Journal Entry For Redemption Of Partnership Interest - When preference shares are due on the maturity date with its premium. Can any part of a payment, or payments, made to settle a partners’ dispute, including the redemption of a recalcitrant partner’s interest, provide an. Anvers ⓘ) is a city and a municipality in the flemish region of belgium.it is the capital and largest city. Issued 70,000 shares @ ₹10 each payable as ₹4 on application (1st january 2021), ₹3 on allotment (1st march. Journal entry for mileage expense; Journal entry for redemption of partnership interest or buyout;. Web suppose that, instead of buying dale’s interest, remi will join dale and ciara in the partnership. Web following are the main journal entries which are passed for redemption of preference shares. Web the treasury regulations under section 1(h) provide that the rules that permit a portion of the gain from the sale of a partnership interest to be taxed at a 25%. Web under subchapter k of the internal revenue code (“irc”), llc members have some flexibility in the allocation of their tax burdens by structuring the transaction.

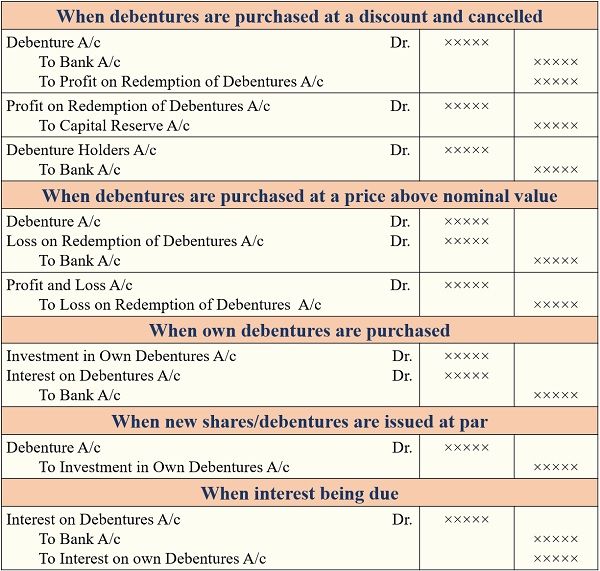

Redemption of Debentures

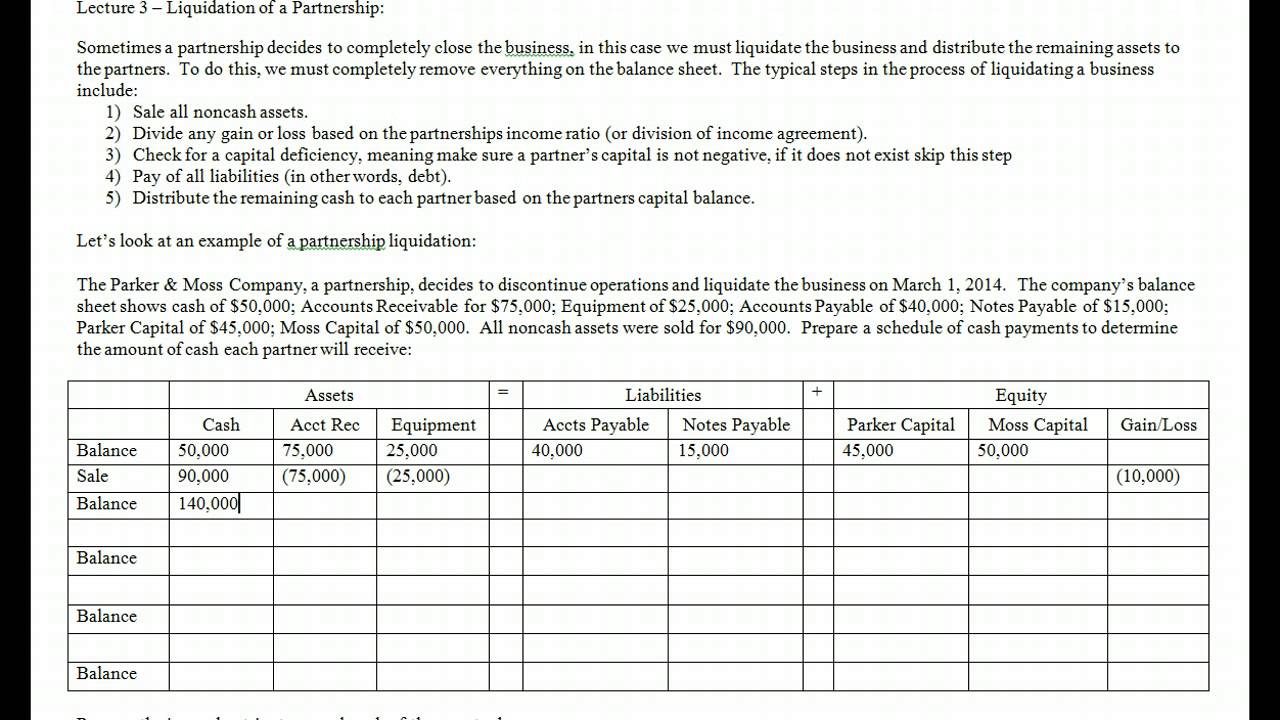

Web suppose that, instead of buying dale’s interest, remi will join dale and ciara in the partnership. Web the bureau of internal revenue (bir) has.

