Journal Entry For Net Income - It other words, it shows how much revenues are left over after all expenses have been paid. Web an accounting journal entry is the written record of a business transaction in a double entry accounting system. The debit entry increases the balance sheet carrying value of the investment by the share of net income. What is the journal entry to record net income from an investment under the equity method? Retained earnings is a stockholders’ equity account, so total equity will increase $5,500. Net income can be positive or negative. Hence, the retained earnings account will increase (credit) or decrease (debit) by the amount of net income or net loss after the journal entry. Web during the financial year ended 31 december 2017, mc earned net income of $800,000 and declared dividends of $600,000. Web under the equity method the investee business has increased in value and the investor reflects its share of this increase in the investment account with the following journal entry. When your company has more revenues than expenses, you have a positive net income.

How to Adjust Journal Entry for Unpaid Salaries

Web your ask joey ™ answer. Every entry contains an equal debit and credit along with the names of the accounts, description of the transaction,.

Chapter 4 Closing Entries with a net YouTube

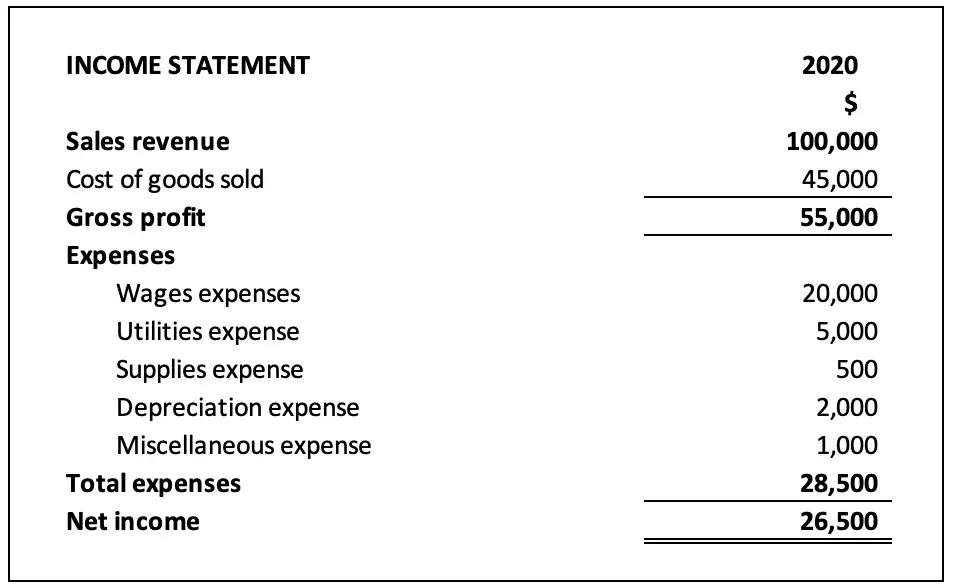

Web on december 31, 2020. Or, if you really want to simplify things, you can express the net income formula as: Under the equity method,.

Journal Entry for Tax Paid by Cheque davistakey1939 Davis

At the end of the period, the company will need to make the closing entry for net income by transferring all revenues and expenses to.

Closing entry for net Example Accountinguide

Web an adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any.

Casual Journal Entry For Tax Payable Financial Statement

Retained earnings is a stockholders’ equity account, so total equity will increase $5,500. Under the equity method, net income will increase the investment amoun, while.

Journalizing Closing Entries / Closing Entries Types Example My

When the xzy corporation reports the net income of $150,000 on december 31, 2020, the company abc can record its shares of income of $45,000.

Accounting Journal Entries For Dummies

The more revenue you have, the more net income (earnings) you will have. Accounts receivable is going up so total assets will increase by. Under.

Summary Journal Entry Example Accountinginside

Pc must recognize investment income equal to the 40% of $800,000: The company can make the income summary journal entry by debiting the income summary.

Accounting Journal Entries For Dummies

It is shown on the debit side of an income statement (profit. Net income can be positive or negative. When the xzy corporation reports the.

Pc Must Recognize Investment Income Equal To The 40% Of $800,000:

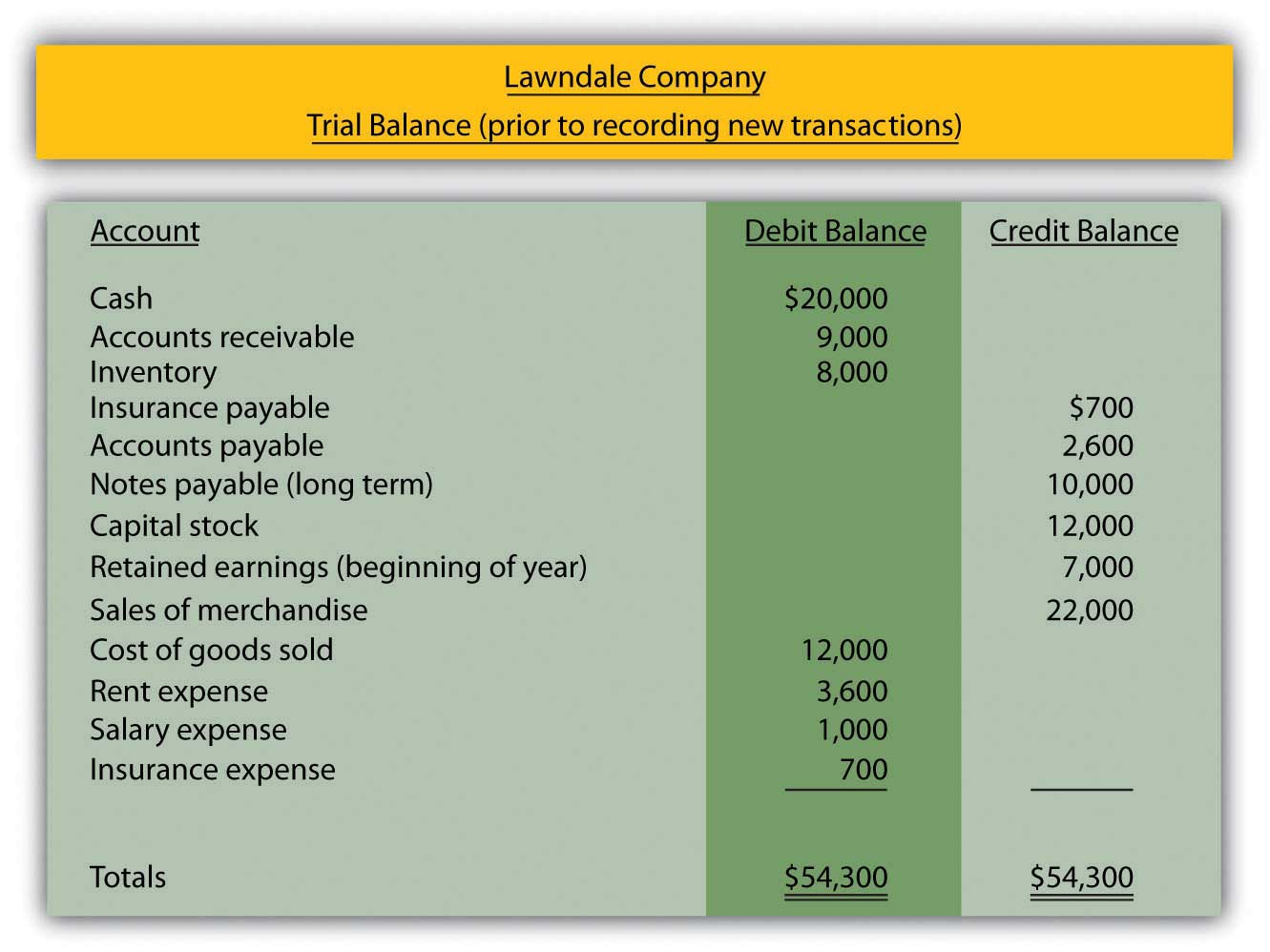

The debit entry increases the balance sheet carrying value of the investment by the share of net income. Web net income, also called net profit, is a calculation that measures the amount of total revenues that exceed total expenses. What is the amount of net income in the following case? Or, if you really want to simplify things, you can express the net income formula as:

The Company Can Make The Income Summary Journal Entry By Debiting The Income Summary Account And Crediting The Retained Earnings If The Company Makes A Net Income.

When the xzy corporation reports the net income of $150,000 on december 31, 2020, the company abc can record its shares of income of $45,000 ($150,000 x 30%) as income from investments and as an increase in the investment in associates in the journal entry below: The more revenue you have, the more net income (earnings) you will have. Web under the equity method the investee business has increased in value and the investor reflects its share of this increase in the investment account with the following journal entry. Web so, the amount of income summary in the journal entry above is the net income or the net loss of the company for the period.

Web Adjusting Journal Entries For Net Realizable Value | Financial Accounting.

Create journal entries to adjust inventory to nrv. The more earnings you have, the more retained earnings you will keep. Web an adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. Web your ask joey ™ answer.

Web The Journal Entries Would Be:

What is the journal entry to record net income from an investment under the equity method? Income from investment in associates. Every entry contains an equal debit and credit along with the names of the accounts, description of the transaction, and date of the business event. Presentation in the financial statements.