Journal Entry For Indirect Labor - Rock city percussion july journal entry to record the labor cost Since indirect labor costs cannot be traced back to an individual product or service, they are classified as overhead costs on the income statement. Web what is the journal entry for indirect labor? Web the journal entries for the flow of production costs are the same with process and job costing. Prepare the journal and ledger entries to record labour costs inputs and outputs, and interpret entries in the labour account. Calculate direct and indirect costs of labour. Indirect labor records are also maintained through time tickets, although such work is not directly traceable to a specific job. The indirect materials relates to supplies and components that are not a significant cost item. This is due to the labor cost account is a temporary account that will be cleared at the end of the period. Web in these entries, we will distribute the payroll summary (factory payroll) to the jobs and overhead.

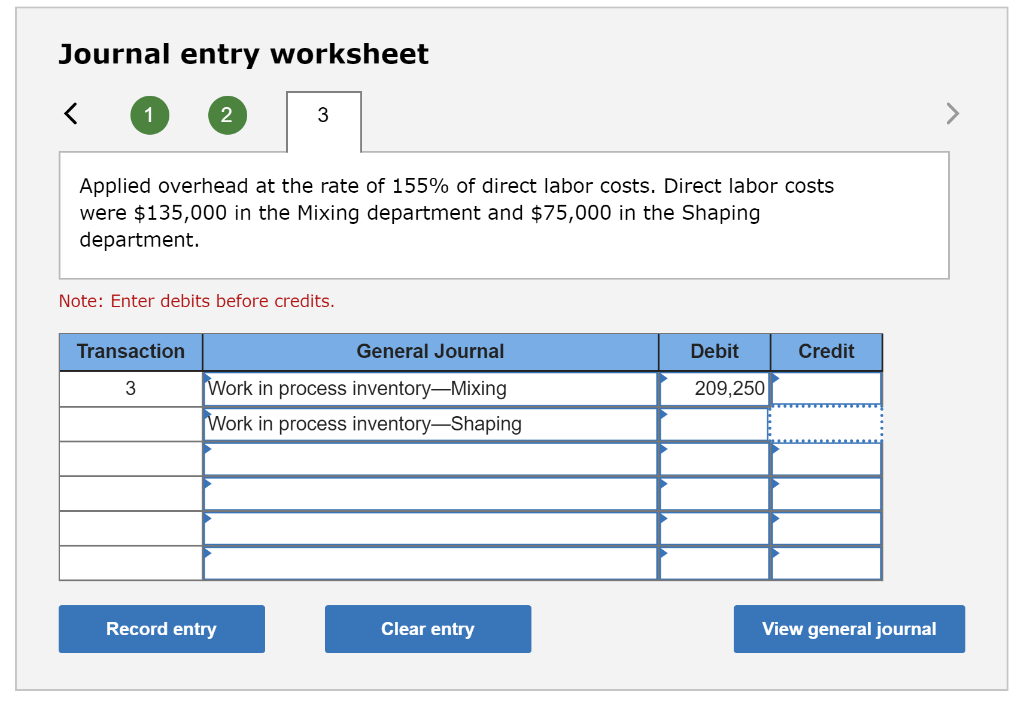

Journal Entry Worksheet Printable Calendar Blank

Prepare the journal and ledger entries to record labour costs inputs and outputs, and interpret entries in the labour account. The indirect materials relates to.

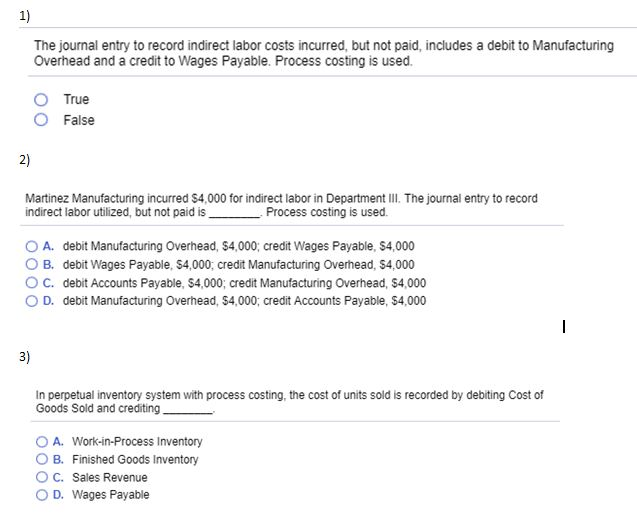

Solved 1) The journal entry to record indirect labor costs

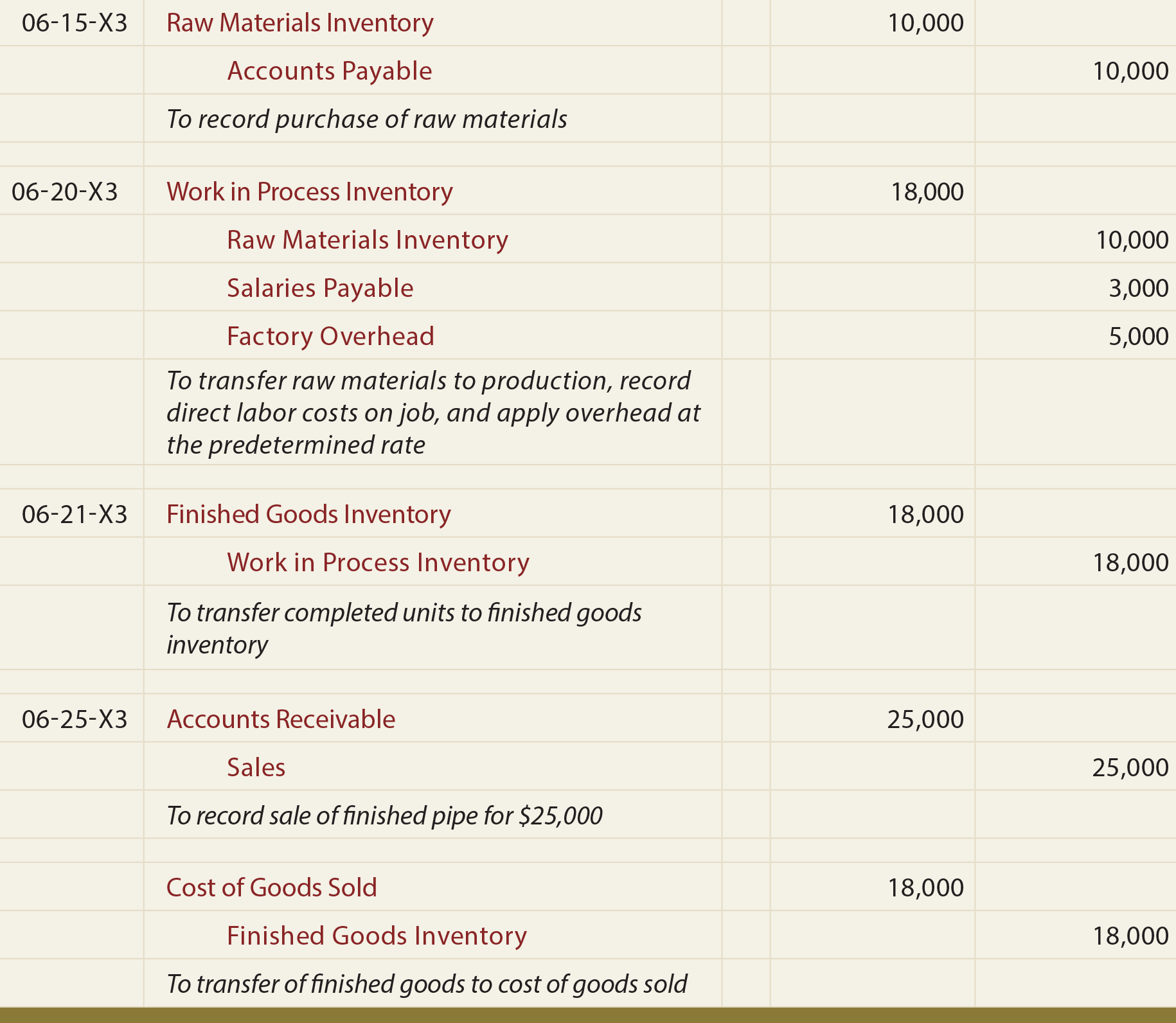

The journal entry to record the labor costs is: This is due to the indirect raw materials and indirect labor are considered the manufacturing overhead..

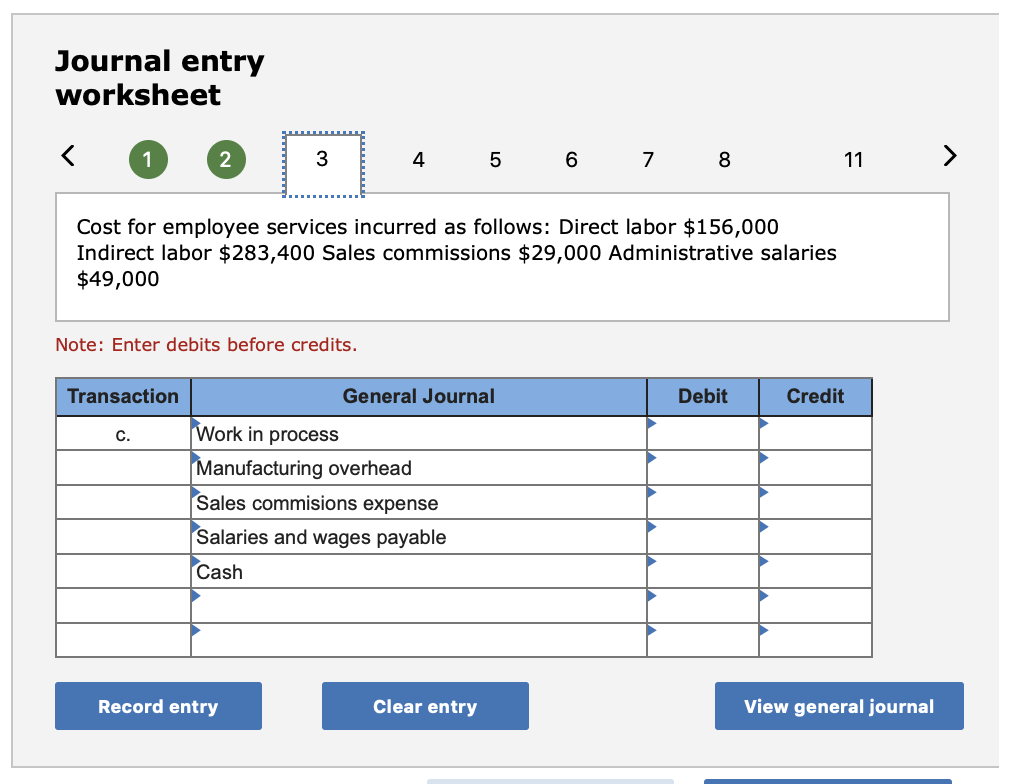

Prepare journal entries to record the following production activities

Web in this journal entry, raw materials and labor costs will only include the cost of raw materials and labor that is directly involved in.

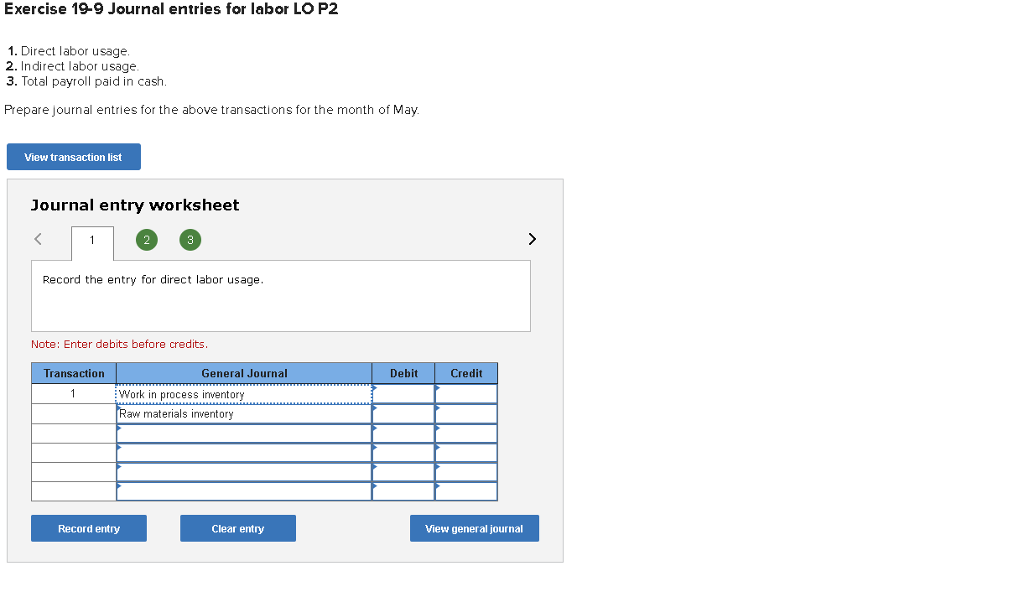

Solved Exercise 199 Journal entries for labor LO P2 1.

