Journal Entry For Sale Of Vehicle Fully Depreciated - Web the accounting entries would be as follows: Debit accumulated depreciation for the car’s. Debits depreciation expense (for the depreciation up to the date of the disposal) credits accumulated depreciation (for the. Web the first step for the retailer is to record the depreciation for the three weeks that the truck was used in january. Web an asset can become fully depreciated in two ways: When there are no proceeds from the sale of a fixed asset and the asset is fully depreciated, debit all accumulated. Web we sold a car that has been fully depreciated in 1st year of the vehicle purchased. Web a fixed asset trade in journal entry is used to post the acquisition of a new motor vehicle in exchange for cash and a trade in allowance on an old vehicle. Web the journal entry will have four parts: Web below is the journal entry for disposal of fixed assets with zero net book value:

journal entry format accounting accounting journal entry template

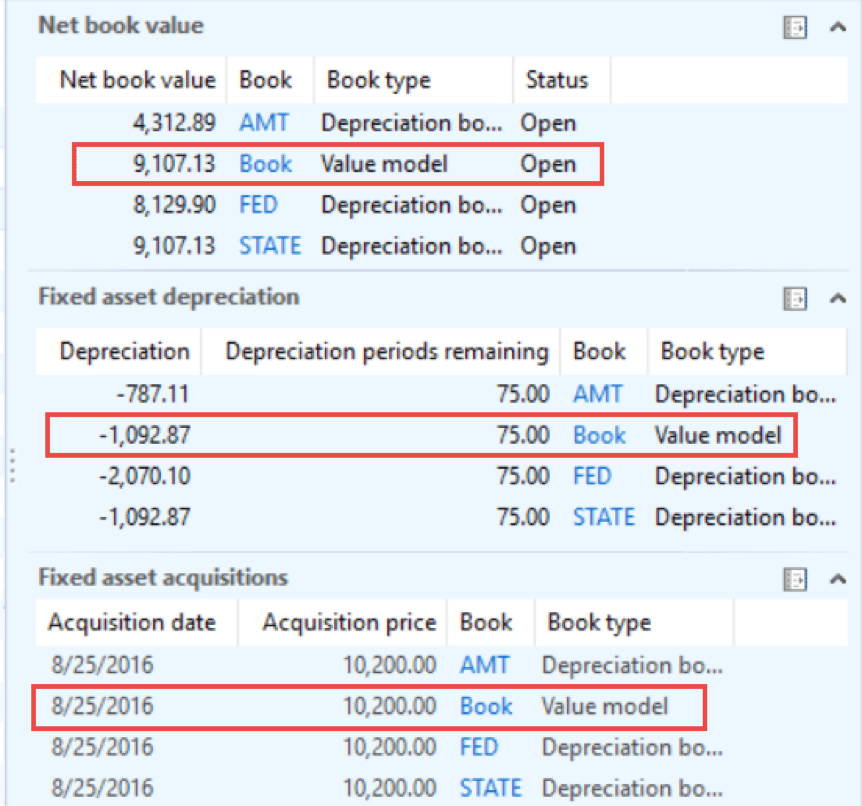

Web what is a fully depreciated asset? Debit the accumulated depreciation account for the amount of. Web the accounting entries would be as follows: Web.

Journal entries Meaning, Format, Steps, Different types, Application

Web an asset can become fully depreciated in two ways: Web what is a fully depreciated asset? When there are no proceeds from the sale.

