Journal Entry For Inventory Write Down - Market or economic conditions can cause a drop in value. This entry means we are increasing our cost of goods sold by $100 and reducing our stock on hand by $100. Web the write down of inventory involves charging a portion of the inventory asset to expense in the current period. This method ensures that the inventory value on the balance sheet is accurate and that the cost of goods sold on the income statement accurately reflects the current market value. This process is essential for maintaining accounting accuracy and ensuring that a company’s financial statements reflect the actual worth of its inventory. This is required when the inventory’s market value drops below its book value on the balance sheet. Imagine an online store called case haven. Cr stock on hand $100. This should be done at once, so that the financial statements immediately reflect the reduced value of the inventory. Dr cost of goods sold $100.

Accounting Archive October 31, 2016

Imagine an online store called case haven. The write down will reduce the balance sheet value of inventory and create an expense on the income.

Inventory Write Down Double Entry Bookkeeping

Web the journal entry is: So, the cases they have aren't as valuable anymore. Market or economic conditions can cause a drop in value. Web.

journal entry format accounting accounting journal entry template

Web create journal entries to adjust inventory to nrv. Dr cost of goods sold $100. The company may write off some items in the inventory.

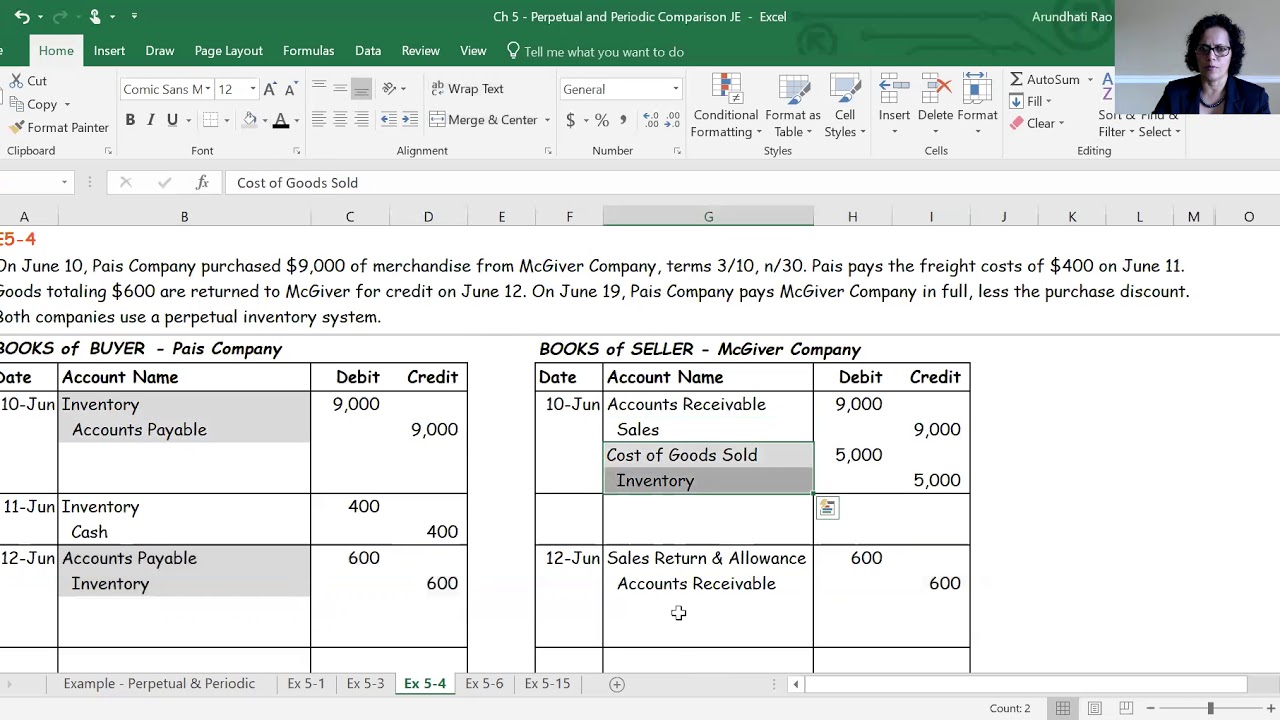

Perpetual Inventory Journal Entries Buyer & Seller YouTube

Web the journal entry for an inventory write down can be handled in two ways, which are as follows: Inventory is written down when goods.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

Let’s recap the effect of the different methods of applying cogs, gross profit, and ultimately, net income, assuming that total selling, general, and administrative expenses.

