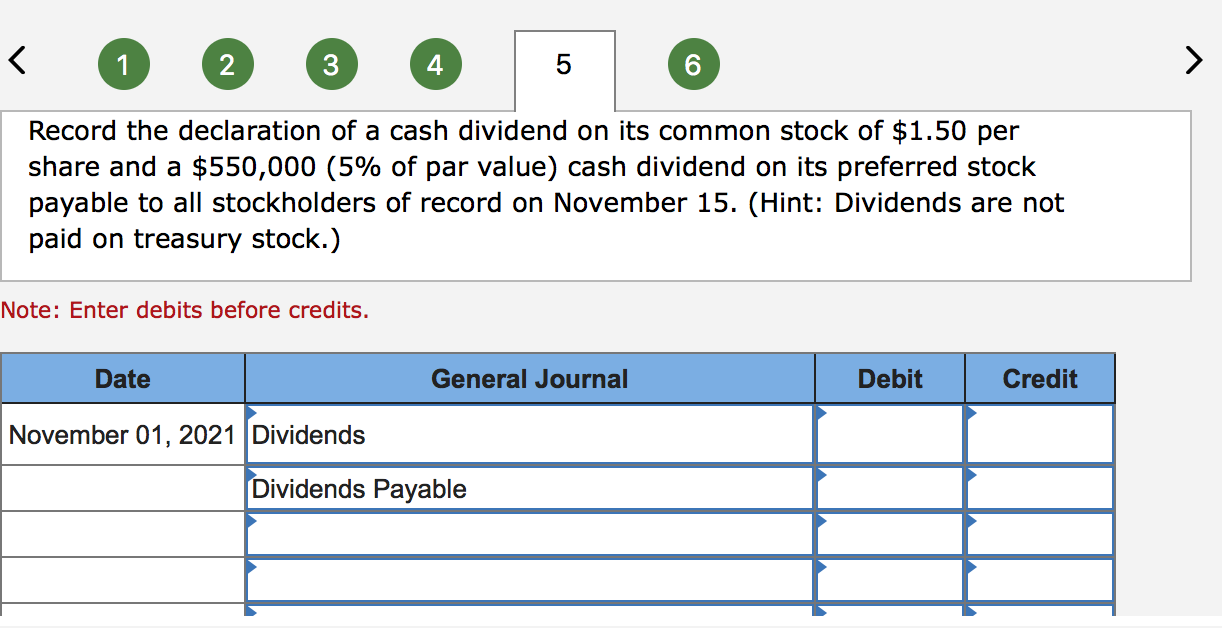

Journal Entry For Declaration Of Cash Dividend - As the company has declared a 10% stock dividend, it would be accounted just like a cash dividend. Web to record the declaration of a dividend, you will need to make a journal entry that includes a debit to retained earnings and a credit to dividends payable. By posting this closing entry, your business’s dividends will be reset to zero, and its retained earnings will decrease to $13,450,000. Because financial transactions occur on both the date of declaration (a liability is incurred) and on the date of payment (cash is paid), journal entries record the transactions on both of these dates. Web upon the declaration of dividends by the board of directors, the company must make an entry in its journal to reflect the creation of a dividend payable liability. (2) on february 10, 20×1, entity a paid $750,000 cash dividend declared on january 10, 20×1. The debit is a charge against the retained earnings of the business and represents a distribution of the retained earnings to the shareholders. When a cash dividend is declared by the board of directors, debit the retained earnings account and credit the. If an amount box does not require an entry, leave it blank. Bonds payable at a premium;

Cash Dividends (Journal Entries) YouTube

(1) on january 10, 20×1, entity a declared a $1.50 per share cash dividend on 500,000 shares of common stock. 100000 x $0.25 = $25000..

Calculating Dividends, Recording Journal Entries YouTube

Dividend = $0.50 × 100,000 = $50,000. Journalize the entries required on each date. Web the total cash dividend to be paid is based on.

what is dividend declared Example Journal Entries YouTube

Account types typical financial statement accounts with debit/credit rules and disclosure conventions. Web the dividends declared journal entry is shown in the accounting records using.

How To Record And Report Dividend Payments In Accounting Records And

When cash dividends are declared, if there is any preferred stock outstanding, the dividends have to be applied to the preferred stock first. One month.

Dividends Payable Accounting Journal Entry

(1) on january 10, 20×1, entity a declared a $1.50 per share cash dividend on 500,000 shares of common stock. The debit is a charge.

Journal Entry for Dividends YouTube

The debit is a charge against the retained earnings of the business and represents a distribution of the retained earnings to the shareholders. Web a.

Declaration of Cash Dividends ICTSI

Because financial transactions occur on both the date of declaration (a liability is incurred) and on the date of payment (cash is paid), journal entries.

Recording Payment Of Dividend Journal Entry

Web the declaration of dividends is journalized as follows: Web the dividends account is a debit account, so we will credit the dividend account by.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Web as an example above, there is no journal entry on this date. As the company has declared a 10% stock dividend, it would be.

If An Amount Box Does Not Require An Entry, Leave It Blank.

Record date is 14 may 2015. No cash has been paid to shareholders yet, as all that has happened is the company has declared a dividend will be paid in the future. Because financial transactions occur on both the date of declaration (a liability is incurred) and on the date of payment (cash is paid), journal entries record the transactions on both of these dates. Web what are journal entry examples of dividends payable?

When Cash Dividends Are Declared, If There Is Any Preferred Stock Outstanding, The Dividends Have To Be Applied To The Preferred Stock First.

If the corporation’s board of directors declared a cash dividend of $0.50 per common share on the $10 par value, the dividend amounts to $50,000. Dividends can be made in the form of additional stock, debt, property, or other assets, but are most commonly paid in cash. Dividend = $0.50 × 100,000 = $50,000. The $20,000 for preferred and $12,000 for common dividends can be combined into one journal entry.

Company Declared And Paid A $17,200 Dividend And Reported Net Income Of $103,200.(A)Journalize The Transactions On The Books Of Ivanhoe Company.

Journalize the entries required on each date. Dividend payments reduce the company's retained earnings, so debit the retained earnings. We’ll tackle that in the next section after you check your understanding of accounting for cash dividends in general. Web the cash dividend declared is $1.25 per share to stockholders of record on july 1, (date of record), payable on july 10, (date of payment).

This Is The Date That The Dividend Payment Is Made To The Shareholders.

100000 x $0.25 = $25000. The company usually needs to have adequate cash and sufficient retained earnings to payout the cash dividend. Bonds payable at a premium; Web the journal entry of cash dividends is usually made in two parts.