Journal Entry For Reconciliation Discrepancy - Web journal entries in bank reconciliation. Web it is useful when trying to process a bank reconciliation, especially when you have a stubborn discrepancy, to look not only at the last month’s account reconciliation. Web reconciliation discrepancies in quickbooks online refer to inconsistencies between the bank statement and the financial records within the software, impacting the accuracy of. Web effective reconciliation involves systematic steps from verifying general ledger accuracy to posting necessary journal entries to correct any discrepancies. Summarize the ending balances in all revenue accounts and verify that the aggregate amount matches the revenue total in. They're sorted by statement dates. Web at the end of a reconciliation, you may see a small amount left over. Web reconciliation adjustments (journal entries, etc.) so, if the reconciliation discrepancy has occurred due to the addition, deletion or modification of the previously added. Web if the journal entry isn't part of that reconciliation period, you can either delete or change the journal entry's date. Web this reconciliation process involves the following steps:

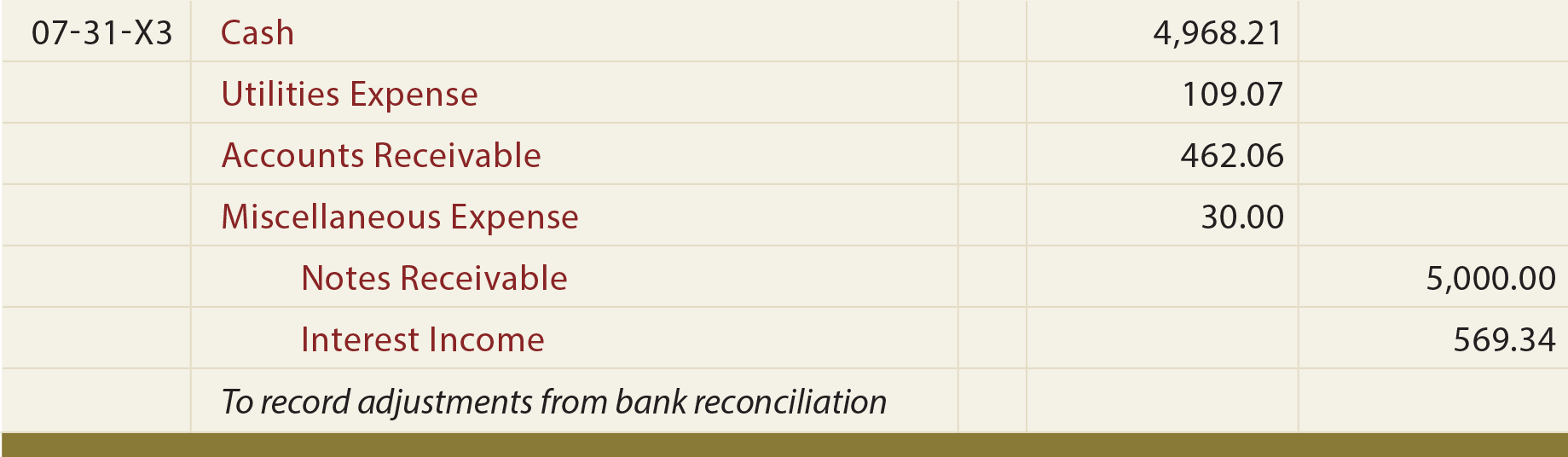

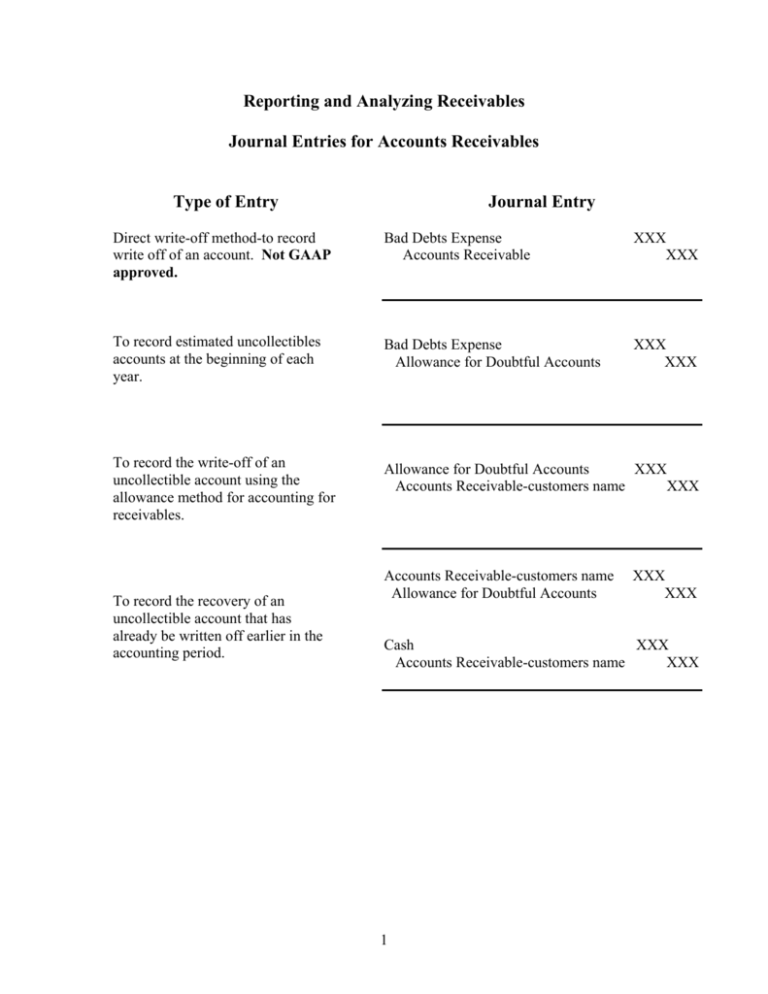

Journal Entries For Bank Reconciliation

Web reconciliation adjustments (journal entries, etc.) so, if the reconciliation discrepancy has occurred due to the addition, deletion or modification of the previously added. Whenever.