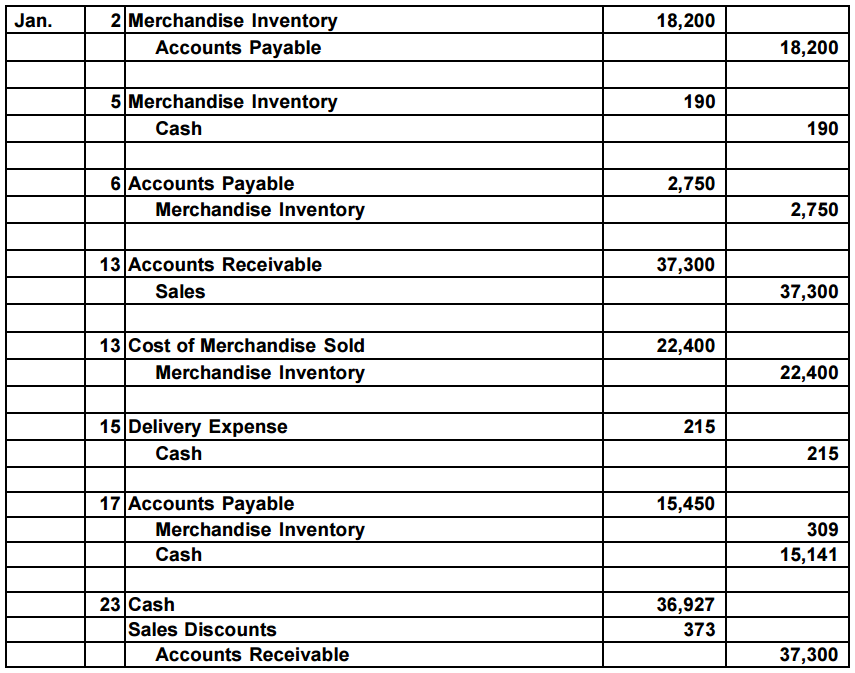

Perpetual Inventory System Journal Entry

Their current cases won't fit this new phone. Web when $100 of stock is written off, the following journal entry would be processed: This process.

Inventory WriteOff Definition as Journal Entry and Example

Web the journal entry is: Web create journal entries to adjust inventory to nrv. Inventory is written down when goods are lost or stolen, or.

Accounting Q and A Appendix Ex 639 Journal entries using perpetual

Web the journal entry is: Let’s recap the effect of the different methods of applying cogs, gross profit, and ultimately, net income, assuming that total.

Write Down of Inventory Journal Entries Double Entry Bookkeeping

There are three main implications to this journal entry: Under fifo and average cost methods, if the net realizable value is less than the inventory’s.

This Process Is Essential For Maintaining Accounting Accuracy And Ensuring That A Company’s Financial Statements Reflect The Actual Worth Of Its Inventory.

Cr stock on hand $100. This should be done at once, so that the financial statements immediately reflect the reduced value of the inventory. The company may write off some items in the inventory when it deems that they are no longer have value in the market or the business. It captures the drop of the inventory's market value below its value on the balance sheet.

So, The Cases They Have Aren't As Valuable Anymore.

Once there is a sale of goods from finished goods, charge the cost of the finished goods sold to the cost of goods sold expense account, thereby transferring the cost of the inventory from the balance sheet (where it was an asset) to the income statement (where it is an expense). Web the write down of inventory involves charging a portion of the inventory asset to expense in the current period. This is required when the inventory’s market value drops below its book value on the balance sheet. The write down will reduce the balance sheet value of inventory and create an expense on the income statement.

Under Fifo And Average Cost Methods, If The Net Realizable Value Is Less Than The Inventory’s Cost, The Balance Sheet Must Report The Lower Amount.

Imagine an online store called case haven. There are three main implications to this journal entry: If you are using a periodic inventory system in which there is not an inventory record for each individual item in stock, then credit the inventory asset account by the amount to be written down, and debit a loss on write down of inventory. This entry means we are increasing our cost of goods sold by $100 and reducing our stock on hand by $100.

Web The Journal Entry Is:

This method ensures that the inventory value on the balance sheet is accurate and that the cost of goods sold on the income statement accurately reflects the current market value. Let’s recap the effect of the different methods of applying cogs, gross profit, and ultimately, net income, assuming that total selling, general, and administrative expenses of geyer co. Their current cases won't fit this new phone. Market or economic conditions can cause a drop in value.

:max_bytes(150000):strip_icc()/Inventory-Write-Off_Final3-resized-9ab3fcc8c1234d1ea005ca1443e8ff65.jpg)