Journal Entry For Sales Allowance - In the sales revenue section of an income statement, the sales returns and allowances account is subtracted from sales because. In this session, i discuss sales. Web the journal entry recorded by the company for the sales allowance is a debit of $1,000 to the sales allowance account and a credit to the accounts receivable. The two accounts affected by this entry. As we can see from the journal entries above, the seller should debit the exact amount of return to the revenue account or the sales return. Accounting for sales returns and allowances is simple. Web sales return journal entry. Web at the end of 2021, windsor co. Web here is the sale return journal entry: In short, a sales allowance does not involve a physical return of goods.

2.4 Sales of Merchandise Perpetual System Financial and Managerial

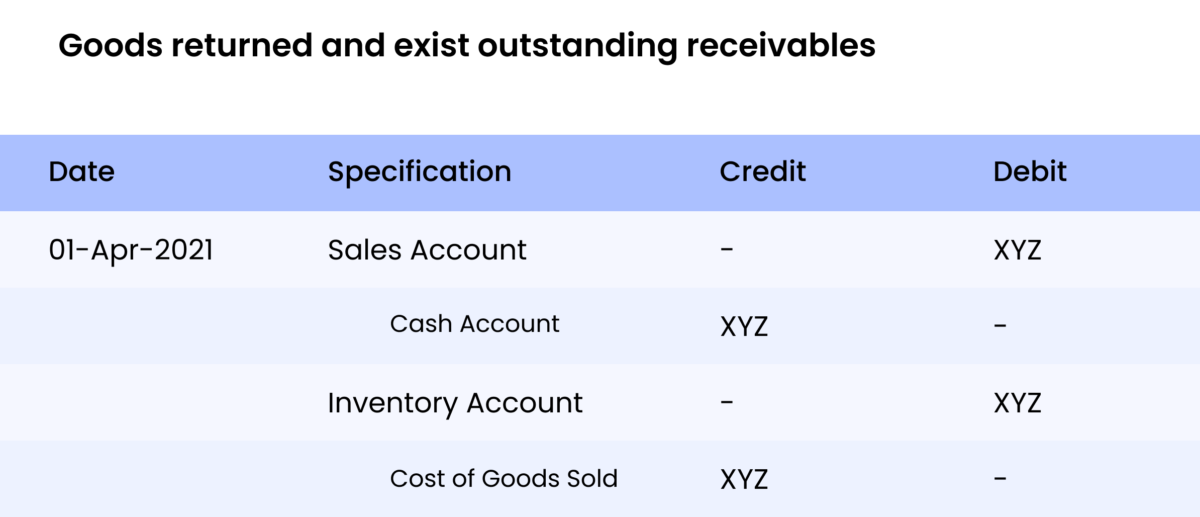

Web the journal entry would be: Some companies do not maintain a 'sales returns and allowances account. Web summary of sales transaction journal entries. The.

Perpetual Inventory System Journal Entry

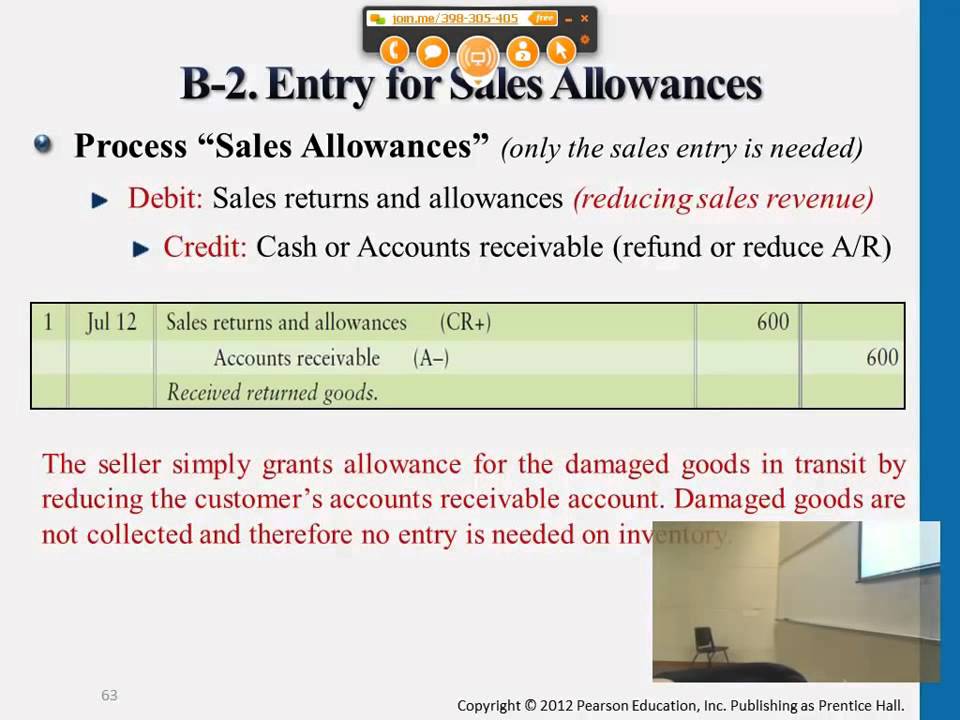

Web like sales returns, companies have to record sales allowances separately. Either perpetual or periodic inventory system, the journal entry for the sales returns and.

Purchase Allowance Journal Entry Double Entry Bookkeeping

Web updated on february 23, 2024. Either perpetual or periodic inventory system, the journal entry for the sales returns and allowance is the same except.

Accounting Journal Entries For Dummies

Either perpetual or periodic inventory system, the journal entry for the sales returns and allowance is the same except the additional entry on the cost.

How to Account for Sales Returns and Allowances Journal Entry. YouTube

Web summary of sales transaction journal entries. When it comes to accounting, the journal entry for sales returns and allowances is one of the most.

Sales Return Journal Entry Explained with Examples Zetran

The sales return journal entry is required to debit sales returns and allowances account and credit cash or accounts receivable as below: Web return of.

Accounting for Sales Return Journal Entry Example Accountinguide

Web sales returns and allowances must be properly tracked by accounting using journal entries. Returns are a normal part of running a business. Either perpetual.

How to Make Journal Entry for Sales and Purchase with VAT and without

Web sales return journal entry. Review the process for recording sales returns and allowances with examples. Web like sales returns, companies have to record sales.

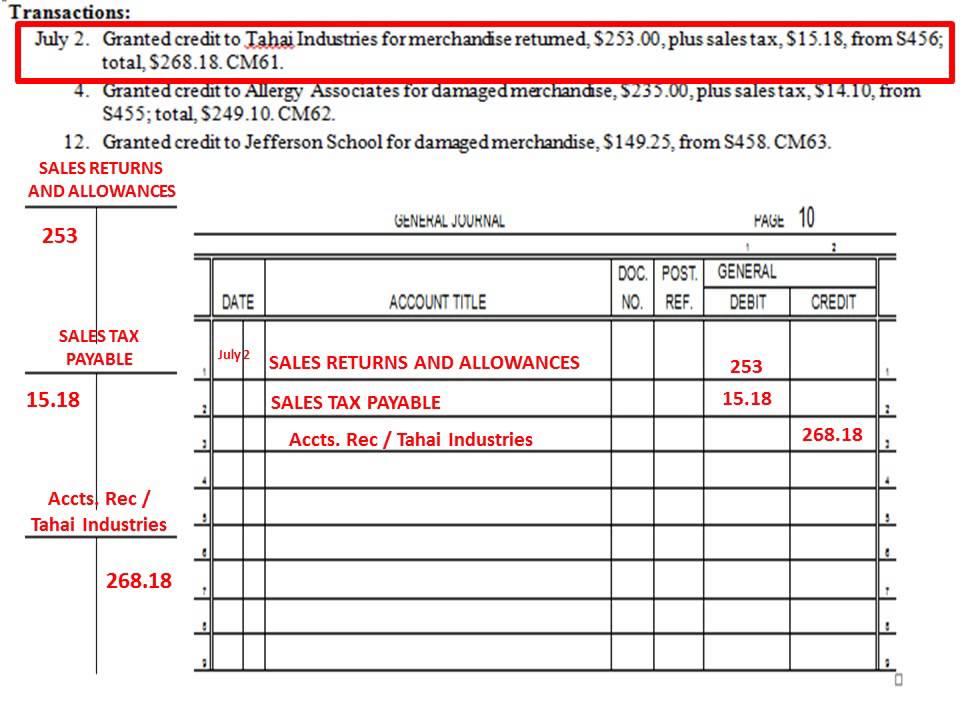

Chapter 10.3 Journalizing Sales Returns and Allowances Using a General

On january 24, 2022, it is learned that the company's. Web summary of sales transaction journal entries. Accounting for sales returns and allowances is simple..

Web A $100 Allowance Requires The Same Entry.

Web summary of sales transaction journal entries. Review the process for recording sales returns and allowances with examples. Either perpetual or periodic inventory system, the journal entry for the sales returns and allowance is the same except the additional entry on the cost of goods sold and merchandise inventory in the perpetual. Web under the allowance method of recording credit losses, gem’s entry to write off the customer’s account balance is as follows:

Accounting For Sales Returns And Allowances Is Simple.

Depending on the inventory system the company adopts; In short, a sales allowance does not involve a physical return of goods. Has accounts receivable of $691,000 and an allowance for doubtful accounts of $27,210. Web sales return journal entry.

Web Updated On February 23, 2024.

In the sales revenue section of an income statement, the sales returns and allowances account is subtracted from sales because. Returns are a normal part of running a business. Accounting events related to goods being returned are documented in the final. Web the journal entry would be:

Revenue Recognition (New Fasb Rules) | Intermediate Accounting | Cpa Exam Far.

When it comes to accounting, the journal entry for sales returns and allowances is one of the most important entries a business must make. To record a returned item, you’ll use the sales returns and allowances account. The sales return journal entry is required to debit sales returns and allowances account and credit cash or accounts receivable as below: Web the entry to record a sales return or allowance involves debiting the sales returns and allowances account and crediting the cash or accounts receivable account, effectively.