Journal Entry For Cogs - First, review your sales and purchase order (po) invoices to determine the total cost of inventory that was sold during the accounting period. Web the cost of goods sold journal entry is: You will credit your purchases account to record the amount spent on the materials. Opening inventory plus purchases and production costs minus closing inventory. Web how to record a journal entry for cost of goods sold. Then, subtract the cost of inventory remaining at the end of the year. Likewise, we can view the updated outstanding balance of inventory on the balance sheet as well as the updated figures of the cost of goods sold in the income statement if we use an accounting system such as quickbooks. So, where do you begin? Web the journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory. When recording journal entries for the cost of goods sold, accountants work in tandem with manufacturing or operations to ensure they’re booking the correct costs.

Cash Sales Journal Entry Example

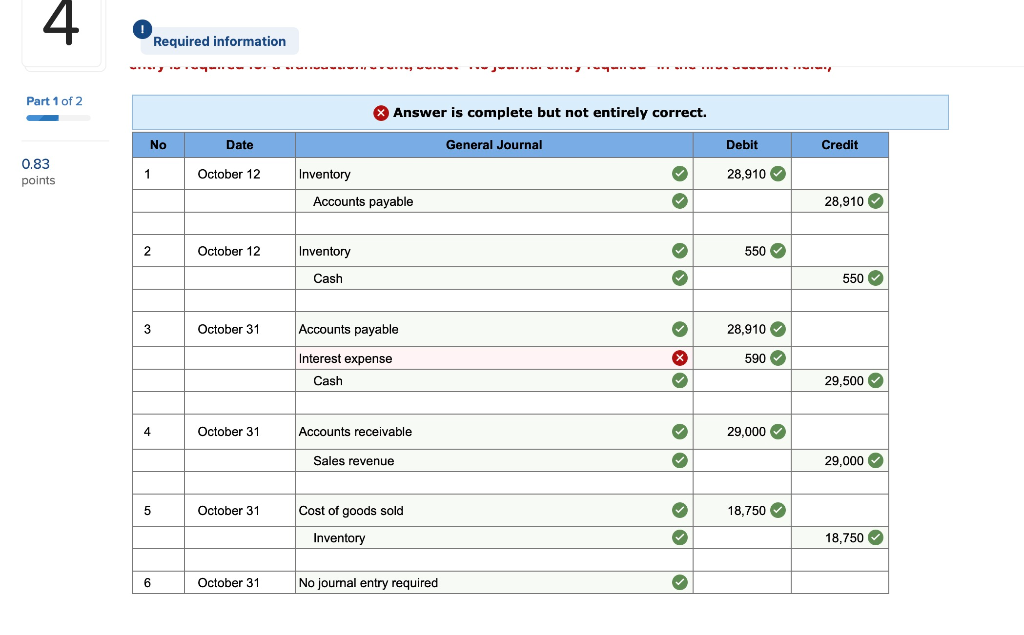

Web the journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory. What ratios or financial metrics.

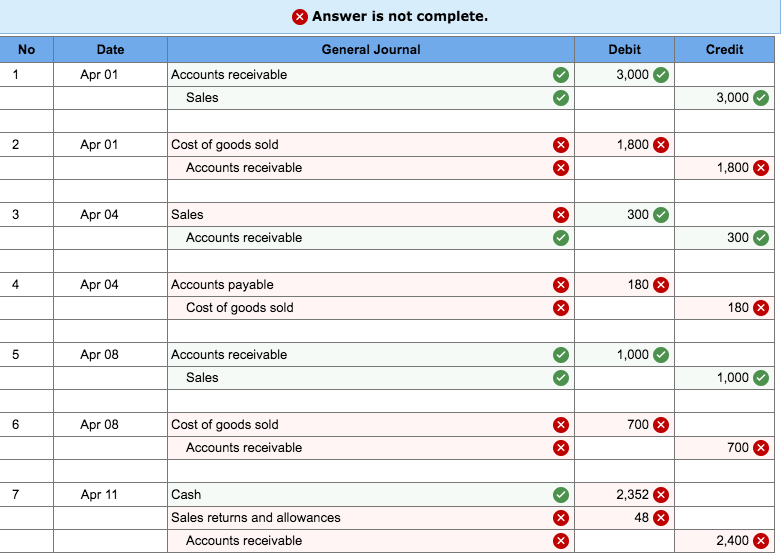

[Solved] Develop journal entries and find out the cost of goods sold

So, where do you begin? Web the cost of goods sold journal entry is: Web the journal entry for cost of goods sold is a.

Cost of Goods Sold Journal Entries Video & Lesson Transcript

When recording journal entries for the cost of goods sold, accountants work in tandem with manufacturing or operations to ensure they’re booking the correct costs..

Recording a Cost of Goods Sold Journal Entry

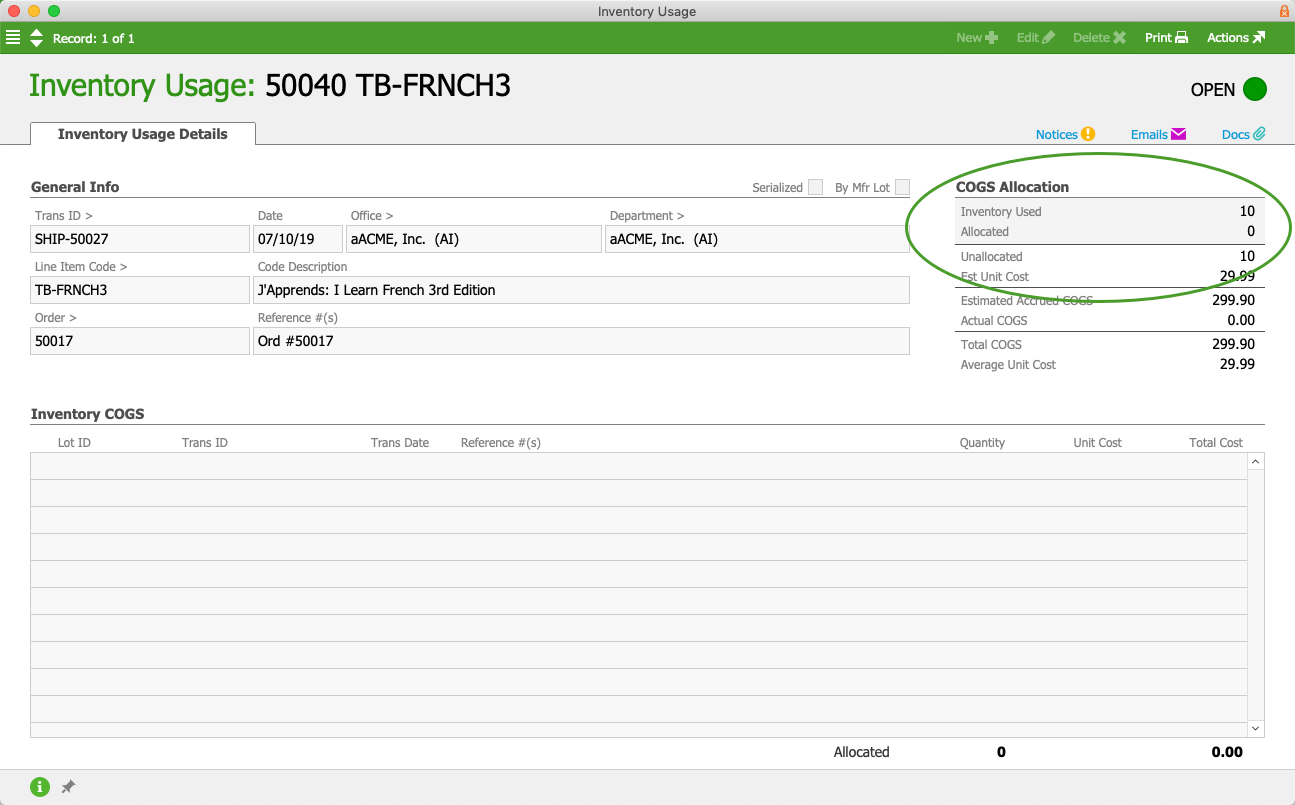

Web use this number to make a journal entry in qbo that moves this lump sum from your balance sheet to your profit and loss.

Cogs journal entry picturesgerty

This method just needs two data points to work effectively: Web create a journal entry when adding a cogs journal entry, you will debit your.

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

Web create a journal entry when adding a cogs journal entry, you will debit your cogs expense account and credit your purchases and inventory accounts..

Cogs accounting horsetyred

As the first part of this step, ensure you have all raw materials inventory, your related expenses, and information about additional inventory available. What is.

Cogs journal entry picturesgerty

Web making a cogs journal entry allows you to track your inventory costs and ensure our financial statements are correct. Web how to record a.

Cogs journal entry vinoatila

This entry matches the ending balance in the inventory account to the costed actual ending inventory, while eliminating the $450,000 balance in the purchases account..

What Ratios Or Financial Metrics Is Cost Of Goods (Cogs) Used In?

Beginning inventory + (purchases, net of returns and allowances, and purchase discounts) + freight in − ending inventory = cost of goods sold. This method just needs two data points to work effectively: Web introduction to cost of goods sold. You will credit your purchases account to record the amount spent on the materials.

Web Create A Journal Entry When Adding A Cogs Journal Entry, You Will Debit Your Cogs Expense Account And Credit Your Purchases And Inventory Accounts.

The cost of goods sold formula is: Start here by learning all about cogs, including the cost of goods sold formula and what you can use it for. Web how to calculate the cost of goods sold. Purchases are decreased by credits and inventory is increased by credits.

What Is Cost Of Goods Sold?

Web the cost of goods sold journal entry is: This entry matches the ending balance in the inventory account to the costed actual ending inventory, while eliminating the $450,000 balance in the purchases account. When recording journal entries for the cost of goods sold, accountants work in tandem with manufacturing or operations to ensure they’re booking the correct costs. Web to record the cost of goods sold, we need to find its value before we process a journal entry.

Web Michele Bossart | Sep 21, 2021.

The final number will be the yearly cost of goods sold for your business. Inventory valuation methods and cost of goods sold (cogs) cost of goods sold (cogs) and tax calculation. The items must have been sold otherwise there is no cost of goods sold. Web use this number to make a journal entry in qbo that moves this lump sum from your balance sheet to your profit and loss sheet.