Journal Entry For Discount On Sales - Web the best practice to record a sales entry is debiting the accounts receivable with full invoice and credit the revenue account with the same amount. Web the discount allowed journal entry will be treated as an expense, and it’s not accounted for as a deduction from total sales revenue. Sale discount will present as the contra account of sale revenue which will be present on the. Cash received from rishabh worth ₹19,500 and discount allowed to him ₹500. Web as discounts are taken, the entry is a credit to the accounts receivable account for the amount of the discount taken and a debit to the sales discount reserve. We explore how to recognize discounts in different situations, below. Web the first step is to debit the accounts receivable account in a journal entry in your records by the full invoice amount of a sale before a cash discount, according to the association. Discounts may be classified into two types:. Web memorial day free meals 2024. An example of a sales discount is for the buyer to take a 1% discount in exchange for paying within 10 days of the invoice date, rather.

Discount Allowed Double Entry

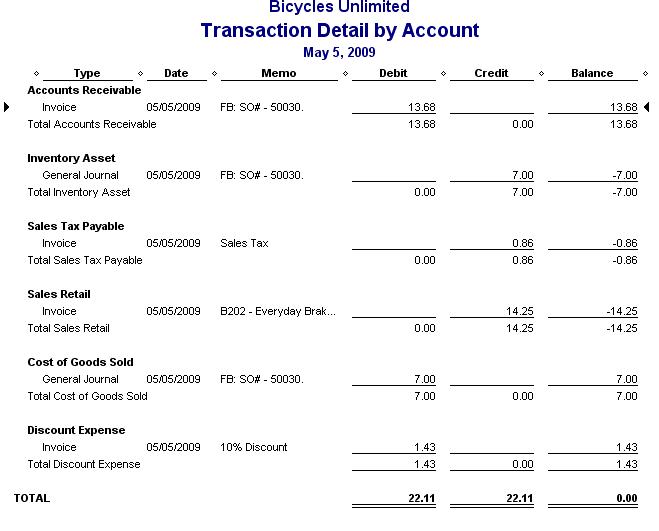

Web sample journal entries using discounts can be found in a later post. Web the company can make sale discount journal entry by debiting cash.

Sales Journal Definition, Explanation, Format and Entry Examples

In this article, we cover the. Has acquired rights to nearly half of 99 cents only stores llc's former locations as part of a bankruptcy.

Discount Received Journal Entry

Web a sales revenue journal entry is an accounting entry recorded in the financial ledgers of a company to document the income generated from the.

Accounting for Sales Return Journal Entry Example Accountinguide

An example of a sales discount is for the buyer to take a 1% discount in exchange for paying within 10 days of the invoice.

Journal Entry for Discount Received Examples

Web discount retailer dollar tree inc. Post the sale to cost of goods sold by debiting. An example of a sales discount is for the.

Sales Journal (Sales Day Book) Double Entry Bookkeeping

Web the best practice to record a sales entry is debiting the accounts receivable with full invoice and credit the revenue account with the same.

What Does Discounts Received & Allowed Mean? Online Accounting

Accounting for sales discounts requires two journal entries. Record the sale as usual in the sales journal. At the time of origination of the sales,.

6.4 Analyze and Record Transactions for the Sale of Merchandise Using

Web this journal entry will reduce both total assets on the balance sheet and the net sales revenue on the income statement by the amount.

How To Calculate Discount Journal Entry Haiper

As a general rule of thumb, bob evans offers a 10% discount for active, veterans and retired military every day. Web discount retailer dollar tree.

Coupons Are Sales Discounts On.

Web memorial day free meals 2024. Web sample journal entries using discounts can be found in a later post. At the date of sale the business does not know whether the. Web discount allowed by a seller is discount received for the buyer.

Web The Discount Allowed Journal Entry Will Be Treated As An Expense, And It’s Not Accounted For As A Deduction From Total Sales Revenue.

Web as discounts are taken, the entry is a credit to the accounts receivable account for the amount of the discount taken and a debit to the sales discount reserve. Web in order to encourage early payment, each business normally provides a sales discounts if customers make payment within the discount period. Post the sale to cost of goods sold by debiting. Web the first step is to debit the accounts receivable account in a journal entry in your records by the full invoice amount of a sale before a cash discount, according to the association.

Because Of The Discount, The Amount Collected (Cash) Is Less Than The Amount.

Web how to account for sales discounts. Has acquired rights to nearly half of 99 cents only stores llc's former locations as part of a bankruptcy sale, which includes leases for two stores. At the time of origination of the sales, the seller has no idea whether the buyer will avail of the sales discounts by paying off the outstanding amount early or making the full. Discounts may be offered on sales of goods to attract buyers.

Web This Journal Entry Will Reduce Both Total Assets On The Balance Sheet And The Net Sales Revenue On The Income Statement By The Amount Of Discount Allowed.

Accounting for sales discounts requires two journal entries. The total sales offered on different items will reduce cash. On 1st january, feliz inc., sold goods worth $1000 to jayman. Web journal entries of accounting for sales discounts the two journal entries, as shown below: