Journal Entry For Depreciation On Equipment - There are 2 steps to solve. Web journal entry examples. We simply record the depreciation on debit and accumulated depreciation on credit. Web the journal entry for depreciation expense is: Dr depreciation expense cr accumulated depreciation $1,950 ÷ 12 = $162.50. Journal entry for accumulated depreciation. When it comes to recording equipment, loop the income statement in once you start using the asset. The journal entry to record this expense is straightforward. Web jul 7, 2023 bookkeeping by adam hill.

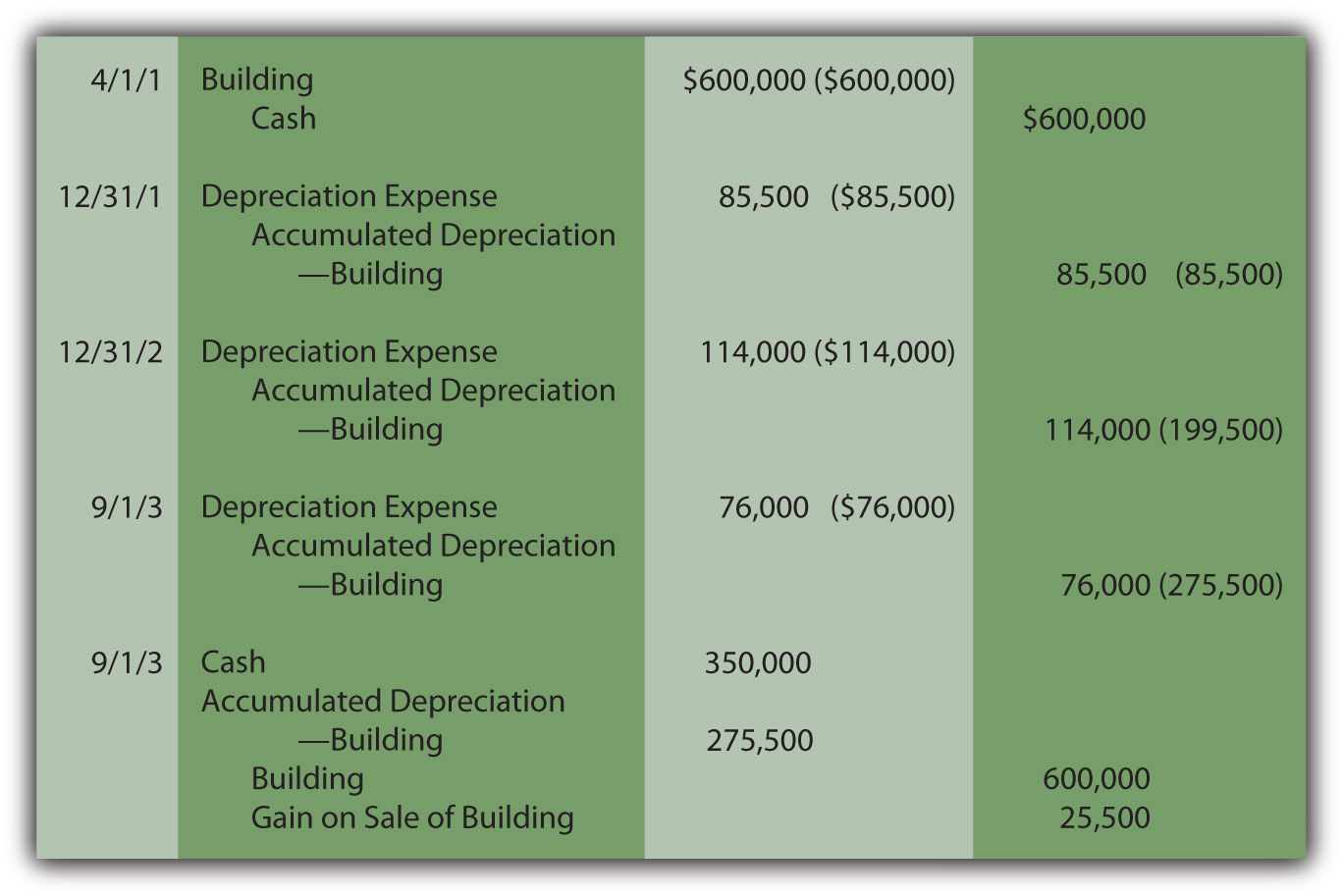

10.3 Recording Depreciation Expense for a Partial Year Financial

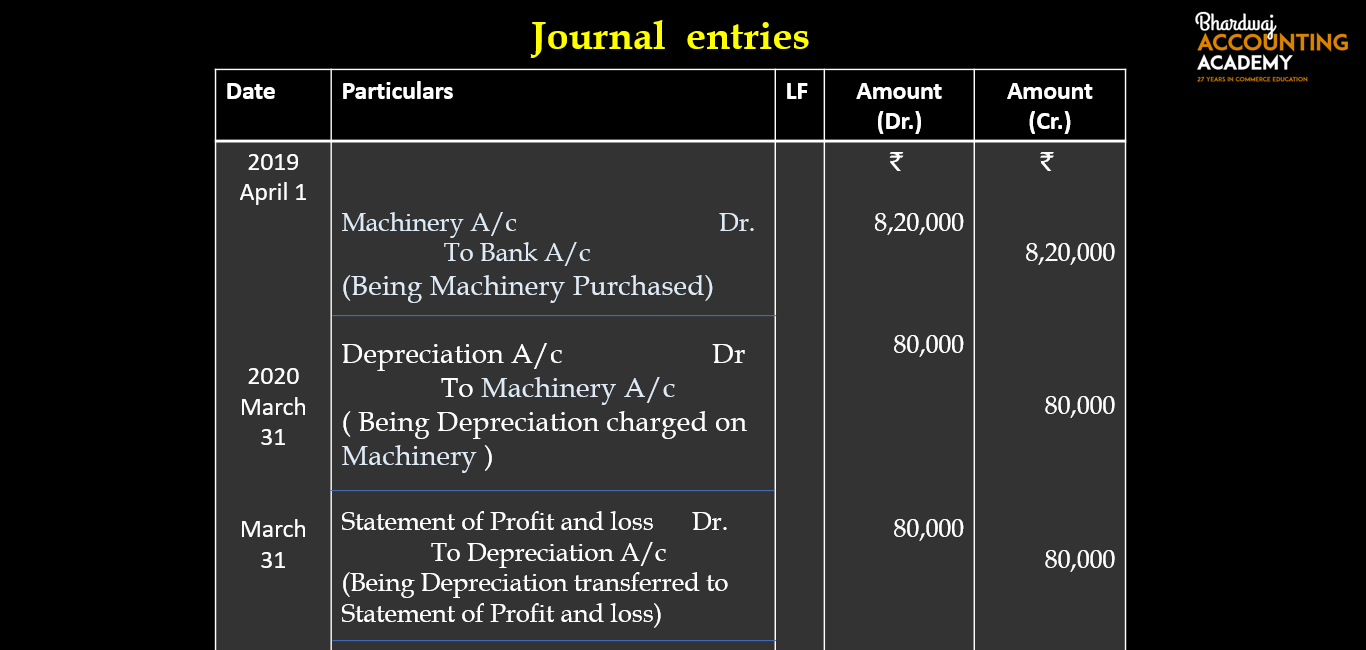

There are 2 steps to solve. The journal entry on depreciation requires two parts: Web jul 7, 2023 bookkeeping by adam hill. The debit entry.

Depreciation Journal Entry Examples

A debit and a credit entry. Web to calculate depreciation by month: Web what is the journal entry to record depreciation expense? (a) cost of.

Depreciation and Disposal of Fixed Assets Finance Strategists

Web if a company issues monthly financial statements, the amount of each monthly adjusting entry will be $166.67. Record journal entries for equipment purchase and.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

(a) cost of equipment =. Credit to the balance sheet account accumulated depreciation. There are 2 steps to solve. Web accounting entries to record depreciation:.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Web initial journal entry. Web jul 7, 2023 bookkeeping by adam hill. Web journal entry examples. Visualizing the balances in equipment and. (a) cost of.

Accounting Entries for Depreciation, Accounting Lecture Sabaq.pk

Dr depreciation expense cr accumulated depreciation Web journal entry examples. Web journal entry for depreciation. (a) cost of equipment =. Instead, depreciation is merely intended.