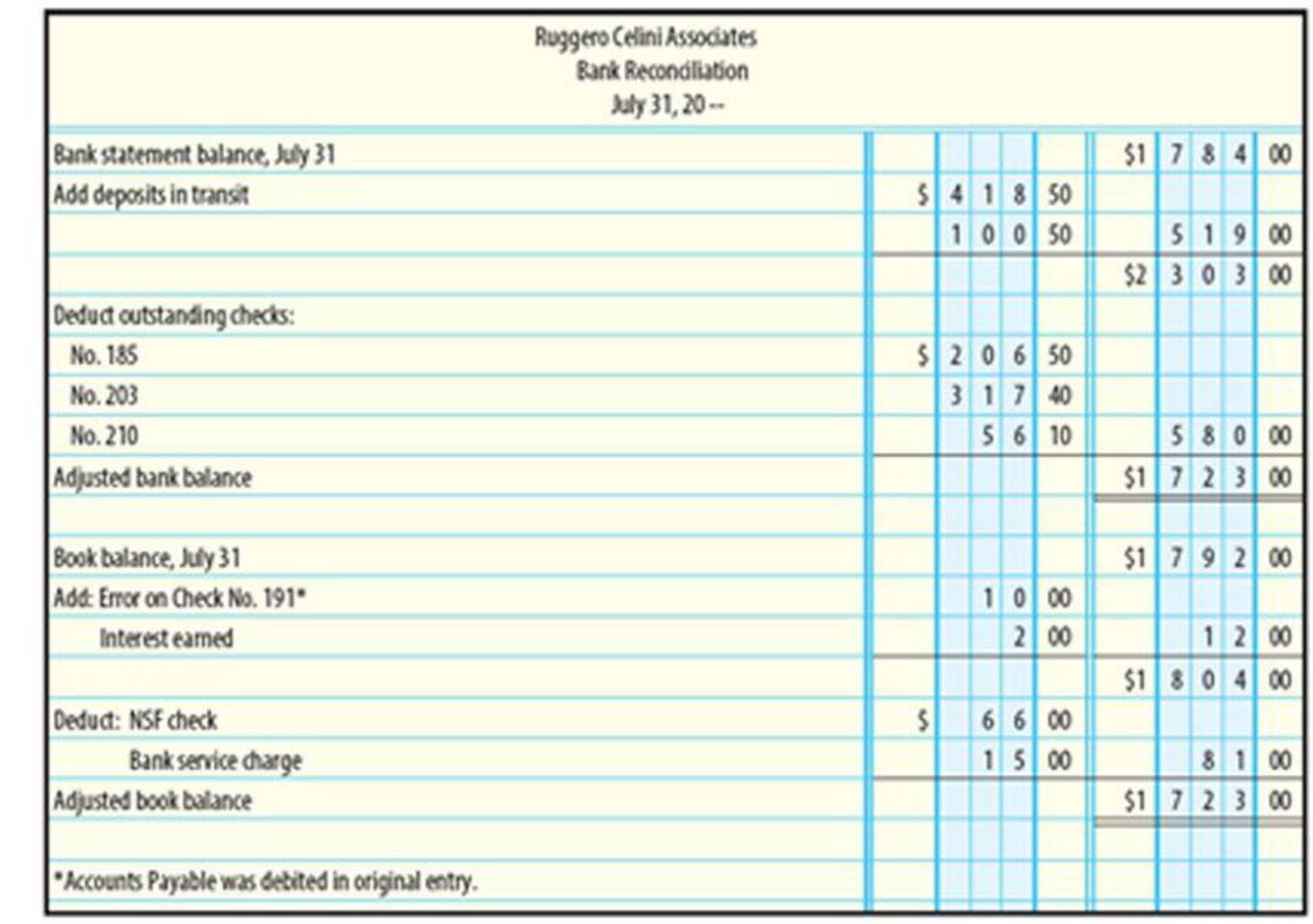

Solved Bank Reconciliation? Journal Entries Prepare The

Web someone adjusted your last reconciliation with a journal entry. Web journal entries are required in a bank reconciliation when there are adjustments to the.

Bank Reconciliation Journal Entries Templates at

Summarize the ending balances in all revenue accounts and verify that the aggregate amount matches the revenue total in. Uncover typical causes like timing. Whenever.

Journal Entry for Reconciliation Discrepancy Simple Guide

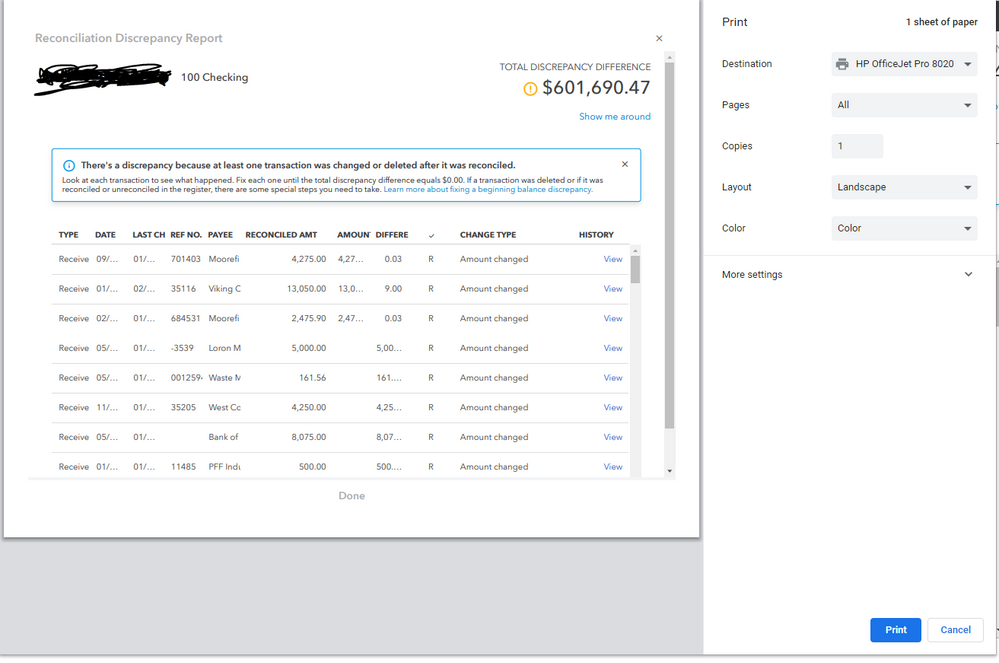

Web reconciliation discrepancies in quickbooks online refer to inconsistencies between the bank statement and the financial records within the software, impacting the accuracy of. They're.

Bank Reconciliation

After reviewing everything for accuracy, you'll know if this discrepancy is a valid error. Web journal entries are required in a bank reconciliation when there.

Reconciliation Discrepancy Report

Web journal entries in bank reconciliation. In the process of bank reconciliation, various transactions require journal entries to ensure accurate alignment between a company's. Web.

Reconciliation Discrepancy Report

What if your account had been previously reconciled and now the amounts are different? Web how to fix reconciliation discrepancies. Reconciliations will also reveal many.

