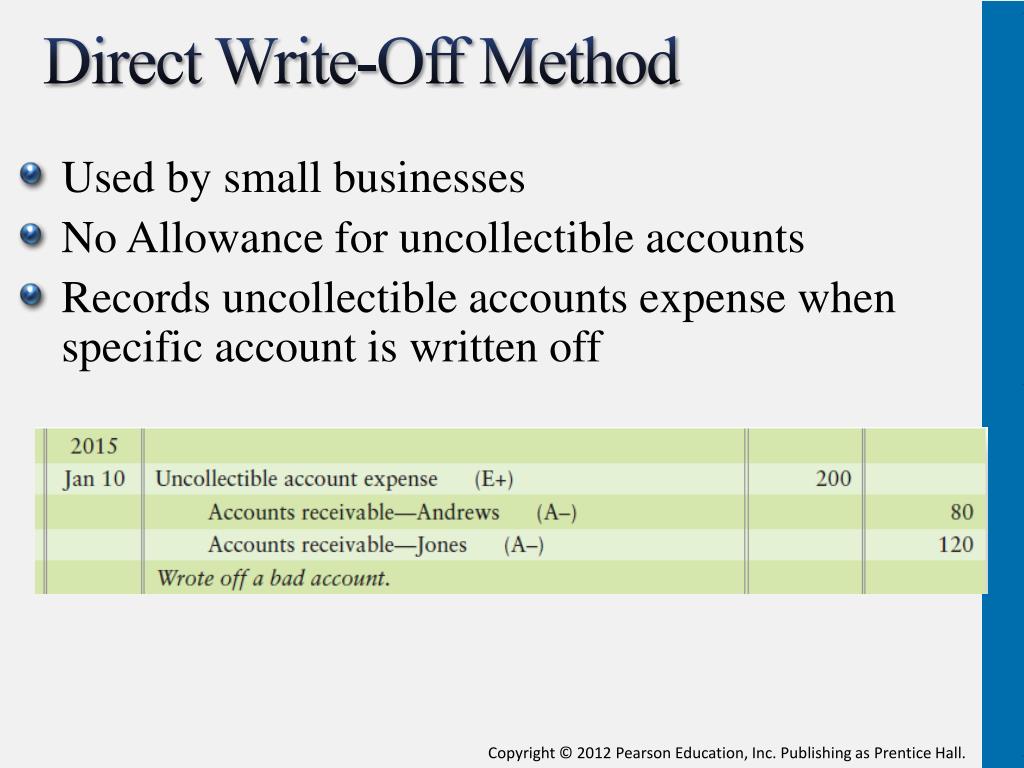

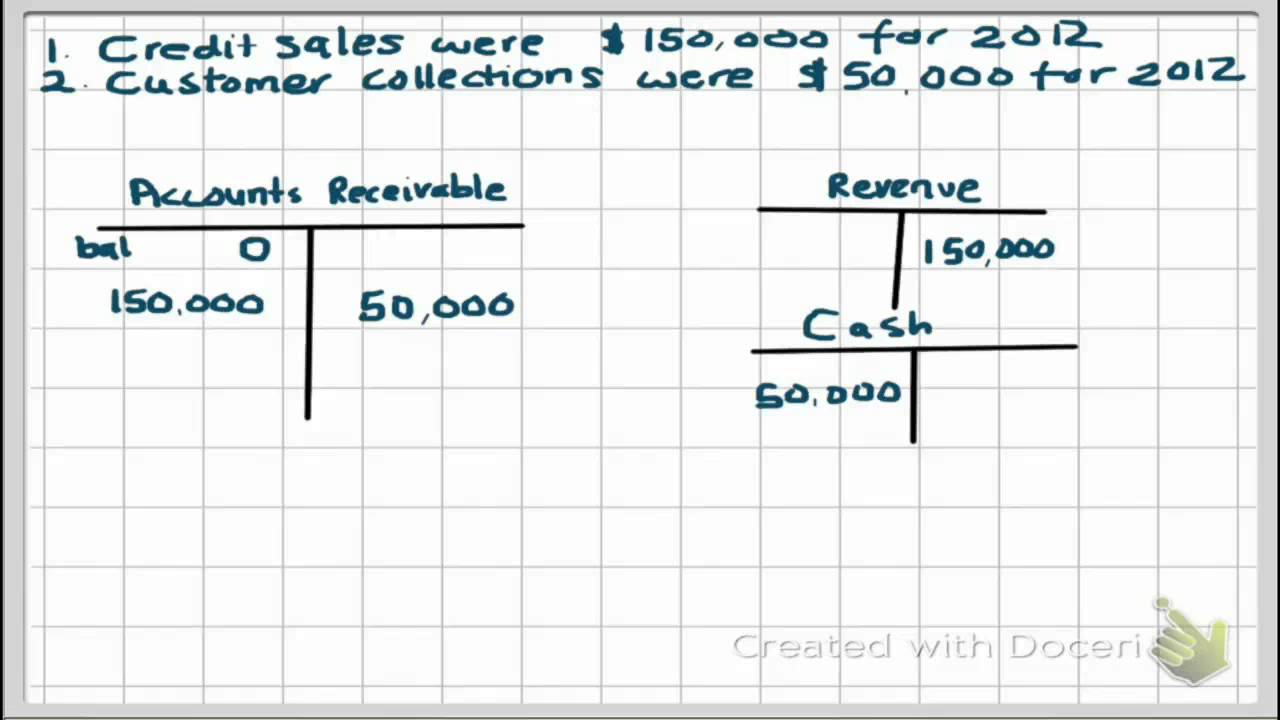

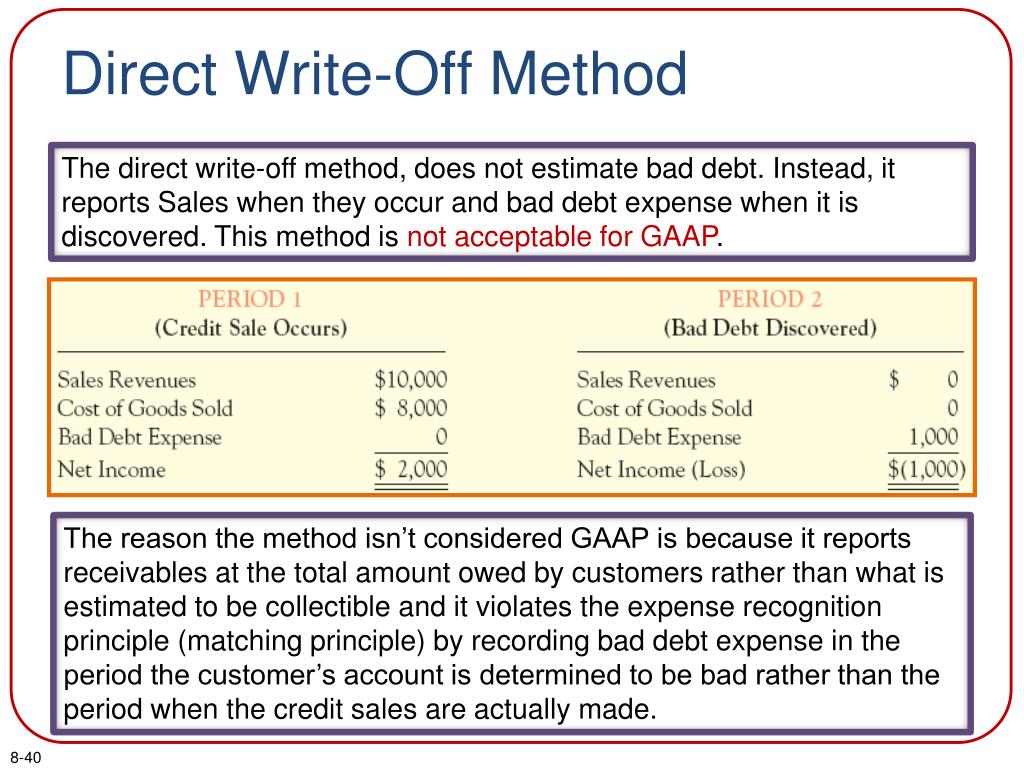

Journal Entry For Direct Write Off Method - The offsetting debit is to an expense account: Web once the allowance is established, an adjusting journal entry is made to debit bad debt expense and credit the allowance for doubtful accounts. Allowance for doubtful accounts journal entry example. The allowance method estimates bad debt expense at the end of the fiscal year, setting up a reserve account called allowance for doubtful accounts. In this method, the company does not make an estimation of bad debt for adjusting entry, so no allowance for doubtful accounts is created. Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. We will demonstrate how to record the journal entries of bad debt using ms excel. Hence, it’s important to note that writing off an account does not erase the debt legally or financially; This method is commonly used by smaller businesses. Under the , a is charged to as soon as it is apparent that an will not be paid.

PPT Receivables PowerPoint Presentation, free download ID1657894

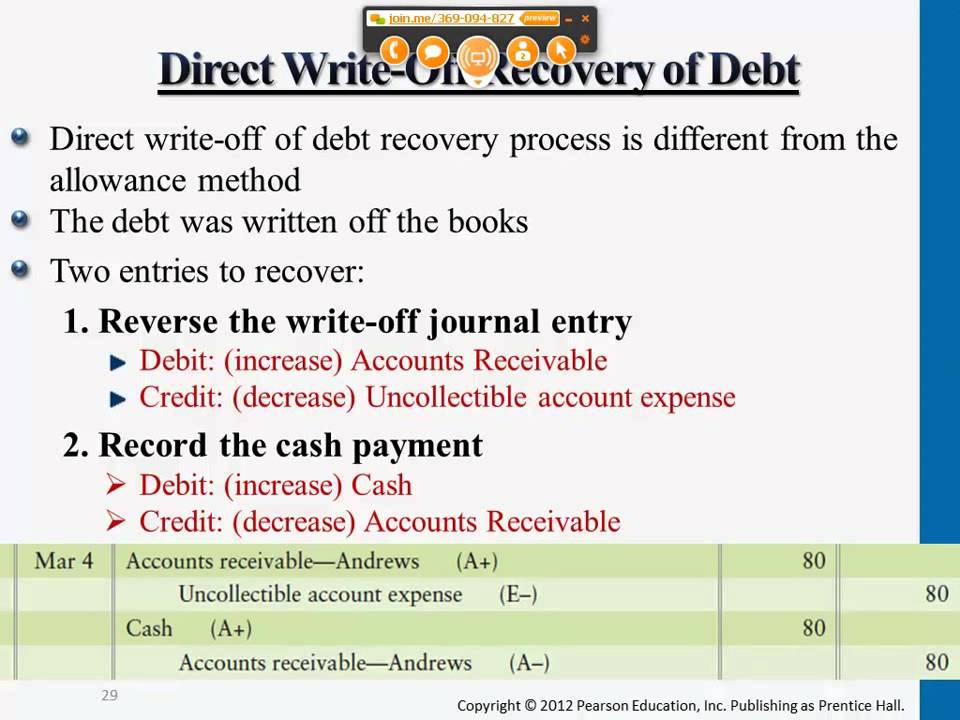

It merely reflects the acknowledgment that the company believes it is unlikely to recover the amount. Decides to write off one of its customers, mr..

Comparing Direct WriteOff and Allowance Methods HKT Consultant

Web direct write off method. We will demonstrate how to record the journal entries of bad debt using ms excel. What is allowance for doubtful.

How to calculate and record the bad debt expense QuickBooks

Journal entries (debit and credit) microsoft allowance for doubtful accounts example. The offsetting debit is to an expense account: Under the , a is charged.

Direct Write Off Recovery of Debt YouTube

We will demonstrate how to record the journal entries of bad debt using ms excel. When debt is determined as irrecoverable, a journal entry is.

Image result for direct write off method of accounting for

This method is commonly used by smaller businesses. Z as uncollectible with a balance of usd 350. When debt is determined as irrecoverable, a journal.

Accounting Q and A EX 914 Entries for bad debt expense under the

In this method, the company does not make an estimation of bad debt for adjusting entry, so no allowance for doubtful accounts is created. When.

5.4 Direct Write Off Method YouTube

Allowance for doubtful accounts journal entry example. This is the simplest way to recognize a bad debt, since the entry is only made when a.

PPT Chapter 8 PowerPoint Presentation, free download ID1665126

This chart shows us the similarities and differences betw. When debt is determined as irrecoverable, a journal entry is passed, in which bad debts expense.

Topic 12.2 The Direct Write Off and Allowance Methods (Accounting for

Z as uncollectible with a balance of usd 350. The allowance method estimates bad debt expense at the end of the fiscal year, setting up.

Web Direct Write Off Method.

This is the simplest way to recognize a bad debt, since the entry is only made when a specific customer invoice has been identified as a bad debt. Decides to write off one of its customers, mr. This chart shows us the similarities and differences betw. Journal entries (debit and credit) microsoft allowance for doubtful accounts example.

Web Once The Allowance Is Established, An Adjusting Journal Entry Is Made To Debit Bad Debt Expense And Credit The Allowance For Doubtful Accounts.

Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. The allowance method estimates bad debt expense at the end of the fiscal year, setting up a reserve account called allowance for doubtful accounts. Hence, it’s important to note that writing off an account does not erase the debt legally or financially; This method is commonly used by smaller businesses.

The Seller Can Charge The Amount Of An Invoice To The Bad Debt Expense Account When It Is Certain That The Invoice Will Not Be Paid.

What is allowance for doubtful accounts? Under the , a is charged to as soon as it is apparent that an will not be paid. Z as uncollectible with a balance of usd 350. In this method, the company does not make an estimation of bad debt for adjusting entry, so no allowance for doubtful accounts is created.

The Offsetting Debit Is To An Expense Account:

When debt is determined as irrecoverable, a journal entry is passed, in which bad debts expense account is debited and accounts receivable account is credited as shown below. The journal entry is a debit to the bad debt expense account and a. We will demonstrate how to record the journal entries of bad debt using ms excel. It merely reflects the acknowledgment that the company believes it is unlikely to recover the amount.