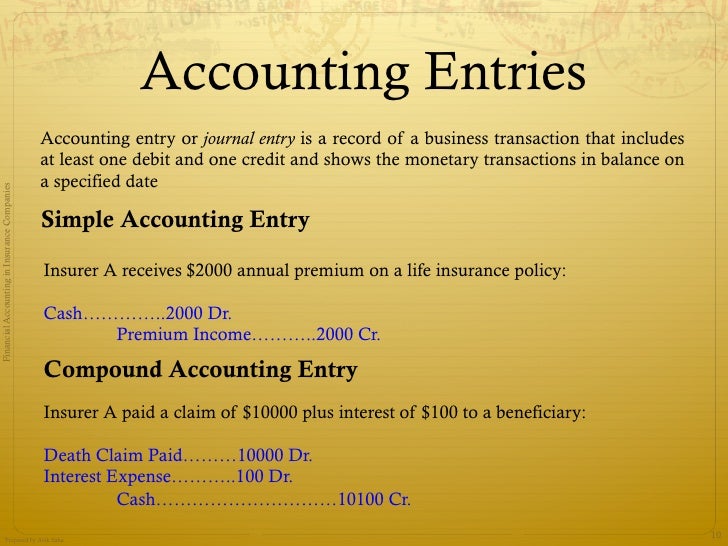

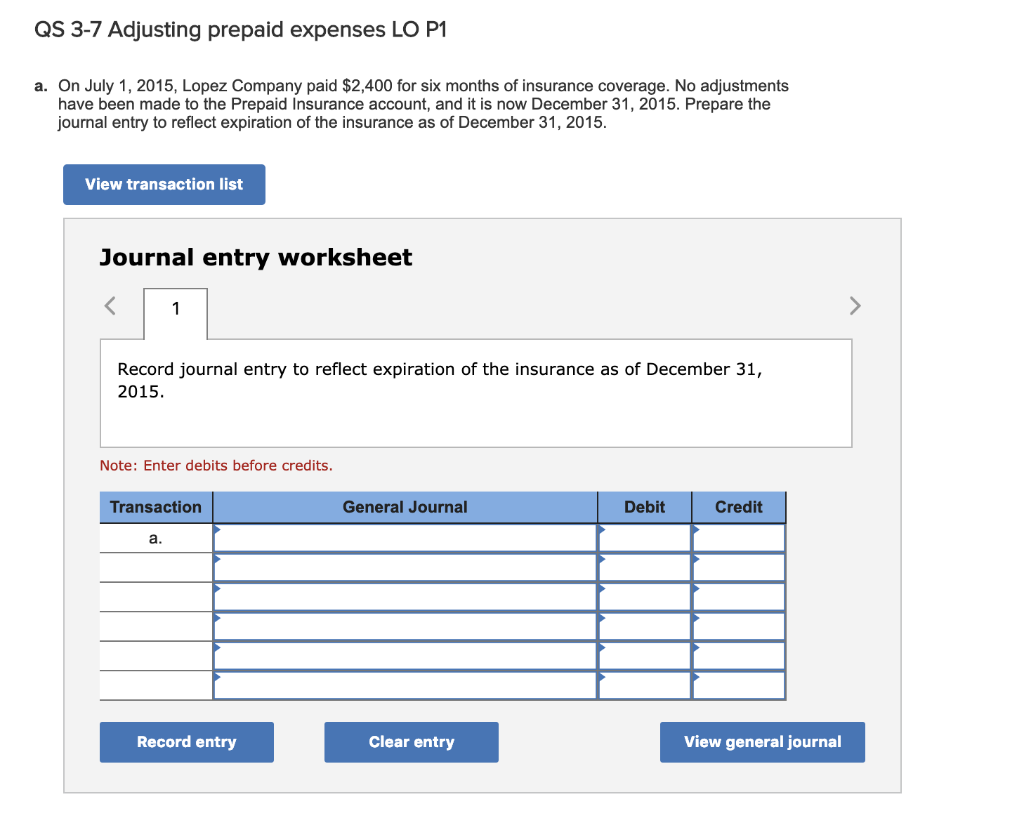

Journal Entry For Insurance Claim - Web in this journal entry, the credit of the fixed asset is to remove it from the balance sheet as it should already have been destroyed by the accident (e.g. Web a journal entry is posted for the amounts received from insurance companies by crediting the actual figures of lost assets against which we claimed insurance. Web journal entry for loss of insured goods/assets. However, recognition and measurement of. Web the journal entries below act as a quick reference for accounting for insurance proceeds. Fire) to have received the insurance claim from the insurance company. Web journal entry for an insurance claim. Web the following journal entry may therefore be recorded to account for the loss or theft of inventory, stores and spares: Web assume that a company received $105,000 from its insurance company as a settlement for the inventory lost in a fire. Web accounting considerations for insurance recoveries.

Insurance Claim Journal Entry

General business insurance (plant, premises, stock, loss of profits, etc.) sickness & accident insurance. However, recognition and measurement of. Web your accounting entry depends on.

Journal Entry for Insurance Claims YouTube

Under account type, select the appropriate account type. Web journal entry for insurance claims: General business insurance (plant, premises, stock, loss of profits, etc.) sickness.

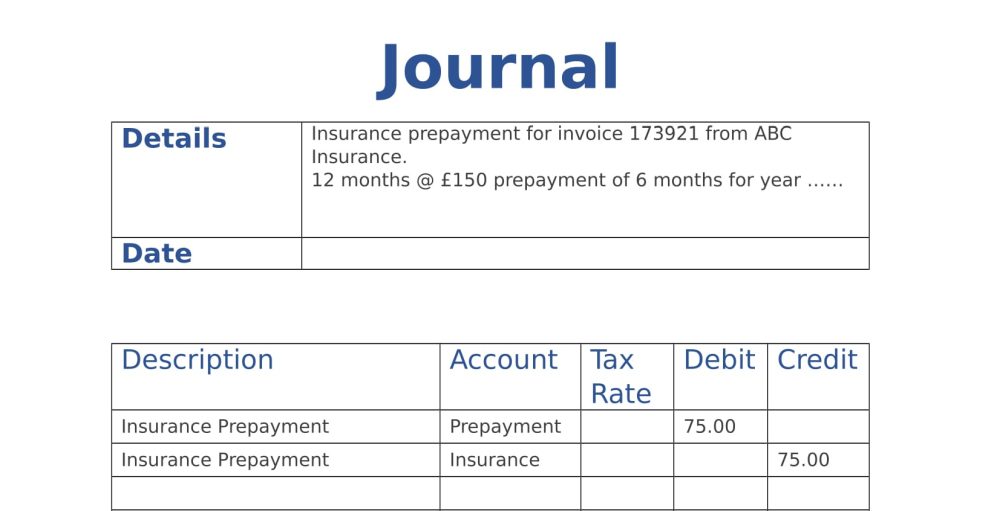

Journal Entry for Prepaid Insurance Online Accounting

Web the following entries would be recorded and following net casualty loss would be recognized: The insured amount is the net book. Web assume that.

Insurance Journal Entry for Different Types of Insurance Bookkeeping

Web record the journal entry: Web a potential insurance recovery should be evaluated and accounted for separately from the related loss and should not in.

Insurance Journal Entry for Different Types of Insurance (2022)

Write off the damaged inventory to the. Once the insurance company approves the claim and the company receives the proceeds, record the appropriate journal entry.

Insurance Claim Journal Entry

However, recognition and measurement of. Premium receivable recorded with offsetting unearned premium liability for total written premium. Web accounting for insurance proceeds. Sometimes insured goods.

Insurance Claim Received Journal Entry CArunway

Sometimes insured goods are lost by fire, theft, or any other reason. Web journal entry for loss of insured goods/assets. Under account type, select the.

How to do journal entry of loss by fire and insurance claim

The inventory lost in the fire is in the company’s general ledger. *this may instead be set off against the loss on asset theft. Web.

Journal Entry For An Insurance Claim En Intipanime

A company may make an insurance claim if an accident or fire has destroyed the company’s assets. Web journal entry for an insurance claim. Web.

Write Off The Damaged Inventory To The.

Some companies may have insurance cover for losses triggered by a. Reporting entities often purchase insurance to manage business risks. A company may make an insurance claim if an accident or fire has destroyed the company’s assets. Web a potential insurance recovery should be evaluated and accounted for separately from the related loss and should not in any way affect the recorded amount of the loss.

The Insured Amount Is The Net Book.

*this may instead be set off against the loss on asset theft. There can be three cases. Web assume that a company received $105,000 from its insurance company as a settlement for the inventory lost in a fire. When a business suffers a that is covered by an , it a in the amount of the insurance proceeds received.

Unexpected Events Can Impact The Financial Stability Of The Business.

Web a journal entry is posted for the amounts received from insurance companies by crediting the actual figures of lost assets against which we claimed insurance. Web there are many types of insurance products available, among them: We’ll look at both scenarios and walk you. The process is split into three stages as follows:

However, Recognition And Measurement Of.

Web in this journal entry, the credit of the fixed asset is to remove it from the balance sheet as it should already have been destroyed by the accident (e.g. A basic insurance journal entry is debit: Web the company will record the payment with a debit of $12,000 to prepaid insurance and a credit of $12,000 to cash. Web accounting for insurance proceeds.