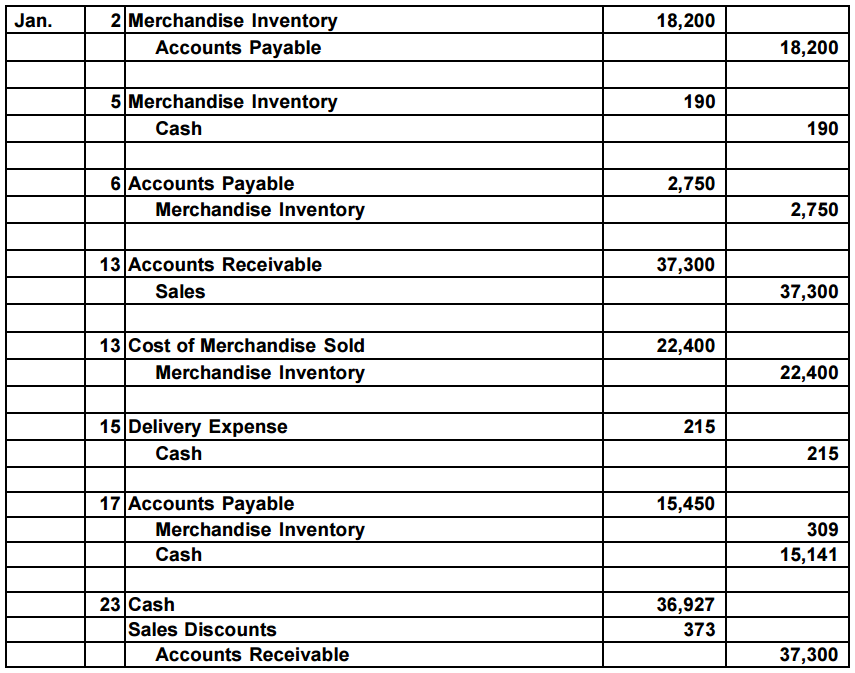

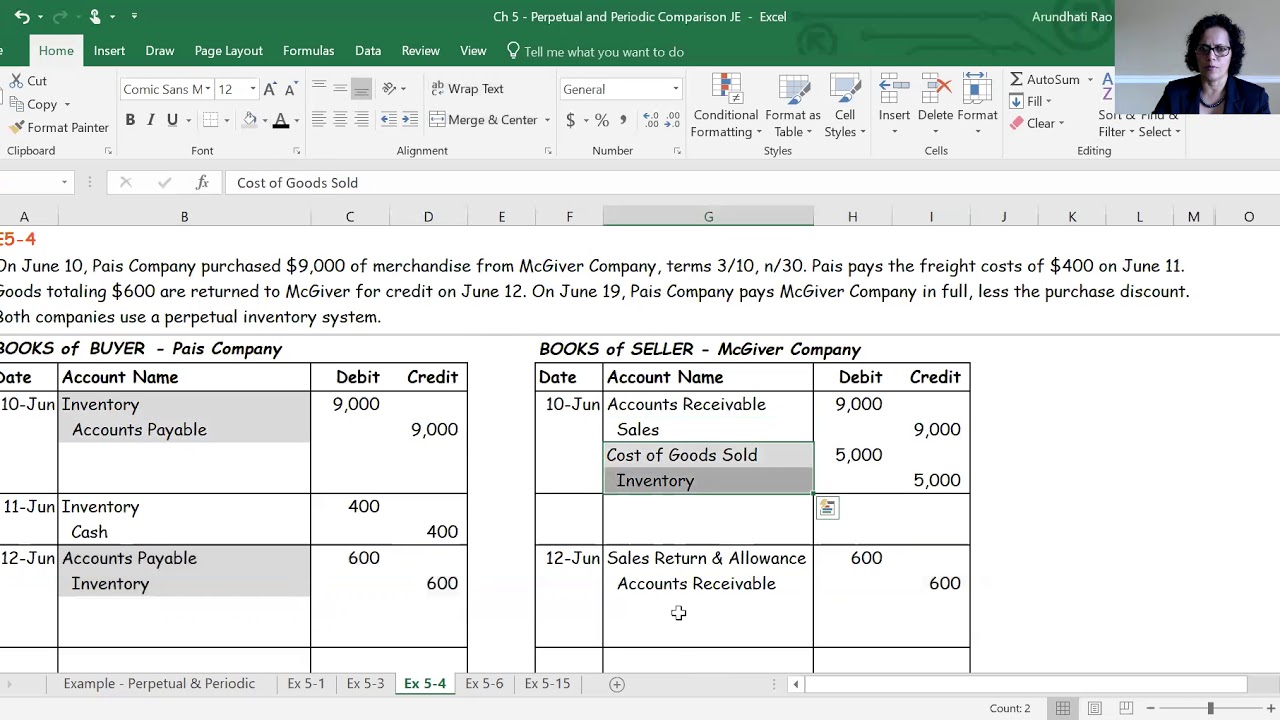

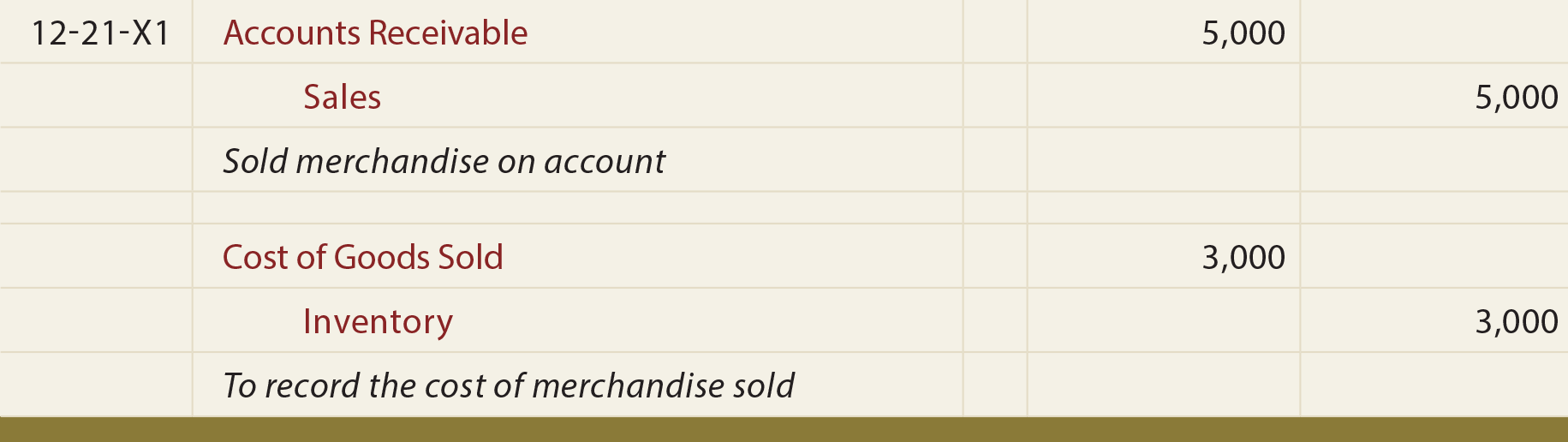

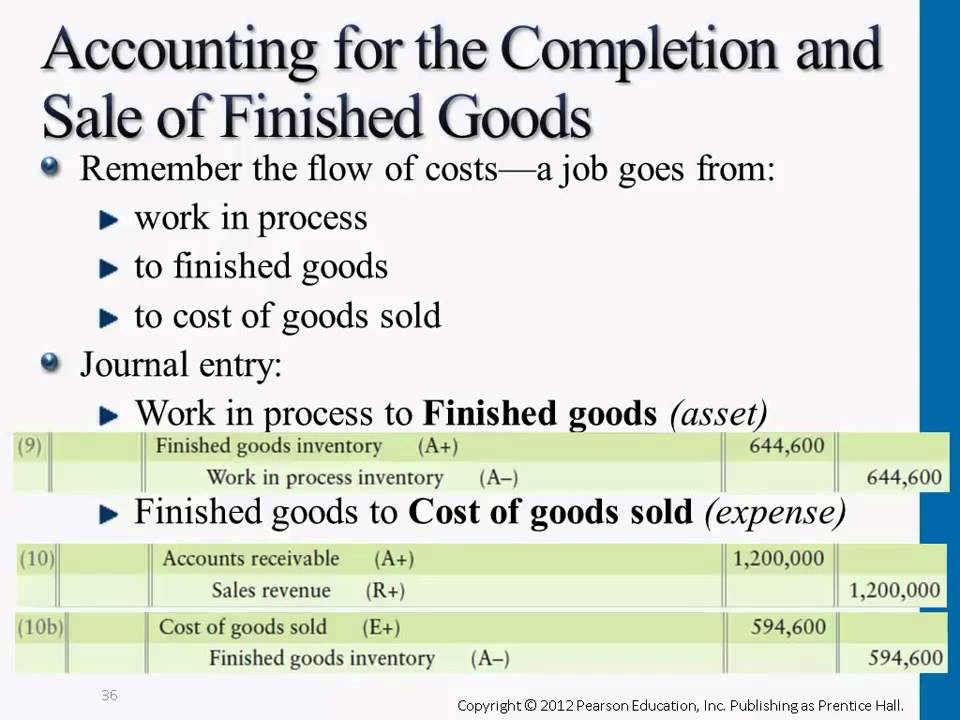

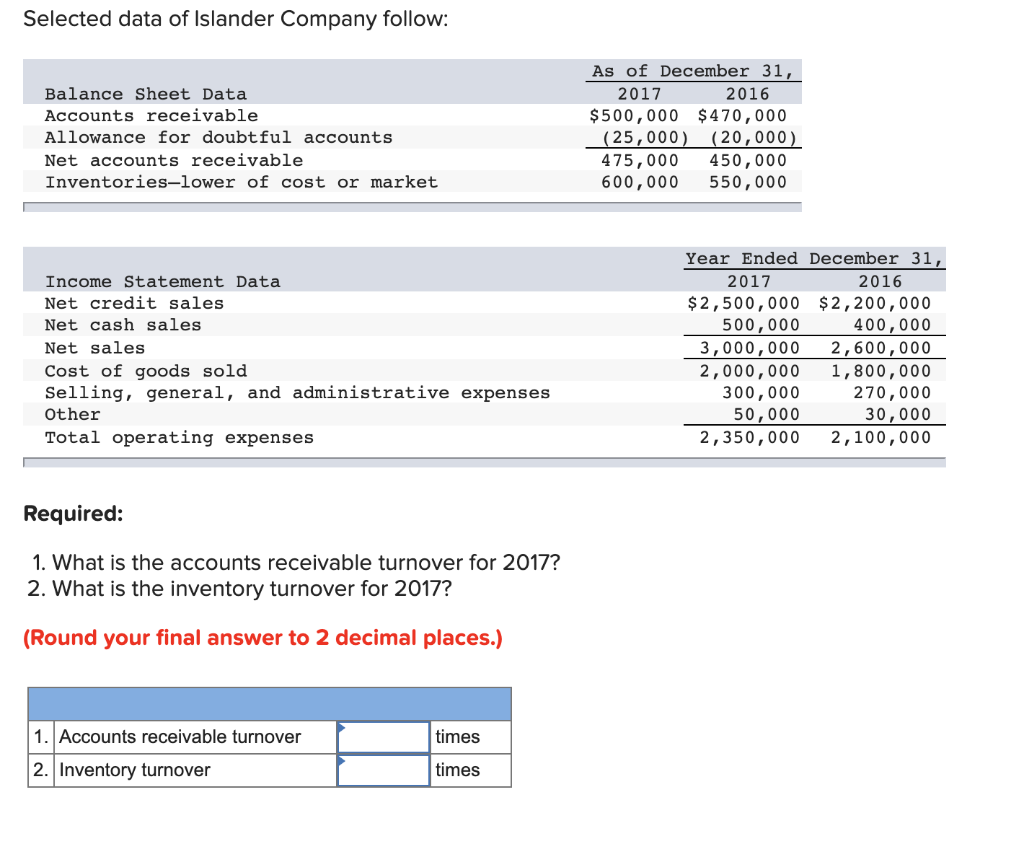

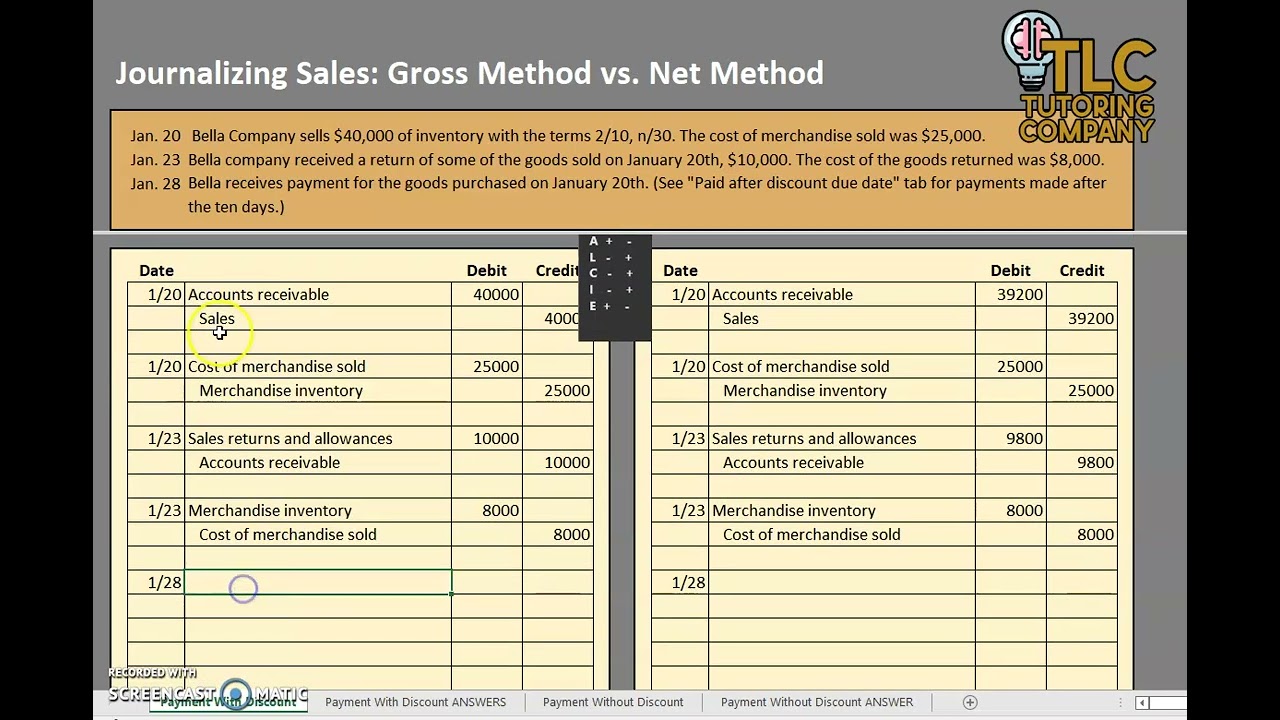

Journal Entry For Sale Of Inventory - Uses the periodic inventory system instead, what is the journal entry for the inventory. You use accounting entries to show that your customer paid you money and your revenue. A typical entity that has heavy inventory movement. Web perpetual inventory system journal entries. This journal entry needs to record three events, which are the recordation of a. Web what is the journal entry for the purchase transaction? Depending on the type of inventory and how much. The journal entries below act as a. Inventory transactions are journalized to keep track of inventory movements. The credit sale of inventory affects accounts receivable, revenue accounts,.

Accounting Q and A Appendix Ex 639 Journal entries using perpetual

Web the journal entry is: Perpetual inventory system and period inventory system are the two methods of accounting for inventory that is different from one.

Perpetual Inventory Journal Entries Buyer & Seller YouTube

The accounting records will show the following bookkeeping entries for the sale of inventory on account: Perpetual inventory system and period inventory system are the.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

If the company abc ltd. Inventory transactions are journalized to keep track of inventory movements. Web perpetual inventory system journal entries. Web an inventory purchase.

Perpetual Inventory

Web a sales journal entry records the revenue generated by the sale of goods or services. The perpetual inventory system journal entries below act as.

Completion of Sale & Finished Goods Journal Entries YouTube

Web a journal entry for inventory is a record in your accounting ledger that helps you track your inventory transactions. Depending on the type of.

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

Inventory transactions are journalized to keep track of inventory movements. Depending on the type of inventory and how much. Uses the periodic inventory system instead,.

Perpetual Inventory Systems

Perpetual inventory system and period inventory system are the two methods of accounting for inventory that is different from one to another. Web a sales.

LO 6.4a Analyze and Record Transactions for the Sale of Merchandise

Depending on the type of inventory and how much. The journal entries below act as a. The accounting records will show the following bookkeeping entries.

Cash Sale of Inventory Double Entry Bookkeeping

Web when selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit sale revenue, as well as debit.

A Typical Entity That Has Heavy Inventory Movement.

Perpetual inventory system and period inventory system are the two methods of accounting for inventory that is different from one to another. Web in this method, periodic inventory system journal entries are made to record the purchase, sale, and ending inventory balances. Web journal entry for sales example & guide | accountant town. Web the journal entry is:

Web A Sales Journal Entry Is A Journal Entry In The Sales Journal To Record The Sale Of Inventory On Credit.

A journal entry for selling inventory records transactions of sales made in a business. A sales journal entry records a cash or credit sale to a customer. Web how to record a journal entry for inventory? Web perpetual inventory system journal entries.

Depending On The Type Of Inventory And How Much.

You use accounting entries to show that your customer paid you money and your revenue. The journal entries below act as a. Uses the periodic inventory system instead, what is the journal entry for the inventory. The credit sale of inventory affects accounts receivable, revenue accounts,.

Web A Sales Journal Entry Records The Revenue Generated By The Sale Of Goods Or Services.

The accounting records will show the following bookkeeping entries for the sale of inventory on account: Web a journal entry for inventory is a record in your accounting ledger that helps you track your inventory transactions. There are many journal entries that must be made to record the movement of inventory. This entry typically involves debiting the inventory account to increase.