Depreciation journal Entry Important 2021

Journal entry for accumulated depreciation. There are 2 steps to solve. Web what is the journal entry to record depreciation expense? Web the journal entry.

Adjusting Journal Entries Equipment, Depreciation Expense YouTube

Dr depreciation expense cr accumulated depreciation Visualizing the balances in equipment and. Record journal entries for equipment purchase and depreciation. The debit entry is the.

QuickBooks Adjusting Journal Entry 3 Furniture Depreciation YouTube

Record journal entries for equipment purchase and depreciation. At the yearend like 30, dec we will record the following entries. Entity a sold the following.

Web Initial Journal Entry.

Web journal entry examples. Debit to the income statement account depreciation expense. Removing the asset, removing the accumulated depreciation, recording the receipt of cash, and recording the loss. At the yearend like 30, dec we will record the following entries.

The Above Entries Should Be Recorded In The Following Manner.

Web the journal entry for depreciation expense is: Journal entry for accumulated depreciation. Web the first step requires a journal entry that: Web the journal entry for depreciation is:

Web Accounting Entries To Record Depreciation:

Debits depreciation expense (for the depreciation up to the date of the disposal) credits accumulated depreciation (for the. The journal entry to record this expense is straightforward. Web jul 7, 2023 bookkeeping by adam hill. Web journal entry for equipment depreciation.

Record Journal Entries For Equipment Purchase And Depreciation.

Web the journal entry will have four parts: Web if a company issues monthly financial statements, the amount of each monthly adjusting entry will be $166.67. The journal entry on depreciation requires two parts: Entity a sold the following equipment.