Journal Entry For Salary Paid - Salary paid in advance is also known as prepaid salary (it is a prepaid expense). In accounting, accrued salaries are the amount that the company owes to its employees for the services they have performed during the period but not have been paid for yet. Journal entry when payment happens: However, the company may pay the employees in advance if there are any special requests. A payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. These entries are then incorporated into an entity's through the. Web journal entry for directors’ remuneration paid in cash. Web journal 1 shows the employee’s gross wages ($1,200 for the week). In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s tax rate is 6.2%. During the month, the company has paid wages of $ 35,000 to all employees.

How To Correctly Post Your Salary Journal

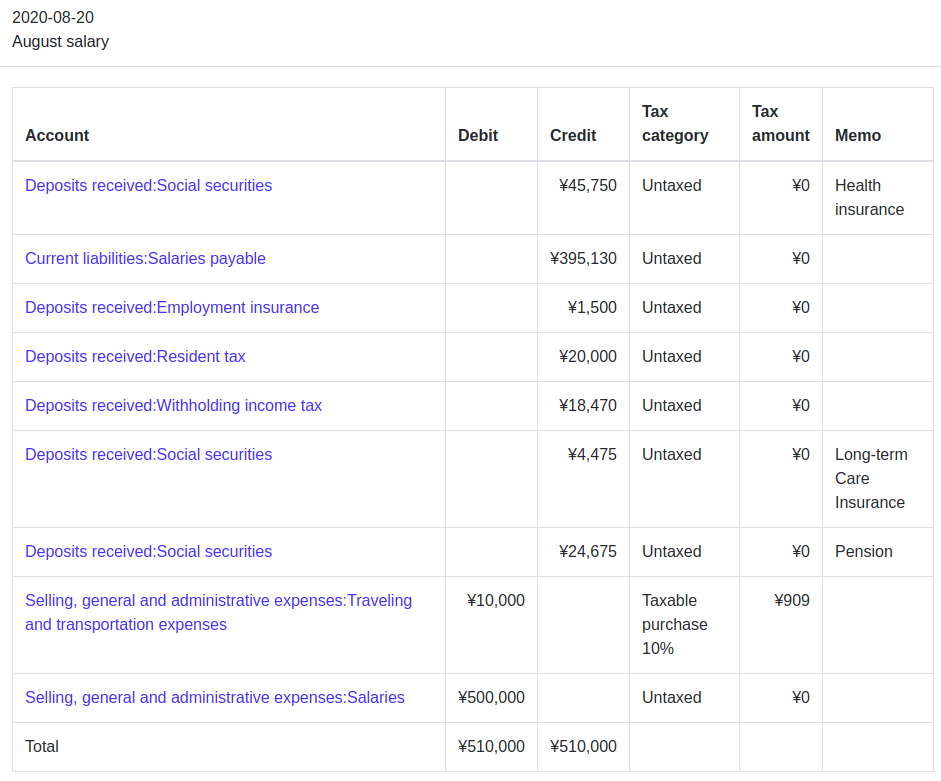

Now, you can record the journal entry in your accounting system. The company needs to make journal entry by debiting salary advances and credit cash.

What Is The Journal Entry For Payment Of Salaries Info Loans

Web journal entry for directors’ remuneration paid in cash. Journal entries relating to the salary: Web payroll journal entries are used to record the paid.

10 Payroll Journal Entry Template Template Guru

The key types of payroll journal entries are noted below. Likewise, as the expense has already incurred, the company needs to properly make journal entry.

Salary Paid Journal Entry CArunway

Web journal 1 shows the employee’s gross wages ($1,200 for the week). It is used to record the payment of an employee’s salary, including wages,.

How To Journalize Salaries Cagamee

Has the policy to make the salary payment at the end of each month. Journal entries relating to the salary: Web the journal entry is.

Complete journal entries of Salaries YouTube

However, the company may pay the employees in advance if there are any special requests. Esi contribution (employer + employee) =45000 (30000+15000) pf contribution (employer.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

The primary payroll is for the initial recordation of a. Salary paid in advance is also known as prepaid salary (it is a prepaid expense). In.

What Is The Journal Entry For Payment Of Salaries Info Loans

A payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. Web what is a payroll journal.

Your BookKeeping Free Lessons Online Examples of Payroll Journal

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. These entries are.

Web Journal 1 Shows The Employee’s Gross Wages ($1,200 For The Week).

These amounts include the basic salary, overtime, bonus, and other allowance. It is used to record the payment of an employee’s salary, including wages, bonuses, commissions, and other forms of payment. The journal entry for salary paid should also include a description of the transaction, which includes the. In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s tax rate is 6.2%.

Company Abc Hires Some Workers To Complete The Work For Customers.

Has the policy to make the salary payment at the end of each month. Let’s assume our company also has salaried employees who are paid semimonthly on the 15th and the last day of each month. At the end of the month), it can make the journal entry to settle advance salary as below: A salary of ₹50,000 is paid in cash after making deductions of professional tax ₹500, tds ₹1,000, and provident fund ₹1,200.

Web Journal Entry For Salary:

Now, you can record the journal entry in your accounting system. Record the necessary journal entry. Each quarter end, the accounting manager books the following entry to recognize the payment to james: Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee.

House Rent Allowance = 150000.

A payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. These entries are then incorporated into an entity's through the. Most of the company pays employees at the end of the month or even the beginning of next month. We need to debit the salary gl to increase the expenditure with a corresponding credit to the salary payable gl per the above rules.