Journal Entry For Deferred Revenue - This journal entry increases cash for the amount received and records a liability for the goods or services we owe the customer. Web you need to make a deferred revenue journal entry. Web deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. This reflects the increase in cash or receivables and the corresponding obligation to deliver goods or. Services contract paid in advance. The revenue associated with the contract flows through the income statement and (assuming it was priced appropriately) positive net income (ni in the image below). Deferred revenue is a crucial concept in accounting, representing income received by a company before it provides goods or services. Web understanding deferred revenue journal entry: Deferred revenue (income) video explanation. When a company receives payments for goods or services that have yet to be delivered or performed, it records this as deferred revenue.

Deferred Revenue Journal Entry Double Entry Bookkeeping

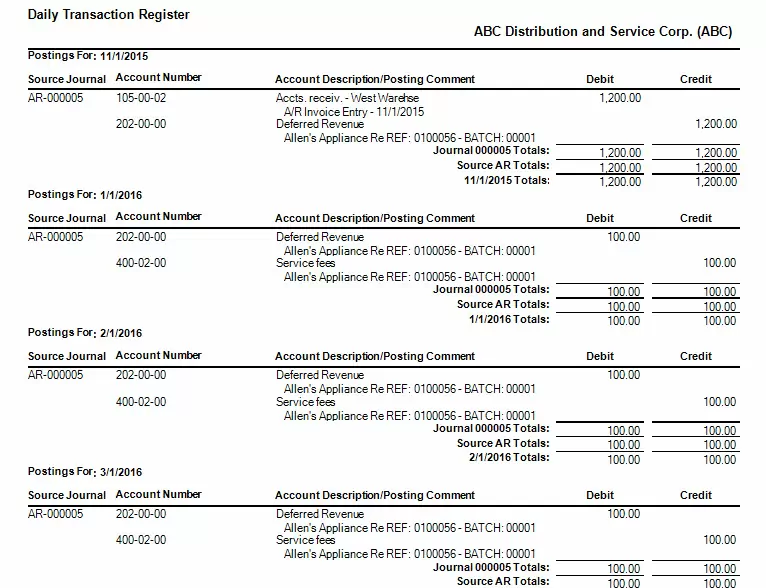

Web the per month revenue of the company is $1000. Deferred revenue journal entry is passed to record the advance payments received for goods and.

Deferred Revenue Expenditure EXPLAINED By Saheb Academy YouTube

Web how to record a deferred revenue journal entry. In this journal entry, we record the deferred revenue as a liability on the balance sheet.

What Is Unearned Revenue? QuickBooks Global

You scratch out what you think the journal entry would look like (you also draw in the original transaction for reference and accuracy sake): To.

Deferred Revenue Journal Entry Example

Web the per month revenue of the company is $1000. Then you write the journal entry. Web but, what is deferred revenue and what does.

Deferred Revenue Journal Entry with Examples Financial

In accounting, deferred revenue can affect your balance sheet and profit and loss statement. It is the revenue that the company has not earned yet..

Journal Entry Deferred Revenue Expenditure in Accounting

This means that deferred revenue is a liability account showing your obligation to your customer. Deferred revenue journal entry example 3: Deferred revenue, also known.

Deferred Tax Liabilities Explained With Reallife

Web you need to make a deferred revenue journal entry. Web how to record deferred revenue. Web in simpler terms, a deferred revenue journal entry.

PPT Profitjets Revenue Journal Entry PowerPoint Presentation, free

Imagine a scenario where a company acquires buses for $20,000. Web what is the journal entry for deferred revenue? Web deferred revenue, also sometimes called.

What is Deferred Revenue? The Ultimate Guide (2022)

The journal entries would be as follows: It is the revenue that the company has not earned yet. Web you need to make a deferred.

Likewise, The Company Needs To Properly Make The Journal Entry For This Type Of Advance Payment As Deferred Revenue, Not Revenue.

Deferred revenue is money that you receive from clients or customers for products or services that you haven’t delivered yet. Deferred revenue is a crucial concept in accounting, representing income received by a company before it provides goods or services. The initial journal entry will be a debit to the cash account and credit to the unearned revenue account. Do customers pay for the goods or services purchased before delivering them?

If So, The Need For Knowing About Deferred Revenue Arises.

We can record the deferred revenue with the journal entry of debiting the cash account and crediting the deferred revenue account. In this journal entry, we record the deferred revenue as a liability on the balance sheet as it represents the obligation that we owe to our customers. Web what is the journal entry for deferred revenue? Web written by cfi team.

Deferred Revenue Journal Entry Example 2:

Web the per month revenue of the company is $1000. Rent payments received in advance. Deferred revenue, also known as unearned revenue or unearned income, happens. Web the deferred revenue journal entry is your tracking mechanism for this type of revenue, within your accounting.

Then You Write The Journal Entry.

Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. Deferred revenue is reduced to zero. Web a deferred revenue journal entry is a financial transaction to record income received for a product or service that has yet to be delivered. Web journal entries for recording deferred revenue.