Journal Entry For Income Tax Paid - When making payment, the company will reduce the. Web how to prepare a payroll journal entry + examples. Sayad (executive) (179 points) 09 april 2022. Web june 12, 2021 10:00 am. I'll share with you the steps on how to record your tax payments in quickbooks online (qbo) payroll. Web journal entry for advance tax. Web to record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to income tax payable. Web provision for income tax journal entry is an accounting item that is debited to the income tax expense account and credited to the income tax payable account. As a business owner, you know that every dollar matters. If you're using qbo enhanced.

Journal Entry for Tax Paid by Cheque davistakey1939 Davis

Web to record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit.

Tax Paid Journal Entry Class 11 Journal Entry of Tax

Web provision for income tax journal entry is an accounting item that is debited to the income tax expense account and credited to the income.

Accounting Journal Entries For Dummies

As a business owner, you know that every dollar matters. This journal entry is an important part of the. Major kinds of taxes would be.

Casual Journal Entry For Tax Payable Financial Statement

Web journal entry for salary: The concept of income tax accounting involves following certain. Web income tax is paid by the business on the profit.

Your BookKeeping Free Lessons Online Examples of Payroll Journal

Web june 12, 2021 10:00 am. Web accrued income tax journal entry example shows how to record an estimated income tax expense due on profits.

Tax Expense Journal Entry Journal Entries for Normal Charge

Web income tax is paid by the business on the profit earned during the year. When making payment, the company will reduce the. The journal.

Salary Paid Journal Entry CArunway

Income tax is a personal liability of the proprietor. Web june 12, 2021 10:00 am. What is the journal entry for advance income tax paid.

10 Payroll Journal Entry Template Template Guru

This item is any money paid by the employer or organization to the government as taxes every year. Sayad (executive) (179 points) 09 april 2022..

Journal Entry For Tax Payable

For companies that use the cash basis for both financial and tax reporting, income tax. Web income tax is paid by the business on the.

This Journal Entry Is An Important Part Of The.

Major kinds of taxes would be state income taxes,. The journal entry will be: Web below are sample journal entries: Web journal entry for advance tax.

If You're Using Qbo Enhanced.

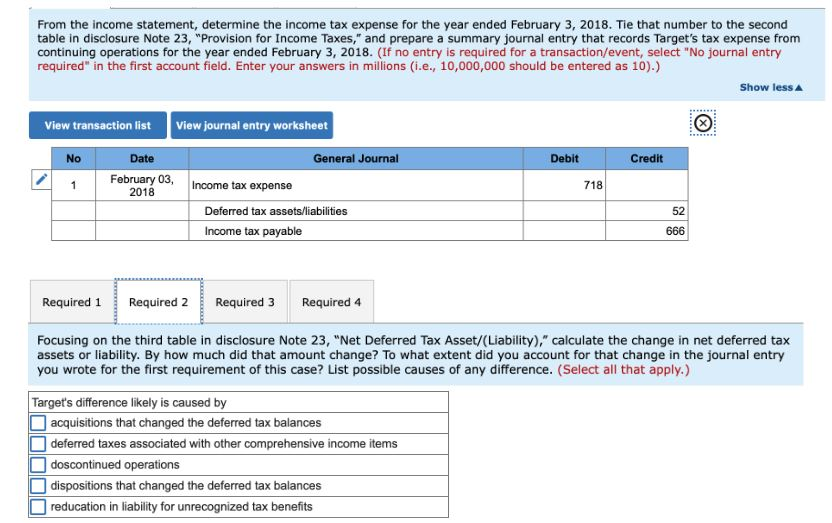

The income tax expense will be present on the income statement and the income tax payable will be present on the balance sheet. Web the journal entry is debiting income tax expense and crediting income tax payable. As a business owner, you know that every dollar matters. House rent allowance = 150000.

I'll Share With You The Steps On How To Record Your Tax Payments In Quickbooks Online (Qbo) Payroll.

Web to record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to income tax payable. Web companies record both income tax expense and income tax payable in journal entries. For companies that use the cash basis for both financial and tax reporting, income tax. Web journal 1 shows the employee’s gross wages ($1,200 for the week).

Web The Journal Entry For Income Tax Payable Is A Debit To The Income Tax Expense Account And A Credit To The Income Tax Payable Account.

Web the current portion of the income tax expense is calculated in the tax computation and recorded in a journal entry that increases the expense account with a debit entry and. Web income tax is paid by the business on the profit earned during the year. In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s. Income tax is a personal liability of the proprietor.