Journal Entry For Overapplied Overhead - The process of determining the manufacturing. Web if the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: Application of underapplied overhead to cost of goods sold if the overhead was overapplied, and the actual. The adjusting journal entry is: Web overapplied overhead occurs when the total amount of costs assigned to produced units is more than was actually incurred in the period. If the total labor paid for the job is $66, the overhead applied to the job is $2.50. Web the adjusting journal entry is: This is usually viewed as a favorable outcome, because less has been. Web the adjusting journal entry is:

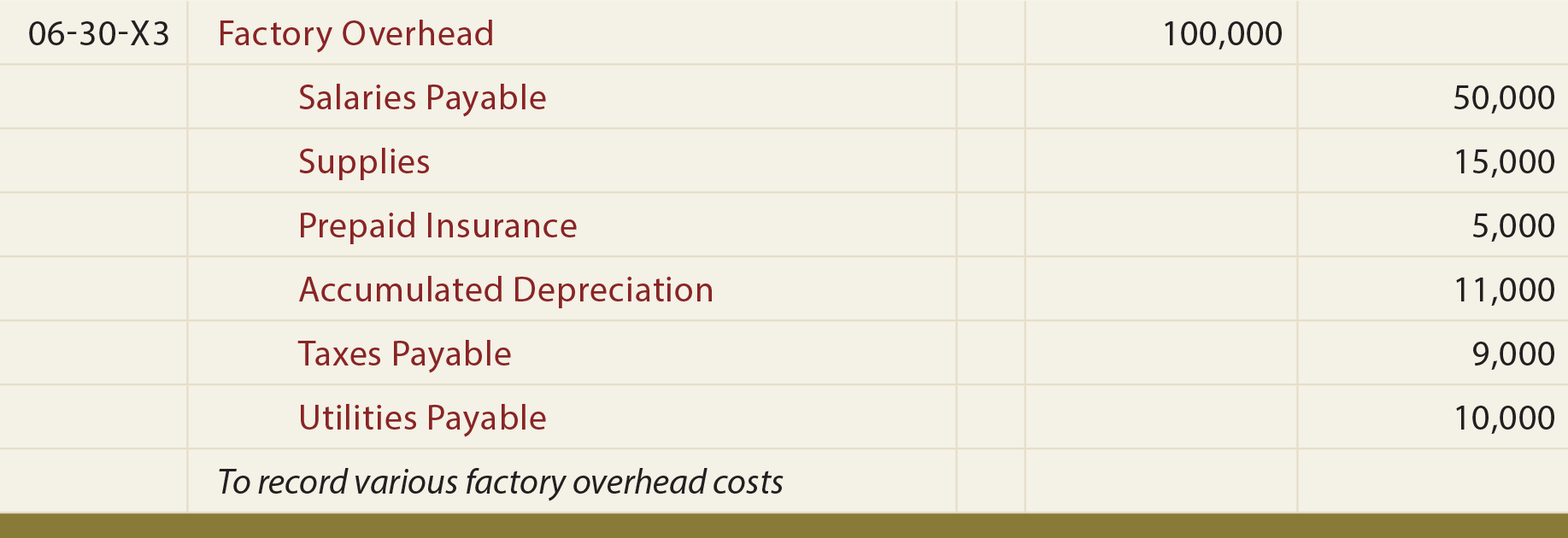

Accounting For Actual And Applied Overhead

The amount of overhead applied to job mac001 is $165. If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead.

Under & Over applied Overhead Journal Entry YouTube

Web the adjusting journal entry is: Web the adjusting journal entry is: See how to dispose of underapplied or overapplied overhead by closing. Web since.

SOLUTION Applying Overhead; Journal Entries; Disposition of

If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: Web the adjusting journal.

SOLUTION Applying Overhead; Journal Entries; Disposition of

If the total labor paid for the job is $66, the overhead applied to the job is $2.50. The adjusting journal entry is: The process.

Overhead Allocation Journal Entry YouTube

Web adjusting journal entries. In this case we would, debit the. See examples, formulas and methods for. Adjusting journal entries are necessary to correct the.

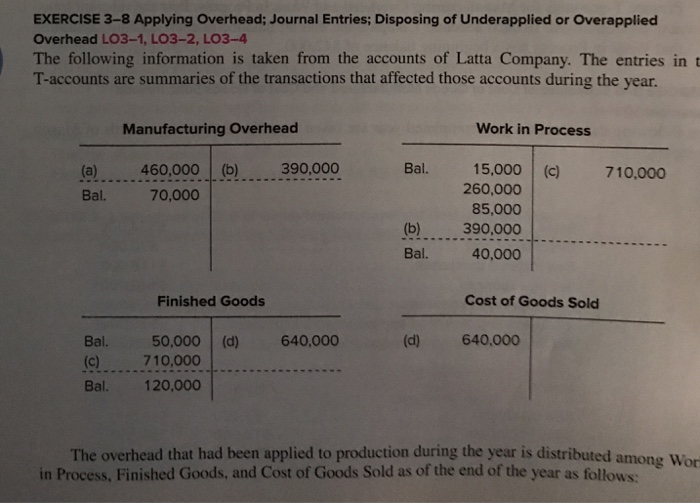

Solved EXERCISE 38 Applying overhead; Journal Entries;

If the total labor paid for the job is $66, the overhead applied to the job is $2.50. Web adjusting journal entries. Web when the.

[Solved] Hello, please help determine Journal entries, overapplied

Web when the overhead is applied to the jobs, the amount is first calculated using the application rate. If the overhead was overapplied, and the.

Solved Exercise 38 Applying Overhead; Journal Entries;

Web if the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. In this case we would, debit the. The adjusting.

Overapplied Overhead YouTube

If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: The process of determining.

Adjusting Journal Entries Are Necessary To Correct The Financial Distortions Caused By Overapplied Overhead.

Application of underapplied overhead to cost of goods sold if the overhead was overapplied, and the actual. Web the adjusting journal entry is: This is usually viewed as a favorable outcome, because less has been. Web the adjusting journal entry is:

This Figure Is Reported On A Company's.

Web learn how to reconcile the underapplied or overapplied overhead at the end of the accounting period with journal entries. When overhead is overapplied or underapplied, there are two different ways to allocated the variance. Hence, the company can make the journal entry to assign the manufacturing overhead to the work in process of job a as. Web adjusting journal entries.

The Process Of Determining The Manufacturing Overhead Calculation Rate Was Explained And.

Web if the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. If the total labor paid for the job is $66, the overhead applied to the job is $2.50. Web since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. Web a journal entry must be made at the end of the period to reconcile the difference between the estimated amount and the actual overhead costs.

Web Overhead Assigned To Job A = 1,600 X 5 = $8,000.

In this case we would, debit the. The process of determining the manufacturing. The amount of overhead applied to job mac001 is $165. The adjusting journal entry is:

![[Solved] 1a. Determine whether overhead is overapplied or](https://media.cheggcdn.com/study/261/26177f98-46eb-41dc-9baa-e061d203c9b3/image)