Journal Entry For Capital Invested - What is the journal entry for the following transaction: The business of college sports is about to get upended as schools are forced to share revenue with players. Web it is the gain on investment. Web the journal entry is debiting cash and credit share capital. Due to operation loss, company does not have enough money to pay for a supplier, so mr. A also contribute his new car to the company. You will have one capital account and one withdrawal (or drawing) account. Web journal entry for capital introduced. Investment income refers to the amount earned on investments in common stock, bonds or other financial instruments of outside. Cash balance increases by $20,000.

Capital Invested In Business Journal Entry Invest Walls

Web learn how to record capital investments to track money going into your business. When the company introduces the capital, it will record increased assets..

Invested In The Business As Capital Journal Entry Business Walls

The transaction will increase cash balance on the balance sheet and credit share capital under the equity section. You will have one capital account and.

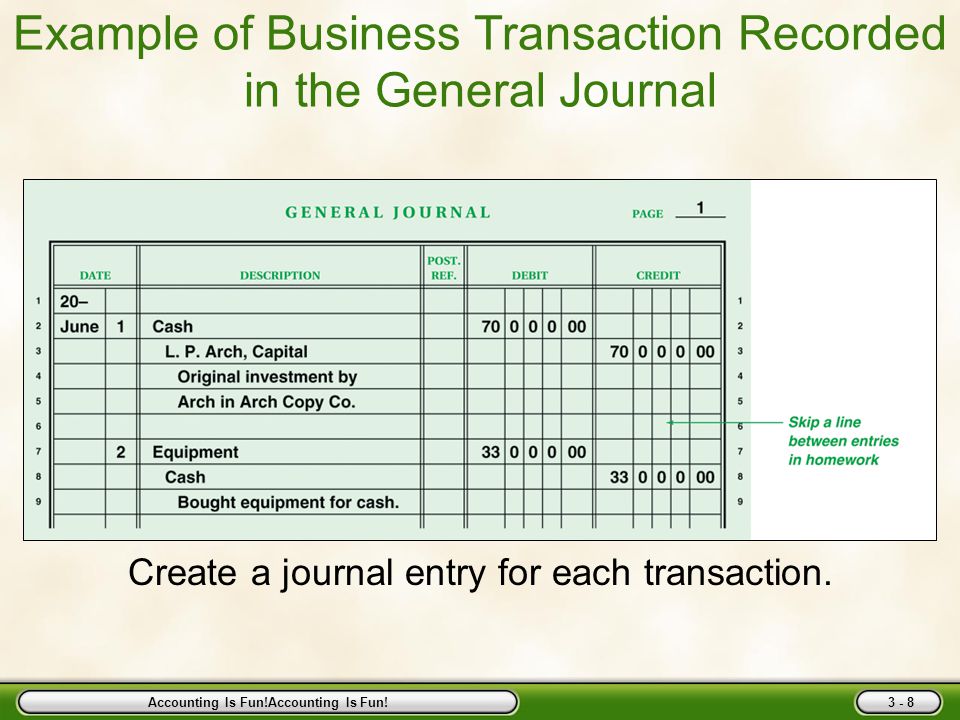

Basic Journal entry rule for CAPITAL [STEP BY STEP Guide] YouTube

Web journal entry for capital introduced. Web in this journal entry, the stock investment account is an asset account on the balance sheet, in which.

Capital Invested In Business Journal Entry Invest Walls

Web in this journal entry, the stock investment account is an asset account on the balance sheet, in which its normal balance is on the.

Accounting for Share Capital Accountancy Knowledge

The transaction will increase cash balance on the balance sheet and credit share capital under the equity section. The amount invested in the business whether.

Invested In The Business As Capital Journal Entry Business Walls

Is capital an asset or liability? Web in this journal entry, the stock investment account is an asset account on the balance sheet, in which.

Accounting Journal Entries For Dummies

Capital a/c & interest on capital a/c. Prepare a journal entry to record this. At the same time, it will increase share capital on balance..

Capital Invested In Business Journal Entry Invest Walls

When the company introduces the capital, it will record increased assets. This stock investment can be a. The transaction will increase cash balance on the.

Invested In The Business As Capital Journal Entry Business Walls

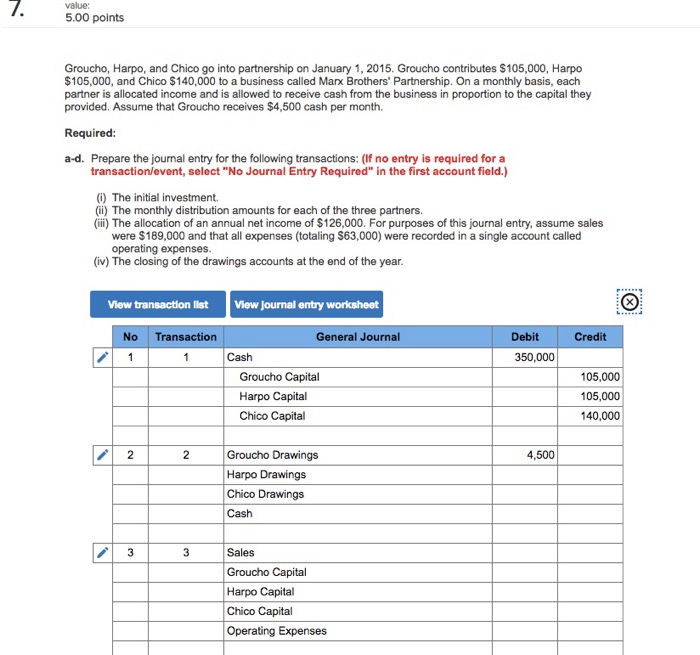

Web anytime a partner invests in the business the partner receives capital or ownership in the partnership. Web it is the gain on investment. [q1].

What Is Started Business With Cash Journal Entry?

The owner of company has made an investment of $. On the other hand, if an investor sells their investments at a lower price compared to the initial purchase. Web what is the difference between capital receipts and revenue receipts? Web you will need to make the following journal entry as at 30 september 2017:

Web Remember, The Investment Of Assets In A Business By The Owner Or Owners Is Called Capital.

Web private equity wants in. Interest on capital is an expense for the business and is added to the. Investment income refers to the amount earned on investments in common stock, bonds or other financial instruments of outside. Web the journal entry is debiting cash and credit share capital.

He Just Bought This Car A.

Web in this journal entry, the stock investment account is an asset account on the balance sheet, in which its normal balance is on the debit side. This stock investment can be a. Please prepare a journal entry for the capital introduction. Web accounting for investment income.

Cash Balance Increases By $20,000.

Due to operation loss, company does not have enough money to pay for a supplier, so mr. A new business led by. A invests an additional $ 50,000 on 01 march 202x. It means they are making losses, also.

![Basic Journal entry rule for CAPITAL [STEP BY STEP Guide] YouTube](https://i.ytimg.com/vi/QDkDDbSHIR8/maxresdefault.jpg)