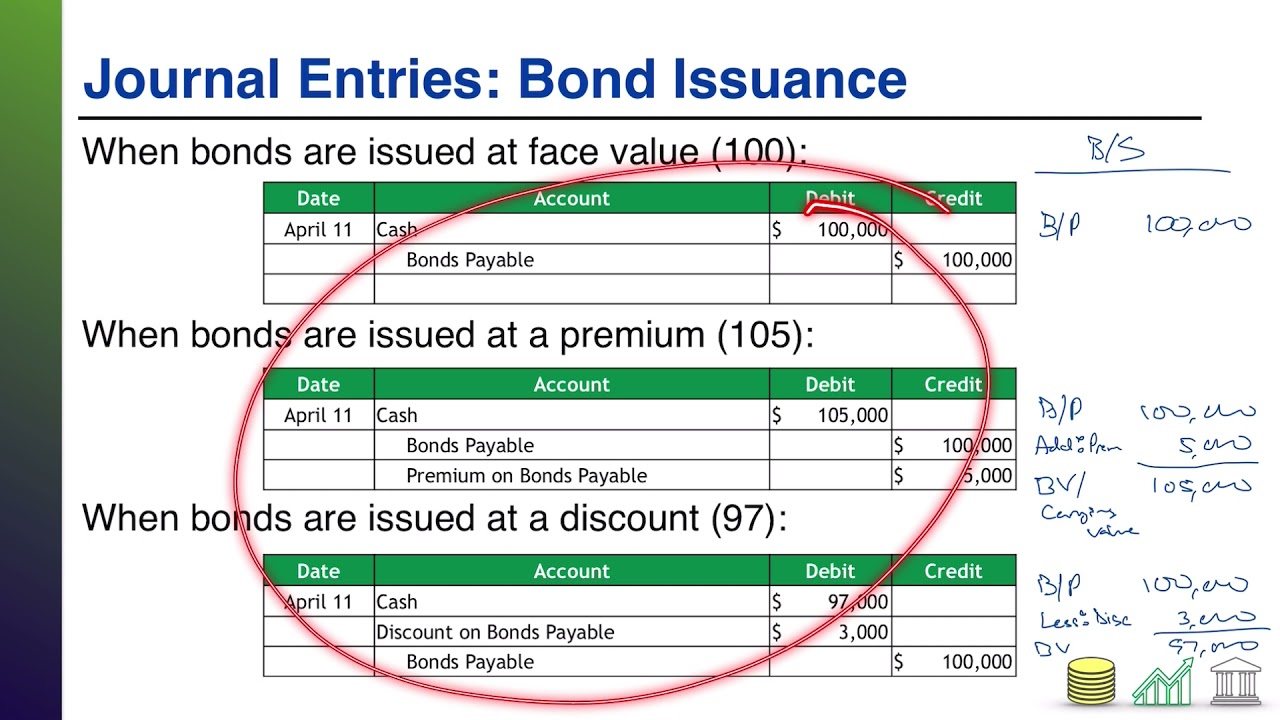

Journal Entry For Premium Bonds - Web the journal entry to record the sale of 100 of these bonds is: In this journal entry, we credit the bond premium account to remove it from the balance sheet as it will have not been fully. Cash ($100,000 x 12% x 6 months / 12 months) 6,000: If investors buy the bonds at a discount, the difference between the face value of the bonds and the amount of cash received is recorded in a. When a company issues bonds at a premium or discount, the amount of bond interest expense recorded each. Web in this section, we will explore the journal entries related to bonds. Web if the bond has been sold at face value, rather at a premium or discount, the entry made is very simple. Bonds issued at a premium. Web there are five possible journal entries related to investing in bonds, as follows: Investment of bonds at par;

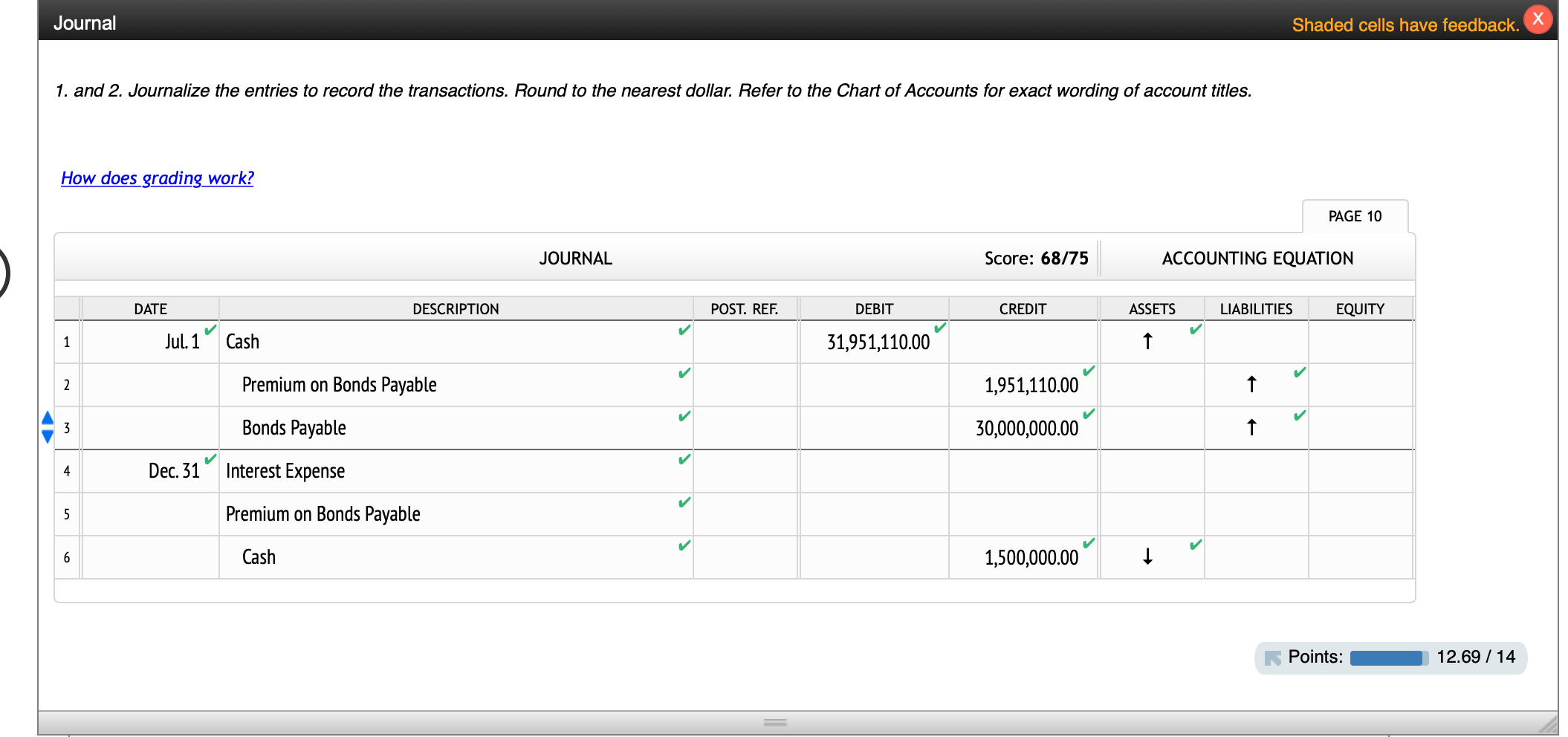

Solved Bond premium, entries for bonds payable transactions,

The product of 10,000 number of bond. Web redemption of bonds issued at a premium: When the company purchase bonds from the market, it will.

Chapter 11 Journal Entry Bond Premium YouTube

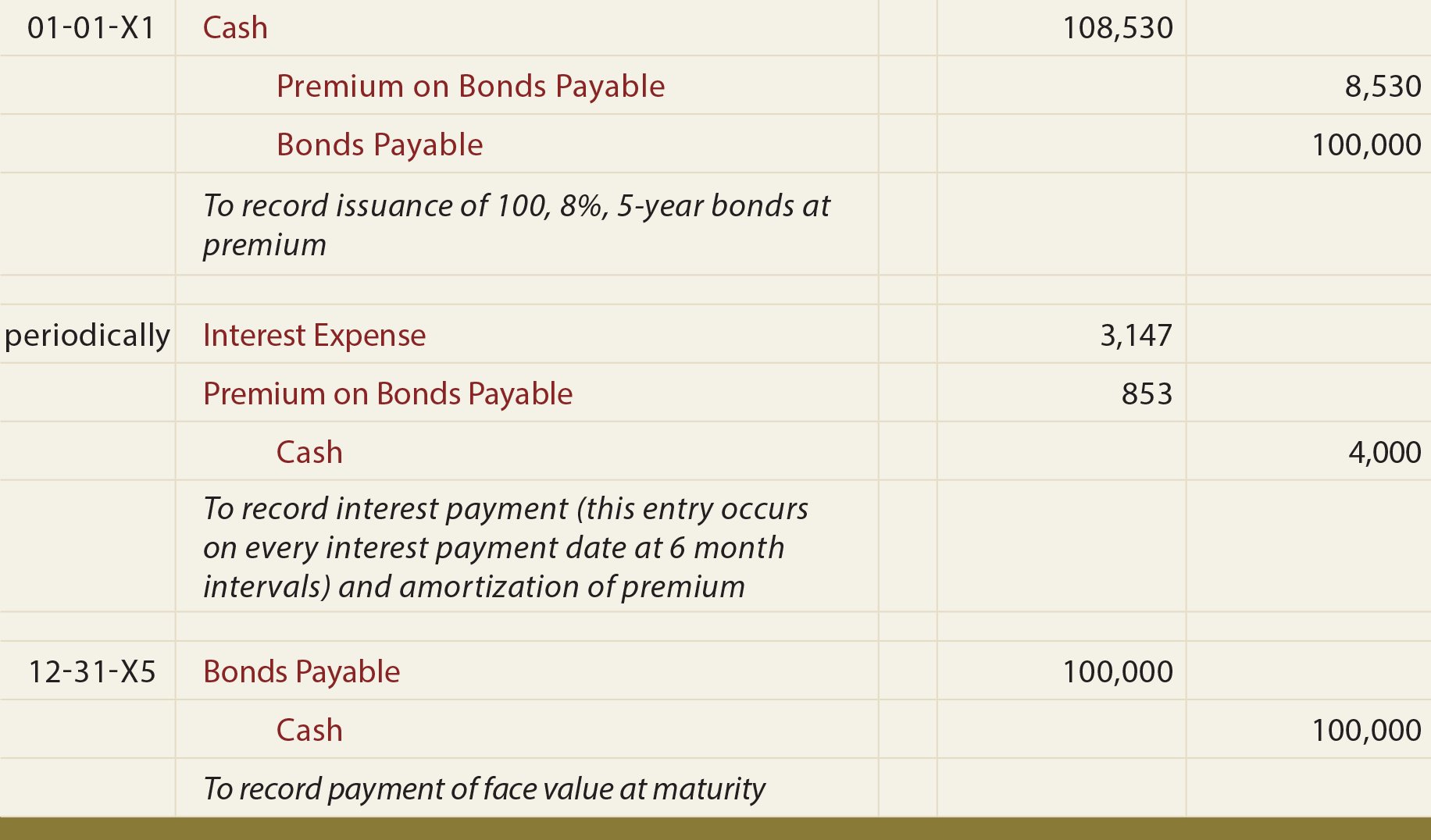

Premium on bonds payable ($5,250 premium / 6 interest payments) 875: Amortization of bond premium refers to the amortization of excess premium paid over and.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

Web redemption of bonds issued at a premium: Bonds issued at a premium. Web investment in bonds at a premium; Web the journal entry to.

Bond Premium with StraightLine Amortization AccountingCoach

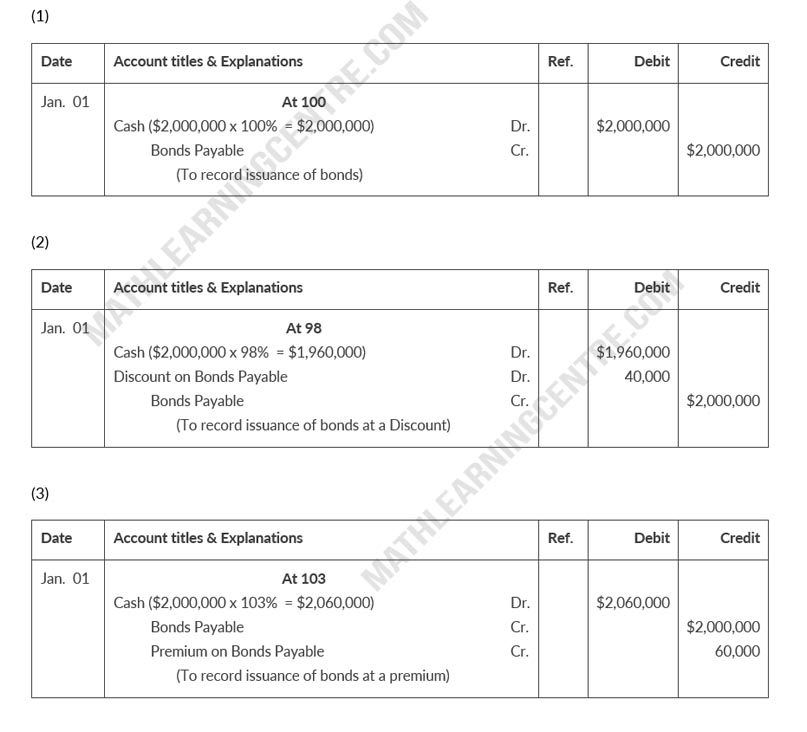

Web there are four journal entries that relate to bonds that are issued at a premium. Bonds issued at a premium. Since the book value.

Bonds Payable at a Premium

Since the book value is equal to the amount that will be owed in the future, no other account is included in the journal. Web.

Bonds Issued at a Premium Explanation, Examples & Journal Entries

The product of 10,000 number of bond. The receipt of cash when the bond is. Record a debit to the cash account and a credit.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

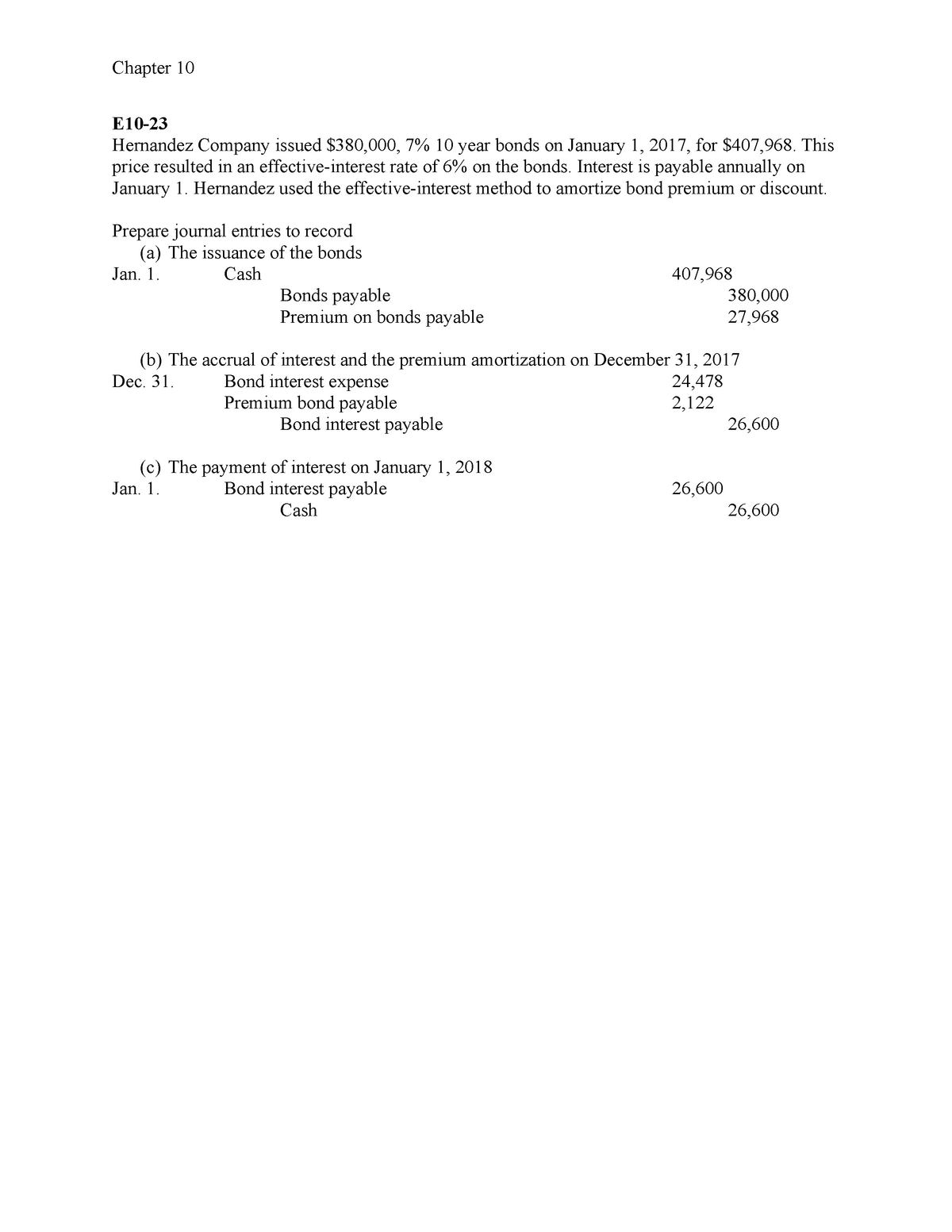

Web what is the journal entry for the amortization of bond premium for the three years using: Record a debit to the cash account and.

Accounting Q and A PR 143B Bond premium, entries for bonds payable

When a company issues bonds at a premium or discount, the amount of bond interest expense recorded each. Bonds issued at a premium. Web redemption.

Bond Premium and Interest Journal Entry YouTube

When the company purchase bonds from the market, it will record the investment in bonds on the balance sheet. Web journal entry for bond purchased.

Earlier, We Found That Cash Flows Related To A Bond Include The Following:

Premium on bonds payable ($5,250 premium / 6 interest payments) 875: Total bond liability equals $10 million i.e. Web what is the amortization of bond premium? The product of 10,000 number of bond.

Web What Is The Journal Entry For The Amortization Of Bond Premium For The Three Years Using:

Web the journal entry to record the sale of 100 of these bonds is: The account premium on bonds payable is a liability account that will always. Amortization of bond premium refers to the amortization of excess premium paid over and above the face value of. Web in this section, we will explore the journal entries related to bonds.

Web The Journal Entry To Record The Sale Of 100 Of These Bonds Is:

Web the journal entry is: In this journal entry, we credit the bond premium account to remove it from the balance sheet as it will have not been fully. When a company issues bonds at a premium or discount, the amount of bond interest expense recorded each. Web you will need to pass the following journal entry to record the issue of this bond:

Issuing Of Bonds At A Premium.

Bonds issued at a premium. When the company purchase bonds from the market, it will record the investment in bonds on the balance sheet. Investment of bonds at par; If investors buy the bonds at a discount, the difference between the face value of the bonds and the amount of cash received is recorded in a.