Journal Entry For Revenue Recognition - Identify the performance obligations in the contract. Web contract accounting revenue recognition has five steps that must be satisfied to recognize revenue: Revenue recognition is a principle in accounting (gaap) that dictates when and how revenue should be recorded based on earned income, not. Ownership of goods or services has been transferred to the. Identify the contract with the customers. Web journal entries related to revenue recognition involve debiting accounts receivable and crediting revenue. Web revenue can be recognized when all of the following criteria have been met: Identify the contract (s) with a customer. Web adjusting journal entry occurs at the end of an accounting period to record any unrecognized income or expenses. Web revenue recognition is one of the most important concepts in accounting.

What is Unearned Revenue? QuickBooks Canada Blog

These journal entries are a way for businesses to. Web the deferred revenue journal entry is your tracking mechanism for this type of revenue, within.

11.2 Analyze, Journalize, and Report Current Liabilities Business

Web the application of these different rules will affect when revenue is recognized; Web revenue can be recognized when all of the following criteria have.

Accounting Journal Entries For Dummies

Web a guide to revenue recognition prepared by: Under cash basis accounting, customer sales are. Getting the journal entriesfor asc 606 correct means we first.

Perpetual Inventory System Journal Entry

Web ifrs 15 journal entries [scenario: Web a guide to revenue recognition prepared by: Web journal entries for the revenue recognition principle. Web adjusting journal.

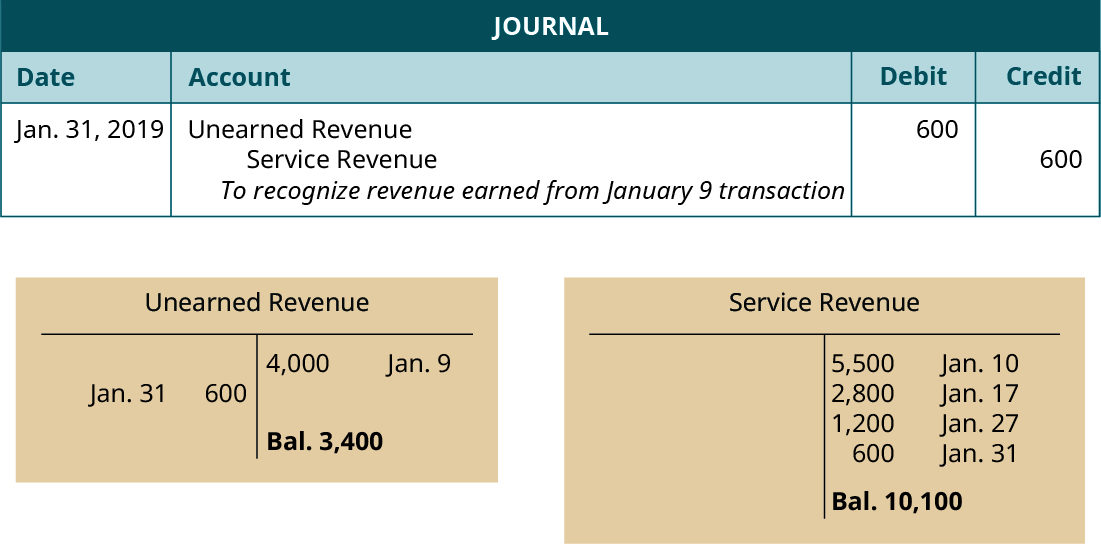

1.10 Adjusting Entry Examples Financial and Managerial Accounting

Web adjusting journal entry occurs at the end of an accounting period to record any unrecognized income or expenses. Marshall, partner, national professional standards group,.

Accounting for the Billing Cycle

Typical journal entries look like: When the revenue is earned but the customer will pay the money at a later date ( commonly called “credit.

