Journal Entry For Bond Retirement - Web retirement of bonds when the bonds were issued at par; By obaidullah jan, aca, cfa and last modified on. A company is usually required to call all of its bonds when it exercises a call option; Web what are bonds in accounting? To a business, a bond payable represents a series of regular interest payments together with a final principal repayment at the. Web the journal entry for bond retirement is the difference between the retirement at the maturity, before maturity, and by conversion. Therefore, the journal entry for semiannual interest payment is as follow: Web retirement of bonds when the bonds were issued at par; Bond retirement means that the company buys back the bond that it previously sold, either at the maturity date or before the maturity date. The company retires 45% of the bonds on september 1st, 2021 immediately after paying.

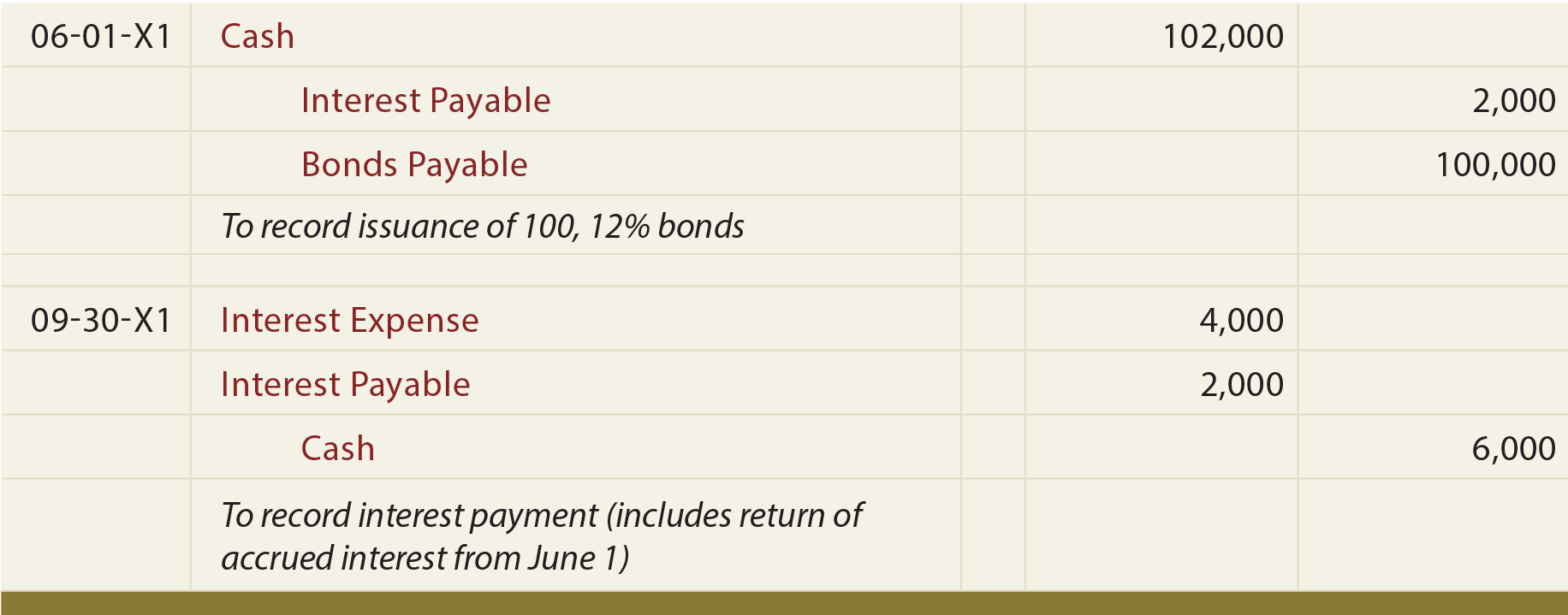

Bonds Issued Between Interest Dates, Bond Retirements, And Fair Value

A gain instead of a loss would result if the. Recall from the discussion in. Therefore, the journal entry for semiannual interest payment is as.

