Journal Entry For Gift Cards - During the holiday, company sold the gift cards for $ 200,000 to various customers. The journal entry for the sale of gift voucher: Web journal entry for gift cards. Web basic and advanced gift card revenue recogniton, journal entries and examples. Web please prepare journal entry for the gift card transaction above. What happens if gift cards. Web if a business gives some of their new customers free gift cards how does this impact the books? Note that revenue is not recorded at this point. On the second line, select the gift card (the one linking to a liability account), and enter a negative amount. There are varying treatments for the residual balances in these cards, as noted below.

gift card breakage revenue example YouTube

A best practice is to create a contra liability account and to use this account to offset the gift card deferred revenue liability so that.

Örök leltárrendszerek Mont Blanc

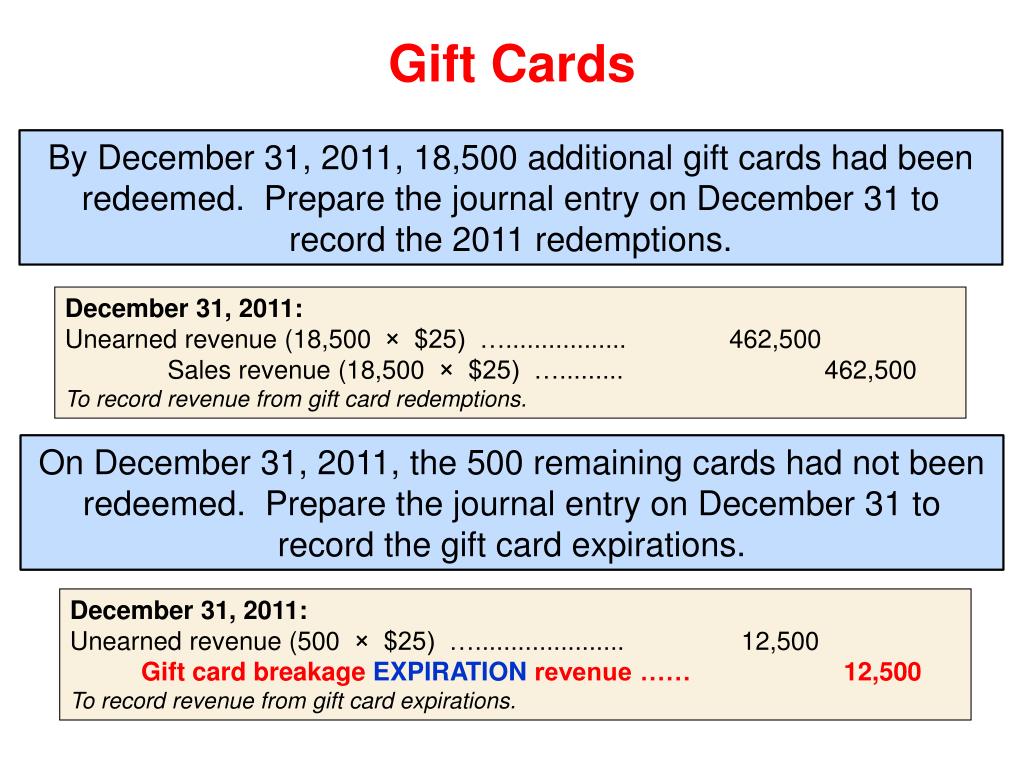

The journal entry to record gift card breakage revenue is to debit deferred revenue and credit breakage revenue. Suppose the business sells gift cards or.

Journal Entries Template

Gift card usage and breakage. Web thus for any expired gift cards you can create a journal entry that debits the gift card liability account.

Solved Exercise 139 (Algo) Gift Cards (LO133] CircuitTown

Where to buy issue gift cards. Gift cards are sold to the customers (usually in return for cash), and the business must establish the liability.

Solved Exercise 139 (Algo) Gift Cards (LO133] CircuitTown

Web basic and advanced gift card revenue recogniton, journal entries and examples. Where to buy issue gift cards. No goods or services were rendered upon.

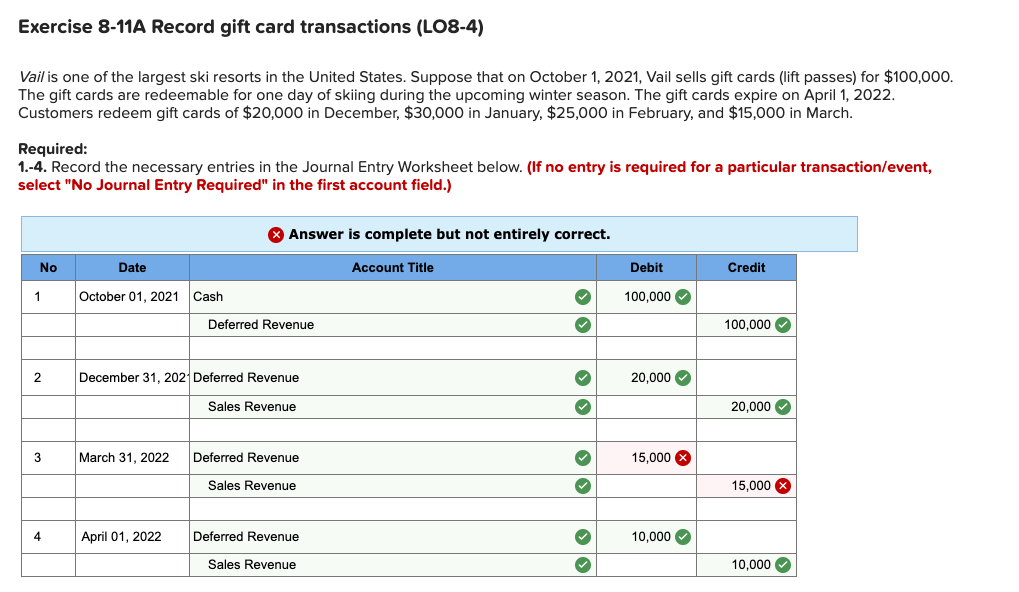

Solved Exercise 811A Record gift card transactions (LO84)

The journal entry is debiting cash $ 200,000 and credit gift card liability $ 200,000. On the second line, select the gift card (the one.

Deferred Revenue Archives Double Entry Bookkeeping

The company must reconcile the journal entry with the cash received to ensure it is accurate. What happens if gift cards. Web how to record.

PPT Chapter 13 PowerPoint Presentation, free download ID3024969

Web the journal entry is debiting gift card liability and credit sale revenue. Can anyone inform how the journal entry would look? Web thus for.

9.1 Explain the Revenue Recognition Principle and How It Relates to

What happens if gift cards. The purchase of the voucher and the redemption of the voucher for goods or services. Where to buy issue gift.

Where To Buy Issue Gift Cards.

Set up a gift card account. A best practice is to create a contra liability account and to use this account to offset the gift card deferred revenue liability so that gift card breakage revenue taken can be tracked independent of gift card deferred. Web thus for any expired gift cards you can create a journal entry that debits the gift card liability account and credits a general income account. Web basic and advanced gift card revenue recogniton, journal entries and examples.

Unresolved Issues Stemming From The Reporting Treatment Of Gift Card Sales And “Breakage” (Gift Cards That Consumers Fail To Redeem) Potentially Encroach Upon Several Accounting Regulations, Including Standards For Revenue Recognition And The.

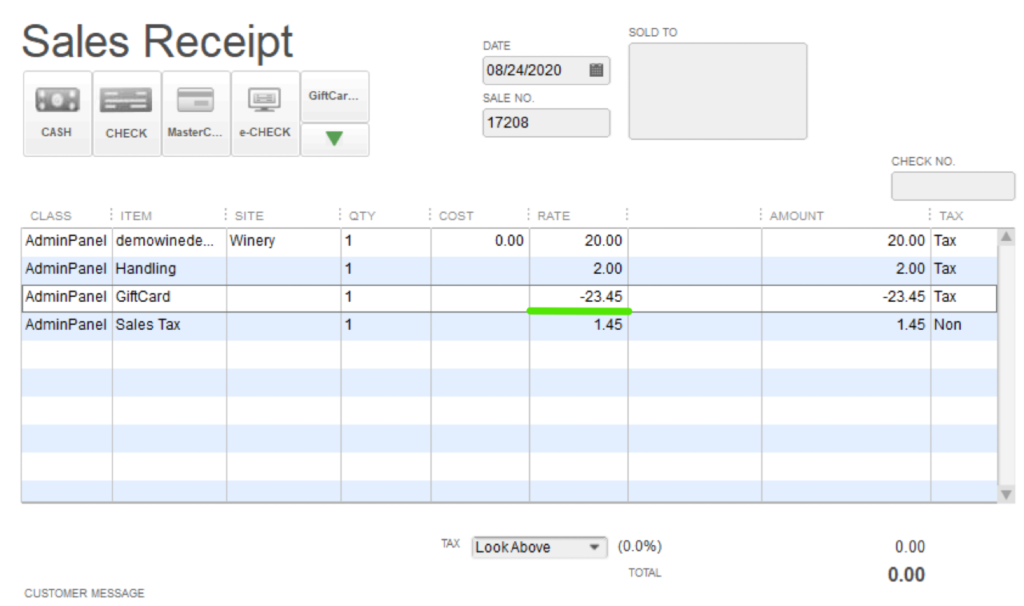

Below is an example of a journal entry when you sell a $100 gift card in shopify (when shopify takes out your merchant fee prior to the payout) The journal entry to record gift card breakage revenue is to debit deferred revenue and credit breakage revenue. Journal entry for credit purchase and cash purchase. Web the sale of a gift certificate should be recorded with a debit to cash and a credit to a liability account such as gift certificates outstanding.

Solved Journal Entry Worksheet Record The.

When should the redeemed gift card revenue be recognized? Web when you sell gift cards, it increases (credits) the liability account and when they are redeemed, the liability account is decreased (debited). Web what is the accounting for gift cards? How should the sale of gift certificates be recorded in.

Web What Accounting Guidance Applies To Gift Card Accounting And Any New Accounting Pronouncements That Occurred Since The Last Holiday Season?

Web how to record your shopify store gift card sales & redemptions in quickbooks online. The journal entry for the sale of gift voucher: Web the accounting for gift card sales presents an emerging reporting dilemma for retailers. Free $10.00 gift cards to the first 100 customers at the grand opening of a restaurant.

![Solved Exercise 139 (Algo) Gift Cards (LO133] CircuitTown](https://media.cheggcdn.com/media/aff/aff5bad8-dca3-484d-a0de-9b22e029607c/phpYJQRRt)

![Solved Exercise 139 (Algo) Gift Cards (LO133] CircuitTown](https://media.cheggcdn.com/media/c85/c851179e-bea4-4855-86d1-e47510ccc6d2/phpHnnD2s)