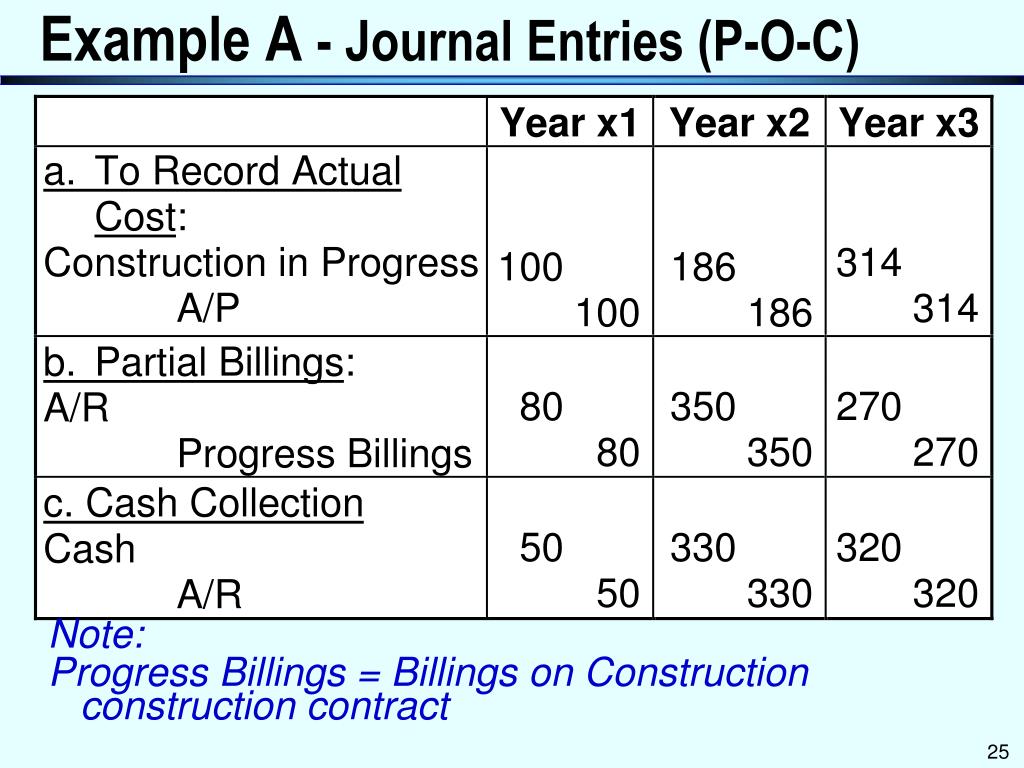

How to recognize revenue in construction contracts Output Method

Web revenue recognition is one of the most important concepts in accounting. Web journal entries for the revenue recognition principle. Ownership of goods or services.

9.1 Explain the Revenue Recognition Principle and How It Relates to

Revenue recognition is a principle in accounting (gaap) that dictates when and how revenue should be recorded based on earned income, not. When the revenue.

PPT Revenue Recognition PowerPoint Presentation, free download ID

Identify the contract with the customers. Unconditional contributions are recognized in the period when either assets. Web revenue can be recognized when all of the.

Web Journal Entries For Revenue Recognition.

According to the principle of revenue recognition, revenues are recognized in the period earned (buyer and seller have entered into an agreement to. Web asc 606 revenue recognition examples and what you can learn from them. Web journal entries for the revenue recognition principle. Web ifrs 15 journal entries [scenario:

Deciding When To Record Revenue And Expenses Can Have A Huge Impact On The Financial Statements.

Ownership of goods or services has been transferred to the. Web contract accounting revenue recognition has five steps that must be satisfied to recognize revenue: Identify the contract with the customers. Revenue recognition is a principle in accounting (gaap) that dictates when and how revenue should be recorded based on earned income, not.

Getting The Journal Entriesfor Asc 606 Correct Means We First Need To Define Revenue Recognition.

Web revenue recognition is one of the most important concepts in accounting. Web the deferred revenue journal entry is your tracking mechanism for this type of revenue, within your accounting. Under cash basis accounting, customer sales are. Identify the performance obligations in the contract.

These Journal Entries Are A Way For Businesses To.

Marshall, partner, national professional standards group, rsm us llp [email protected], +1 203 905. Unconditional contributions are recognized in the period when either assets. Identify the contract (s) with a customer. This article explains the accounting treatment of implementing the revenue recognition.