Early retirement of bonds journal entry Early Retirement

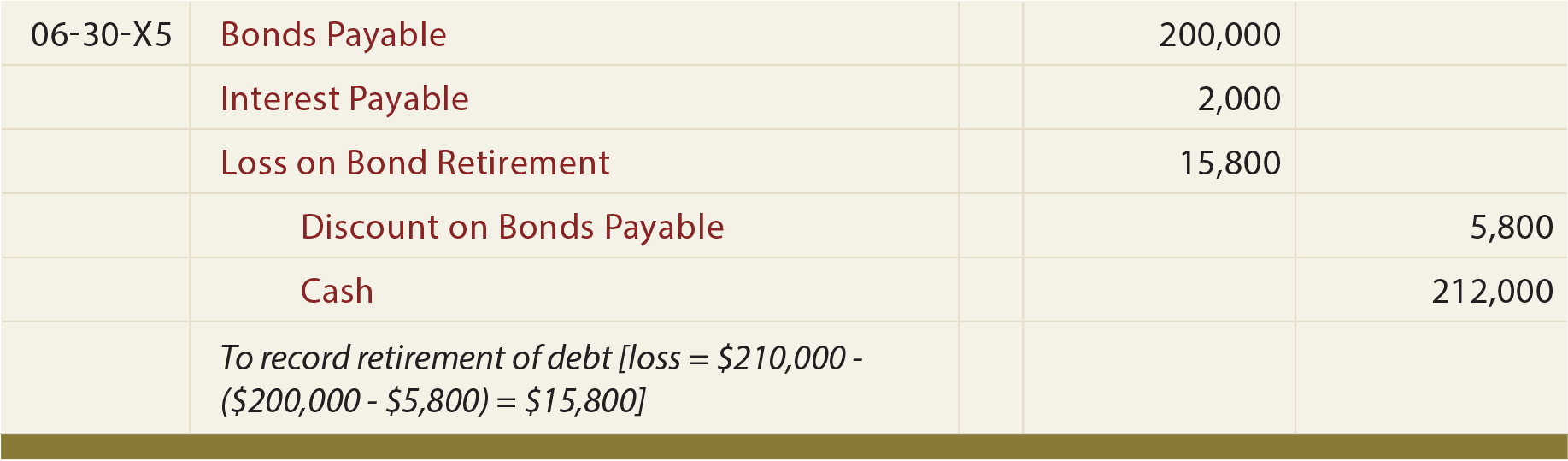

At some point, a company will need to record bond retirement, when the company pays the obligation. Web if there is a loss on the.

Bonds Payable Lecture 2 Journal Entries YouTube

At the maturity date, bonds are retired with no gain or loss. Web retirement of bonds when the bonds were issued at par; Web prepare.

Bond Retirement Journal Entry to Retire a Bond YouTube

Web retirement of bonds when the bonds were issued at par; A gain instead of a loss would result if the. Web what are bonds.

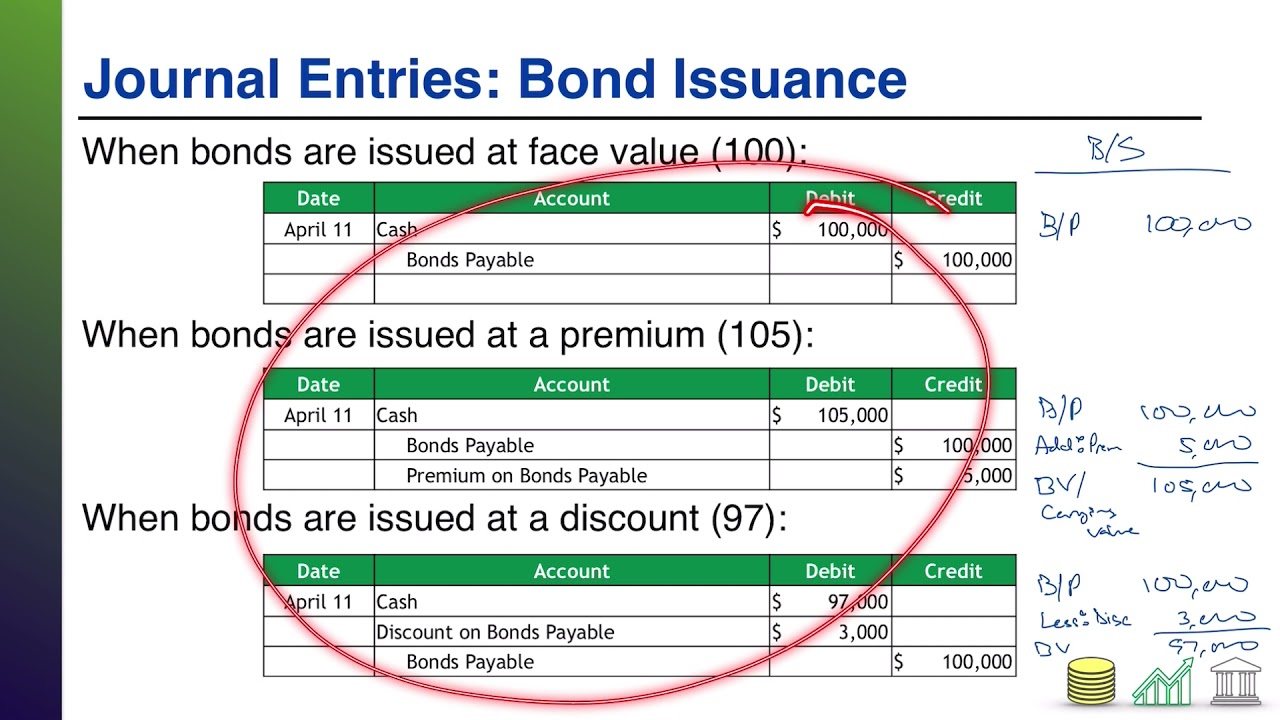

Bond Issuance Journal Entries and Financial Statement Presentation

Web recording entries for bonds | financial accounting. The retirement of a bond means we will be closing the bond by paying out what is.

Early retirement of bonds journal entry Early Retirement

A company is usually required to call all of its bonds when it exercises a call option; Recall from the discussion in. A gain instead.

Financial Accounting Lesson 10.12 Early Retirement of Bond YouTube

Web what are bonds in accounting? Web prepare journal entries to reflect the life cycle of bonds. Web company g should record the gain on.

bond retirement Journal Entry

The company retires 45% of the bonds on september 1st, 2021 immediately after paying. Web the journal entry to record this transaction is: Therefore, the.

Early Redemption of Bonds Wize University Introduction to Financial

Bond retirement means that the company buys back the bond that it previously sold, either at the maturity date or before the maturity date. Web.

Web What Are Bonds In Accounting?

Web prepare journal entries to reflect the life cycle of bonds. If investors buy the bonds at a discount, the difference between the face value of the bonds and the amount of cash received is recorded in a. A company is usually required to call all of its bonds when it exercises a call option; To a business, a bond payable represents a series of regular interest payments together with a final principal repayment at the.

Web Retirement Of Bonds When The Bonds Were Issued At Par;

Web a bond can be retired before the maturity date or at the maturity date. Web company g should record the gain on early retirement of bonds of $3,000 using the following journal entry: Web the journal entry for bond retirement is the difference between the retirement at the maturity, before maturity, and by conversion. At the maturity date, bonds are retired with no gain or loss.

At Some Point, A Company Will Need To Record Bond Retirement, When The Company Pays The Obligation.

Web retirement of bonds when the bonds were issued at par. Web what are the journal entries for the investment in bonds? When the bond matures, the company debits the bond payable account and credits the. Notice that interest was paid in full through september 30.

By Obaidullah Jan, Aca, Cfa And Last Modified On.

Recall from the discussion in. Web retirement of bonds when the bonds were issued at par; Web the journal entry is: However it can choose to retire as many or as few.