Journal Entry For Deferred Rent - Initial direct cost and deferred rent under fasb. Other considerations in rent expense. Web learn how to record deferred rent, a liability account, when the company receives free rent at the beginning of the lease agreement. Dig into a discussion on the changes in how. Web in most leases, deferred rent is a liability that is recorded as a negative balance. See the essential steps, examples and related articles on deferred. Under asc 840, deferred rent is the amount. Deferred revenue journal entry example 2: Web june 8, 2021 lease accounting. Accounting for accrued rent with journal entries.

Deferred Rent Journal Entry CArunway

Web deferred and prepaid expense payments are documented on a business's balance sheet for accounting objectives and also impact the business's financial statement during a..

Accounting for Leases under the New Standard, Part 2 The CPA Journal

Web the deferred revenue journal entry is your tracking mechanism for this type of revenue, within your accounting. How has accounting for rent payments changed.

Journal Entry For Advance Rent Received Info Loans

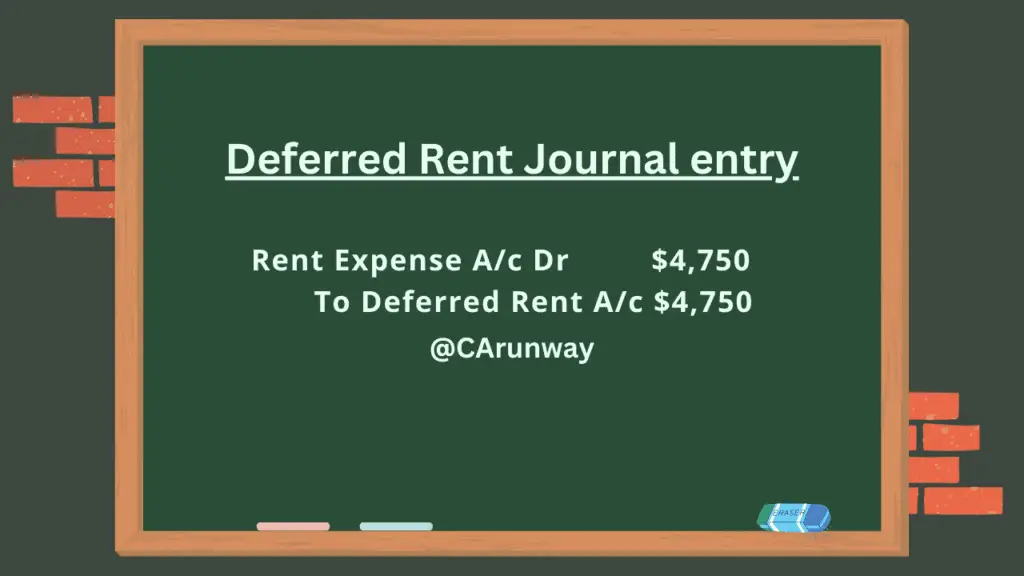

Details on the example lease agreement. Web learn how to record deferred rent, a liability account, when the company receives free rent at the beginning.

Accounting Journal Entries In Excel

Web operating lease accounting example and journal entries. Is prepaid rent an asset? Understanding deferred rent under asc 842. Here is a basic example with.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Here is a basic example with the journal entries necessary to account for an existing deferred rent liability transitioning. Web learn how to account for.

Deferred Rent Journal Entry CArunway

Web a concession may take the form of deferred rent, rent forgiveness, a combination of a deferral of rent with an extension of the lease.

Deferred Revenue Journal Entry Double Entry Bookkeeping

Details on the example lease agreement. Web june 8, 2021 lease accounting. Initial direct cost and deferred rent under fasb. How has accounting for rent.

Deferred Rent Journal Entry CArunway

See the essential steps, examples and related articles on deferred. Web learn how to record deferred rent, a liability account, when the company receives free.

What is the adjusting entry for expenses? Leia aqui What is the

Is prepaid rent an asset? Web a concession may take the form of deferred rent, rent forgiveness, a combination of a deferral of rent with.

Here Is A Basic Example With The Journal Entries Necessary To Account For An Existing Deferred Rent Liability Transitioning.

Understanding deferred rent under asc 842. Initial direct cost and deferred rent under fasb. Understanding the impact of changes brought by asc 842. Web this article will explain how to properly account for rent abatement and periods of free rent under both asc 840 and asc 842.

Details On The Example Lease Agreement.

Services contract paid in advance. Under asc 842, deferred rent is also a concept that no longer exists. Other considerations in rent expense. Web what is deferred rent, and when is it recognized as a liability?

Each Time The Company Pays Rent In Advance, It Must Debit The Current Assets Account For The Amount Of The Rent Prepayment,.

The journal entry for recording during the transition is a debit—or a credit with some. Rent payments received in advance. Determine the lease term under asc 840. Web journal entries for the recognition of rent expenses can involve the allocation of costs over two or more accounting periods.

Web Learn How To Record Deferred Rent, A Liability Account, When The Company Receives Free Rent At The Beginning Of The Lease Agreement.

Web the deferred revenue journal entry is your tracking mechanism for this type of revenue, within your accounting. Accounting for accrued rent with journal entries. Under the new lease accounting standards of asc 842, deferred rent classifications have become. Web june 8, 2021 lease accounting.