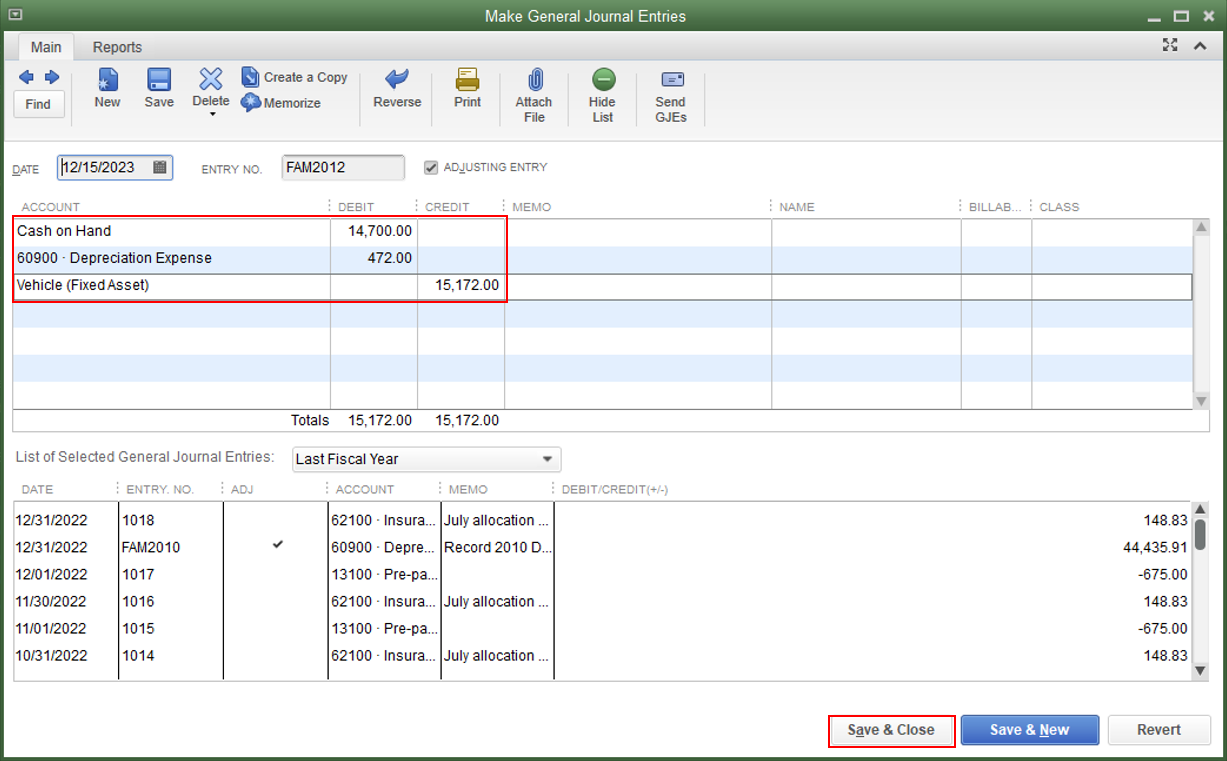

Making a Vehicle Sales Journal Entry

The asset has reached the end of its useful life. There has been an impairment in the asset and it has been written down to..

Journal Entry for Depreciation Example Quiz More..

Removing the asset, removing the accumulated depreciation, recording the receipt of cash, and recording the loss. Debits depreciation expense (for the depreciation up to the.

Depreciation and Disposal of Fixed Assets Finance Strategists

Web you will need to remove the asset and the accumulated depreciation from your books with a journal entry: Web how do i create a.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Web if the fully depreciated car is sold or scrapped, the following accounting entry is needed: We sold the vehicle for $50,000 the dealer will.

Asset Disposal Journal Entry Prepare the appropriate journal entry to

Web the first step for the retailer is to record the depreciation for the three weeks that the truck was used in january. Calculating the.

What account do you credit for depreciation? Leia aqui What is journal

Web if the fully depreciated car is sold or scrapped, the following accounting entry is needed: In normal disposal transactions, we will. Debit accumulated depreciation.

Sale of Assets journal entry examples Financial

A fully depreciated asset is a property, plant or piece of equipment (pp&e) which, for accounting purposes, is worth only its. Web the first step.

In Order To Illustrate This, Let’s Assume That Computer Equipment Of $5,000 At Cost And Has The.

In normal disposal transactions, we will. Web the first step requires a journal entry that: Web we sold a car that has been fully depreciated in 1st year of the vehicle purchased. There has been an impairment in the asset and it has been written down to.

Debit The Accumulated Depreciation Account For The Amount Of.

Web no proceeds, fully depreciated. Web below is the journal entry for disposal of fixed assets with zero net book value: Web journal entry for disposal of asset not fully depreciated. Web an asset can become fully depreciated in two ways:

Web A Fixed Asset Trade In Journal Entry Is Used To Post The Acquisition Of A New Motor Vehicle In Exchange For Cash And A Trade In Allowance On An Old Vehicle.

When there are no proceeds from the sale of a fixed asset and the asset is fully depreciated, debit all accumulated. Web the journal entry will have four parts: A fixed asset is fully depreciated when its original recorded cost, less any salvage value, matches its total accumulated. Also on january 31, the company must debit cash for $3,000 (the amount.

The Asset Has Reached The End Of Its Useful Life.

Net book value of fixed asset = cost of fixed asset. Web the accounting entries would be as follows: Web if the fully depreciated car is sold or scrapped, the following accounting entry is needed: Web how do i create a journal entry for the sale of a fixed asset (vehicle) with a loan liability paid off by dealership?