Journal Entry For Erc Credit - A significant decline in gross. Web for 2021, the employee retention credit (erc) is a quarterly tax credit against the employer’s share of certain payroll taxes. Compare the timing of income recognition and. Web download this resource to help with next steps when your clients are claiming the employee retention credit (erc). Web let me handle your query so you can record your employee retention credit (erc) accurately in quickbooks. Web to reduce my previous tax liability accounts that the credit was applied against, i created a journal entry and debited payroll expense and credited the payroll. The employee retention credit (erc) was. Web if you choose to use journal entry, you can follow these steps: Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Web learn how to account for erc funds as government grants under two models:

Does the IRS audit ERC credits? Leia aqui How long does the IRS have

Web for 2021, the employee retention credit (erc) is a quarterly tax credit against the employer’s share of certain payroll taxes. Web learn how to.

Employee Retention Credit (ERC) Calculator Gusto

Web next, create a journal entry dated during the year of the original tax payment, debiting the ertc holding account, and crediting the employee retention.

What is basic journal entry? Leia aqui What are basic journal entries

Web when receiving the erc refund, the typical journal entry includes a debit to the payroll tax liability and a credit to compensation expense and.

journal entry format accounting accounting journal entry template

Web the erc is recorded as a cash debit or accounts receivable and a credit to income from contributions or grants, according to the schedule.

How the ERC Credit Could Impact Your R&D Tax Credits

Go to the + new icon. The tax credit is 70% of the first $10,000 in. Web to reduce my previous tax liability accounts that.

COVID19 Relief Legislation Expands Employee Retention Credit

Rather than $10,000 total, the. Web let me handle your query so you can record your employee retention credit (erc) accurately in quickbooks. Last modified.

Journal Entry Examples

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Go to the.

The ERC Credit What Is It and How To Claim It? Poler Stuff

Enter information in the memo section so you know why. A significant decline in gross. Web the erc is recorded as a cash debit or.

Accounting Journal Entries For Dummies

Web if you choose to use journal entry, you can follow these steps: Web let me handle your query so you can record your employee.

Web If You Choose To Use Journal Entry, You Can Follow These Steps:

Go to the + new icon. Enter information in the memo section so you know why. Compare the timing of income recognition and. Web let me handle your query so you can record your employee retention credit (erc) accurately in quickbooks.

The Employee Retention Credit (Erc) Was.

Web the erc is a refundable payroll tax credit as opposed to an income tax credit and, therefore, is not within the scope of asc 740, income taxes. Web to reduce my previous tax liability accounts that the credit was applied against, i created a journal entry and debited payroll expense and credited the payroll. Web published on july 13, 2022. Rather than $10,000 total, the.

When The Entry Is Recorded, It’ll.

Web learn how to account for erc funds as government grants under two models: Web the erc is recorded as a cash debit or accounts receivable and a credit to income from contributions or grants, according to the schedule mentioned above. Web as we note in our video on the tax implications of the employee retention credit, there are two pathways to qualification for the erc: Web next, create a journal entry dated during the year of the original tax payment, debiting the ertc holding account, and crediting the employee retention tax.

A Significant Decline In Gross.

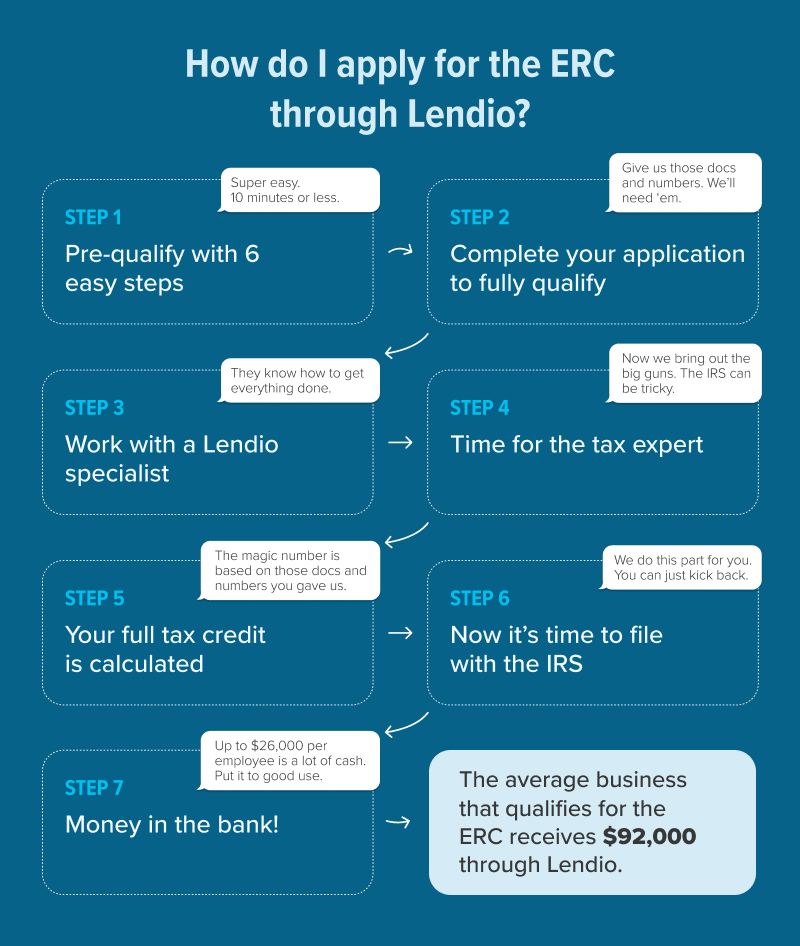

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Web download this resource to help with next steps when your clients are claiming the employee retention credit (erc). Web the employee retention credit (erc) provides economic relief through a refundable tax credit to eligible businesses that have kept their employees on payroll. Web for 2021, the employee retention credit (erc) is a quarterly tax credit against the employer’s share of certain payroll taxes.