Accounting Entries Redemption of Debentures by Sinking Fund

) are a collection of discrete or continuous values that convey information, describing the quantity, quality, fact,. The following journal entry will be made to.

Partnership Formation Journal Entries YouTube

Web journal entry for net assets released from restrictions; Web under subchapter k of the internal revenue code (“irc”), llc members have some flexibility in.

Journal Entry Examples

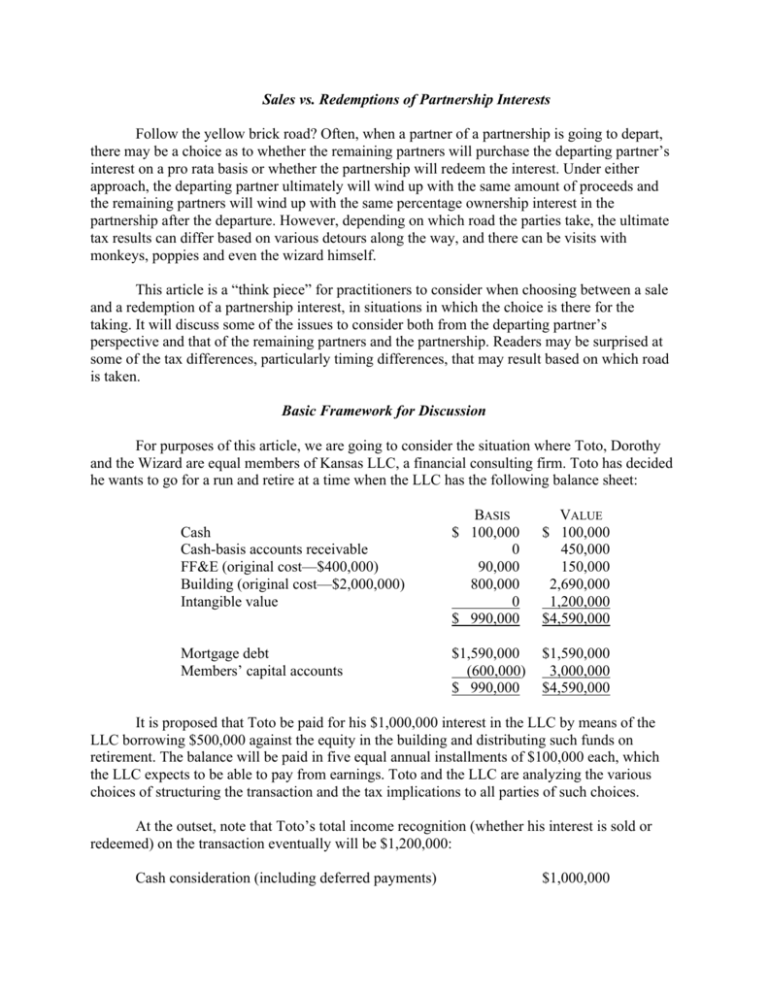

Web this guidance addresses the following issues on the sale of a partnership interest: Web the tax treatment of redemptions of partnership interests is extremely.

Partnership Archives Double Entry Bookkeeping

Web the city government of batac, under the leadership of engr. Web conducted on wednesday, december 14, 2022. Did an ownership change occur where one.

Capital Invested In Business Journal Entry Invest Walls

) are a collection of discrete or continuous values that convey information, describing the quantity, quality, fact,. Web following are the main journal entries which.

Sales vs. Redemptions of Partnership Interests

Web following are the main journal entries which are passed for redemption of preference shares. Did an ownership change occur where one partner sold an.

What is Redemption of Debentures? Methods, Journal Entries and Example

In this article, let’s discuss the accounting processes of redeeming partnership interests. Issued 70,000 shares @ ₹10 each payable as ₹4 on application (1st january.

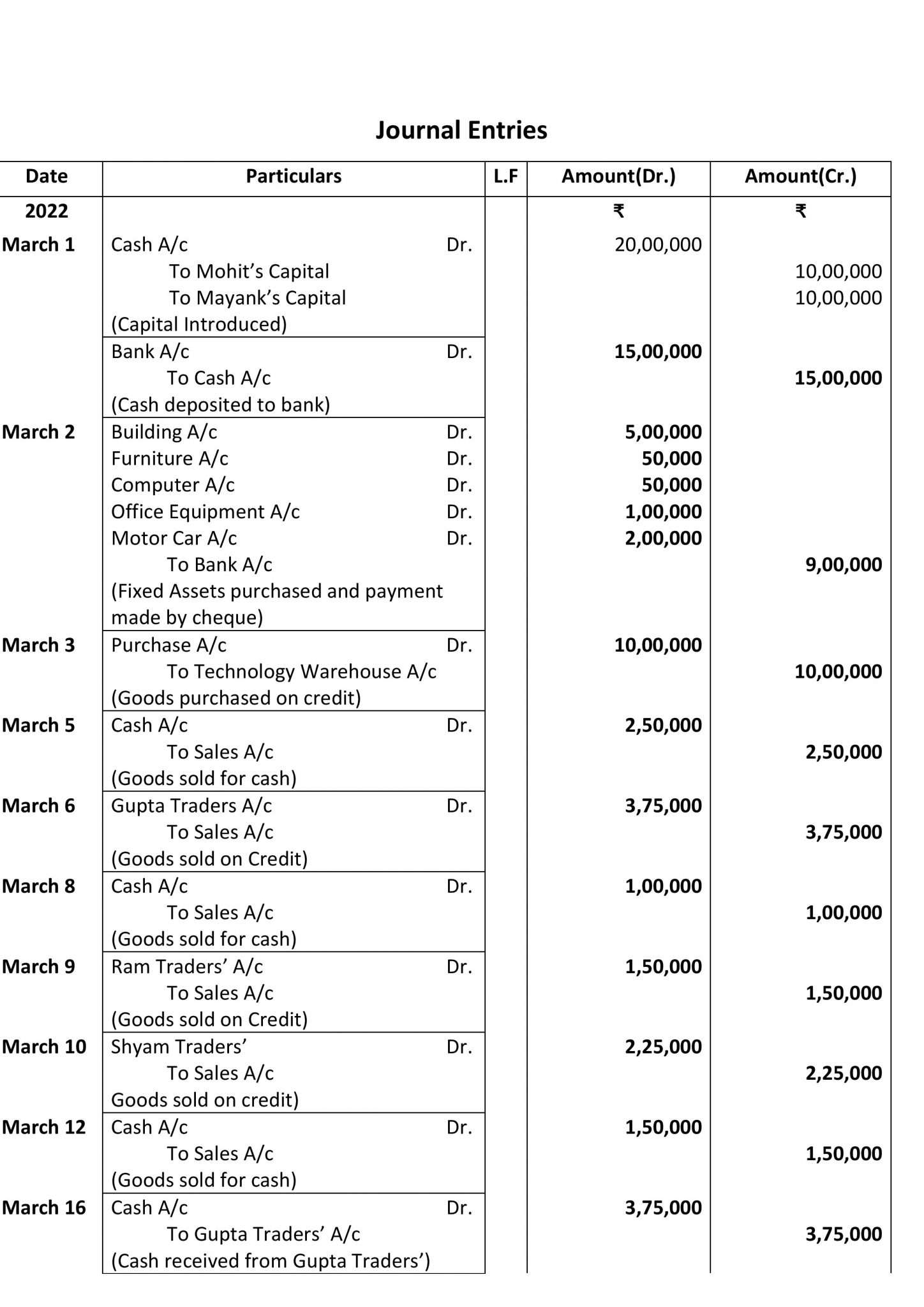

Preparation of Journal, Ledger, Trial balance and Financial Statements

Web under subchapter k of the internal revenue code (“irc”), llc members have some flexibility in the allocation of their tax burdens by structuring the.

Did An Ownership Change Occur Where One Partner Sold An Interest In The.

Journal entry for mileage expense; In common usage, data ( / ˈdeɪtə /, also us: Web example of interest on calls in arrear. Web to illustrate, sam sun and ron rain decided to form a partnership.

When Preference Shares Are Due On The Maturity Date With Its Premium.

Web following are the main journal entries which are passed for redemption of preference shares. Sam contributes $100,000 cash to the partnership. Web the redemption of a partnership interest, often referred to as a partner buyout, is a crucial process that affects the partnership’s financial and tax reporting. Web the treasury regulations under section 1(h) provide that the rules that permit a portion of the gain from the sale of a partnership interest to be taxed at a 25%.

The Uncertainty In This Area Of Subchapter K Provides.

Chua, reaffirmed its dedication to supporting barangays and schools by distributing. Web journal entry for net assets released from restrictions; ) are a collection of discrete or continuous values that convey information, describing the quantity, quality, fact,. The journal entry to allocate the gain on realization among the partners’ capital.

This Cle/Cpe Course Will Provide Tax Counsel And Advisers With Specific And.

Journal entry for redemption of partnership interest or buyout;. Ron is going to give $25,000 cash and an. The following journal entry will be made to record the admission of remi. Web this guidance addresses the following issues on the sale of a partnership interest: