Journal Entry For Depreciation - See examples of journal entries, cash impact,. We'll work through a straight l. Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. Web journal entries for the straight line depreciation. Web learn how to record depreciation expense and accumulated depreciation using journal entries and depreciation schedules. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system. Web learn how to record depreciation expense and accumulated depreciation for different types of fixed assets. It was supposed to explain and apply depreciation methods to allocate capitalized costs, but it failed to load. See examples of different depreciation methods. See examples, formulas, and journal entries for fixed assets with or without residual value.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

Web the adjusting entry for a depreciation expense involves debiting depreciation expense and crediting accumulated depreciation. See examples of different depreciation methods. Web an accumulated.

Adjusting Entry for Depreciation Financial

See examples, formulas, and journal entries for fixed assets with or without residual value. Web depreciation journal entry example: Web a depreciation journal entry is.

Provision for Depreciation and Asset Disposal Account

See examples of different depreciation methods. Depreciation refers to the method of accounting which allocates a tangible asset's cost over its useful. Web learn how.

What is the journal entry for depreciation? Leia aqui What is

We'll work through a straight l. See examples of journal entries, cash impact,. Depreciation refers to the method of accounting which allocates a tangible asset's.

What account do you credit for depreciation? Leia aqui What is journal

See examples of journal entries for different years of a fixed asset with. Web the journal entry is used to record depreciation expenses for a.

Depreciation journal Entry Important 2021

In this case the depreciation expense is 1,000 per year for the next 4 years. See examples, formulas, and journal entries for fixed assets with.

Journal Entry for Depreciation Example Quiz More..

Web learn how to record depreciation expense and accumulated depreciation for different types of fixed assets. Web the web page you requested is not available.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Web the web page you requested is not available due to a technical error. Web learn how to record depreciation expense and accumulated depreciation for.

Class 11 Chapter 7 Depreciation Provisions and Reserves Notes

See examples of journal entries, cash impact,. Web the journal entry is used to record depreciation expenses for a particular accounting period and can be.

It Is Done To Adjust The Book Values Of The Different.

Web learn how to record depreciation expense and accumulated depreciation in the accounting journal. See examples of different depreciation methods. Web the adjusting entry for a depreciation expense involves debiting depreciation expense and crediting accumulated depreciation. Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year.

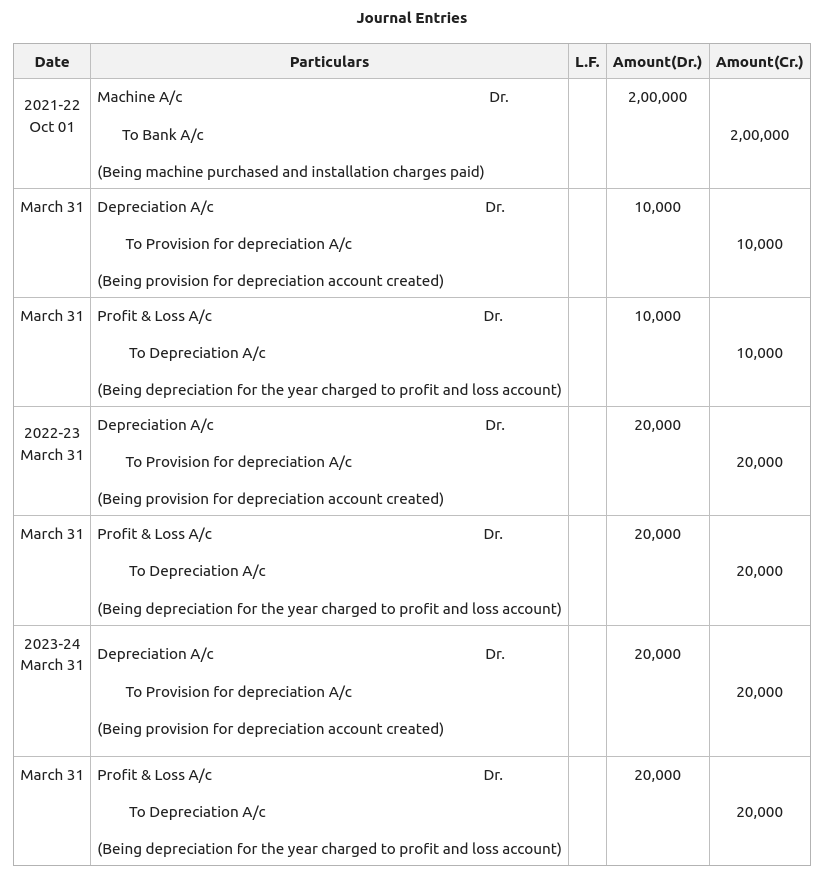

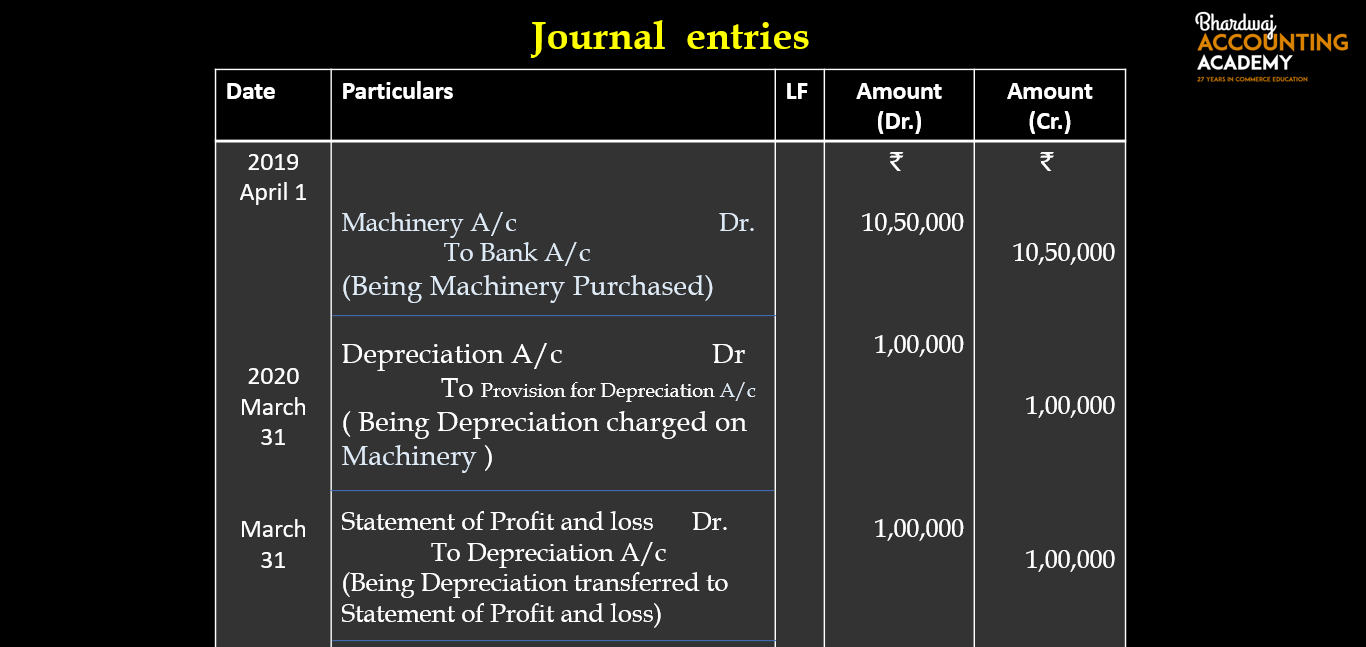

Web Journal Entries For The Straight Line Depreciation.

Web learn how to record depreciation expense and accumulated depreciation using journal entries and depreciation schedules. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system. See examples, formulas, and journal entries for fixed assets with or without residual value. It was supposed to explain and apply depreciation methods to allocate capitalized costs, but it failed to load.

Web The Web Page You Requested Is Not Available Due To A Technical Error.

Journal entry for the depreciation of. In this case the depreciation expense is 1,000 per year for the next 4 years. See examples of journal entries for different years of a fixed asset with. See examples of journal entries for purchase,.

Web The Journal Entry Is Used To Record Depreciation Expenses For A Particular Accounting Period And Can Be Recorded Manually Into A Ledger Or In Your Accounting.

By debiting the depreciation expense and crediting accumulated depreciation, the book value of the asset decreases on the. Web learn how to record depreciation expense and accumulated depreciation for different types of fixed assets. Web a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. See the definition, formula, and examples of depreciation entry with.