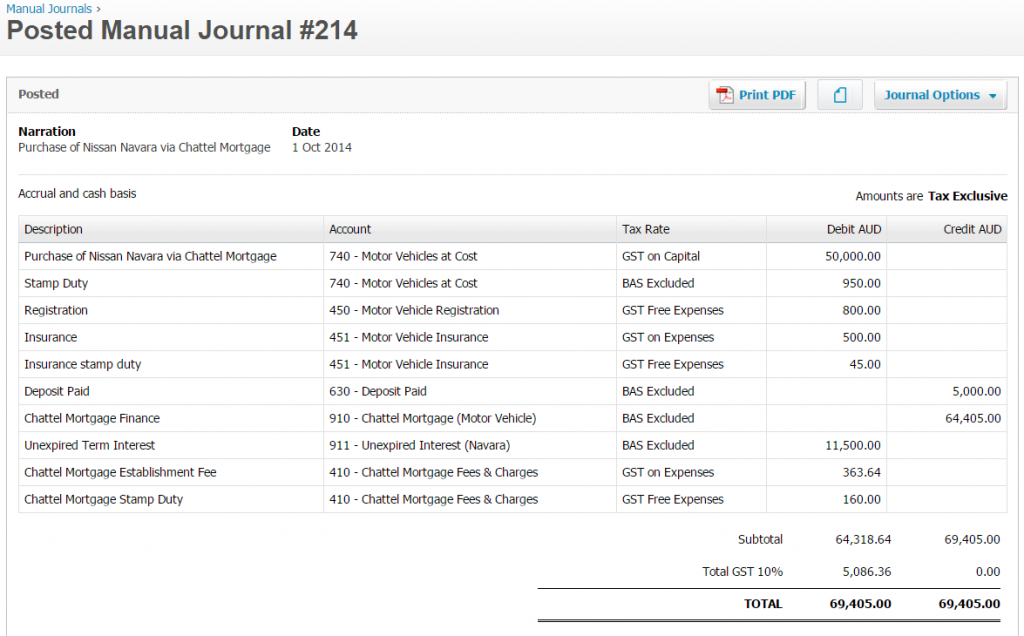

Web business use was 100%. The first step in recording. Web what about a purchase without a loan (cash) with a trade in. Financing new.

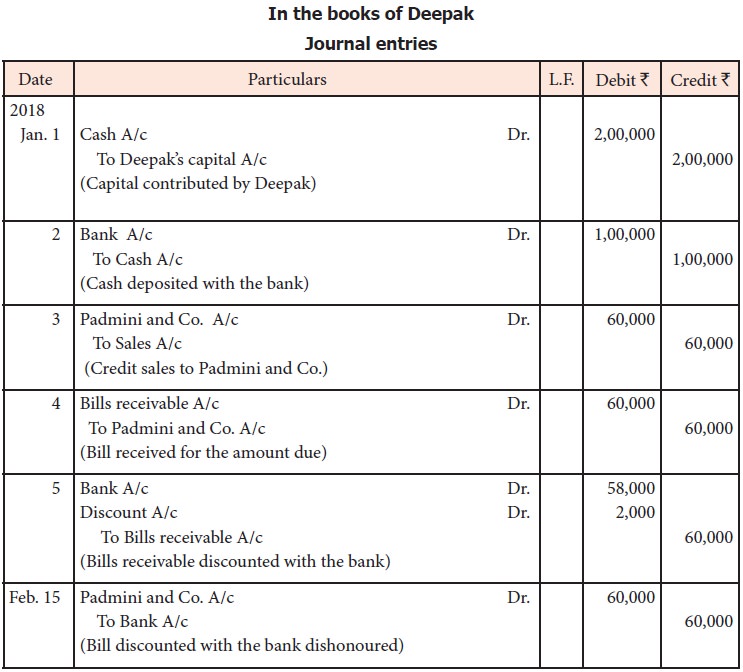

Journal entries Meaning, Format, Steps, Different types, Application

The first step in recording. Generate a tax invoice for sale of asset. The entry should be made at the time of purchase and should.

Journal entries Meaning, Format, Steps, Different types, Application

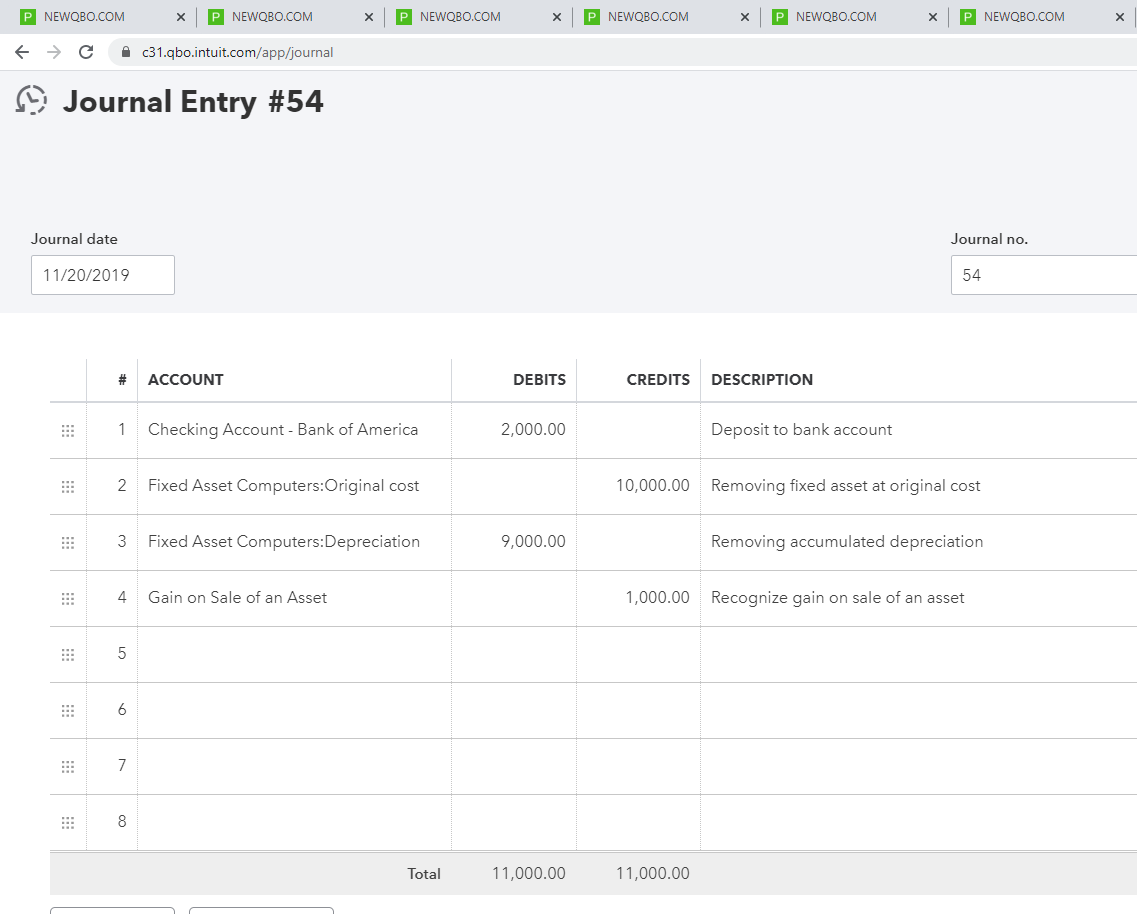

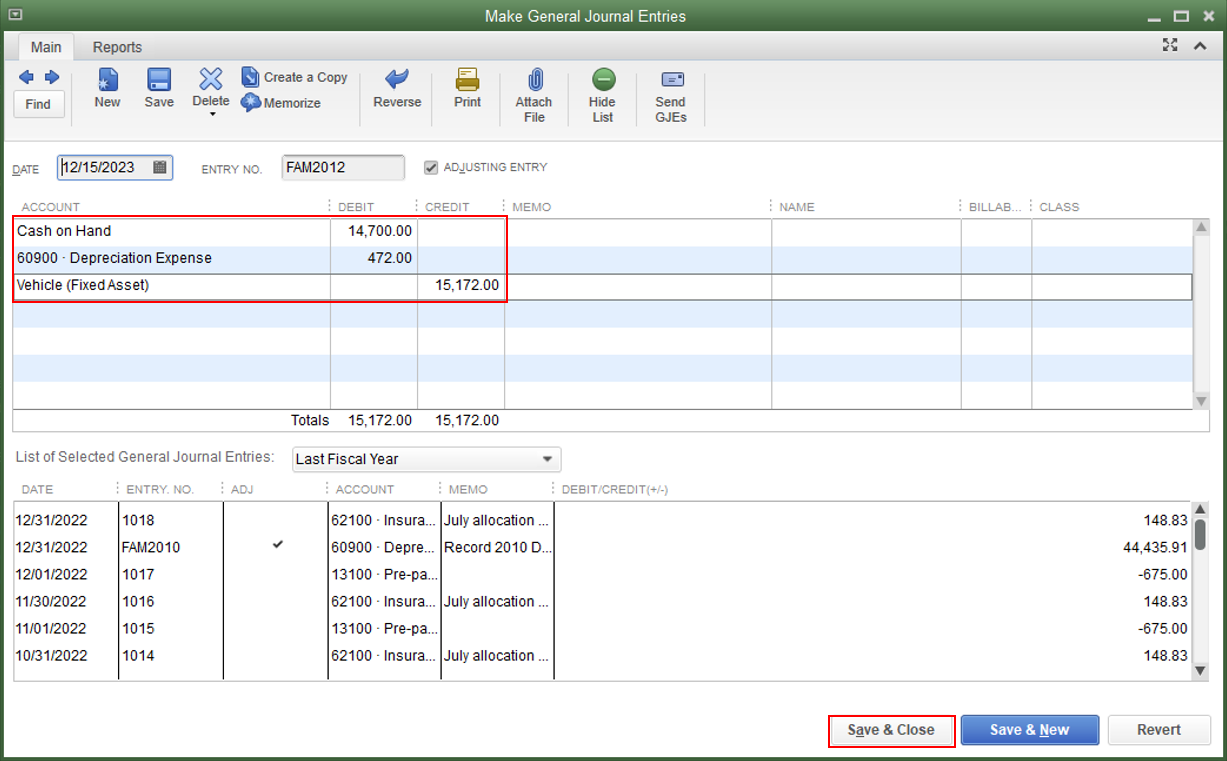

Web learn how to record a vehicle trade in with a note and a trade in allowance in quickbooks online. Web help for recording double.

Home Sad Accountant

The first step in recording. See journal entries, tax implications, and user questions and answers. October 15, 2018 06:34 pm. In 2018, the truck is.

journal entry format accounting accounting journal entry template

To make the transaction as real as possible, the example i. First, the business transaction has to be identified. Web be able to prepare journal.

Trading a Fixed Asset Journal Entries YouTube

Understand the meaning and general effect of “boot” in an exchange transaction. October 15, 2018 06:34 pm. Web learn how to record a vehicle trade.

How to Enter, Setup Record a Vehicle Purchase in QuickBooks

Pay invoice for sale of asset via contra account. But this is not all. Web what about a purchase without a loan (cash) with a.

how to record hire purchase motor vehicle Brian Coleman

See journal entries, tax implications, and user questions and answers. The entry should be made at the time of purchase and should include the details..

Web Learn How To Record A Vehicle Trade In With A Note And A Trade In Allowance In Quickbooks Online.

But this is not all. Web learn how to record the exchange of old and new vehicles in accounting. Web no matter how we use our company vehicles, when it comes to trading in old vehicles, it is important to make sure we properly book the journal entries as it impacts our balance. The entry should be made at the time of purchase and should include the details.

There Are Generally Three Steps To Making A Journal Entry.

First, the business transaction has to be identified. October 15, 2018 06:34 pm. In 2018, you trade in your old. Understand the meaning and general effect of “boot” in an exchange transaction.

Web A Fixed Asset Trade In Journal Entry Is Used To Post The Acquisition Of A New Motor Vehicle In Exchange For Cash And A Trade In Allowance On An Old Vehicle.

In 2018, the truck is fully depreciated. Obviously, if you don’t know a transaction. Web the accounting entries would be as follows: Web help for recording double entries for purchasing a vehicle with partly trade in and party cash.

Web Business Use Was 100%.

And european union on chinese electric vehicles. Posted by sr heavy equip repair over 4 years ago. See journal entries, tax implications, and user questions and answers. Web the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash).