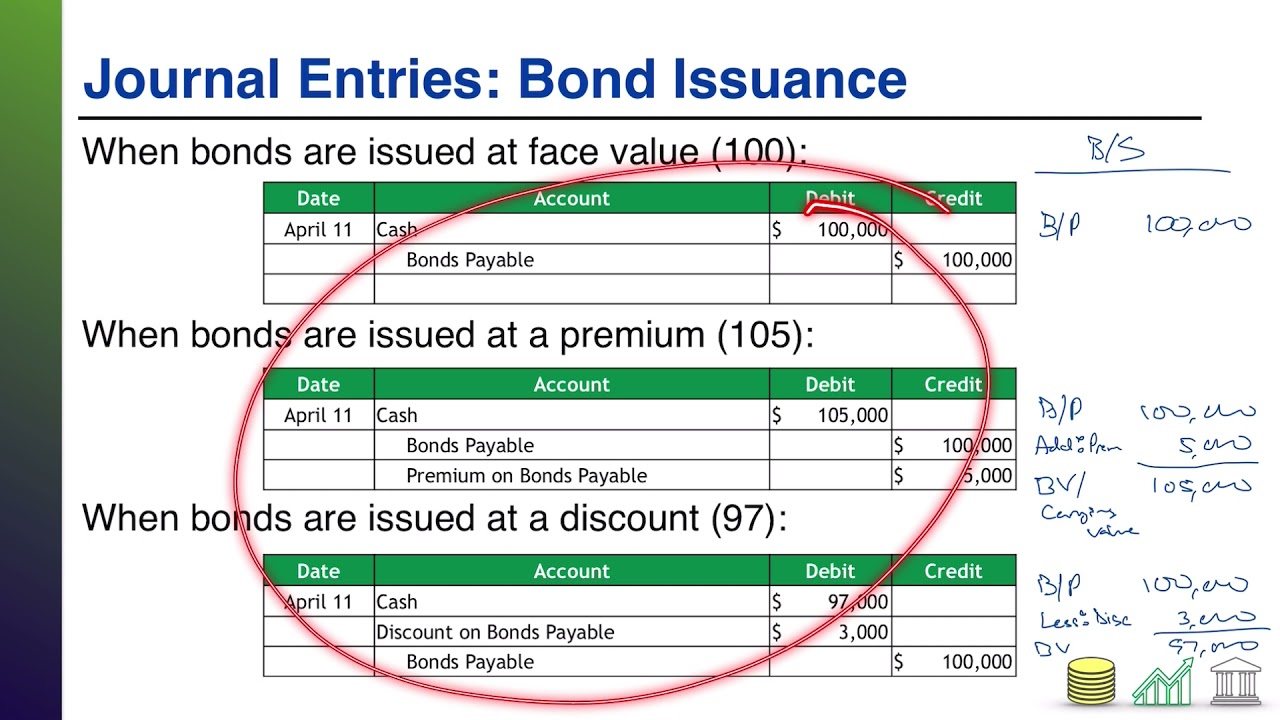

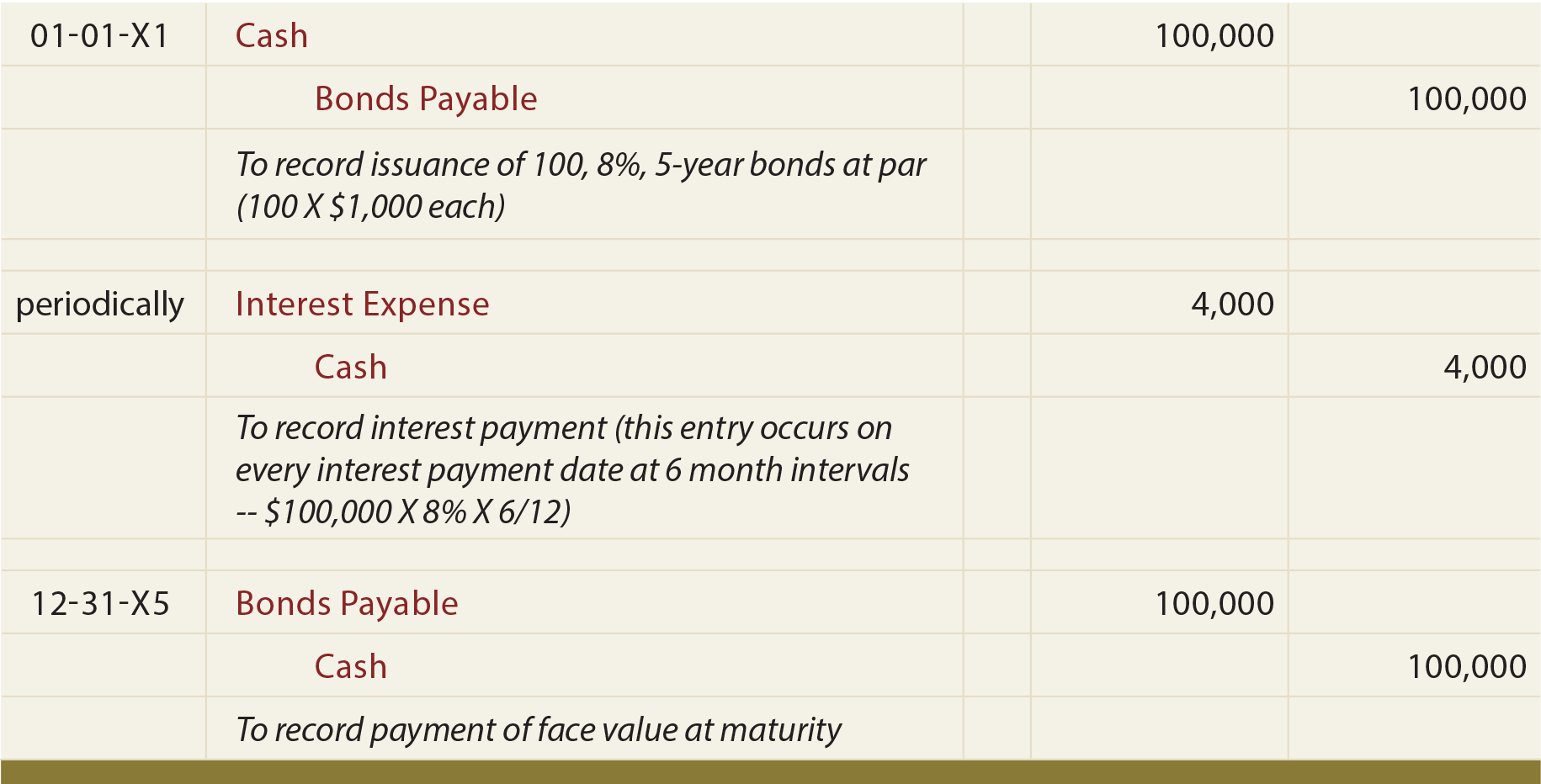

Journal Entry For Bonds - When performing these calculations, the rate is adjusted for more frequent interest payments. Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value. Cash account → debit by $1 million. On december 31, 2020, when the company abc. On january 1, 2020, when the company abc purchase the bond. Web accounting for bonds payable. Web in this section, we will explore the journal entries related to bonds. See the difference between par value, discount, and premium bonds, and. Bonds payable → credit by $1 million. See the journal entries for bond issuance, interest payments, amortization,.

Bond Issuance Journal Entries and Financial Statement Presentation

Web learn how to account for bonds issued by a corporation or government entity. Web learn how to create common journal entries for accrued interest,.

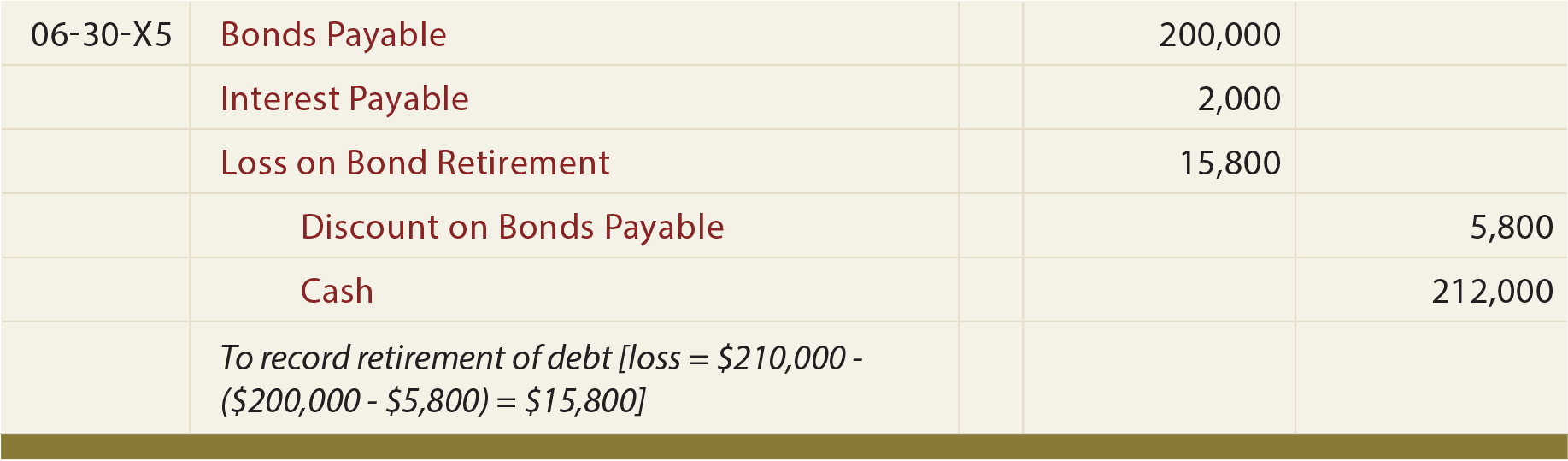

Early retirement of bonds journal entry Early Retirement

Web the journal entries would be as follows: Note that the total amount received is debited to the cash account and the bond’s face amount.

