Journal Entry For Impairment Loss - As the result, company needs to reduce the asset’s book value from the balance sheet. Web the impairment loss would be recognized using the following journal entry: You must record the new amount in your books by writing off the difference. The market value of the asset decreases significantly, there is a significant unfavorable change in either the amount or way in which the asset is used, the asset’s physical condition deteriorates significantly, Web journal entry for recording the impairment is the debit to the loss account or the expense account with the corresponding credit to an underlying asset or credit impaired assets. Can calculate the impairment loss. “4.8 impairment of an equity method investment. If the carrying amount exceeds the recoverable amount, the asset is described as impaired. 4.8.1 loss in investment value that is other than temporary. An investor is required to assess its equity method investment for impairment when events or circumstances suggest that the carrying amount of the investment may be impaired.

Fun Impairment Loss Double Entry Fortis Balance Sheet

Web the journal entry would be: When dealing with a depreciable asset where the impairment loss is more than the previous revaluation increase, the journal.

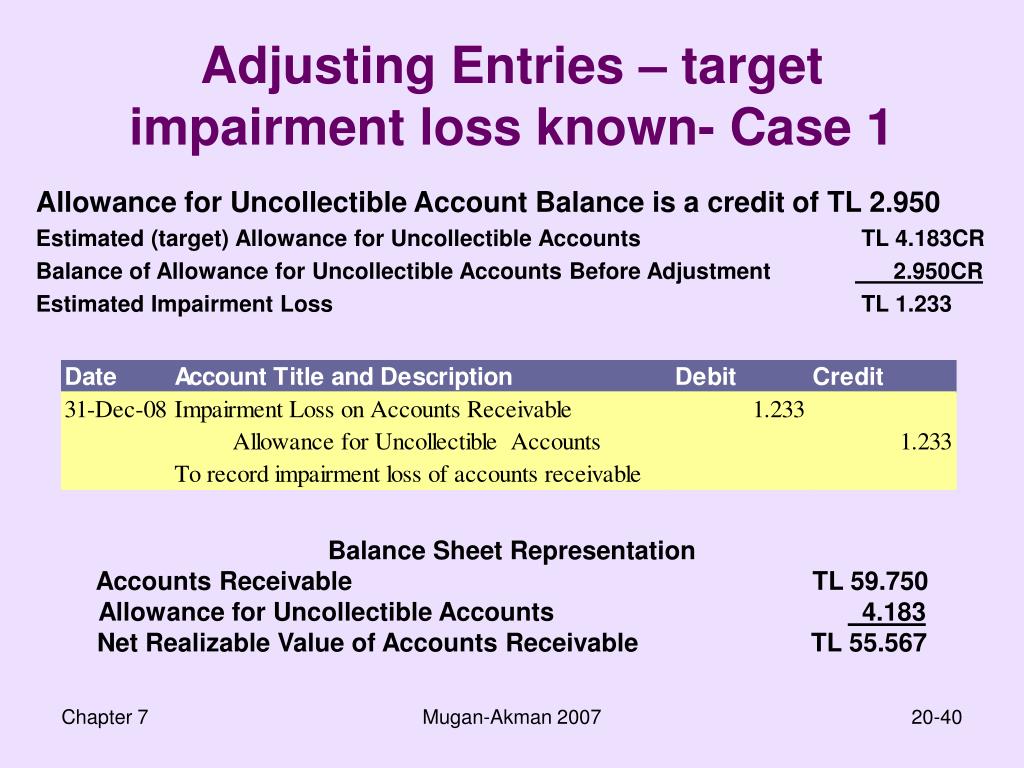

Glory Impairment Loss On Receivables Financial Statement Preparation

This loss will be as below. Us equity method of accounting guide. Web the journal entry would be: Web automatic form fill seal machine. Carrying.

Impairment Loss Journal Entry Rachel Randall

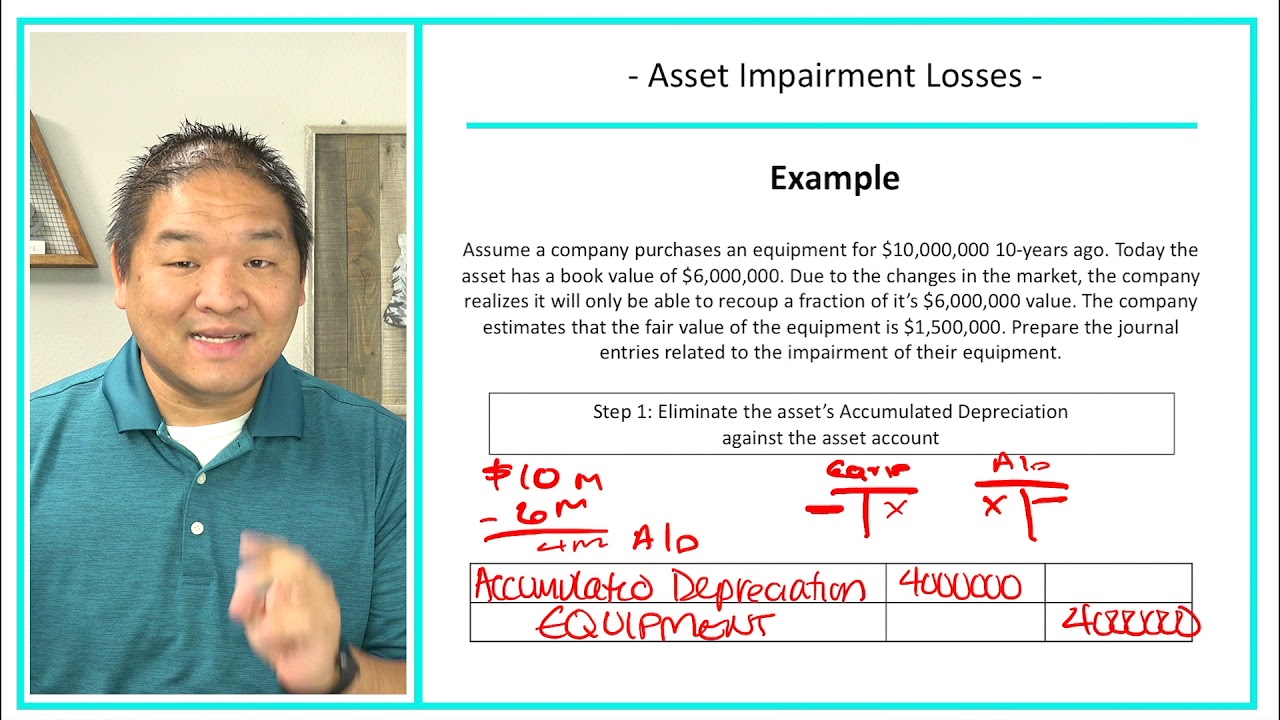

The company can make the fixed asset impairment journal entry by debiting the impairment losses account and crediting the accumulated impairment losses account. Web automatic.

[Solved] 1. Prepare the entry (entries) to record any impairment losses

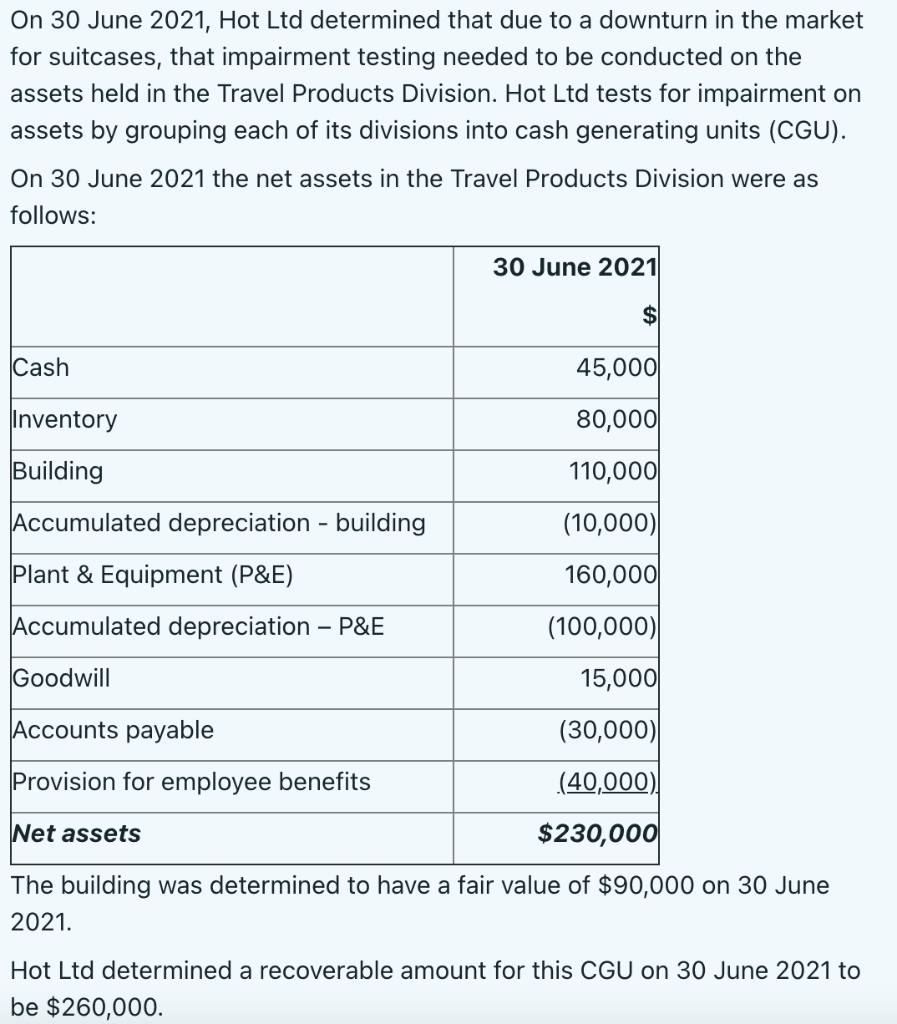

As the result, company needs to reduce the asset’s book value from the balance sheet. Ias 36 prescribes the impairment loss to be allocated: If.

Impairment Loss Journal Entry BronsonaresTownsend

The other side of the journal entry will impact the expense on income statement. Web the impairment loss would be recognized using the following journal.

Accounting For Intangible Assets Complete Guide for 2023

Ias 36 prescribes the impairment loss to be allocated: 4.8.1 loss in investment value that is other than temporary. This loss will be as below..

Impairment Loss Journal Entry KameronhasKhan

Carrying amount is the amount at which an asset is recognised in the financial statements, after deducting any accumulated depreciation/amortisation and any accumulated impairment losses..

10. Goodwill Impairment Accounting Journal Entries YouTube

Can calculate the impairment loss. Web journal of accountancy. Web journal entry for recording the impairment is the debit to the loss account or the.

Accounting for Impairment of Goodwill IFRS & ASPE (rev 2020) YouTube

“asset impairment and disposal.” cpa journal. Impairment refers to a sharp decrease in the fair market value of an asset due to several internal and.

Cpas Need Not Check Every Asset An Entity Owns In Each Reporting Period.

When circumstances change indicating a carrying amount may not be recoverable, cpas should test the asset for impairment. Let us extend the example of zarlascht inc. Web an impairment loss must be recognised for a cgu when the recoverable amount of the unit is less than its carrying amount. Web you should test for impairment of an asset whenever any of the following occurs:

Web In Accounting, Impairment Is A Permanent Reduction In The Value Of A Company Asset.

Us equity method of accounting guide. Impairment refers to a sharp decrease in the fair market value of an asset due to several internal and external factors. The following journal entry must be recorded to account for this condition: Write the asset’s new value on your future financial statements.

The Market Value Of The Asset Decreases Significantly, There Is A Significant Unfavorable Change In Either The Amount Or Way In Which The Asset Is Used, The Asset’s Physical Condition Deteriorates Significantly,

And, you may also need to record a new amount for the asset’s depreciation. Carrying amount is the amount at which an asset is recognised in the financial statements, after deducting any accumulated depreciation/amortisation and any accumulated impairment losses. If the carrying amount exceeds the recoverable amount, the asset is described as impaired. When testing an asset for.

“4.8 Impairment Of An Equity Method Investment.

Web journal entry for recording the impairment is the debit to the loss account or the expense account with the corresponding credit to an underlying asset or credit impaired assets. In this journal entry, total expenses on the income statement increase while total assets on the balance sheet decrease. Web an impairment loss is an asset’s book value minus its market value. This loss will be as below.