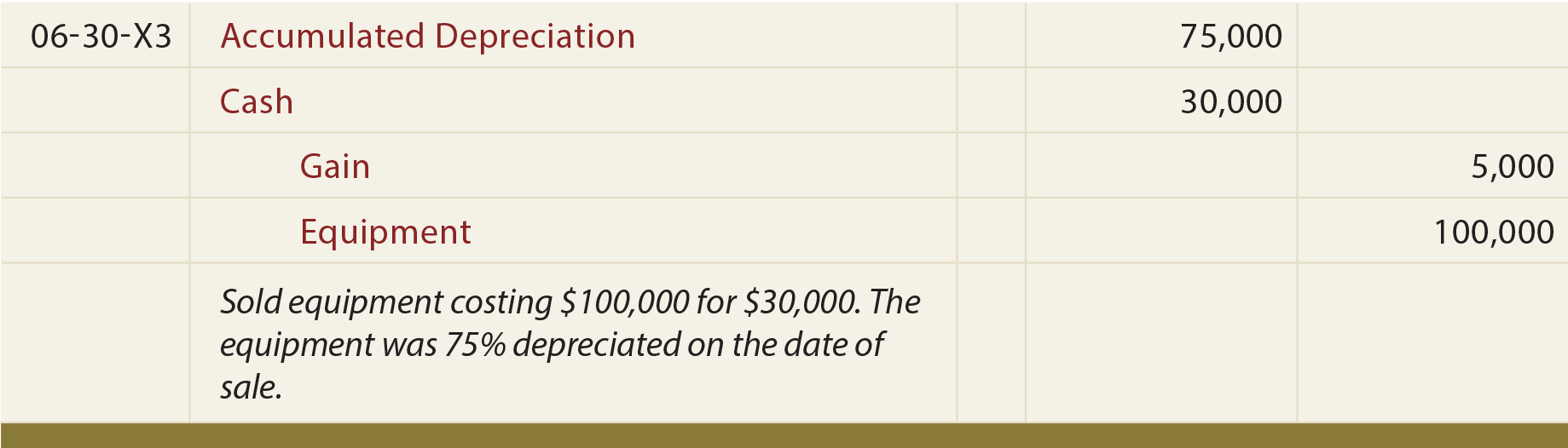

Journal Entry For Sale Of Equipment - Web the journal entry is debiting loss from sale of equipment, accumulated depreciation, and credit cost of equipment. On the other hand, an asset may be disposed of by sale, in which case the journal entry would need to be modified to include the proceeds of the sale. Web defining the entries when selling a fixed asset when a fixed asset or plant asset is sold, there are several things that must take place: Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from the accounting records. Web what is the entry in quickbooks for the sale of an asset? Accounting for depreciation to date of disposal. Web usually, the accounting for an equipment lease involves four activities in the lessee’s books. Removing the asset, removing the accumulated depreciation, recording the receipt of cash, and recording the gain. What is the journal entry if the sale amount is only $6,000 instead? Web to examine the consolidation procedures required by the intercompany transfer of a depreciable asset, assume that able company sells equipment to baker company at.

General Journal entry form June 1 . Purchased equipment in the amount

Removing the asset, removing the accumulated depreciation, recording the receipt of cash, and recording the gain. Abc is a construction company. Web usually, the accounting.

Journal Entry Problems and Solutions Format Examples

Journal entry for sale of assets (land) example 4: Sale of fixed assets journal entry. Detailed below are the accounting treatments for all four activities:.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

Accounting for depreciation to date of disposal. Web the journal entry will have four parts: When equipment that is used in a business is disposed.

Sold machinery for cash journal entry CArunway

The fixed asset's depreciation expense. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the.

Perpetual Inventory System Journal Entry

Web the journal entry is debiting accumulated depreciation, cash/receivable, and credit fixed assets cost, gain, or loss. If the selling price is lower than the.

Journal Entry Examples

Web the journal entry to record the sale is: Web usually, the accounting for an equipment lease involves four activities in the lessee’s books. Fully.

Gain on Sale journal entry examples Financial

Web what is the journal entry of fixed asset sale if the sale amount is $7,000 for the equipment? Web usually, the accounting for an.

Disposal of PP&E

Journal entry for sale of. Journal entry for sale of assets (land) example 4: Web entries to record a sale of equipment. Web usually, the.

journal entry format accounting accounting journal entry template

Show the journal entries to record this asset disposal transaction by ubs. Abc is a construction company. Detailed below are the accounting treatments for all.

The Company Sells The Machinery For Several Reasons And Is Approved By The Management.

Web what is the entry in quickbooks for the sale of an asset? Web when it’s time to buy new equipment, know how to account for it in your books with a purchase of equipment journal entry. Web the journal entry will have four parts: Web for example, abc international buys a machine for $50,000 and recognizes $5,000 of depreciation per year over the following ten years.

Web When A Business Disposes Of Fixed Assets It Must Remove The Original Cost And The Accumulated Depreciation To The Date Of Disposal From The Accounting Records.

Show the journal entries to record this asset disposal transaction by ubs. When the company sold the machine, it must remove the fixed assets. Web to examine the consolidation procedures required by the intercompany transfer of a depreciable asset, assume that able company sells equipment to baker company at. When equipment that is used in a business is disposed of (sold) for cash before it is fully depreciated, two steps must be taken:.

If The Selling Price Is Lower Than The Net Book Value, Company.

Web the journal entry is debiting loss from sale of equipment, accumulated depreciation, and credit cost of equipment. Debit the accumulated depreciation account for the amount of depreciation claimed. Cash balance increases by $20,000. Web the journal entry is debiting accumulated depreciation, cash/receivable, and credit fixed assets cost, gain, or loss.

Journal Entry For Sale Of.

Accounting for depreciation to date of disposal. Removing the asset, removing the accumulated depreciation, recording the receipt of cash, and recording the gain. Web usually, the accounting for an equipment lease involves four activities in the lessee’s books. Web entries to record a sale of equipment.