Bond Premium and Interest Journal Entry YouTube

When performing these calculations, the rate is adjusted for more frequent interest payments. Convertible bond is a type of bond which allows the holder to.

Accounting For Bonds Payable

Web learn how to record bonds issued at face value, discount, or premium, and how to accrue interest payments. Web there are five possible journal.

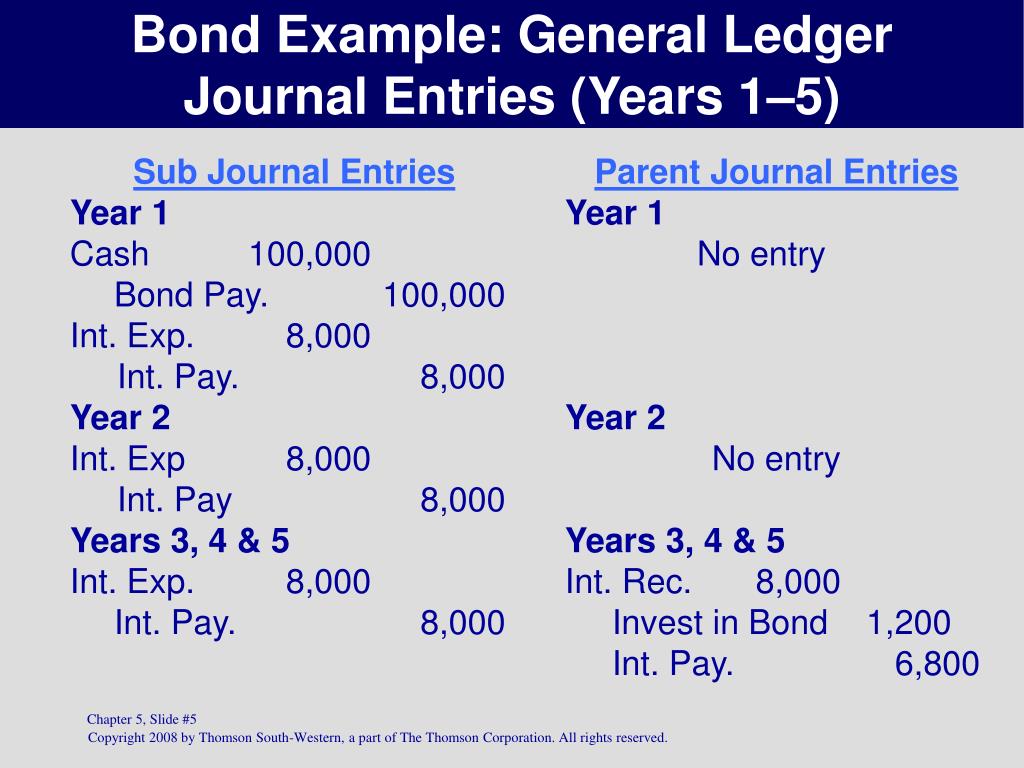

PPT CHAPTER PowerPoint Presentation, free download ID259047

Web the journal entry for this transaction is: The product of 10,000 number of bond. Web what are the journal entries for the investment in.

Chapter 11 Journal Entry Bond&Discount Bonds YouTube

Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value. As this entry.

Bonds Issued Between Interest Dates

Web there are five possible journal entries related to investing in bonds, as follows: Web learn how to record bonds issued at face value, discount,.

P108A, Prepare journal entries to record issuance of bonds, interest

Web learn how to record bonds issued at face value, discount, or premium, and how to accrue interest payments. As this entry illustrates, cash is.

Accounting Q and A EX 154 Entries for investment in bonds, interest

Web the journal entries would be as follows: When performing these calculations, the rate is adjusted for more frequent interest payments. Web there are five.

As This Entry Illustrates, Cash Is Debited For The Actual Proceeds Received, And Bonds Payable Is.

Web accounting for bonds payable. On december 31, 2020, when the company abc. When performing these calculations, the rate is adjusted for more frequent interest payments. See examples of journal entries for bonds issued at par, discou…

Web You Will Need To Pass The Following Journal Entry To Record The Issue Of This Bond:

Note that the total amount received is debited to the cash account and the bond’s face amount is credited to bonds payable. Total bond liability equals $10 million i.e. Learn how to record bond issuance, interest payment, and principal repayment in different scenarios. Web when issuing bonds, two primary journal entries must be recorded:

On January 1, 2020, When The Company Abc Purchase The Bond.

Web the journal entries would be as follows: One entry to record cash received from investors and another entry to record liabilities incurred by issuing. Cash account → debit by $1 million. Web in this section, we will explore the journal entries related to bonds.

Earlier, We Found That Cash Flows Related To A Bond Include The Following:

The product of 10,000 number of bond. Web the journal entry to record the valenzuela bonds is shown as: Web what are the journal entries for the investment in bonds? See the journal entries for bond issuance, interest payments, amortization,.