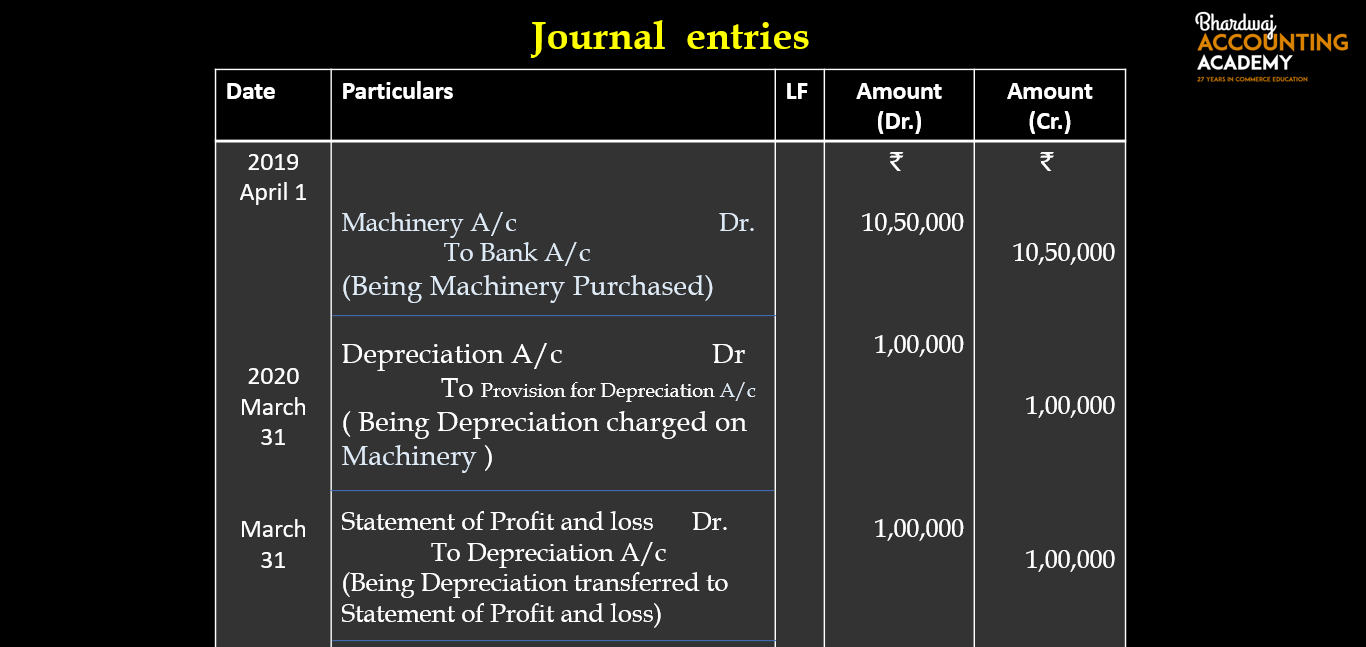

Journal Entry For Depreciation Expense - Web the fixed assets journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting. Web learn how to record depreciation expense and accumulated depreciation for different types of fixed assets. Depreciation is really common term in financial world. Web at the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries. See an example of depreciation expense for a. Web the basic journal entries under this approach are: Web what is the journal entry for depreciation? See the definition, formula, and examples of depreciation entry with. Web the adjusting entry to record the depreciation expense involves debiting the depreciation expense account and crediting the accumulated depreciation account. Web journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the date they.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

Web the fixed assets journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double.

13.4 Journal entries for depreciation YouTube

See an example of depreciation expense for a. Web learn how to record depreciation expense and accumulated depreciation in the accounting journal. See examples, formulas,.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

Web the fixed assets journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double.

Recording Depreciation Expense for a Partial Year

Web what is the journal entry for depreciation? See examples, formulas, and journal entries for fixed assets with or without. From the example, the total.

Journal Entry for Depreciation Example Quiz More..

Web london stock exchange | london stock exchange. Web learn how to record depreciation expense and accumulated depreciation for different types of fixed assets. A.

Depreciation Journal Entry With Example Howto Diy Today

Depreciation is really common term in financial world. Web london stock exchange | london stock exchange. Web the adjusting entry to record the depreciation expense.

Depreciation journal Entry Important 2021

Web london stock exchange | london stock exchange. Web the journal entry is used to record depreciation expenses for a particular accounting period and can.

13.4 Journal entries for depreciation

Web at the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries. See examples, formulas,.

Web Journal Entries For Expenses Are Records You Keep In Your General Ledger Or Accounting Software That Track Information About Your Business Expenses, Like The Date They.

See an example of depreciation expense for a. Web the adjusting entry to record the depreciation expense involves debiting the depreciation expense account and crediting the accumulated depreciation account. Web recording depreciation begins with choosing a depreciation method and ends with ensuring the total accumulated depreciation shown in your general ledger. Web an adjusting entry for depreciation expense is a journal entry made at the end of a period to reflect the expense in the income statement and the decrease in.

Web The Basic Journal Entries Under This Approach Are:

Related to financial sector are actually familiar with. See the definition, formula, and examples of depreciation entry with. See examples, formulas, and journal entries for fixed assets with or without. The depreciation expense is calculated at the end of an accounting period and is entered as a journal as.

Web An Adjusting Entry For Depreciation Expense Is A Journal Entry Made At The End Of A Period To Reflect The Expense In The Income Statement And The Decrease In Value.

Web learn how to record depreciation expense and accumulated depreciation for different types of fixed assets. Web learn how to record depreciation expense and accumulated depreciation in the accounting journal. Web the fixed assets journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting. Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting.

Depreciation Is Really Common Term In Financial World.

Web initial journal entry. See examples of journal entries, cash impact,. Web journal entry for the depreciation of fixed assets. Web what is the journal entry for depreciation?