Journal Entry For Interest - Debit the receiver and credit all incomes and gains) example. Web journal entry for interest on capital includes two accounts; Web add one to start the conversation. Web on each june 30 and december 31 for 10 years, beginning 2010 june 30 (ending 2020 june 30), the entry would be ( remember, calculate interest as principal x interest x. Web the journal entry for recording interest received from the bank is provided below: Web what is the journal entry for the interest? Automate expenses with accounting software. In the future months the amounts will be different. Drawings a/c & interest on drawings a/c. Web how you create an accrued interest journal entry depends on whether you’re the borrower or lender.

Journal Entry for Interest on Drawings CArunway

The interest payable account is. To make a journal entry, you enter the details of a transaction into your. In the future months the amounts.

Journal Entries Accounting

Interest income per month = $ 100,000 * 2% = $ 2,000. Web what is the journal entry for the interest? Web the adjusting journal.

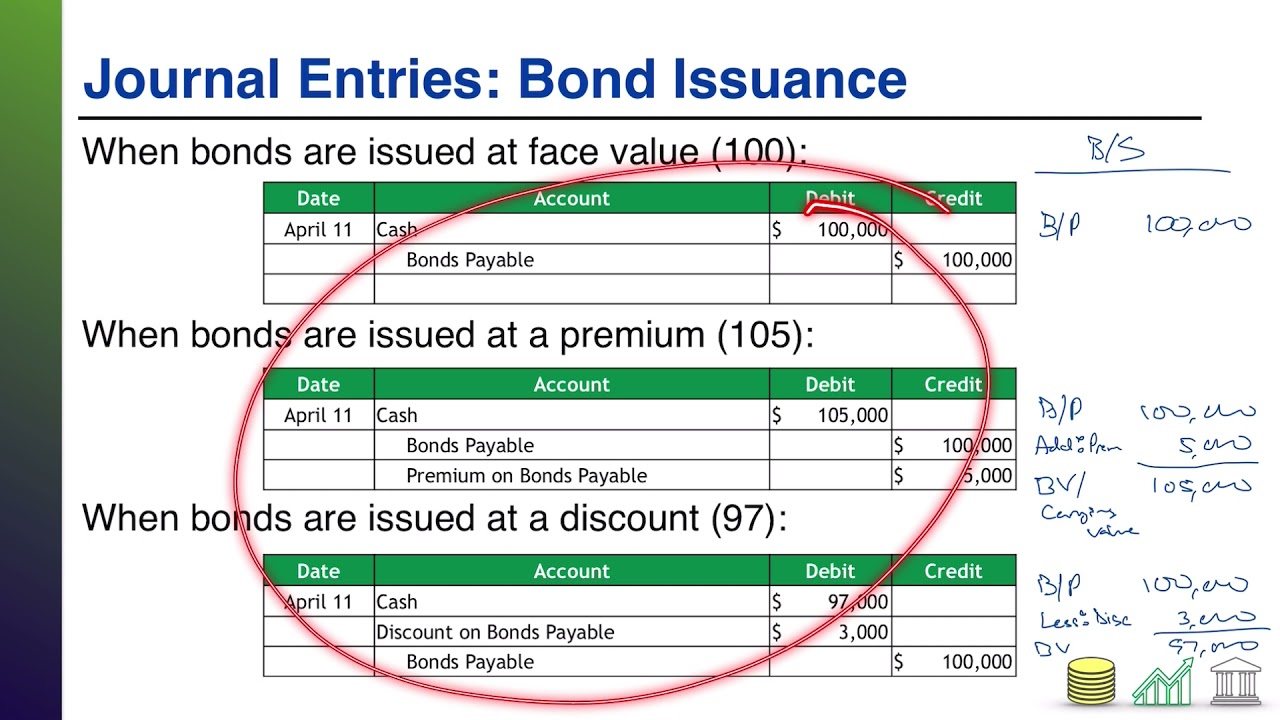

Bond Issuance Journal Entries and Financial Statement Presentation

To the maker of the note, or borrower, interest. Automate expenses with accounting software. There are any references about journal ledger template in templates.blue, you.

Journal Entry Examples

If you’re the borrower, you’ll work the following accounts:. Interest income per month = $ 100,000 * 2% = $ 2,000. Web what is a.

Best Data Science course Data analytics Dehradun Uttarakhand

Interest on drawings is an income for the business, hence, it is added to. Web the interest income is calculated as follows: Web the journal.

What is Accrued Interest? Formula + Loan Calculator

Interest on drawings is an income for the business, hence, it is added to. The company can make the interest expense journal entry by debiting.

Accounting Journal Entries For Dummies

Interest on drawings is an income for the business, hence, it is added to. Web the journal entry for this looks like the following: Web.

Journal Entry of Interest on capital and Interest on Drawing in Accounting

Interest on drawings is an income for the business, hence, it is added to. Interest is the fee charged for use of money over a.

Accounting Journal Entries For Dummies

The journal entry is debiting accrued interest receivable $ 2,000 and. Web what is the journal entry for the interest? Web the journal entry for.

Web The Adjusting Journal Entry For Interest Payable Is:

There are any references about journal ledger template in templates.blue, you can look below. Web journal entry for interest on capital includes two accounts; Capital a/c & interest on capital a/c. Web the interest income is calculated as follows:

Web Journal Entry For Interest On Drawings Includes Two Accounts;

The following interest receivable journal entry example explains the most common type of situations where the journal. Web the journal entry for interest paid on loan is as follows; Any time you borrow money, whether. The journal entry is debiting accrued interest receivable $ 2,000 and.

Interest On Drawings Is An Income For The Business, Hence, It Is Added To.

The interest payable account is. Web the balance sheet or journal entry for interest payable enables firms to check and track their financial obligations and be prepared to bear them as and when. Debit the receiver and credit all incomes and gains) example. It is unusual that the amount shown for each of these accounts is the same.

Automate Expenses With Accounting Software.

Web add one to start the conversation. Web on each june 30 and december 31 for 10 years, beginning 2010 june 30 (ending 2020 june 30), the entry would be ( remember, calculate interest as principal x interest x. Calculate and record accrued interest. Web journal entries for interest expense.