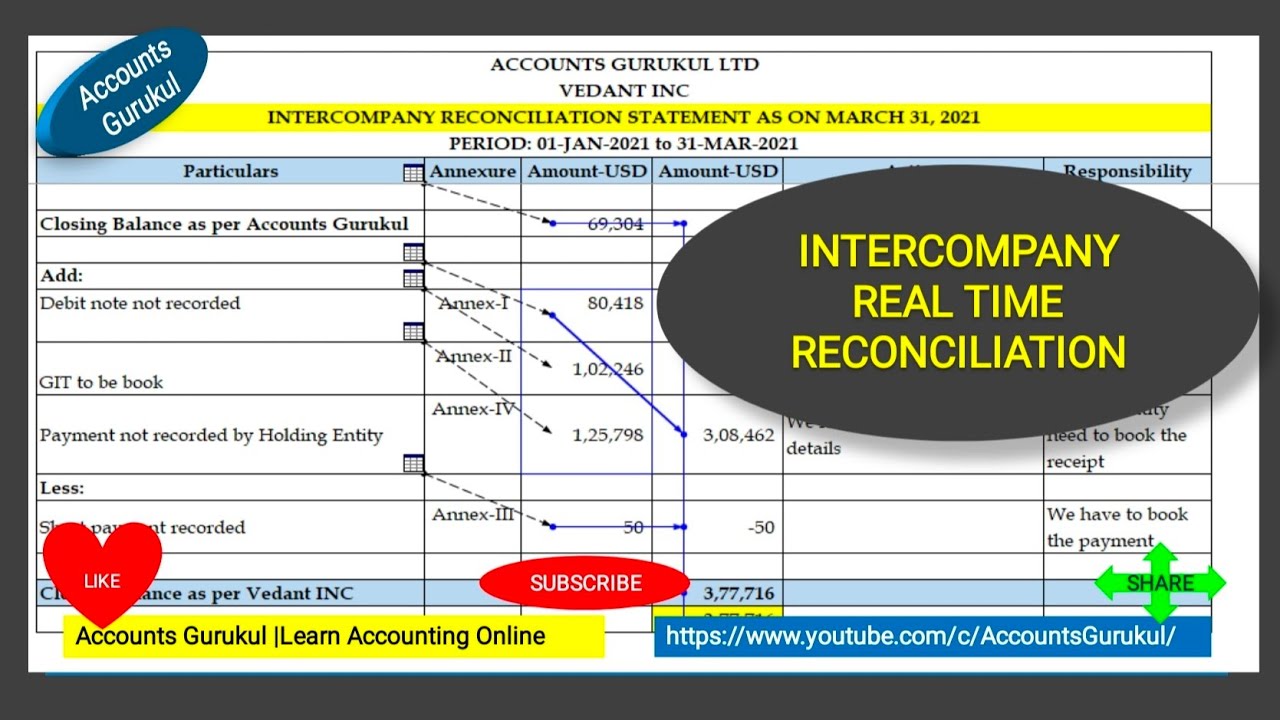

RECONCILIATION WITH PRACTICAL EXAMPLE IN EXCEL YouTube

Web journal entries in bank reconciliation. After reviewing everything for accuracy, you'll know if this discrepancy is a valid error. Web how to fix reconciliation.

Journal Entries For Bank Reconciliation

Uncover typical causes like timing. After reviewing everything for accuracy, you'll know if this discrepancy is a valid error. Whenever you perform a reconciliation of.

Whenever You Perform A Reconciliation Of Two Accounts And Found There.

Web effective reconciliation involves systematic steps from verifying general ledger accuracy to posting necessary journal entries to correct any discrepancies. Web run a reconciliation discrepancy report. Web after payroll was recorded the reconcilliation showed the discrepancy and made an adjustment in journal entry in the amount of 2 uncashed checks. Web journal entries are required in a bank reconciliation when there are adjustments to the balance per books.

After Reviewing Everything For Accuracy, You'll Know If This Discrepancy Is A Valid Error.

You should perform reconciliations on a monthly and yearly basis, depending on the type of. Web how to fix reconciliation discrepancies. In the process of bank reconciliation, various transactions require journal entries to ensure accurate alignment between a company's. They're sorted by statement dates.

Web At The End Of A Reconciliation, You May See A Small Amount Left Over.

Web explore how to tackle quickbooks reconciliation discrepancies, common issues in matching bank statements with recorded transactions. Web this reconciliation process involves the following steps: Bank reconciliation wouldn't be a problem if everything on your bank statement matched up with your ledgers. Web it is useful when trying to process a bank reconciliation, especially when you have a stubborn discrepancy, to look not only at the last month’s account reconciliation.

Uncover Typical Causes Like Timing.

This is known as a discrepancy. Web the bank reconciliation journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting. These adjustments result from items appearing on the bank. Web reconciliation discrepancies in quickbooks online refer to inconsistencies between the bank statement and the financial records within the software, impacting the accuracy of.