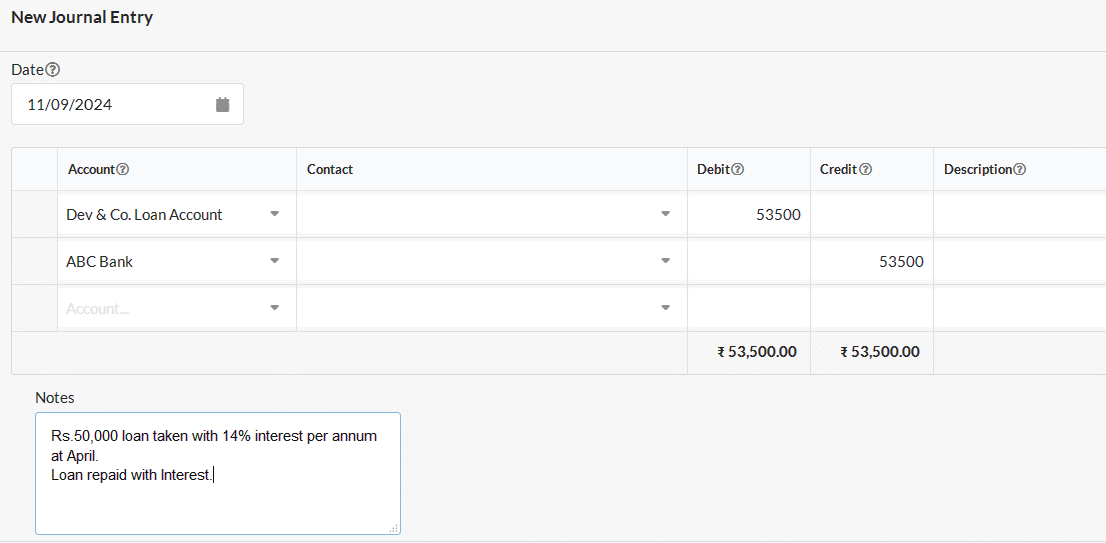

Journal Entry For Loan Repayment - *assuming that the money was due to be paid to abc bank ltd. Web the company’s accountant records the following journal entry to record the transaction: Debit of $3,000 to loans payable (a liability account) debit of $1,000 to interest expense (an expense account) credit of $4,000 to cash (an asset account) controls over loan payment accounting Web a loan received becomes due to be paid as per the repayment schedule, it may be paid in instalments or all at once. Assumed that total repayment including the interest is $ 167,500 where the principal is $ 125,000 and the interest is $. Web journal entry for making loan loan is a sum of money that is borrowed and then repaid over time, typically with interest. Web what is the journal entry for the loan given to employee? On jan 31, 2021, when the company makes the jan 31 adjusting entry. It also depends on the type of loan you’ve taken out: Journal entry for a government support loan forgiven.

What Is The Journal Entry For A Loan Payment

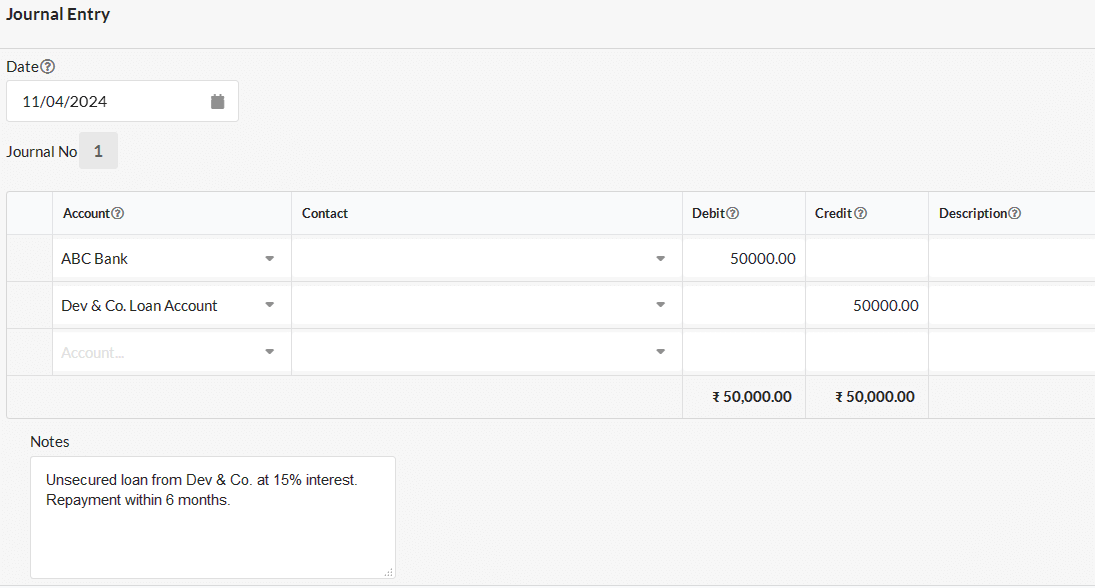

The creditor lends money to the borrower and expects to collect back the money plus interest. Web using journals to make div 7a loan repayments.

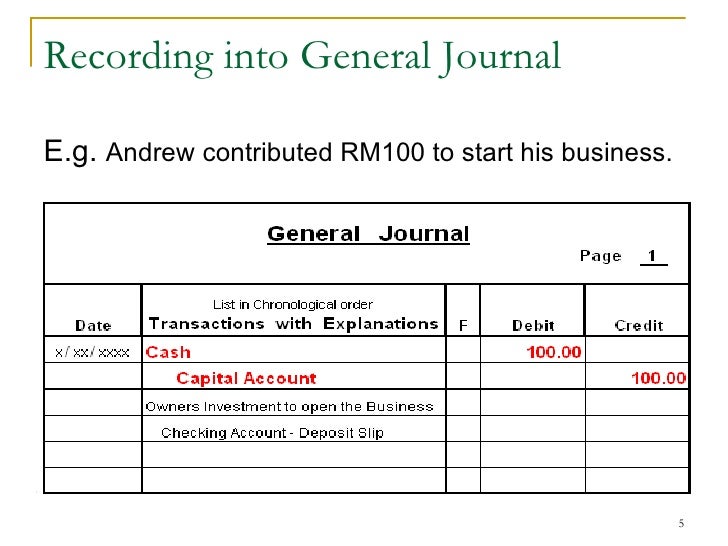

Journal entry for Loan Payable Output Books

Term loan was taken from pnb bank 100000. Select the appropriate bank account from the box and type the amount in the debit field. Below.

Bank Loan Repaid Journal Entry Info Loans

Web alternatively, graduates who can amass $500,000 before taxes over 10 years typically come out ahead and can repay their student loans. There has been.

Journal entry for Loan Payable Output Books

Assumed that total repayment including the interest is $ 167,500 where the principal is $ 125,000 and the interest is $. This journal entry of.

Receive a Loan Journal Entry Double Entry Bookkeeping

Web accounting for a waiver of loan repayments. Web journal entry when the repayment is made. Web the company’s accountant records the following journal entry.

What Is The Journal Entry For Receiving A Loan

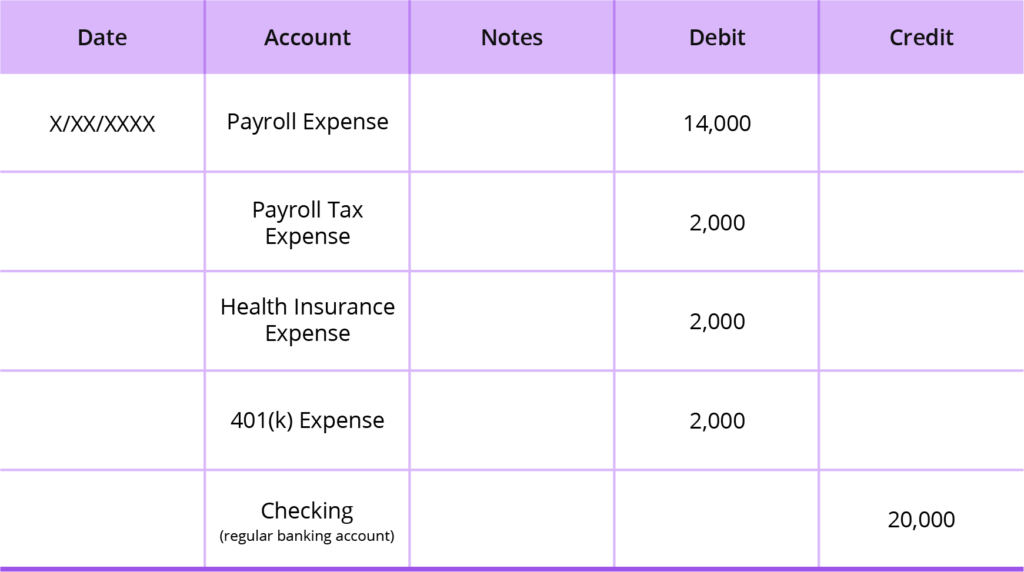

Debit of $3,000 to loans payable (a liability account) debit of $1,000 to interest expense (an expense account) credit of $4,000 to cash (an asset.

Shareholder Loan Repayment Journal Entry Info Loans

The compound journal entry for loan repayment including both principal and interest are as follows: Assumed that total repayment including the interest is $ 167,500.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Web what is the journal entry for the loan given to employee? The creditor lends money to the borrower and expects to collect back the.

Loan Journal Entry Examples for 15 Different Loan Transactions

On feb 1, 2021, when the. When conditions for loan forgiveness have been met, a journal entry must be made to recognize the amount forgiven.

Whilst The Relief Can Take Many Different Forms, Here We Illustrate How A Borrower Accounts For A Waiver Of Loan.

Under other, select journal entry. When conditions for loan forgiveness have been met, a journal entry must be made to recognize the amount forgiven as income to the business. Web go to the +new and select journal entry. The journal entry to recognize the repayment of the loan funds and interest is as such:

The Creditor Lends Money To The Borrower And Expects To Collect Back The Money Plus Interest.

Web using journals to make div 7a loan repayments | accountants daily. Web the loan carries an interest rate of 5% per year and must be repaid in full, including all accrued interest, on january 1, 2023. Web a loan received becomes due to be paid as per the repayment schedule, it may be paid in instalments or all at once. Practitioners are urged to be careful when it comes to complying with rules governing the payment of a dividend by journal entry to make a minimum yearly repayment on a complying division 7a loan.

Below Is A Compound Journal Entry For Loan Payment Made Including Both Principal And Interest Component;

On feb 1, 2021, when the. Web journal entry when the repayment is made. Web accounting for a waiver of loan repayments. Term loan was taken from pnb bank 100000.

Web Go To The +New And Select Journal Entry.

Web the journal entry to recognize the receipt of the loan funds is as such: This journal entry of the accrued interest on loan payable is necessary to avoid the understatement of the liabilities as well as the understatement of the expenses when we prepare the financial statements at the end of the accounting period. Web what is the journal entry for the loan given to employee? To create the journal entry: