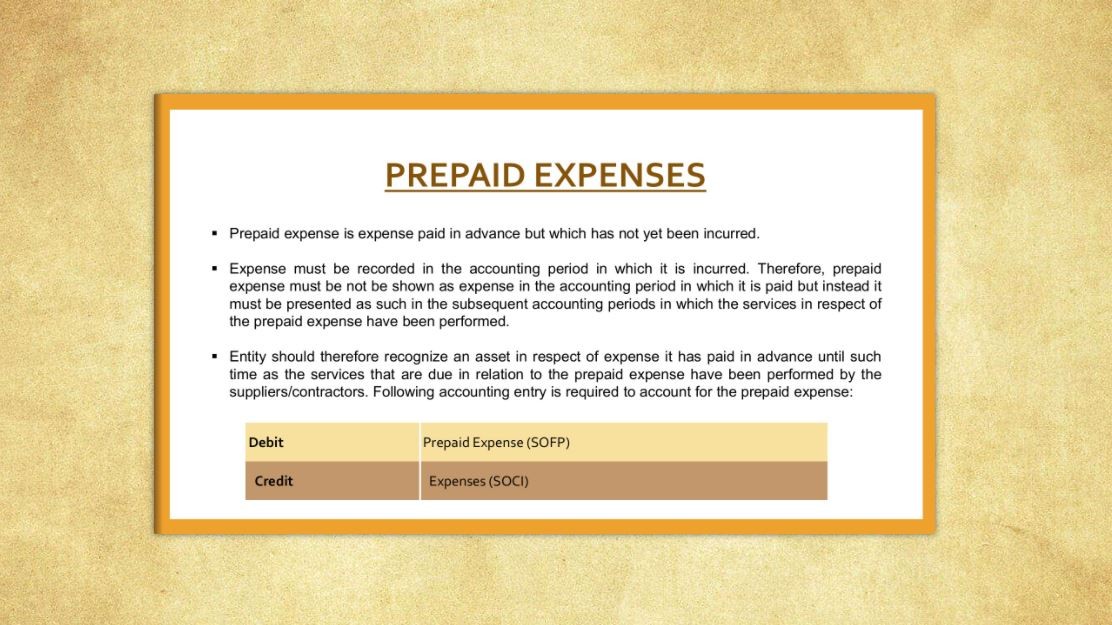

Journal Entry For Prepaid Expenses - This entry plays a crucial role in maintaining accurate financial reporting for your business. See examples of prepaid rent, insurance, and taxes with journal entries and explanations. Web the journal entry is increasing prepaid insurance on the balance sheet. Web learn how to record prepaid expenses as an asset and an expense on the balance sheet and the income statement. Web journal entries that recognize expenses related to previously recorded prepaid expenses are called adjusting entries. Web learn how to record prepaid expenses in accounting with examples and video explanation. This process allows for accurately matching expenses with the periods in which the benefits are received. Web the adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded. Web when a payment is made for a future expense, the following journal entry is made: Interest paid in advance $500.

What is Prepaid expense Example Journal Entry Tutor's Tips

Find out how prepaid expenses affect liquidity ratios and income statement recognition. This entry plays a crucial role in maintaining accurate financial reporting for your.

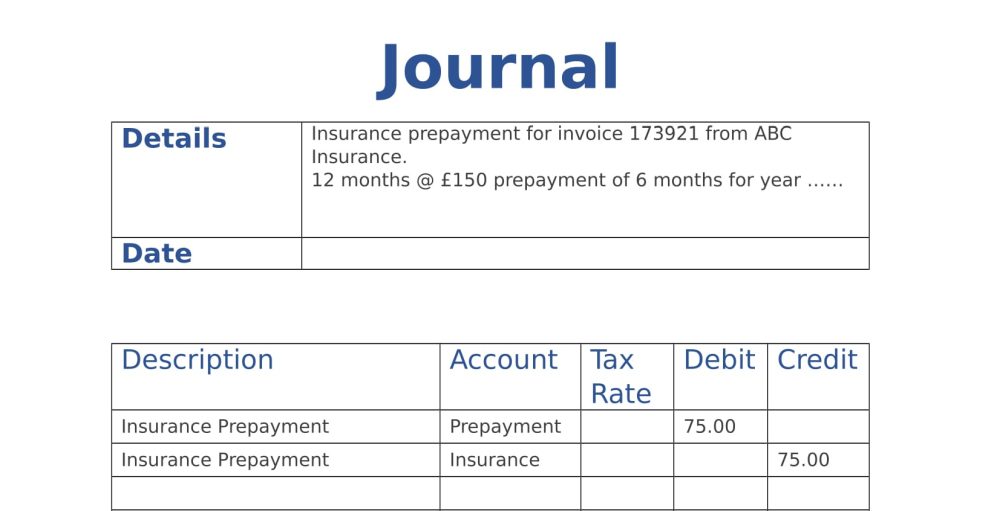

Journal Entry for Prepaid Insurance Online Accounting

A prepaid expenses journal entry is a vital accounting record that acknowledges an expense paid in advance. Interest paid in advance $500. Web learn how.

The Adjusting Process And Related Entries laacib

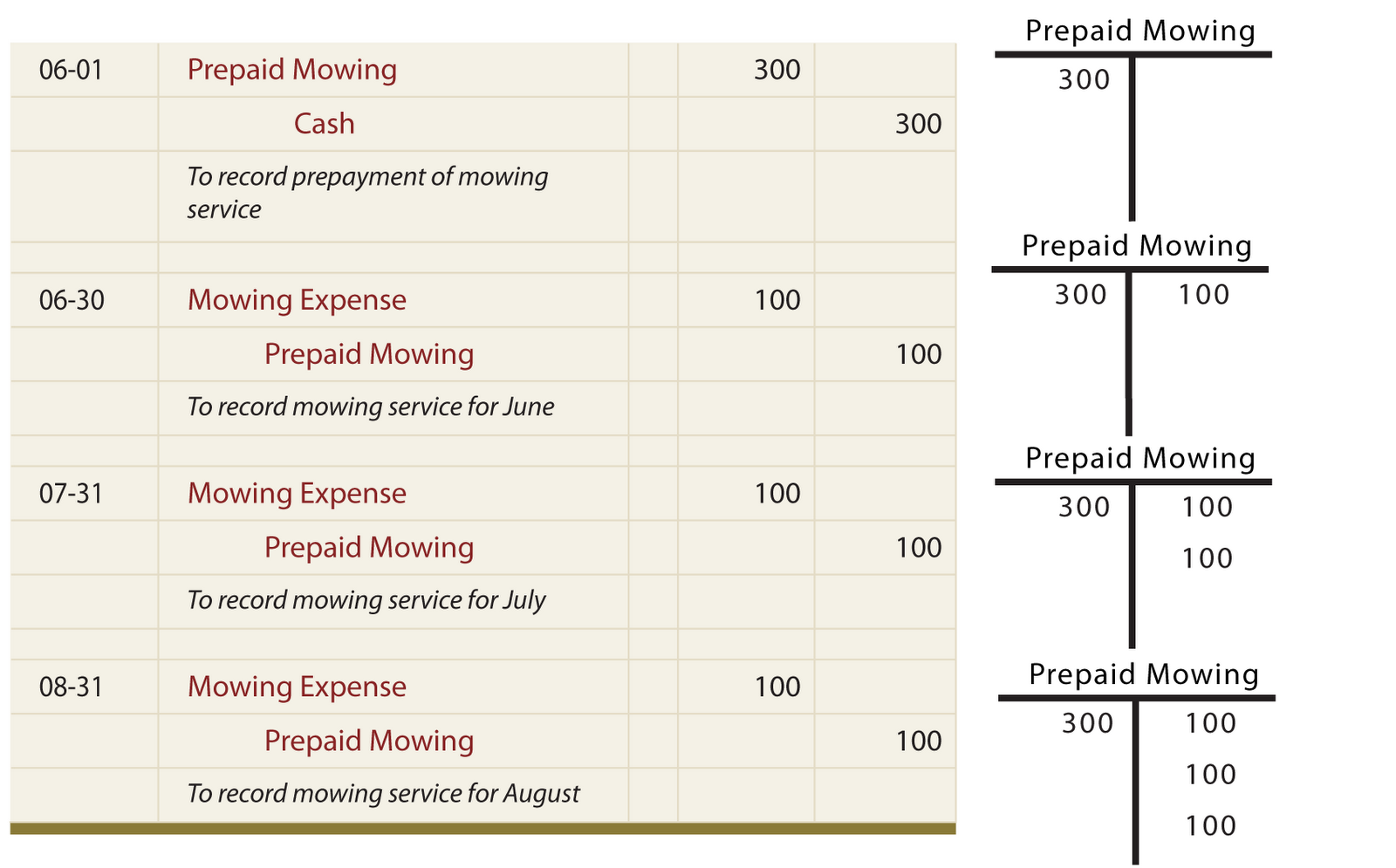

As the related expense is incurred, prepaid expense is written off proportionately as follows: Interest paid in advance $500. Web learn how to record prepaid.

Prepaid Expenses Journal Entry Meaning, Examples

This process allows for accurately matching expenses with the periods in which the benefits are received. Web the journal entry is increasing prepaid insurance on.

Prepaid expense journal entry important 2022

John's case, the journal entry would show: See examples of prepaid expenses and how they affect the financial statements. The following journal entry accommodates a.

Journal Entry For Prepaid Expenses

This entry plays a crucial role in maintaining accurate financial reporting for your business. Out of the rent paid this year, $5,000 is related to.

Journal Entry For Prepaid Expenses

If you use an expense account, the p&l will show a huge loss in one month (from the damage) and then a huge profit in.

Prepaid Expenses Entry Calculation In Excel Printable Templates

Web when a payment is made for a future expense, the following journal entry is made: Business expenses can include a range of things, like.

Journal Entry for Prepaid Expenses

They do not record new business transactions but simply adjust. Also known as deferred expenses, recording these expenses is part of the accrual accounting process..

When Making A Payment, The Cash Balance Will Decrease And Increase The Prepaid Insurance.

Prepaid expense a/c (a newly opened account) cr. There are two ways of recording prepayments: Web learn how to record a prepaid expense in two parts: See an example of office supplies as a prepaid expense and how to adjust it at the end of the period.

Web A Prepaid Expense Is Any Expense You Pay That Has Not Yet Been Incurred.

The payment of cash to create the prepayment and the adjusting entry to reflect the rent expense. See examples of prepaid rent, insurance, and taxes with journal entries and explanations. Web learn how to record prepaid expenses in the journal and the final accounts with examples. Business expenses can include a range of things, like rent, payroll, and inventory.

Web Learn What Prepaid Expenses Are, How They Are Recorded As Assets And Expensed, And See Examples Of Prepaid Rent And Insurance.

As the related expense is incurred, prepaid expense is written off proportionately as follows: Web the journal entry is increasing prepaid insurance on the balance sheet. As a financial consultant or business owner, it is critical to understand prepaid expenses and how to account for them. Web journal entries that recognize expenses related to previously recorded prepaid expenses are called adjusting entries.

Web Learn How To Record Prepaid Expenses As An Asset And An Expense On The Balance Sheet And The Income Statement.

Prepaid expenses are those expenses paid in advance for a benefit yet to be received. Web learn how to record prepaid expenses in accounting, what they are, and how they affect the balance sheet and income statement. Web prepaid expense journal entry is recorded by debiting the particular expense and crediting cash. A prepaid expenses journal entry is a vital accounting record that acknowledges an expense paid in advance.