Explain the methods used to relate input labour costs to work done. Web in a journal entry, we will do entries for each letter labeled.

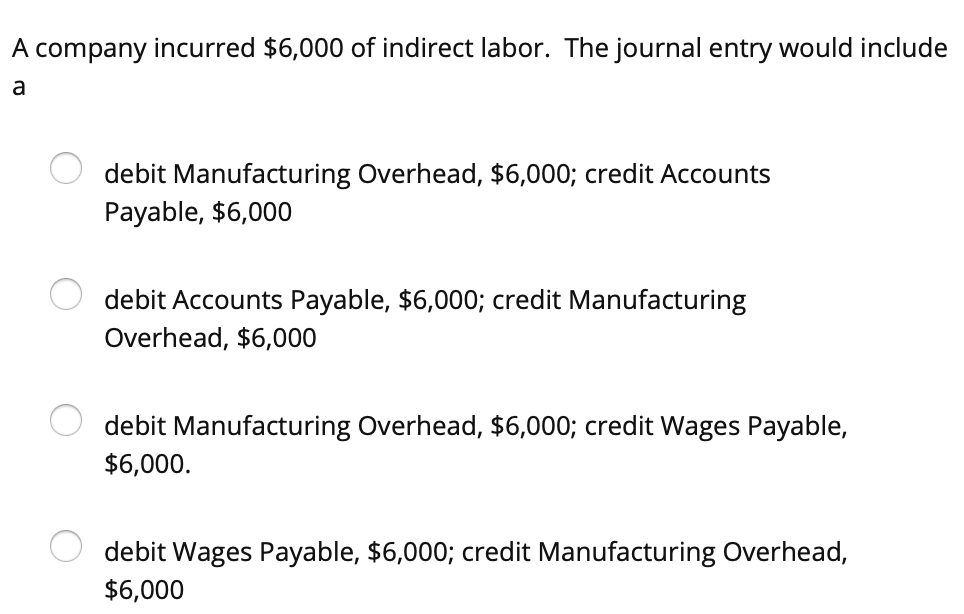

Solved A company incurred 6,000 of indirect labor. The

This is due to the indirect raw materials and indirect labor are considered the manufacturing overhead. Indirect labor records are also maintained through time tickets,.

The Journal Entry to Record Labor Costs Credits

Before you can pay your. Web the company can make the journal entry for indirect labor when it transfers the labor cost (indirect) to the.

Solved Prepare journal entries to record the following

During july, the shaping department incurred $15,000 in direct labor costs and $600 in indirect labor. Explain the methods used to relate input labour costs.

The Journal Entry to Record Labor Costs Credits

Alternatively, the company can transfer the labor cost to the work in process inventory and manufacturing overhead with only one journal entry instead as below:.

Labor Cost journal entries and ledger accounts YouTube

It refers to the wages paid to workers whose duties enable others to produce goods and perform services. Web the journal entry to record production.

During July, Creative Printers Sent Direct Materials From The Materials Storeroom To Jobs As Follows:

Indirect labor records are also maintained through time tickets, although such work is not directly traceable to a specific job. Web the journal entry to record the requisition and usage of materials is: Web what is the journal entry for indirect labor? For indirect labor, we will charge this to overhead instead of to a specific job in work in process inventory.

Indirect Labor Cost Is The Cost Of Labor That Is Not Directly Related To The Production Of Goods And The Performance Of Services.

During july, the shaping department incurred $15,000 in direct labor costs and $600 in indirect labor. Web the journal entry to record production related indirect labor cost is given below: Direct labor paid by all production departments. Explain the methods used to relate input labour costs to work done.

Web The Journal Entries For The Flow Of Production Costs Are The Same With Process And Job Costing.

For indirect labor, we will charge this to overhead instead of to a specific job in work in process inventory. It refers to the wages paid to workers whose duties enable others to produce goods and perform services. Web upon completion of this chapter you will be able to: Web in these entries, we will distribute the payroll summary (factory payroll) to the jobs and overhead.

Rather Than Supplies Expense, Maintenance Expense, Depreciation Expense, Insurance Expense, Wages Expense (Indirect), Etc., The Factory Overhead Account Is Used To Substitute For Any Expense Incurred In The Factory.

$ 9,000 to job no. This is due to the labor cost account is a temporary account that will be cleared at the end of the period. Web in these entries, we will distribute the payroll summary (factory payroll) to the jobs and overhead. Web the difference between direct labor and indirect labor is that the indirect labor records the debit to manufacturing overhead while the credit is to factory wages payable.