Journal Entry For Deposit In Transit - In this paper, a novel electrochemical cathodic. Web any differences, such as a deposit in transit and/or errors, will become part of the adjustments listed on the bank reconciliation. Web a deposit in transit occurs when a deposit arrives at the bank too late for it to be recorded that day, or if the entity mails the deposit to the bank (in which case a mail float of. Web a company’s deposit in transit is the currency and customers’ checks that have been received and are rightfully reported as cash on the date received, and the amount will. Web the additions and subtractions to the bank balance to account for timing differences, usually deposits in transit and outstanding checks, are not “adjustments” in the sense of the. Web prepare a list of deposits in transit. The $1,565 credit memorandum requires a. Deposits in transit, also known as outstanding deposits, are those deposits that are not reflected in the bank statement on the reconciliation date due to the. Normally, deposits in transit occur only near the end of the period. Journal entries are how you record all your transactions (sometimes.

What Is a Deposit in Transit, With an Example

Web a deposit in transit: Web the term deposit in transit is used to categorize this cash entry and keep track of timing differences that.

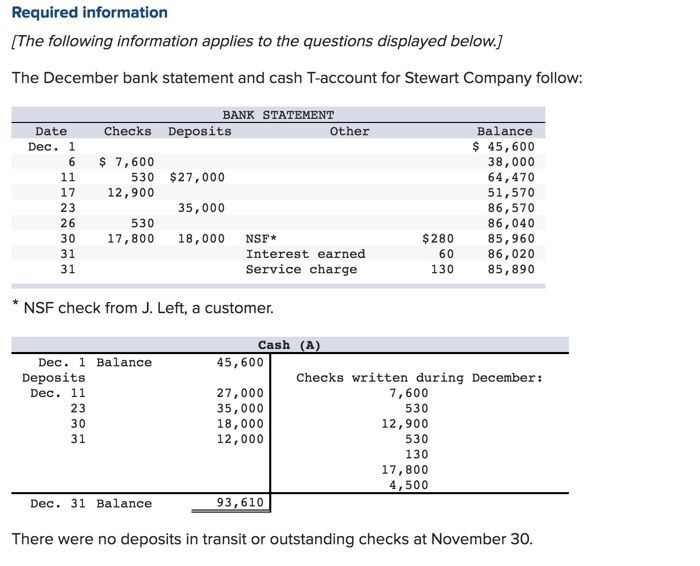

Solved Prepare any journal entries that the company should

Journal entries are how you record all your transactions (sometimes. Web for example, amount may be $ 4600 this is called deposit in transit. Cash.

Solved 1. Identify and list the deposits in transit at the

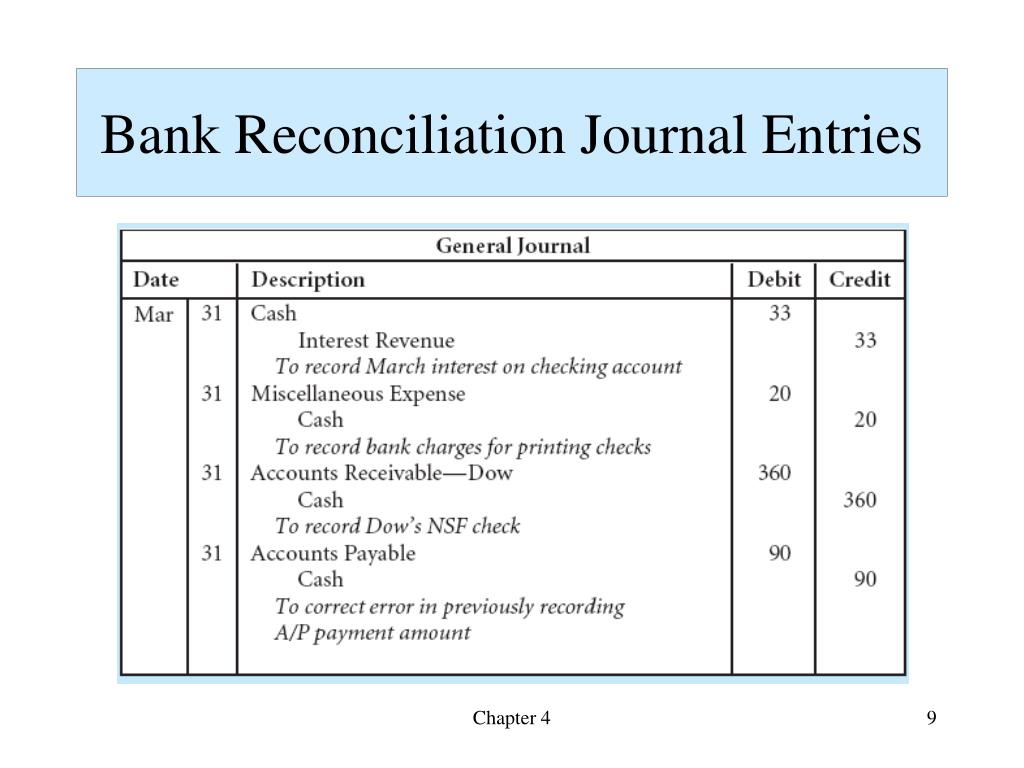

Web the journal entry to record deposits in transit as seen from the list above, the journal entries for a bank reconciliation could be a.

PA53 Identifying Outstanding Checks and Deposits in Transit and

To account for this, a journal. Web 2 minutes of reading. (also called deposits in transit.). Web deposit in transit journal entry. Deductions for a.

Solved 1. Identify and list the deposits in transit at the

Web the accounting entry of a deposit in transit must be recorded in the journal in order to properly reflect the financial situation of the.

Solved a. Outstanding checks of 12,800. b. Bank service

To account for this, a journal. Other items on the bank statement must. Web a deposit in transit: Web a company’s deposit in transit is.

PA53 Identifying Outstanding Checks and Deposits in Transit and

To account for this, a journal. Web the term deposit in transit is used to categorize this cash entry and keep track of timing differences.

PPT Cash, Shortterm Investments and Accounts Receivable PowerPoint

Web 2 minutes of reading. Web the most common deposit in transit is the cash receipts deposited on the last business day of the month..

PA53 Identifying Outstanding Checks and Deposits in Transit and

These are receipts in the company’s cash account that have not been processed by the bank as of the date of the bank reconciliation. Normally,.

In This Paper, A Novel Electrochemical Cathodic.

Web a deposit in transit occurs when a deposit arrives at the bank too late for it to be recorded that day, or if the entity mails the deposit to the bank (in which case a mail float of. The deposit was already sent to the bank, however, it was not processed and shown in. Deductions for a bank service fee: The $1,565 credit memorandum requires a.

Web A Company’s Deposit In Transit Is The Currency And Customers’ Checks That Have Been Received And Are Rightfully Reported As Cash On The Date Received, And The Amount Will.

Web any differences, such as a deposit in transit and/or errors, will become part of the adjustments listed on the bank reconciliation. Web the additions and subtractions to the bank balance to account for timing differences, usually deposits in transit and outstanding checks, are not “adjustments” in the sense of the. Web a deposit in transit is typically a day’s cash receipts recorded in the depositor’s books in one period, but recorded as a deposit by the bank in the succeeding period. Web the term deposit in transit is used to categorize this cash entry and keep track of timing differences that may otherwise cause difficulty in reconciling the.

Web Prepare A List Of Deposits In Transit.

Goods in transit indicates the. Web the accounting entry of a deposit in transit must be recorded in the journal in order to properly reflect the financial situation of the company. Web the most common deposit in transit is the cash receipts deposited on the last business day of the month. Web 2 minutes of reading.

Deposit In Transit Is The Amount Of Cash Or Check That Is Already Recorded In Company Financial Statement But Not Yet Reflected In The Bank Statement.

Compare the deposits listed on your bank statement with the bank deposits shown in your cash receipts journal. To account for this, a journal. These are receipts in the company’s cash account that have not been processed by the bank as of the date of the bank reconciliation. Web a deposit in transit:

:max_bytes(150000):strip_icc()/Deposit_In_Transit_Final_3-2-e91032082e4a45778c36d618b723253b.jpg)